Bitcoin fell 3.47% from June 9 to June 16 to trade at US$25,561 at 3:30 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization dipped below US$25,000 for the first time in three months, before recovering. Ether fell 9% over the week to US$1,670.

This week, crypto investor appetite remained weighed down by the Securities and Exchange Commission’s (SEC) ongoing lawsuits against Binance and Coinbase. The SEC filed a motion to freeze the assets of Binance.US, which was denied in court on Wednesday. Judge Amy Berman Jackson of the D.C. District Court ordered Binance.US to share its business expenses with the court while the two parties continue negotiations.

“The current crackdown can be seen as a pre-emptive strike, dating back to the collapse of FTX in 2022. U.S. crypto companies will automatically adapt their activities to the new rules resulting from the outcome of the lawsuits. As long as there is no immediate threat from other crypto companies, the SEC might be satisfied with this latest show of arms,” Jonas Betz, crypto market analyst and founder of consultancy firm Betz Crypto, told Forkast in a LinkedIn response.

Mike Brusov, co-founder of crypto intelligence firm Cindicator, said that distrust in fiat currencies had led to a large influx of capital into crypto, which bolstered Bitcoin to US$29,538 in May, and that the SEC’s aggressive lawsuits aimed to stop this trend.

“There are a multitude of strange moments involved in this situation,” said Brusov, referencing SEC chair Gary Gensler’s alleged offer to serve as an advisor to Binance. “Also, a large list of coins became declared as ‘unregistered securities’. This extreme accusation suddenly included high-level blockchains whose tokens have specific utility while serving as an integral piece of the project at large,” wrote Brusov.

In the SEC’s other lawsuit against San Francisco payments firm Ripple Labs, the Hinman files – documents of internal communication from former SEC official William Hinman – were released this week. A June 2018 email from Hinman stated that the agency did not classify Ether, the native cryptocurrency of the Ethereum blockchain, as a security. This statement could influence the allegations made by the Commission against Ripple. The SEC argues that XRP, the cryptocurrency used in Ripple’s products and services, is a security.

Rate hikes: Press start to pause

The U.S. consumer price index showed that inflation rose at a 4% annual rate in May, below the expected 4.1%, marking the slowest growth in inflation in two years.

The Federal Reserve announced a pause on interest rate hikes on Wednesday, leaving its lending rate at 5% to 5.25% after over a year of consecutive rate hikes. Bitcoin sank to US$24,983 on Wednesday after the Fed signaled that two more rate increases should be expected this year.

“It’s a clear sign that the U.S. is edging its way to winning the war against inflation. As a result, there was an initial sell-off in the crypto market. This was short-lived as the market quickly rebounded, with investors betting on continued economic growth and corporate profitability despite higher borrowing costs,” Lucas Kiely, the chief investment officer of digital asset platform Yield App, wrote to Forkast.

Image: Win McNamee via Getty Images.

Adding to investor concerns, the European Central Bank raised interest rates by 25 basis points to 3.5% on Thursday, in an eighth consecutive hike. This brings interest rates in the region to the highest in 22 years. The central bank also indicated that it is mulling higher interest rates this year.

The global crypto market capitalization stood at US$1.04 trillion on Friday at 3:30 p.m. in Hong Kong, down 5.45% from US$1.1 trillion a week ago, according to CoinMarketCap data. With a market cap of US$495 billion, Bitcoin represented 47.8% of the market while Ether, valued at US$200 billion, accounted for 19.3%.

See related article: US SEC sues major exchanges; Circle gets Singapore license

Notable Movers: EOS & APE

Layer-1 blockchain protocol EOS Network’s (EOS) token was this week’s biggest loser in the top 100. EOS fell 28.97% to US$0.6355. The token started its downtrend on Saturday, pressured by the SEC’s lawsuits and the overall negative market sentiment.

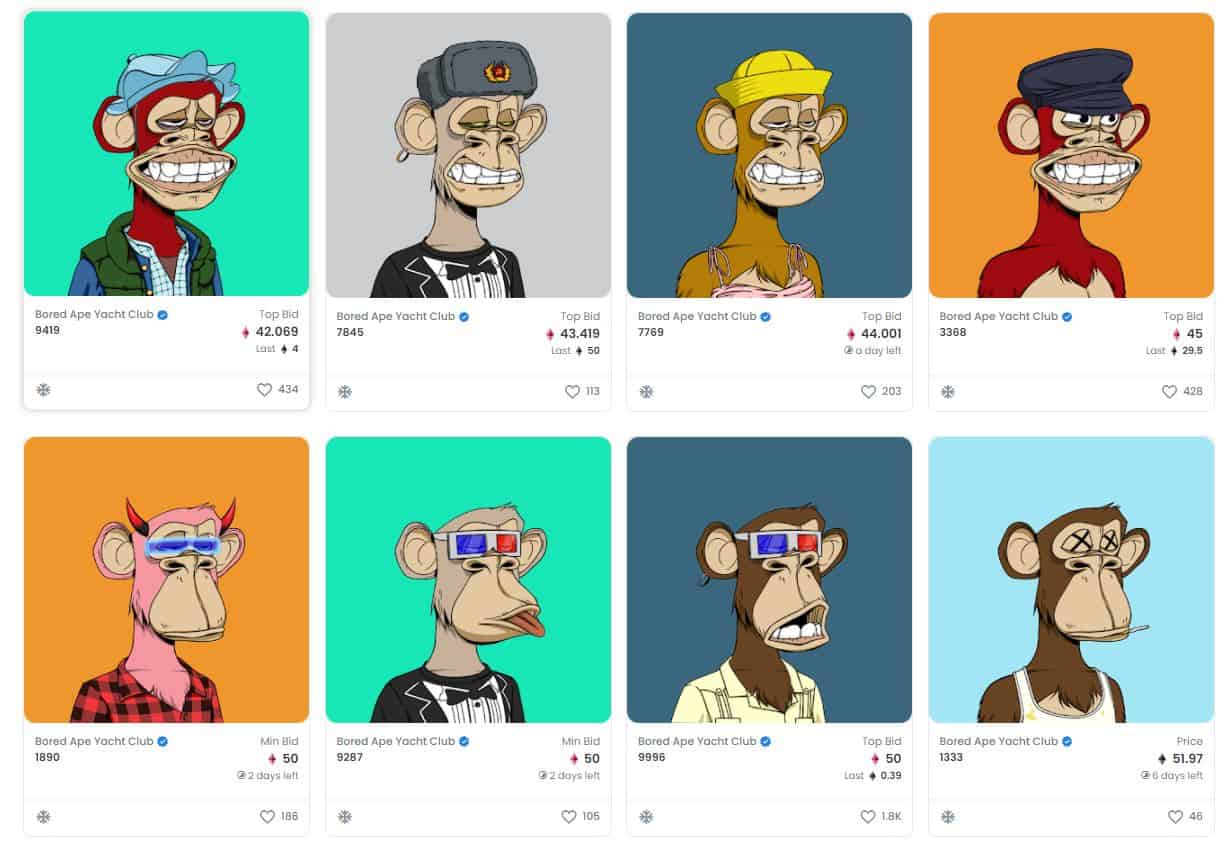

ApeCoin, the official crypto of the Bored Ape Yacht Club ecosystem, was this week’s second biggest loser in the top 100. ApeCoin fell 27.98% to trade at US$2.09, along with most of the notable metaverse tokens. The Sandbox’s (SAND) token also fell 21.53% while Decentraland’s (MANA) token declined 19.56% on the weekly chart.

See related article: Why the US is waging war on Binance, Coinbase

Next week: Can Bitcoin hold US$24,000?

Next week, investors will be looking forward to key speeches from several members of the Federal Open Market Committee (FOMC), including president of the Federal Reserve Bank of Cleveland, Loretta Mester, Atlanta Fed chief Raphael Bostic and St. Louis Fed president James Bullard. Federal Reserve chair Jerome Powell is also set to testify on the Fed’s recent monetary policy actions on Wednesday and Thursday.

The Bitcoin Fear & Greed index, which is a multifactorial measure of crypto market sentiment, rose from 41 points on Thursday to 47 points on Friday, signaling that investor sentiment shifted from fearful to neutral.

While market participants are cautious that the SEC may go after other exchanges, Kasper Vandeloock, chief executive officer of quantitative trading firm Musca Capital, does not expect any more lawsuits from the SEC without further regulatory clarity in the U.S.

Yield App’s Kiely said that Bitcoin price will likely remain range-bound next week unless it falls below US$24,000.

“To confirm an upward trend, Bitcoin prices need to close the week above the key level of US$30,500. Bitcoin has been trading below this for several weeks now, with neither bulls nor bears taking control… On the other hand, if prices fail to hold above current levels, it could indicate a continuation of bearish sentiment. Investors should also keep an eye on another key level at US$24,000,” wrote Kiely.

See related article: BlackRock files for spot Bitcoin ETF, taps Coinbase as custodian