Over US$635 million of Ethereum non-fungible token sales in April were wash trades, which made up nearly 60% of all NFT trades on the blockchain for the month, according to new data from CryptoSlam,

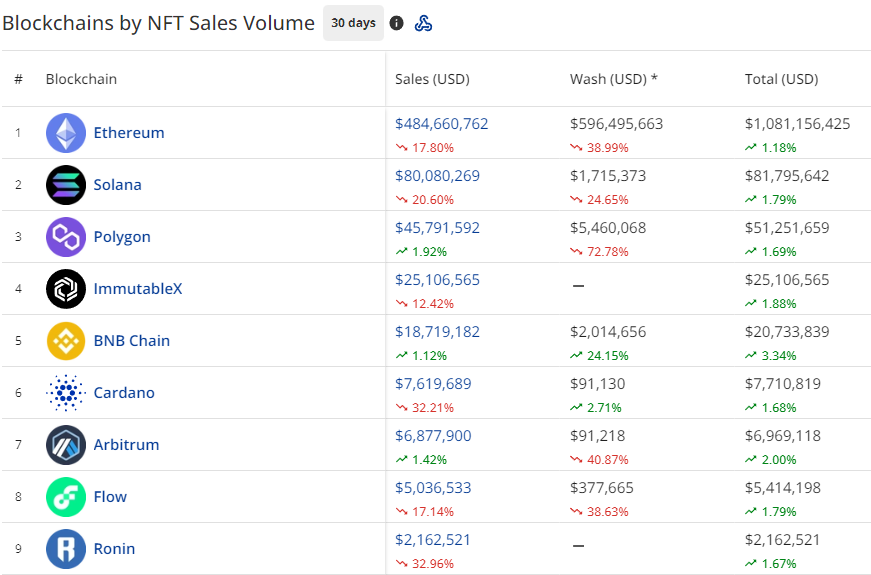

The new data also revealed wash trading activities on Solana, Binance, Polygon, Cardano, Flow and Arbitrum, which had been largely unknown until now.

Wash trades refer to an investor acting as both the buyer and seller of a financial instrument to generate misleading trading volume and potentially manipulate prices. The practice is illegal in U.S. securities markets.

Blur marketplace’s point farming is the primary driver of Ethereum NFT wash trades, leading to US$3.4 billion worth of NFT trades being flagged as wash sales so far this year. Blur traders’ bids and listings are incentivized by the marketplace’s points — the platform’s loyalty system — fueling some traders’ reliance on bulk wash sales to maximize points, which is subsequently rewarded in the form of Blur’s utility token, $BLUR.

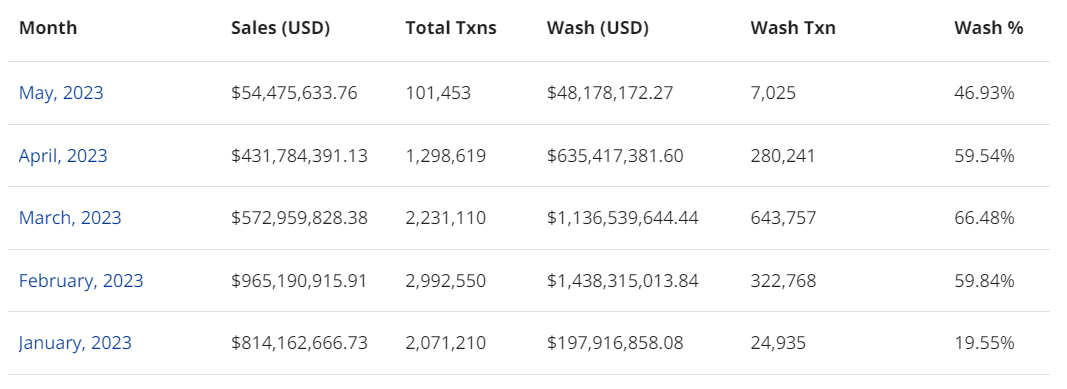

In March, over US$1.1 billion, or 66% of all NFT sales on Ethereum, were wash trades. However, the single highest wash trading day occurred on Feb. 20, days after the launch of $BLUR. Traders aggressively farmed points to earn more $BLUR token rewards, resulting in over 85% of the day’s sales volume, valued at US$295 million, being flagged as wash trades.

February, March, and April stand out as high points for wash trading on Ethereum, with a combined total value of over US$3.135 billion. At the peak of wash trading on March 4, 2023, daily NFT wash trades transactions on Ethereum reached 49,806 compared to 2,743 on April 16, 2022, the apex of $LOOKS token farming.

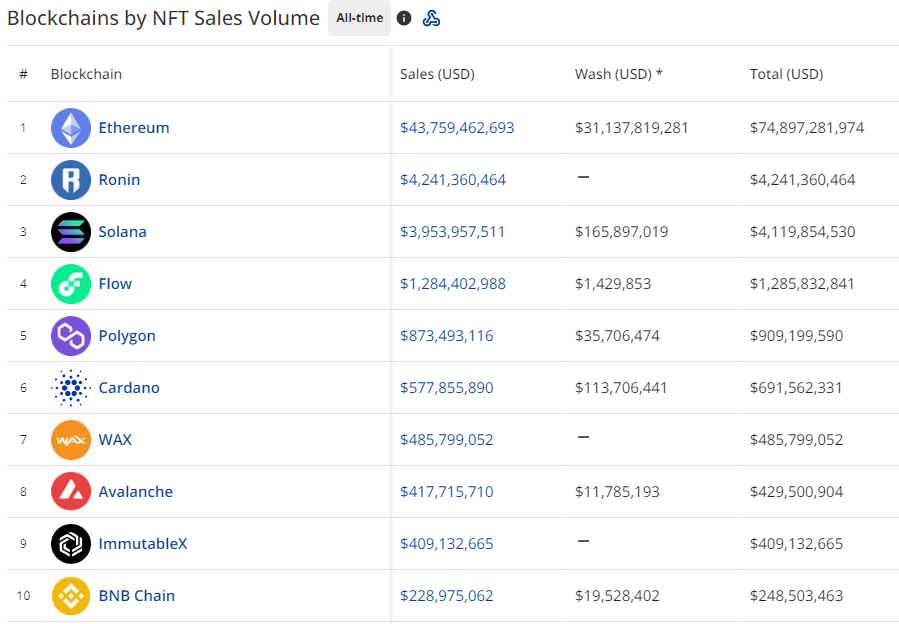

Similar to $BLUR token farming in 2023, traders in early 2022 were farming $LOOKS tokens at the then-new LooksRare marketplace. CryptoSlam’s data has revealed $LOOKS farming as the driving factor behind US$819 million in wash sales that took place on Jan. 19, 2022, the most successful day for wash trading ever. Over US$18 billion in wash trades were flagged in January and February 2022.

Though the value of wash trading sales has decreased since last year, the number of transactions has grown nearly 20x, CryptoSlam data shows.

The top two wash-traded collections across all blockchains are Ethereum’s Terraforms and Meebits, with US$11.5 billion and US$9 billion in flagged trades, respectively. Standout NFTs from these collections include Terraforms #4206, which has been wash traded for 86,905.12 ETH (US$242.97 million), and Meebit #13824 for 29,453.9 ETH (US$99. 4 million).

Highlighting the extent of traders’ practices, CryptoSlam has uncovered US$31 billion in all-time wash trade sales volume on Ethereum, totaling 41% of the blockchain’s US$74 billion in sales. An additional US$330 million in wash trades is reflected across the other top 10 NFT blockchains, making up a much smaller percentage of their all-time sales.

Wash trading is expected to continue and possibly increase on Ethereum as traders use liquidity-providing tools like BenDAO, NFTfi and Blur’s new Blend lending protocol to pursue more platform rewards in Blur’s Season 2.

1/ Introducing Blend: the Peer-to-Peer Perpetual Lending Protocol for NFTs.

— Blur (@blur_io) May 1, 2023

Built in collaboration with @danrobinson and @transmissions11 at @paradigm, Blend enables 10x higher yield opportunities than current DeFi protocols and unlocks greater liquidity for NFTs.

Here’s how 👇 pic.twitter.com/uOFC6i3LSq

While Ethereum owns the bulk of global wash sales due to $LOOKS and $BLUR token farming, it is expected to continue on other chains with a growing number of marketplaces adopting reward incentives.

(Update: edits third paragraph to clarify wash trading defintion)