Non-fungible token (NFT) traders on Solana could be moving to newer projects, as the Forkast SOL NFT Composite dipped this week while sales surged, an industry expert said.

The Forkast SOL NFT Composite – a measurement of the performance of the Solana NFT market through 100 smart contracts launched this week by Forkast.News and data partner CryptoSlam – dropped 6.13% to 1,155.15 over the past seven days through 3:30 p.m. in Hong Kong.

Sales on Solana, the second largest NFT blockchain, surged 40.66% over the past week to US$20.21 million, but the number of unique buyers for Solana NFTs shrank 86% to 12,113, according to data from CryptoSlam.

“The Forkast SOL NFT Composite being down can reflect the casino aspect of NFTs where traders are moving from the more established projects to the newer ones, but it also could show some traders simply cashing out,” said Yehudah Petscher, NFT strategist at CryptoSlam.

Petscher added: “With the overall weekly sales on Solana being up, and the announcement of rewards from the Tensor marketplace, it seems safe to assume that the Forkast SOL NFT Composite is reflecting traders farming for Tensor rewards.”

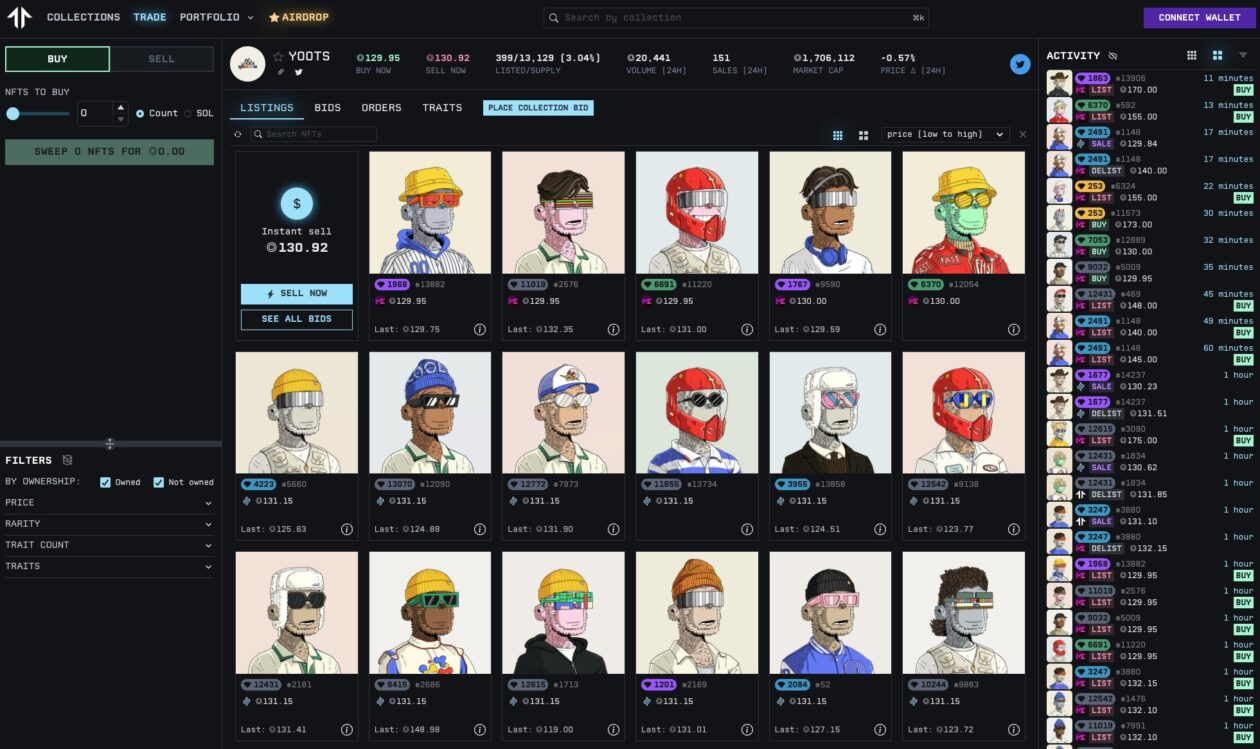

Activity on Tensor, a Solana NFT marketplace, started to pick up this week after it launched an airdrop on Monday as part of its reward program, a model similar to what Ethereum NFT marketplace Blur has deployed to take customers and market share from OpenSea.

Some 21.63% of all Solana NFT trades were made on Tensor over the past 24 hours, compared to 53.51% on Magic Eden, the dominant marketplace on the blockchain, according to figures from Solana data aggregator Tiexo. Tensor was a little-known marketplace where less than 10% of Solana NFT trades occurred until it launched its Blur-inspired airdrop.

On Monday, Tensor said it raised US$3 million in a seed round led by blockchain venture capital Placeholder.

“It’s hard not to root for just good old-fashioned competition,” Petscher said. “Since Tensor announced a US$3 million raise and an upcoming airdrop of reward tokens, we’re seeing the markets react similarly to how they did on Ethereum with Blur.”

Petscher added that the method of marketplaces winning over traders with rewards worked. “Trader-friendly tools then give Tensor an identity that differentiates them from other marketplaces, and in this case, they are tools that we’re proven to be preferred by traders (similar to Blur’s tools).”

Meanwhile, Global NFT sales rose 1.73% over the past seven days to US$188.2 million, with the number of unique buyers plunging 70.62% to 175,708, according to CryptoSlam data.

Outside Solana, Yuga Labs, creator of top collections like Bored Ape Yacht Club, released a new project on the Bitcoin blockchain, which raised about US$16.5 million through the sale of 288 NFTs over 24 hours. The “TwelveFold” collection, which launched on Sunday, consists of 300 individual works of 3D-rendered art.

“Whether it’s wanting a stake in Bitcoin history with a low-numbered inscription, or simply having exposure to Yuga Labs, the provenance is the real value here, and apparently, it’s worth a lot,” Petscher wrote in a CryptoSlam’s Tuesday newsletter.