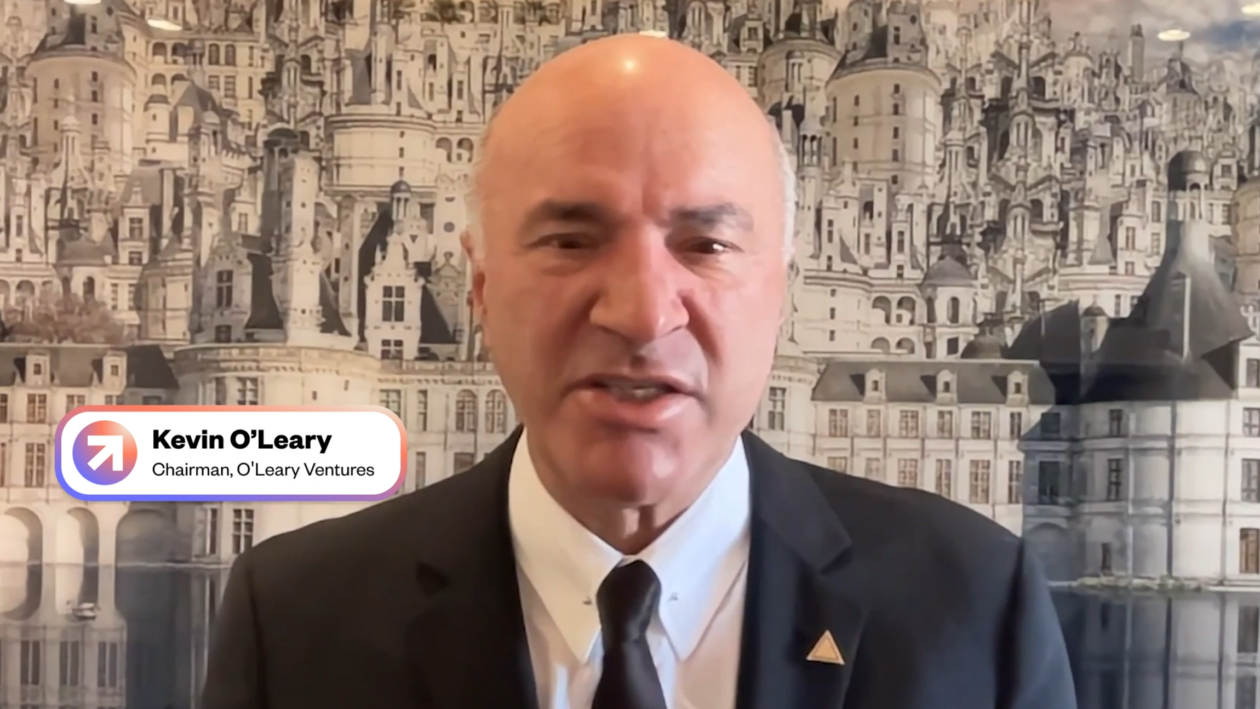

Kevin O’Leary, chairman of venture capital firm O’Leary Ventures and star of TV’s Shark Tank, said it’s too soon to be writing off the cash-strapped FTX.com, because an investor may appear to rescue the company, once the world’s second-biggest cryptocurrency exchange.

Trouble began at the weekend for FTX.com – the unit of the company providing services for non-U.S. residents – when details about questionable collateral at its brokerage arm Alameda Research sparked a run on the native FTX token FTT.

This was followed by reports FTX.com has a hole in its books in the region of US$6 billion and is in need of a rescue after rival exchange Binance pulled out of a planned bailout, this for a company that was valued at US$32 billion earlier this year.

While the future of FTX is in doubt, O’Leary told Forkast Editor-in-Chief Angie Lau in an exclusive interview that while the situation may look dire, it wouldn’t take much to turn it around.

“If I could buy FTX today and figure out how much risk there is with regulators and everything else, I would be looking at that asset,” he said, speaking to Lau as part of Forkast’s Crypto Rising series. “FTX has value; many players know that there must be a tremendous amount of activity going on in the background trying to figure this out,” he said.

“Here’s the funny thing about liquidity, if in five minutes you saw a tweet that there was going to be a white knight, the withdrawals would stop. That’s the remarkable situation.”

O’Leary told Forkast he is an investor in FTX International and FTX U.S. — the exchange service for U.S.-based customers — and is an account holder with FTX, making up just one of the many customers whose funds are currently locked within the exchange.

Suitors & Regulators

FTX Chief Executive Officer Sam Bankman-Fried in his first Twitter thread since Binance pulled out of a rescue deal, said there are a “number of players” the firm is in talks with, but that nothing is confirmed.

In an interview on Bloomberg TV on Friday, Justin Sun, the billionaire founder of the Tron blockchain and crypto platform, indicated he is interested in FTX.

“We will take care of our own customers first, then we will start to measure it (FTX) and we will see what we can do,” he said in the interview, adding he didn’t want to commit to anything in the first steps.

The former billionaire founder of FTX also acknowledged the tension between himself and Binance Chief Executive Officer Changpeng Zhao (better known as CZ), whose tweets last week kicked off the run on FTX’s crypto token FTT, deepening their liquidity crisis, and sparking speculation it was part of CZ’s plan to undermine a rival.

“In the thought of Zen and the Art of War that I could wipe out my competitor and get all of their accounts with zero customer acquisition costs, that would be very tempting,” O’Leary said, adding that he’s sure the two global entrepreneurs would have big enough egos to engage in this kind of jousting.

“For many observers who are seeing this open public social media battle, that’s what it looks like,” he said.

Ultimately, the scuffle and the fall out doesn’t serve either of them or the industry very well, O’Leary said, but if there is one silver lining it would be that the discourse around regulation of the industry is now going to become “hyperbolic.”

He said now is the time to act on the few pieces of legislation currently making their way through U.S. Congress, including the Stablecoin Transparency Act, and two others broadly aimed at defining cryptocurrencies as commodities.

O’Leary also expressed frustration at Securities and Exchange Commission chair Gary Gensler for dragging his feet on regulation over the past few years.

Given that FTX.com is headquartered in the Bahamas — and is a separate entity from FTX U.S. — O’Leary also acknowledged that it’s going to be difficult to establish jurisdiction over the matter.

That will not stop regulators from trying though, and may indeed force more entities onshore in the long run, he said, adding this would be positive for the industry as it will mean more institutions will feel comfortable investing in the industry.

“Crypto is not going away,” he said, “it’ll take this hit, it’ll move on because the promise, the productivity, the attributes of it are so powerful and so disruptive that they deserve a place on the international financial services stage.”

Hear more from Kevin O’Leary at Forkast’s Crypto Rising live stream on November 15th.