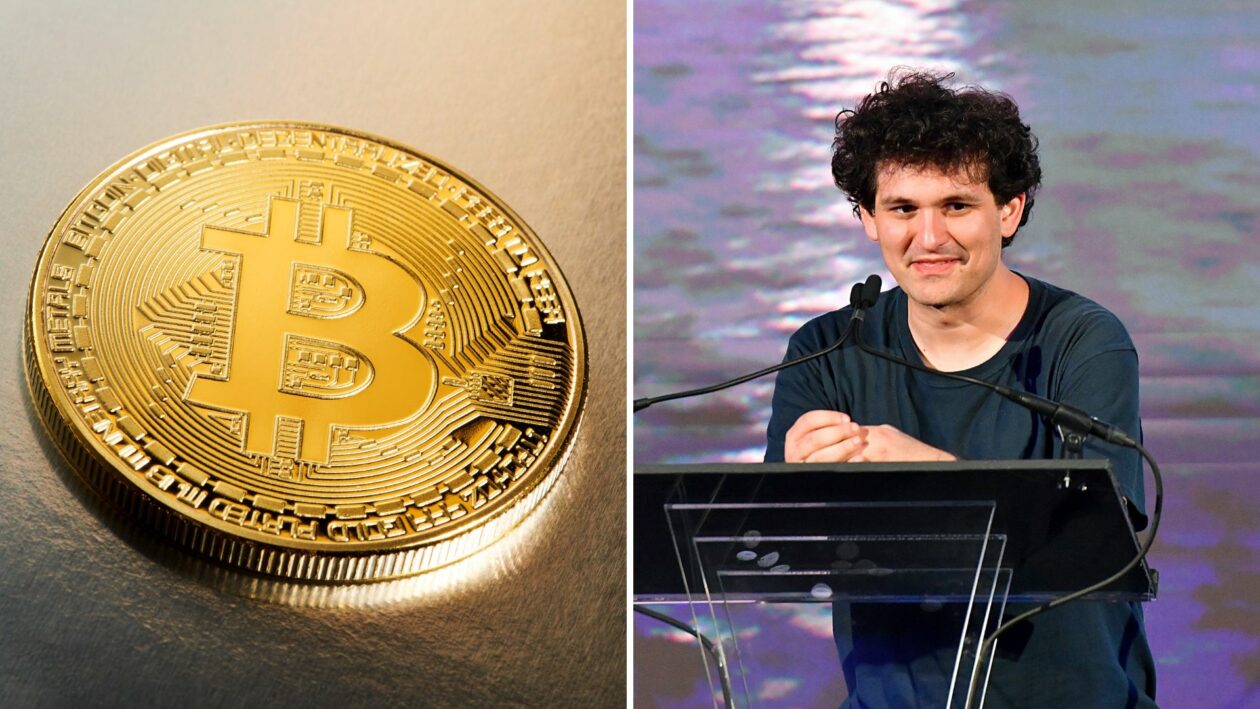

Cryptocurrency prices fell across the board in Thursday morning trading in Asia as Binance Global Inc., the world’s biggest crypto exchange, said it was backing out of a deal to acquire struggling rival exchange FTX.com just 24 hours after making the offer, leaving FTX facing collapse if no other buyers emerge.

Binance tweeted on Thursday morning it was no longer planning to acquire FTX as a “result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.”

Bitcoin fell to a two-year low of US$15,682 before recovering to US$16,829 as of 4 p.m. in Hong Kong, down 8%, according to CoinMarketCap. Ether fell to US$1,083, its lowest since June, before recovering to US$1,197, a decline of 7%.

All the market volatility has been created by the FTX issue, said Blake Cassidy, chief executive officer of Bamboo 61 Pty Ltd., an Australian company offering micro-investments in cryptocurrency.

“It looks like their (FTX) trading arm Alameda (Research) is insolvent or is close to insolvency, as well as that there could be contagion across their exchange,” he said in an interview.

The native token of the blockchain operated by Binance, BNB, didn’t escape the slump, falling almost 11% to US$281.71, after earlier in the day dropping to US$261.73 its lowest since July.

Solana was the hardest hit of the major tokens, falling 20.5% to US$15.34, wiping several billion dollars off its market capitalization and sliding three spots to 13 in CoinMarketCap’s list of cryptocurrencies by market cap. It started the week in the top ten.

Solana, the once fourth-ranked token by market cap, was hit particularly hard as FTX’s brokerage arm Alameda Research sold large quantities of its cryptocurrency reserves — much of which was Solana — to try to contain the collapse of the FTX token FTT.

FTT dive

To little avail, however, as FTT plunged 38.8% to US$2.90 in the past 24 hours and almost 90% in the past 48 hours from US$22 before questions about FTX’s finances hit the market. The price plunge was greased by a series of tweets Binance chief executive officer Changpeng Zhao sent on Sunday announcing Binance was selling its FTT holdings citing “recent revelations” about FTX.

“The 2008 Global Financial Crisis saw many companies who were over exposed with leverage become unstuck and unfortunately, we have seen another example of this today,” said Anna Clive, chief operating officer of Australian crypto exchange BTC Markets Pty Ltd, in shared commentary with Forkast.

“It’s a sad time for the industry and yesterday’s events clearly articulate the need for regulatory clarity in our space,” Clive added.

U.S. Senator Cynthia Lummis, who introduced a bill aimed at regulating cryptocurrency this year, alluded to the need for clearer rules in a statement on Wednesday prior to Binance pulling out of the deal.

“The recent events that have transpired between FTX and Binance are the clearest example yet of why we need clear rules of the road for digital asset exchanges in the United States,” she said. “Market manipulation, lending activity, and whether customer funds and assets were appropriately safeguarded are just a few of the many issues my colleagues and I need to consider in the coming days.”

Aside from the regulatory focus, Cassidy said the FTX affair could drive users towards decentralized finance (DeFi), which has protocols that have proved remarkably resilient in the face of crashes or hacks of more centralized platforms.

He said he expects centralized exchanges to change the way they operate in response as well.

“We’re seeing a trend of [exchanges] doing publicly verifiable proofs of their assets that they hold, which I suspect over time will become a gold standard across the industry that [means] the public can audit the exchange or the platform that they’re using, or the assets in the wallets.”

“It will be fascinating to see how the industry self-regulates off the back of this because as we’re seeing, regulation can be a bit slow to catch up.”