What is the true value of a non-fungible token (NFT) collection, and how many of your favorite blockchain’s sales are from true collectors? If you are a trader, you already know that’s a riddle few have been able to solve. Mix in some wash trading, and you now have a cipher worthy of legend.

MEGA GMs!

— hudah.eth|tez (@Hudah_Idiot) May 5, 2023

Do you know what the single most wash traded #NFT is?

Introducing Terraforms (@mathcastles) #4206, swapped 20x during @LooksRare token farming last year, at over $10m each sale. In total it has been sold for 86,905.12 ETH or $242.97m. Degens gona degen. https://t.co/qAYKH1IcMz pic.twitter.com/oF9tQW6kxl

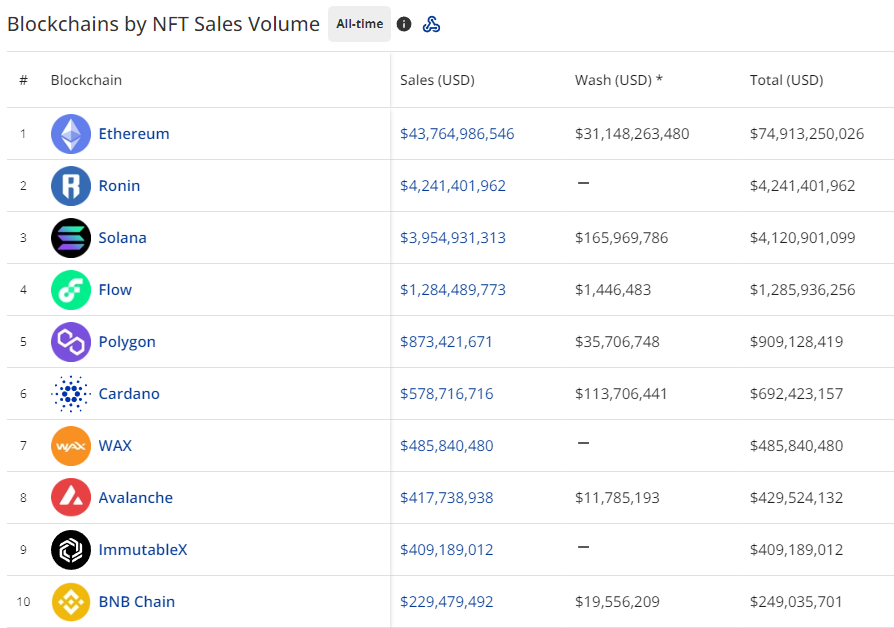

This week, CryptoSlam unveiled new on-site wash trade metrics that give traders and professionals tools to unravel organic NFT sales from the wash trades. And the real game changer? These new metrics aren’t just for Ethereum.

CryptoSlam’s Chief Marketing Officer Yohann Calpu says, “As we can see from the new data published on CryptoSlam.io, the wash numbers are a large part of sales volumes across many of the top blockchains, including Ethereum. The beauty of blockchain technology lies in its inherent transparency, which allows us to unearth the truth behind the numbers, this only increases overall trust.”

Ethereum’s wash trading isn’t exactly breaking news, though the extent of it is often worth reporting on. What is news, however, is that the public has come face to face with wash trading on other blockchains. Though not as extensive as wash trading on Ethereum, most other major chains now have a small percentage of their volume comprised of wash trades, and because of that, these new tools are welcome.

Now broken down by blockchain in 24 hours, seven days, 30 days and all time periods, traders can dial into each blockchain on cryptoslam.io to get a breakdown of sales vs wash sales along with a total U.S. dollar value, number of transactions, and total wash percentage.

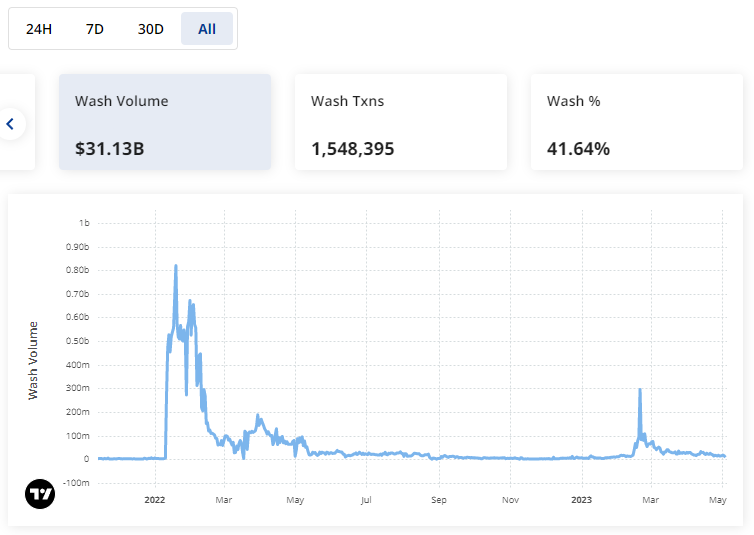

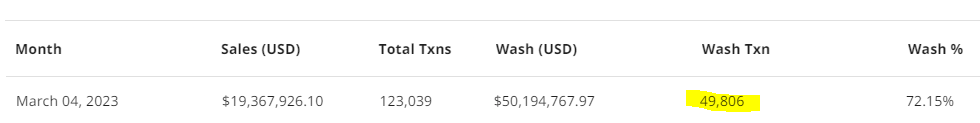

Putting these tools to use, we can look at Ethereum’s history of wash trading to compare LooksRare wash trading in 2022 to today’s Blur wash trading. It’s easy to see, the value of wash trades in 2022 has yet to be matched, even with all-time high wash trade transactions happening this year.

The story doesn’t end there, and I’ve recently written about the extent of wash trading on Forkast News. In short, wash trades make up a significant percentage of monthly transactions and are still largely driven by traders’ farming points on the Blur marketplace.

While the NFT market faces a significant downturn made more complicated by wash trades, it is important to measure both organic growth and wash trades.

Systems can be gamed, but the numbers don’t lie; NFTs have grown into a multi-billion dollar market. Analyzing all sales allows clarity into the growth of Web3 as new technology and products are born using decentralized platforms, game theory, DAOs, and, yes, even wash trades.

The Forkast 500 NFT Index excludes wash sales to provide an accurate measure of the NFT market’s value. While the total USD volume of global sales has been up in the past seven days, the Forkast 500, with wash sales removed, shows the NFT market actually losing value and is down over 2%.