The makers of Stoner Cats non-fungible tokens (NFT) and its accompanying web series were charged and fined by the Securities and Exchange Commission (SEC) on Wednesday after the federal regulator took issue with Stoner Cats 2, the company behind the collection, raising over US$8 million worth of Ether through offering and selling unregistered securities as NFTs.

Stoner Cats 2 has accepted the regulator’s cease-and-desist order and agreed to the US$1 million civil penalty.

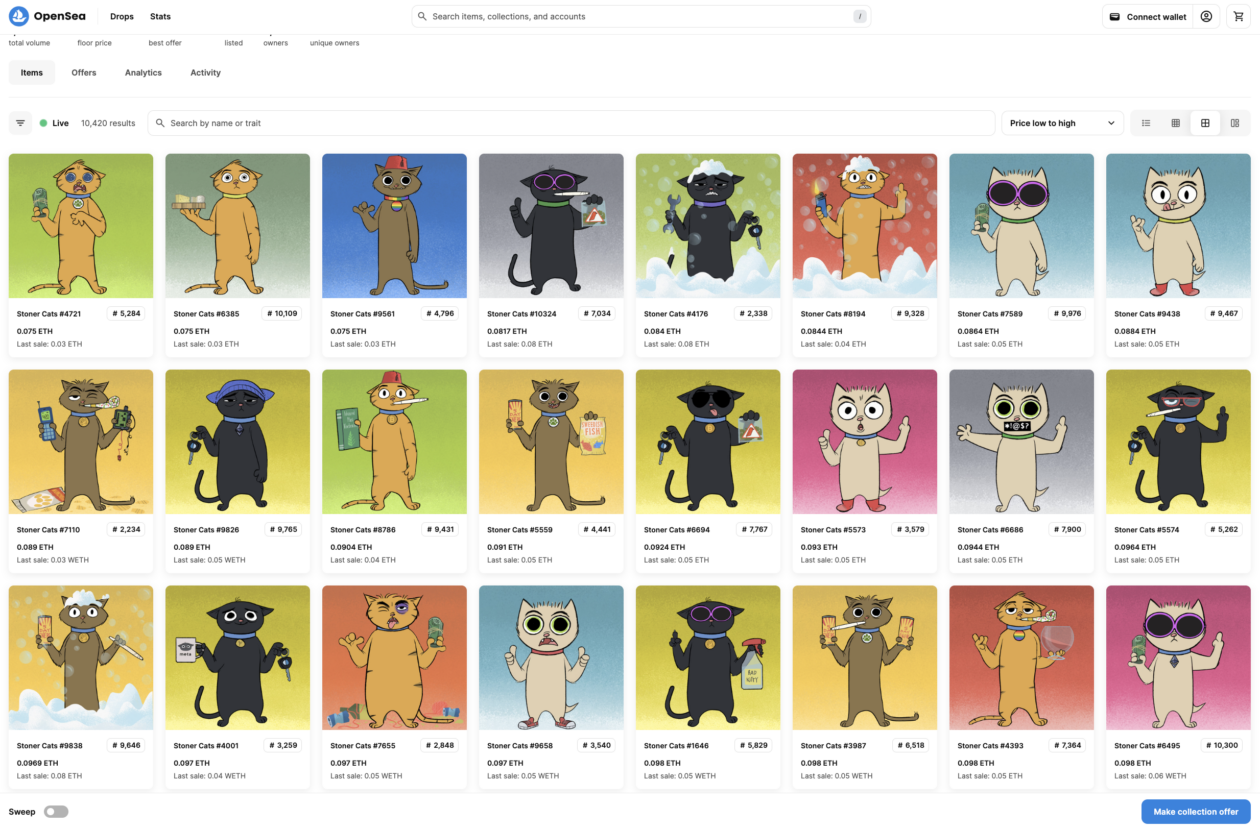

The Stoner Cats NFT project sold 10,320 NFTs of cat-themes animated characters on July 21, 2021 for US$800 each, to finance the animated web series of the same name that is voiced by a star-studded cast including Mila Kunis, Ashton Kutcher and Jane Fonda.

The SEC claims that the company’s marketing campaign led the investors to anticipate further profit in secondary market sales and interest, concluding that Stoner Cats NFTs were indeed financial securities.

“Regardless of whether your offering involves beavers, chinchillas or animal-based NFTs, under the federal securities laws, it’s the economic reality of the offering – not the labels you put on it or the underlying objects – that guides the determination of what’s an investment contract and therefore a security,” Gurbir S. Grewal, SEC director of the enforcement division, said in Wednesday’s press release.

NFTs slide

This is not the first time the SEC has charged an NFT company for offering unregistered securities. On Aug. 28, the agency brought the same charges on California-based media and entertainment company Impact Theory. Like Stoner Cats 2, Impact Theory agreed to the SEC’s cease and desist order and penalty.

SEC has also launched lawsuits against multiple crypto firms including Binance, Coinbase and Ripple Labs for allegedly offering unregistered securities in the form of cryptocurrencies. The enforcement action on Impact theory marks the first case of the U.S. regulator applying this approach to NFTs.

The NFT market is bracing for more. The Forkast 500 NFT Index, which is a proxy measure of the global NFT market performance, dropped 1.63% in the last 24 hours leading up to 1:30 p.m. on Thursday in Hong Kong.

Stoner Cats 2 has not immediately responded to Forkast’s email request for comments.

The Howey Test

SEC commissioners Hester Peirce and Mark Uyeda said in a statement expressing dissent against the enforcement that the SEC’s use of the Howey Test is short of “any meaningful limiting principle.”

Their statement insisted that regulators had to bring clarity to the NFT space before “arbitrarily bringing” charges against projects.

“Stoner Cats NFTs are not that different from Star Wars collectibles sold in the 1970s,” the statement said, explaining that toy company Kenner sold “early bird” coupons and memberships for future Star Wars-related action figures in order to strengthen the fan community.

“Would those I.O.U. certificates, which could be re-sold, constitute investment contracts? Using the analysis of today’s enforcement action, the SEC should have parachuted in to save those kids from Star Wars mania,” the statement said.

In determining a financial instrument as a financial security, the SEC uses the Howey Test, which contains four assessment aspects: an investment of money, in a common enterprise, with an expectation of profits, from the efforts of others.

There is no doubt that money was invested. Stoner Cats sold more than 10,000 NFTs at approximately US$800 each, raising around US$8 million. However, the nature of NFTs complicates this criterion. If the primary purpose of buying these digital assets was personal enjoyment or fandom, then the “investment of money” criterion could be up for debate.

The funds raised were earmarked for an animated web series, seemingly tying the fate of the NFTs and the series together. But what if each NFT is unique and not directly tied to the performance of the series or the company? The notion of a “common enterprise” is far from clear-cut in the decentralized world of blockchain.

The SEC argues that Stoner Cats’ marketing led investors to expect profits, especially with the option for NFT owners to resell. However, the motivations for purchasing NFTs can be diverse, ranging from collectibility to utility in a digital ecosystem. If profit isn’t the primary driver, this criterion could be in doubt.

The final prong of the Howey Test examines whether the value of the investment is dependent on the efforts of a third party. While Stoner Cats 2 marketed its expertise and required a 2.5% royalty for secondary market transactions, one could argue that the value of the NFTs could also be derived from their intrinsic qualities or even the actions of the broader community.