In this issue

- Do Kwon: Whereabouts unknown

- The Merge: A high, then a hangover

- e-CNY: Canberra calling

From the Editor’s Desk

Dear Reader,

“Fight or flight” is a threat response hard-wired into our psychological make-up before our ancestors even learned to make fire. Today, it has a very modern application — in crypto.

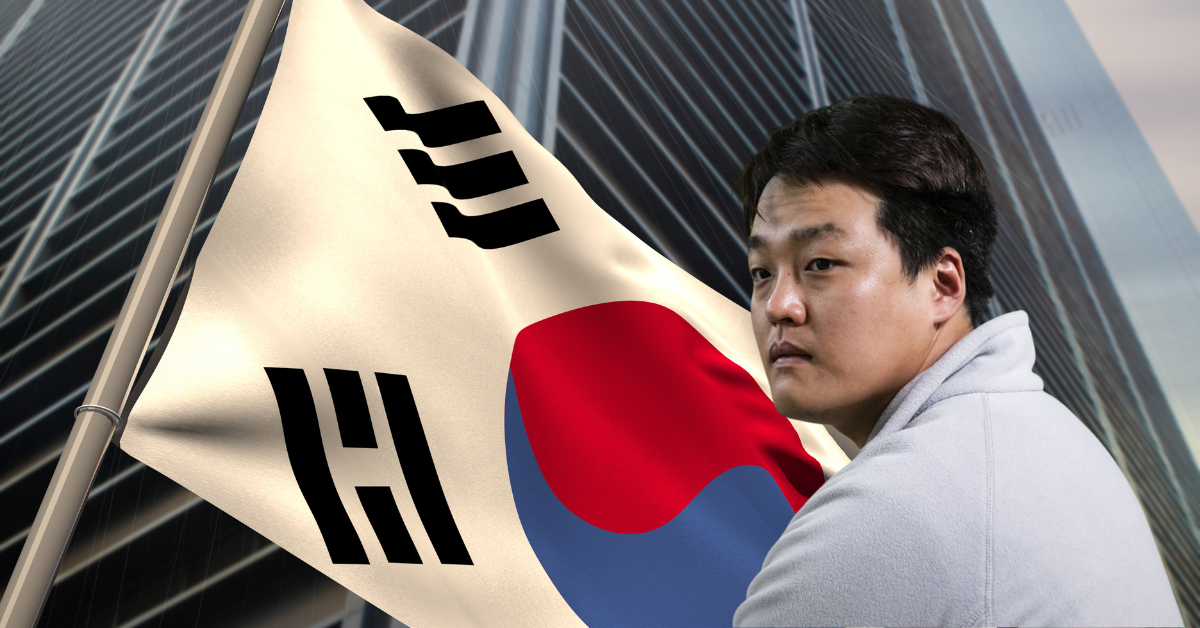

Flight is something in which Terraform Labs chief executive Do Kwon — to give him his full name, Kwon Do-hyung — appears to be engaged, having skipped his native South Korea for Singapore before the net of law enforcement began to close around him and the US$37 billion collapse of his Terra-LUNA cryptocurrency project.

Singapore police claim Mr. Kwon is not in the city-state, which begs the question: Well, where then is he? as authorities in his home country await a response to their request for an international arrest warrant for him.

A bigger story is the fight that is coming on the other side of the Pacific, in the United States, where, following the Ethereum network’s Merge last week, Securities and Exchange Commission Chair Gary Gensler appeared to set the stage for more cryptocurrencies — notably all those minted using Ethereum’s new proof-of-stake consensus — to be treated as securities.

The fight against securities classification already has a high-profile combatant in the form of Ripple Labs, which has been grappling with the SEC for two years over the regulator’s accusation that the payments company sold US$1.3 billion of unregistered securities in the form of XRP tokens. But Gensler’s comments have implications for the crypto industry that go far beyond just Ripple, subjecting an increasing number of tokens to its scrutiny.

How this will play out will be front and center in the minds of the crypto community as we inch closer to the U.S. mid-term elections this autumn and related policy developments that follow in 2023.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. Cash me if you can

By the numbers: Where is Do Kwon? — over 5,000% increase in Google search volume.

Wherever Terraform Labs Chief Executive Kwon Do-hyung — better known as Do Kwon — is currently located, he faces the risk of being deemed an illegal alien, as South Korea has started the process of canceling his passport. Prosecutors in Seoul have reportedly asked Interpol to issue a red notice — an international request for law enforcement agencies in Interpol’s 195 member nations to arrest and detain a suspect in a criminal case — for Kwon.

- South Korean authorities issued an arrest warrant for Kwon, the creator of the collapsed algorithmic stablecoin UST and its sister Luna coin (now renamed Luna Classic), for alleged violations of domestic capital markets laws. Five other people are also on the wanted list alongside Kwon, according to Bloomberg.

- South Korea has been probing Kwon and Terraform Labs for suspected fraud following the multibillion-dollar collapse of the Terra ecosystem in May. Many investors lost large sums of money from Terra’s implosion, and some saw their life savings disappear.

- Terra’s death spiral triggered a series of insolvencies and bankruptcies in the crypto industry as coin prices plummeted, lopping more than a trillion dollars off the overall crypto market cap.

- Kwon was widely believed to be in Singapore, and a video interview released last month appeared to confirm his location.

- But over the weekend, Singapore police said Kwon was not currently in the city-state.

- “I am not ‘on the run’ or anything similar — for any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide,” Kwon said on Twitter while defending his privacy. South Korean prosecutors dispute Kwon’s claims.

- A Terraform Labs spokesperson declined to comment on the charges Kwon faces, and Kwon has not responded to Forkast’s requests for comment.

Forkast.Insights | What does it mean?

South Korean authorities have shifted up a gear in their investigation of suspected fraud related to the Terra-LUNA crash, moving to cancel Kwon’s passport and seeking to enlist Interpol in bringing him back within their reach.

The process of voiding Kwon’s travel document is being handled by the Ministry of Foreign Affairs and can take from one week to a month, Dongguk University Professor of Information Security Hwang Suk-jin told Forkast.

If Kwon’s passport is canceled, any visa or entry permit that he holds based on that document will be invalidated — unless he is traveling on a second passport, certain nationalities of which can be purchased with relative ease.

Out of the ashes of Terra’s collapse, Kwon has led the creation of Terra 2.0, a new, scaled-down incarnation of the Terra blockchain that no longer uses the UST stablecoin, which is now renamed USTC.

Terra’s original blockchain, now known as Terra Classic, will be implementing a 1.2% tax burn on Luna Classic (LUNC) and USTC transactions starting on Sept. 22 in Asia.

The mechanism is a variation of a community proposal to burn some of the supply of the cryptocurrency to help preserve its value — a plan that was dismissed by Kwon and Terraform Labs in favor of a hard reset through the creation of Terra 2.0.

Back in its pre-crash incarnation when it was called Luna, LUNC was a top-10 cryptocurrency by market capitalization. But it fell out of the top 100 following its crash in May. The crypto has regained ground to become the 33rd-largest token by market cap, seeing 225% gains in the past 30 days that have led to the token burn set to begin this week.

Luna 2.0 was the world’s 94th-largest cryptocurrency by market cap as of press time.

South Korea’s manhunt for Kwon may further dampen investors’ appetite for the new coin.

2. Merge, no surge

By the numbers: The Merge Ethereum — over 5,000% increase in Google search volume.

The crypto industry celebrated the success of Ethereum’s Merge last week as the network completed its transition to a proof-of-stake (PoS) consensus mechanism and phased out its energy-intensive proof-of-work (PoW) system.

- This week started with a major headache for the crypto market, with Ethereum falling below US$1,300 on Monday for the first time since July. The token was trading at US$1,330 as of mid-week Asia time.

- Bitcoin also dipped below US$18,500, its lowest level since June. BTC has since crept up to US$18,900.

- Ethereum forks, driven by miners to preserve their PoW way of doing business, have also faced technical issues at launch, with coins that have sprung up, such as EthereumFair, having lost as much as 88% of their value since the Merge.

- Other leading altcoins that use PoS, such as Cardano, Solana and Polkadot, were among the biggest losers at the beginning of the week.

- Crypto investors are treading water this week as the U.S. Federal Reserve is expected to announce another 75 basis point interest rate increase during the wee hours on Thursday in Asia, or Wednesday afternoon in the U.S.

- CME Group market analysts initially predicted a 40% chance that the Fed would opt for a more drastic full 1% hike after August inflation data exceeded expectations. The analysts have since lowered that forecast to 18%.

- Fed Chair Jerome Powell has pledged to bring U.S. inflation back down to 2%. Economists expect the central bank to raise interest rates to 4% within the year to tame spiraling inflation.

Forkast.Insights | What does it mean?

Ethereum’s smooth and successful upgrade last week — a long-anticipated event intended to increase the network’s scalability and greatly reduce its carbon footprint — had the industry in an ebullient mood for a few days. But fears of the U.S. Federal Reserve’s third successive 75 basis point interest rate increase have brought the market swiftly back to the reality of surging inflation.

Although the market remains focused on the Fed, the U.S. Securities and Exchange Commission (SEC) is also attracting attention.

Following Ethereum’s Merge, SEC Chair Gary Gensler stated that PoS-based cryptocurrencies were capable of passing the Howey test, which determines whether a transaction qualifies as an investment contract and is therefore a security. That benchmark would place such assets under U.S. securities laws.

Gensler’s comments raise the stakes in the SEC’s ongoing court battle against Ripple Labs.

Ripple and the securities watchdog have been butting heads in court since December 2020 over whether the company sold US$1.3 billion worth of unregistered securities in the form of XRP crypto.

In a filing over the weekend, the SEC argued that Ripple Labs had not disputed that its XRP sales had involved exchanges of “money,” thus meeting the “investment of money” qualification of the Howey test.

Ripple hit back in its own filing the same day, saying: “Ripple had and has no contract at all with many XRP recipients and was not even involved with most XRP trading in the secondary market.”

Who knew that the tribally loyal Ethereum and XRP communities would one day be making common cause?

3. Aussie rules

Australian Senator Andrew Bragg — one of the nation’s most crypto-literate lawmakers — has a bill in the works to monitor Chinese banks operating Down Under and their future use of China’s central bank digital currency (CBDC), which he claims could be a threat to Australia’s national security.

- The digital yuan, known officially as e-CNY, is the most advanced CBDC project operating in a major economy. While the United States has been hesitating on the issuance of a digital dollar, trials of Beijing’s CBDC — which has been in development for over seven years — have expanded to 23 Chinese cities and regions.

- “[E-CNY] currency, if it became widespread in the Pacific, or even within Australia, would give the Chinese state enormous power — economic and strategic power that it doesn’t have today,” Bragg said on local radio this week. “So, I think we need to be prepared for that. We need to know more about this digital currency, so the [proposed Digital Assets (Markets Regulation) Bill] establishes reporting requirements in that regard.”

- The Aussie crypto advocate said he plans to introduce the Digital Assets Bill during parliament’s next sitting at the end of the month.

- China is Australia’s largest trading partner, but the relationship between the two nations has soured as Beijing imposed bans and sanctions on Australian exports in response to Canberra’s call for an independent probe into the origins of Covid-19.

- China’s growing influence in the Asia-Pacific region has also been a cause for concern in Canberra. Earlier this year, China signed a security pact with the Solomon Islands that would allow Beijing to establish a military base in the country, which neighbors Australia.

Forkast.Insights | What does it mean?

Senator Bragg’s national security concerns related to e-CNY come as China, citing its need to stem money laundering, has made it clear that complete anonymity will never be a feature of its CBDC.

Although China does not yet have a specific law for the digital yuan, officials at the nation’s central bank say that e-CNY wallets holding higher balances and engaging in larger transactions will go through a know-your-customer process to support what the central bank calls “managed anonymity.”

China watchers are also paying close attention to e-CNY tests in Hong Kong, as the city’s global connections and ties with the Chinese mainland make it a natural testbed for the cross-border use of the digital yuan. Howard Lee, deputy chief executive of the Hong Kong Monetary Authority, the city’s de facto central bank, said earlier this month that it had made progress in the second phase of e-CNY testing in Hong Kong, which involved the existing Faster Payment System, an instant cross-bank payment tool using the Hong Kong dollar and the Chinese yuan.

Meanwhile, China is aggressively driving domestic e-CNY adoption. Fan Yifei, a deputy governor of the People’s Bank of China, said this week that the central bank planned to expand digital yuan pilots on a province-wide level to Guangdong, Jiangsu, Hebei and Sichuan within the year. That means China could soon have almost 40% of its population using its new digital currency, according to Forkast calculations based on publicly available information.

China’s e-CNY is the most advanced CBDC in a major economy undergoing testing anywhere, and as Washington-based think tank the Atlantic Council has pointed out, Beijing is also keenly interested in its cross-border uses — which positions China for setting future global standards for CBDC development.

Australia’s legislative initiative to keep a close watch on Chinese banks’ e-CNY uses is likely just the beginning of such moves by countries wary of China’s global influence, which may soon be given additional momentum by the international use of the digital yuan.