In this issue

- China’s crypto crackdown: Scorched earth

- Beijing’s mining ban: Buried alive

- Germany’s crypto-trading hamster: Mr. Goxx’s fuzzy logic

From the Editor’s Desk

Dear Reader,

“Winter is coming” may feel like a stark warning for the cryptocurrency sector, but for China’s crypto community, it’s very much already here.

The Chinese crypto space has been a chilly one for some time, but in recent days it has entered a deep freeze.

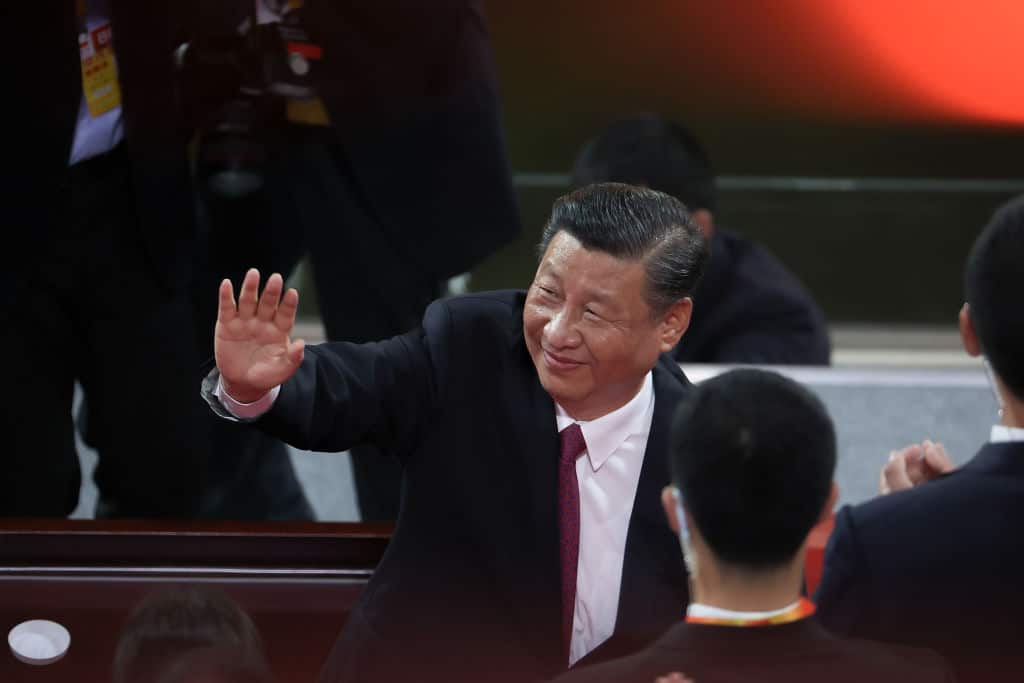

Beijing’s years-long crypto crackdown acquired a frosty new edge as the country’s leadership literally doubled down on its already hardline stance, banning crypto altogether and taking an ice axe to the remains of the crypto mining industry.

These latest developments are not entirely surprising, coming from a regime not exactly known for its live-and-let-live spirit. And they are still less surprising given the credibility China’s leaders are putting on the line with the widely anticipated winter launch of the country’s own digital currency, to which cryptos are seen as an unwelcome rival. But they show that when it comes to control of the monetary system, Beijing means business. In this context, crypto is not collateral damage — it’s a threat to be contained.

Beijing’s war of attrition with cryptocurrencies has a long history, although many previously heralded regulatory enforcement drives have had the saber-rattling characteristics of cold-war gestures rather than hot-war kinetics. And there are signs that market players are gambling on the possibility the latest moves may be more of the same, as suggestions circulate that decentralized exchanges may fill the gap left by centralized bourses such as Huobi and OKEx, which are already shutting out Chinese investors.

I encourage you (if you haven’t already) to check out my conversation with Sam Bankman-Fried, CEO of crypto derivatives exchange FTX, who candidly shared how he views China’s tightening chokehold on crypto.

Bankman-Fried, in what seems to be a sign of the times, is off to warmer regulatory climes in the Bahamas. Far from the chilly Chinese-imposed crypto winter.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. China’s digital dirigisme deepens

By the numbers: China crypto ban — over 5,000% increase in Google search volume.

China’s central bank and nine government agencies published a notice this past Friday afternoon prohibiting all cryptocurrency transactions. The notice, dated Sept. 15, is the latest salvo fired in China’s lengthy battle against cryptocurrencies and prompted a sell-off that saw Bitcoin slump by around 9% and Ether by at least 11% within hours. Adding to China’s previous counter-crypto measures that included cracking down on crypto mining and banning banks from opening accounts with crypto exchanges or crypto-related entities, the latest regulatory assault forbids the provision of services such as marketing and IT support to crypto businesses, and explicitly targets crypto exchanges outside China, banning them from providing crypto-related services to Chinese residents.

- China’s beef with Bitcoin, specifically, goes as far back as 2013, when finance sector involvement in crypto transactions was the first facet of the business to face restrictions and enforcement. Initial coin offerings and exchanges came next. And earlier this year, many Chinese crypto miners were left with little option but to relocate abroad amid a series of decrees and enforcement actions against the sector.

- Nevertheless, the latest ban stops short of prohibiting ownership of crypto assets. Just last month, a district court in Shanghai classified Bitcoin as a virtual commodity, a ruling in line with a decision in a 2019 case that recognized Bitcoin as virtual property. Also last month, Shandong’s High Court referred to a 2017 case to reiterate the point that crypto trading remains prohibited.

Forkast.Insights | What does it mean?

Although China’s hardline stance on crypto dates back to the 20-teens, Beijing’s rationale for stepping up its more recent efforts to crack down on the industry has its own distinct origins. As Forkast.News has reported in recent weeks, China’s central bank digital currency — the digital yuan, or e-CNY — is being rolled out both domestically and internationally. And the government is planning on using the Winter Olympics — which it is hosting in a little over five months from now — as a public relations exercise to promote the new currency.

The clampdown on crypto can be attributed to Beijing’s desire to protect its own digital currency — in true-to-form zero-sum fashion — at the expense of others.

Cornell University economist Eswar Prasad, who once led the International Monetary Fund’s China team, told Bloomberg this week that Beijing wanted not only to maintain control of digital payments within China’s borders, but also — and more importantly — to ensure that cryptocurrencies were not used as conduits to move money into or out of the country through unofficial channels.

China’s crypto crackdown is part of a larger narrative of control of Chinese peoples’ money. Alipay and WeChat — two huge companies that have been among the hardest hit by new restrictions — dominate China’s digital payments market and have a commensurately outsized role in the functioning of the country’s economy. China wants to change that, and the e-CNY is part of the offensive against big business and unregulated cryptocurrencies.

Once the e-CNY gains a foothold, it will give Chinese authorities unprecedented control over how Chinese people are able to spend their money. But until then, the new currency remains vulnerable to less surveilled assets and to citizens’ wish to keep Beijing out of their wallets.

2. Beijing buries mining holdouts

By the numbers: SparkPool — over 5,000% increase in Google search volume.

China’s clampdown on crypto mining may have prompted an exodus of mining pools to destinations such as Kazakhstan and North America earlier this year, but a ban on crypto mining in Inner Mongolia seems to not have yielded the results Beijing had hoped for. Local media outlets reported earlier this week that authorities in Inner Mongolia had seized 10,100 crypto mining rigs from a government-operated tech park following the appointment of a local company to scout out the region’s surviving mining operations. That came after the National Development and Reform Commission and other authorities on Friday released a joint notice saying that authorities would enhance their electricity monitoring to identify mining projects.

- He Zhiguo, a finance professor at the University of Chicago Booth School of Business, told Forkast.News yesterday that the new nationwide blanket ban suggested frustrations among authorities over the persistence of mining activity in China, despite the obstacles that miners already faced from regional and province-level bans.

- Following the notice, Chinese miner Poolin lost more than 36% of its Bitcoin hashrate. China-based Ethereum miner SparkPool, the world’s second-biggest Ethereum mining pool, announced that it would be shutting down all of its services.

- Chinese tech giant Alibaba also announced that it would be prohibiting the sale of crypto mining hardware and software, including tutorials and strategies, on Oct 8.

Forkast.Insights | What does it mean?

Beijing has been projecting an image of confidence abroad and control at home during the Communist Party’s centenary year, but not all stories coming out of China are as propaganda-perfect as the party and its apparatchiks would have one believe.

China is grappling with an energy crisis. More than half of the country’s provinces are limiting electricity usage, with some regions suffering blackouts, as a result of a global crunch in energy supplies.

But the crisis in China is worse than elsewhere, thanks to the country’s choking dependence on cheap coal (not helped by Beijing’s politicized ban on buying the black stuff from Australia) and, to some extent, leader Xi Jinping’s vision of decarbonizing the economy, even though coal-fired power plants account for more than 70% of the country’s electricity generation.

Pair that pincer effect with surges in demand for Chinese-made goods, and the upcoming winter has left China woefully short of power, putting cryptocurrency miners in the crosshairs of a campaign to weed out intensive energy use.

Beijing is also heavily invested in the success of its central bank digital currency, the e-CNY, to which it sees Bitcoin as a direct rival. Clearing out the country’s remaining miners represents a chance for Communist Party bosses to be seen as tough on energy-wasters and bullish on Beijing’s homegrown new money.

3. Crypto-trading hamster gives market veterans paws for thought

By the numbers: Mr. Goxx — over 5,000% increase in Google search volume.

A new superstar trader in the digital asset space is taking social media by storm — Mr. Goxx, a crypto-trading hamster. The rodent’s anonymous Germany-based owners have been broadcasting Mr. Goxx during his “office hours” on streaming platform Twitch, where it’s possible to view the fluffy crypto trader placing orders by crawling through a “buy” tunnel or a “sell” tunnel. Mr. Goxx has a career trading volume of more than US$5,350 and was holding 16 cryptocurrencies as of press time. According to his latest live stream, he has a portfolio worth an estimated US$445, representing a +16.62% career performance.

- According to calculations by media outlet Protos, Mr. Goxx has outperformed Warren Buffet’s Berkshire Hathaway, the S&P 500, the Nasdaq 100, and even Bitcoin since his trading debut in June.

- Mr. Goxx’s owners told Forkast.News in a Reddit direct message exchange that the hamster’s rise to superstardom had brought lots of laughs for their household, but also plenty of stress. Although Mr. Goxx’s dominant digital asset is currently Tron, his owners say he has “made most of his money with trades on Bitcoin.” They politely declined to give additional information on their identities, saying that Mr. Goxx was “rightfully the star of this show.”

Forkast.Insights | What does it mean?

The world loves a mascot — especially when punters can hitch their fortunes to the outcome of the choices made by an animal. Punxsutawney Phil, Maggie the Monkey and Lazdeika the Crab are three examples of animal oracles.

Paul the Octopus remains perhaps the most famous oracular animal. During the 2008 European football championships and the 2010 FIFA World Cup, Paul successfully predicted the outcomes of football matches 85% of the time.

Mr. Goxx has had similar luck with his crypto predictions, outperforming stock markets and the Oracle of Omaha’s Berkshire Hathaway. Although the clamor to hang off Mr. Goxx’s every trade is palpable, his keepers are keen to highlight that the entire Mr. Goxx phenomenon is a critique of how crypto fans choose what coins to invest in.

“It seems like most people from our generation see no other chance than throwing a lot of their savings on the crypto market without having a clue what’s going on there,” Mr. Goxx’s owners told the BBC.

Indeed, the hamster’s name pays homage to Mt. Gox, a Japanese crypto exchange that once handled up to 70% of Bitcoin trades before collapsing from one of the biggest hacks in crypto history. But despite such warnings, crypto is the land of animal memecoins, animal non-fungible tokens and meme NFTs involving animals. The rise to fame of a crypto-investing hamster feels par for the course — as does its owners’ decision to create their own NFTs to capitalize on their rodent’s good fortunes.