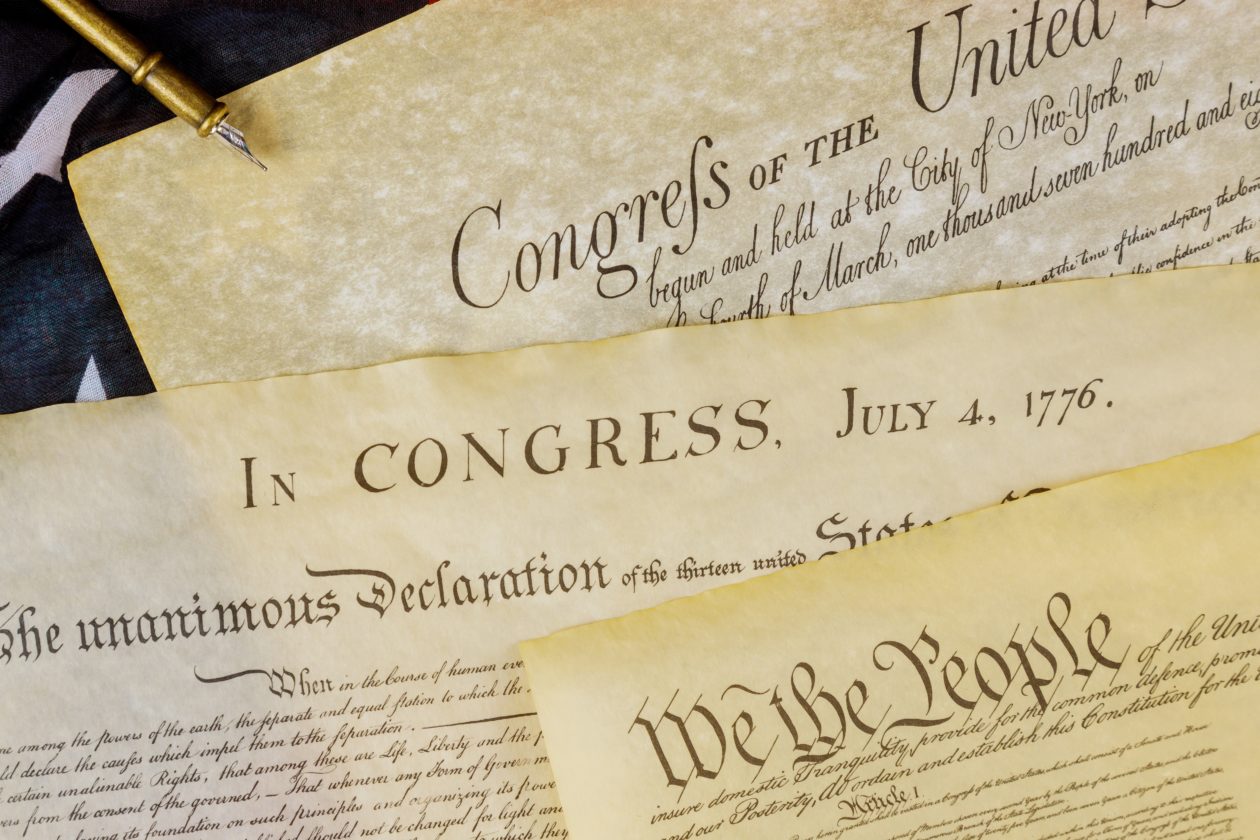

DAOs, short for decentralized autonomous organizations, are often referred to as the next generation of organizational structure, where a community of like-minded people is working together towards a common interest, without a central authority figure leading the way. A form of business and community organization in the blockchain and crypto sector since Bitcoin’s founding, DAOs are now a topic of public conversation after a group called ConstitutionDAO — composed of 17,437 people who came together through word of mouth, like a flash mob — pooled over US$40 million in funds to try to buy a 243-year-old original paper copy of the U.S. Constitution.

While ConstitutionDAO ultimately failed in its mission, losing out to a higher bidder, the DAO did its job — and it is showing the world how technology can replace the hierarchy of leaders, managers and staff that have long run and defined traditional organizations.

DAOs are run largely by computer code and blockchain-based governance, where each member — united by a common goal, such as trying to buy a rare document at auction — has a say.

DAOs strive to be democratic, and they promise total transparency in decision-making. But they also come with vulnerabilities. To understand the ideals, promises and challenges of DAOs — and whether it could replace your employer one day — let’s dive into this Forkast.News explainer:

- What is a DAO?

- Why have a DAO?

- ‘The DAO’ and the aftermath

- Other examples of DAOs

- What is the future of DAOs?

1. What is a DAO

The term DAO refers to an organization that is governed by smart contract algorithms, without the need for a central decision-maker and classical company hierarchy. Imagine a corporation without a C-suite or a non-profit without an executive director that reports to a human board of directors. DAOs are organizations that can function leaderlessly and autonomously.

The consensus protocol of a DAO is based on smart contracts that live on the blockchain. Smart contracts are essentially self-verifying, tamper-proof protocols that are programmed to execute automatically once certain pre-established criteria are met. These algorithms can incorporate complex sets of internal and external information and eliminate the need for human intervention, thanks to their inherent immutability.

DAOs are decentralized since no single entity has the authority to overrun the smart contract algorithms set in place. They’re usually governed by a community of stakeholders, with pre-defined governance protocols designed to advance the network towards a common economic incentive.

One of the most important features of DAOs is that they provide instant trust and transparency for organizations and institutions to work toward a common, without participants having to know one another. The rules of a DAO are recorded on a transparent, secure, and open-source blockchain ledger, which helps make sure that no stakeholder can override them in the future — at least not without a majority vote — so the organization only acts to advance the common interest of the community.

But how can computer code recognize what is in the organization’s best interest? To keep a DAO focused and community-minded, the computer code running a DAO will employ complex economic mechanisms, like game theory, to align its interests and future direction with its mission. The DAO’s shareholders also make decisions by setting forth and voting for proposals. Stakeholders have governance tokens that are used to cast votes. The more tokens a stakeholder has, the bigger the impact of his or her vote on the network. To take effect, proposals have to be approved by the majority of the governance tokens and comply with the DAO’s consensus rules.

2. Why DAOs?

Decentralized autonomous organizations were built to eliminate the risk of human error and faulty decision-making from an organization’s governance. DAOs also appeal to investors who are looking to avoid organizations with central decision-makers, who may not have the community’s best interest and values in mind and whose business judgment can be clouded by prejudices.

In economics, this is referred to as the principal-agent problem, and it describes a situation where the agent — for instance, an investment manager — can make important decisions without much involvement by the principal, in this case, investors or a company. Due to the lack of transparency in a classical corporate hierarchy, shareholders or investors may never find out about an unscrupulous agent acting in his own self-interest.

DAOs aim to be totally transparent by building their organization directly on a shared, open-source, blockchain platform. This allows the organization and all of its decisions to be fully visible to all parties involved. The immutability of smart contract algorithms will preserve the organization’s economic and any other interests on a tamper-proof shared ledger, where all actions and transactions are recorded, for all to see. This steers the organization toward its shareholders’ common goals.

Another advantage of DAOs, at least in theory, is that any stakeholder can have genuine input by using the governance tokens to submit improvement proposals. These proposals will only go into effect if the majority of the token holders agree. Each stakeholder can cast their proposals and votes, regardless of their position in the organization.

Are DAOs living up to their ideals and promises? While ConstitutionDAO is dominating the current news cycle, let’s now take a look at a much older DAO — named “The Dao” — and how its problems led to Ethereum in its current incarnation.

3. ‘The DAO’ and the first major cyberattack in DeFi

While Bitcoin is arguably the world’s first DAO, the more famous — and infamous — incarnation of a decentralized autonomous organization was formed seven years after Bitcoin’s birth. In April 2016, “The DAO” launched after a month-long ICO (initial coin offering). The idea was to create an automated investment fund where investors could anonymously send funds in exchange for governance tokens that would allow them to cast their vote on upcoming projects and proposals.

The DAO raised the equivalent of US$150 million from its ICO, making it the largest crowdfunding effort up to that point.

The DAO was built on the Ethereum network, using smart contract algorithms to secure its governance structure and economic incentives. But shortly after its launch, The DAO suffered an attack that stole US$50 million — or a third of the funds raised in its ICO. The hack succeeded because The DAO’s code base contained vulnerabilities.

To stop the cyber attack, the Ethereum blockchain performed a hard fork, causing Ethereum to split into two different blockchains — today’s Ethereum, where the stolen funds were reversed and returned, and Ethereum Classic, where the original blockchain kept going and the hacked funds were never recovered.

This is still referred to as one of the biggest hacks in cryptocurrency, exposing the risks of DAOs and diminishing the trust of investors.

4. Other examples of DAOs

The truth is that DAOs, much like the blockchain industry, are still in their infancy, and developers are still chiseling and refining the infrastructure. Hence, investors should weigh their risks before getting involved and committing a lot of money.

There’s a case to be made that Bitcoin was the first-ever DAO. Bitcoin adheres to the principles of decentralized organizations, considering that it functions autonomously, has pre-programmed rules and it’s governed through a proof-of-work consensus protocol. Token holders are also incentivized to act in the network’s best interest, as a price surge in Bitcoin is in everyone’s common interest.

Another prominent example of a DAO is MakerDAO — a decentralized governance community that is the issuer of the stablecoin DAI. MakerDao has a decentralized governance structure, where stakeholders use MKR tokens to cast their suggestions and votes on protocol changes.

DAOstack, an open-source project focused on building decentralized governance frameworks, is yet another DAO. DAOstack offers fully decentralized, autonomous business models, where each business function is replaced by smart contract algorithms. Think of DAOstack as a pre-built template for launching a decentralized autonomous organization.

DASH, the organization behind the DASH token, the cryptocurrency currently ranked 79 by market capitalization, is also a popular example. DASH has a fully decentralized and autonomous governance structure.

JennyDAO is a decentralized organization in the non-fungible token space. This DAO provides fractional ownership of NFTs, where smart contracts control the organization’s NFT vault, as members oversee their purchase.

The Switzerland-based Jelurida ecosystem is a decentralized, autonomous blockchain software company that offers public, private, and hybrid blockchain implementations as a service. Jelurida strives for greater scalability, by separating their transactional coins used for smart contracts, and their governance tokens used within the organization.

5. What is the future of DAOs?

Decentralized autonomous organizations enable a community to work towards a common goal, without the need for a central coordinating entity. DAOs resolve the issues of trust, by programming their governance rules in smart contract algorithms, to steer the organization towards the common interest of the participants.

Despite their potential as a new and disruptive organizational structure, DAOs still face issues related to their security and legality. There is also a lack of understanding by new investors looking to get involved, not to mention the technical competence required to maintain and secure the underlying infrastructure and consensus mechanism.

Even in the world of cryptocurrency and decentralized finance, DAOs are still an uncommon occurrence. But they’re slowly emerging as an alternative organizational structure. According to DeepDAO, there are now 181 DAOs, and the DAO ecosystem’s total assets under management (AUM) have grown from US$7.6 billion to US$13.4 billion from July to now.

The main driving force behind DAOs is their use cases, which will continuously increase as we make advancements in artificial intelligence, automation, the internet of things (IoT) and blockchain technology. One of its most sought-out use cases is DACs, or decentralized autonomous companies, that ditch the traditional corporate hierarchy in favor of decentralization. ShapeShift, a Denver-based company that offers global digital-asset trading platforms, is an employer that is remaking itself into a DAO.

Another new use case for DAOs is DAVs — or decentralized autonomous vehicles. DAV, a blockchain-based transportation protocol, is developing a decentralized transportation network using these principles. DAV imagines a future where smart contracts can be employed for everyday functions, such as programming cars to drive themselves to the mechanic, operating taxicabs or ride-sharing services autonomously and enabling vehicles to transact directly with client passengers.

As the economies head towards increasingly decentralized, could DAOs be in the future of government? It may not be a far stretch to imagine decentralized autonomous governments, where each citizen could be a national governance token holder.