Ethereum has seen massive growth this year with the network now supporting over 2,000 decentralized applications (dApps) spanning decentralized finance (DeFi), non-fungible tokens (NFTs), gaming and more, according to State of the DApps.

The number of Ethereum users has also soared. Monthly active users of the MetaMask non-custodial wallet product have surpassed 21 million — a 38-fold increase from 2020. There are now 3.4 million Ethereum addresses interacting with DeFi protocols and over US$170 billion in total value locked in DeFi protocols, according to DeFi Llama.

But Ethereum’s expanding ecosystem and popularity have also resulted in skyrocketing transaction fees and concerns that Ethereum’s scalability issues have made it cost-prohibitive for mainstream users.

Although competitor blockchains such as Binance Smart Chain, Solana, Cardano and Polkadot have emerged, Ethereum still remains the dominant smart contract platform given its network effect and the technical investment by projects and developers.

Layer 2 — the future of Ethereum scaling

A myriad of solutions are being developed to scale Ethereum, with the main goal to increase transaction speed and transaction throughput, without compromising decentralization or security. Eth 2, a multi-year, multi-phase series of upgrades that includes Ethereum’s transition to a proof-of-stake network and shard chains, plans to make Ethereum more scalable, more secure, and more sustainable. However, Ethereum base-layer scalability for applications remains years away.

Layer-2 projects, a collective term for solutions designed to scale Ethereum by handling transactions off the mainnet while relying on Ethereum’s decentralized consensus mechanism for security, is a growing trend. Rollups, a Layer-2 solution, are designed to decongest the Ethereum network by bundling (or “roll-up”) transactions together, compressing and processing them off-chain, before sending the results back to Ethereum, resulting in improved speed and significantly lower transaction costs.

In a recent speech at the 2021 Shanghai International Blockchain Week, Ethereum creator Vitalik Buterin said Layer 2 is the future of Ethereum scaling and the only safe way to scale Ethereum while preserving decentralization that is so core to the blockchain.

See related article: Vitalik Buterin: Layer 2 is the future of Ethereum scaling

Rollups take two forms: “Optimistic rollups” that assume transactions are valid and only execute the computation if a fraudulent transaction is suspected, and “zero-knowledge rollups” (ZK rollups) that bundle the transactions for processing off-chain and submit a validity proof to the Ethereum network verifying that the transactions are valid. It is estimated that optimistic rollups can offer up to 10 to 100 times improvements in scalability depending on the transaction.

Why Arbitrum is leading Ethereum scaling

Arbitrum, a layer-2 optimistic rollup solution built on Etherum by Off-chain Labs, currently leads layer-2 usage, with a market share of 41% and total value locked of over US$2.72 billion, according to L2 Beat, which tracks layer-2 projects.

Blockchain analytics platform Nansen sees Arbitrum leading the wave of Ethereum scalability solutions in the near future with developers increasingly building on it.

“Arbitrum is the most Ethereum Virtual Machine (EVM) compatible layer 2 as of today. This makes it almost trivial for developers to migrate existing Ethereum applications to rollups because they don’t have to rewrite the code,” Nansen wrote in a research report on Arbitrum published this week.

Arbitrum allows for 40,000 transactions per second (TPS), significantly more than Ethereum’s 15 to 30 TPS for Ethereum. Transaction fees on Arbitrum are currently about three times lower compared to using the Ethereum base layer (US$3.46 on Arbitrum One vs. US$11.17 on Ethereum as of publishing time, according to L2 fees.)

Attracted by lower transaction costs, users are turning to Arbitrum when using dApps on Ethereum that require transactions such as Aave and Uniswap. This could be done by adding the Arbitrum One network extension to the MetaMask wallet. Centralized cryptocurrency exchanges such as Binance and Crypto.com have also recently added support for Arbitrum. There are currently 280,000 unique addresses on Arbitrum — an increase of over 4,000% since the beginning of September.

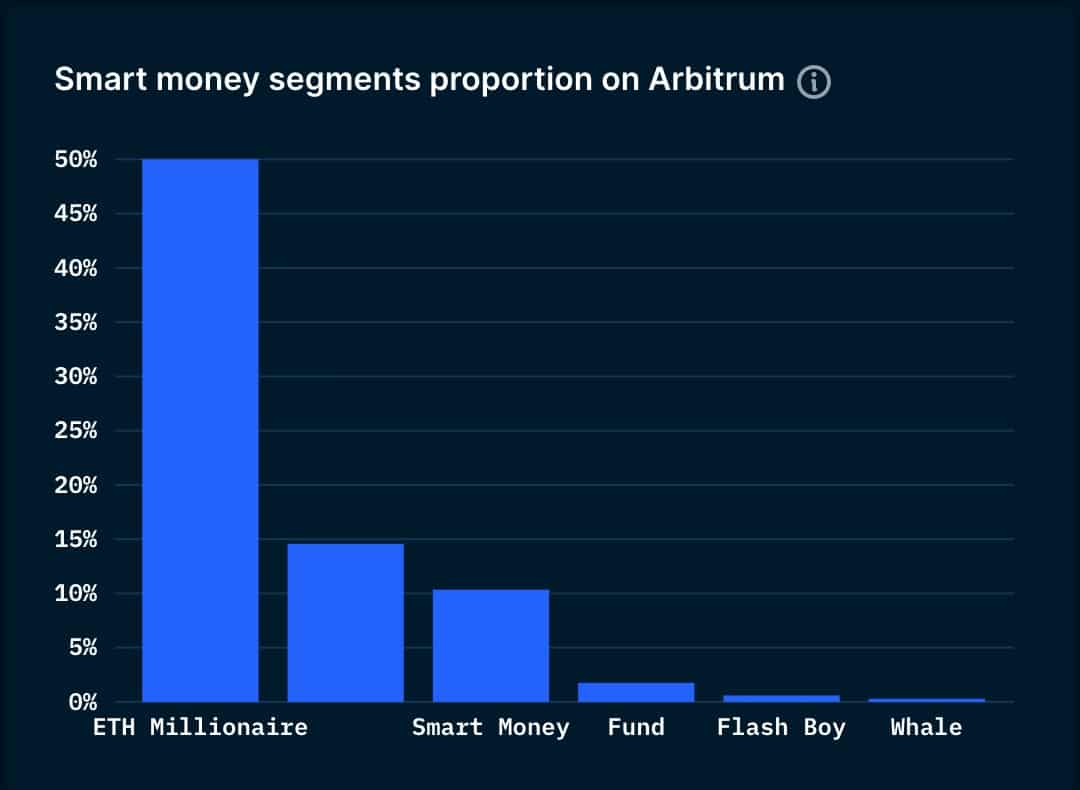

The crypto whales, too, are interacting with Arbitrum. Half of “ETH Millionaires” — addresses with an Ether (ETH) balance of at least US$1 million — that use Ethereum also use Arbitrum, according to Nansen data. Over 3.66 million transactions have been processed on Arbitrum, with a peak of over 267,608 daily transactions on Sept. 12, according to Arbiscan.

Although optimistic rollups like Arbitrum, Boba Network and Optimism promise much in terms of improving Ethereum’s scalability, they are still at an early stage of development. Current challenges include a long withdrawal time, where withdrawals can take up to seven days due to potential fraud disputes, lack of interoperability and the fragmentation of liquidity between the different rollups, according to Nansen’s report.

Optimistic rollups may be preferred in the short term as they are simpler and easier to build, according to Ethereum’s creator Buterin. But ZK rollups, notwithstanding their complexity, may prevail as a better technical solution in the longer term given their faster finality time and stronger security.

Polygon, a layer-2 Ethereum scaling platform, this month announced the launch of Polygon Miden, which uses advanced zero-knowledge cryptography to enhance the scalability, privacy and security of Polygon and Ethereum.

Most rollups such as Arbitrum currently do not have native tokens, but Nansen predicts that most rollups will eventually release one. Loopring, a ZK rollup for trading and payment that enables decentralized exchanges to process thousands of requests in batches off-chain with zero-knowledge proofs, has seen the price of its Loopring (LRC) native token surge close to 400% this month amid the hype over rollups.

As blockchain adoption grows, Nansen expects other layer-1 blockchains to start building rollups on top of their mainnet in the long run.

“Beyond Ethereum, rollups is a paradigm that will be exported to other competing L1 and fuse in an increasingly complex landscape of scaling solutions,” Nansen wrote. “For everyone in crypto, L2s like Arbitrum are not just an investment question, they are the basis to ongoing and future projects in DeFi, the NFT space; will sustain DAOs and virtual worlds, but also support the entire creator economy and the Metaverse.”