In this issue

- Hong Kong approves Arrano Capital as manager of crypto funds

- Ripple rips YouTube over crypto fraud videos

- dForce is robbed, but cyber bandit then gives it all back

- In China: courier giant builds logistics lab, and 224 more blockchain firms get green light

- Startup funding in Singapore, U.K. and the U.S.

From the Editor’s Desk

Dear Reader,

While much of the world is staying in place, developments in blockchain is doing anything but. The industry continues to press on, grow and evolve. And the Current Forkast is monitoring the temperature inside the hothouse biosphere of emerging technology innovation, while the outside world continues to fight on. That micro climate is getting steamy.

In Hong Kong, a big win for Venture Smart Asia that has its roots in blockchain investment in the early days. It has evolved since then, and its blockchain investment arm Arrano Capital got a big regulatory nod from the Securities and Futures Commission of Hong Kong. The approval in and of itself shows a maturation in the regulatory space — from skeptical policing agency to one developing guidelines to help shape a valid market participant. The spectrum of maturity in this space, however, remains broad if you contrast this with what YouTube is facing this week: a lawsuit filed by Ripple for failing to police crypto scams. It shows that we are not all there yet. While the SFC gets it, YouTube is still (surprisingly) unable to figure out its basic obligations to its own audience.

Also, I want to highlight the great analysis from Forkast.Insights on why DeFi may not be ready for primetime. It’s one thing to be a brilliant coder, it’s another when you can’t think through the application, implications, and all the consequences to the existing ecosystem. It will take a concerted and collaborative effort between traditional market participants and the innovators that want to disrupt the whole system. If Covid-19 hasn’t taught us that cooperative efforts elevate us faster to a solution than each protecting their own turf, then maybe a little more reflecting while we shelter in place is in order before we rush back out to a world that isn’t ready for us quite yet.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. Venture Smart Asia

By the numbers: Venture Smart Asia — over 5,000% increase in Google search volume.

Venture Smart Asia’s blockchain arm Arrano Capital is launching Hong Kong’s first virtual asset fund with SFC approval to trade in cryptocurrency. Arrano Capital has revealed plans to launch a second actively managed fund, later this year.

- Arrano Capital is aiming to manage over $100 million worth of assets with a bitcoin price-tracking fund.

- This fund is not available to the general public, as the fund is not an “authorized fund.” Arrano Capital is given regulatory approval to target institutional investors.

Forkast.Insights | What does it mean?

Although many who follow the crypto market focus on the price of the specific coin or token, this is not a great measure of maturity — there’s much more to it than that. The more interesting metric to examine are institutional holdings, which has been on the rise since 2017 when Morgan Stanley declared that Bitcoin and altcoins were a “new institutional investment class.”

The rapid decline of the commodity market during the Covid-19 pandemic has fund managers searching for an alternative store of value. But how do institutions invest in bitcoin? They can’t just go and buy it from a local exchange, fund managers are governed by a plethora of rules. This is where the vehicle that Arrano Capital has created steps in. Now that Arrano Capital has the Hong Kong SFC’s regulatory seal of approval, this means that funds that are only allowed to invest in regulated markets can step in and allocate capital.

Arrano Capital isn’t the first to offer such a product. Funds like this exist in the U.S. as well as in Canada and Singapore. But this is the first for Hong Kong — the headquarters of capitalism for Asia, which means that it will be noticed by all the important fund managers. In an interview with Forkast, Arrano Capital’s Chief Investment Officer Avaneesh Aquilla also mentioned Hong Kong’s tax benefits that simply can’t be replicated elsewhere as a reason why this fund is being set up in the Special Administrative Region.

But this is only the first step. The fact that it’s only available to institutional investors shows that regulators believe there’s still an unacceptable level of risk for retail investors. After all, the market gyrations that bitcoin is infamous for are much more violent than anything in the traditional equities or commodities market. In order to contain this, the fund needs some sort of counterbalance, perhaps in the form of a basket of digital assets backed by traditional commodities. Arrano Capital says that’s potentially in the works, so it’s a space to watch.

For the bitcoin market to mature, it needs to embrace regulation and lose the status of being a tool for “degenerate gamblers.” Punters that simply make bets aren’t building value. Anarcho-capitalist hideouts in sketchy offshore jurisdictions won’t bring in serious money. Funds like this are a step in the right direction, and should more of them emerge in competing jurisdictions, it will be better for the market as a whole.

2. Ripple v. YouTube

By the numbers: Ripple sues YouTube — over 5,000% increase in Google search volume.

Ripple and CEO Brad Garlinghouse are taking legal action against YouTube for its alleged failure to remove videos involving fraudulent XRP giveaways despite submitting 49 takedown demands to YouTube. According to the lawsuit, millions of people have viewed the scam videos, resulting in an estimated hundreds of thousands of dollars in losses, but Google’s immensely profitable video-sharing platform has deliberately ignored the fraud and failed to take action.

- Brad Garlinghouse: Today, @Ripple and I personally are taking legal action against @YouTube because their platform is the epicenter for imposter scams, and they’ve done next to nothing in response to our constant takedown requests. (2/4)

- Ripple’s allegations against YouTube comes while some cryptocurrency-related channels, enthusiasts, and even educators have been banned from the platform.

- YouTube’s 2019 purge of crypto personalities was reportedly a mistake, but the bans have continued to happen.

Forkast.Insights | What does it mean?

“Giveaway scams” are a common phenomenon on Twitter. The premise is simple: a well-regarded account makes a post claiming that they will give away a large number of crypto tokens to anyone that sends them some first. And of course, the offer is always followed through with the celebrity account sending hundreds of crypto tokens to anyone that sends them a mere fraction of one.

Not so fast. These popular accounts are not what they seem. Occasionally, hackers are able to take over a celebrity’s account. Other times, imposters create a doppelganger that uses bots to post milliseconds after. In an effort to curb these bad actors, Twitter has taken to banning new accounts made with famous names like “Elon Musk” or “Vitalik Buterin.”

YouTube is the next medium for these fraudsters. Usually, on this platform, scammers send well-known YouTubers phishing emails claiming that they represent a PR agency and would like access to their account stats to set up an advertising deal. But no such deal exists. It’s really an attempt to get the victim to provide their login credentials to enable the malicious deeds.

While there’s no question that these scams are a huge headache and bother for influencers and celebrities — who need to constantly remind people that they aren’t prone to charitable bouts of crypo-kindness with these seemingly random giveaways — it’s also a question if YouTube should be liable for any of this. After all, if the channel owner takes the proper security cautions that Google suggests — such as second-factor authentication — it would prevent fraudsters from taking over the account in the first place. But at the same time, YouTube’s inaction, or sluggish response, to taking down flagged videos does not look good for the company.

3. Hackers mess with dForce’s brain trust

By the numbers: dForce hack — 1,850% increase in Google search volume.

Hackers toyed around with DeFi startup dForce’s Lendf.Me protocol and took advantage of loopholes in its codebase. The hackers first stole $25 million worth of digital assets, and if this wasn’t embarrassing enough, then returned the loot. Two days after the heist, almost all the assets have been “recaptured,” wrote dForce founder, Mindao Yang. “We are still in the middle of the process so unfortunately I cannot share more details at this time; however, I will absolutely do so in a future post.”

- dForce was previously accused of plagiarizing Compound’s codebase.

- EthHub co-founder Anthony Sassano: Now that the hacker has returned the funds to dForce it’s time for dForce to return Compound’s code.

- Details of the hack and returns can be observed in the Ethereum blockchain.

Forkast.Insights | What does it mean?

Decentralized Finance (DeFi) might not be ready for prime time may be the big takeaway from the hack of dForce.

According to reports, hackers utilized a bug that exists when Uniswap, a smart contract protocol for automated liquidity, and ERC-777, a new token protocol, are paired together — but not necessarily present on their own. A Github thread from July 2019 alerted developers about the issue and suggested alternative approaches that could be incorporated.

No alternative approach was incorporated, and the hazardous pairing of code made it into the production stack that went live. This was likely a product of the dForce team’s inexperience. Code that made up the back end of dForce was extensively borrowed from the Compound Protocol — an Ethereum dApp to create money markets — which had the same problematic pairing in earlier versions. However, as the Compound Protocol matured, the bug was identified internally and arrangements were made to remove it. But this wasn’t noticed by the dForce team, which continued using an older version of the Compound code on the day of the hack.

But this particular bitcoin bandit might also have lacked the technical finesse of others who made off with similarly-sized pots of virtual loot. Within days of the hack, investigators from the community and Singapore’s police force were closing in on a suspect. How did this happen so fast? The hacker apparently left a virtual trail to himself, and executives at an exchange that received some of the stolen crypto forwarded the details to authorities.

“He seems to be a good programmer, but an inexperienced hacker,” said Sergej Kunz, the CEO of 1inch.exchange.

4. In China: first blockchain logistics lab and 730 blockchain firms now have official approval

Chinese courier giant YTO Express Group Co. signs an agreement with Conflux, a public blockchain system, to jointly build a blockchain logistics lab, the first of its kind in China, according to People.cn.

- According to the agreement, all signed data will be stored on Beijing-based public chain start-up Conflux, which is endorsed by the Chinese government.

- Conflux will provide permanent records preservation and node-checking services to YTO Express, to facilitate transactions, tracking receipts and invoices, and supply chain management.

Forkast.Insights | What does it mean?

Supply chain management and integrity is a major pain point for China, and many local startups are developing protocols and applications to try to address this.

While there are many blockchain companies working on this issue, we should take notice of Conflux’s contributions here given their other body of work: addressing the problem of scale. Conflux’s codebase allows for up to 3,000 transactions per second to be processed over its blockchain — a major improvement over the 7 to 15 transactions per second that bitcoin and ethereum are currently able to process.

YTO Express has roughly 12% of China’s 100 million-package a day delivery market, according to published figures. Should blockchain play a role in YTO’s future infrastructure, it needs to have the scale to match an industry as large as China’s package delivery. The partnership between Conflux and YTO will be an excellent proving ground to see how versatile the technology really is.

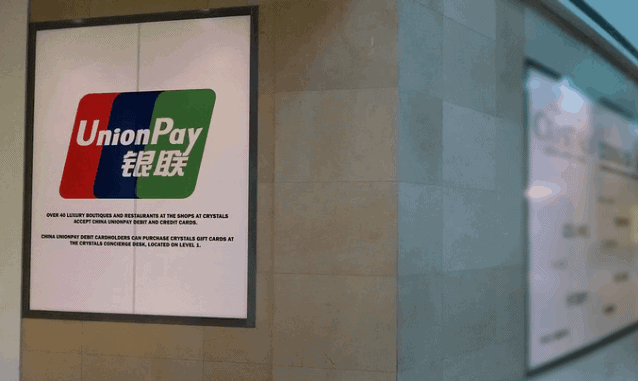

By the numbers: blockchain service filing number and new infrastructure — 205 published stories in Chinese media sources on the topic this week.

China’s Office of Central Cyberspace Affairs Commission (CAC) published the third round of companies to receive blockchain service filing numbers, which means that they meet the authority’s standards for executing blockchain information services, defined as “internet websites and application programs based on blockchain technologies or systems.”

- China Unionpay, Ping An Bank Co., Alibaba’s Ali Health Pharmacy Medicine Chain Co. and Baidu are among the 224 companies that received blockchain service filing numbers.

- The major businesses of the 224 companies are finance, blockchain framework construction and blockchain traceability.

- Since the Provisions on the Administration of Blockchain Information Services were published in February 2019, CAC has issued three rounds of service filing numbers, and a total of 730 blockchain companies in China now have blockchain service filing numbers.

- Simultaneously, the National Development and Reform Commission (NDRC) officially has categorized blockchain technology, for the first time, as new infrastructure, according to an April 20 press conference.

- New infrastructure has been regarded as the key player of the next wave of China’s economic transformation. Many provinces and cities have seen new infrastructure programs as its key programs in 2020. Chinese elite financial media Yicai.com reports that seven provinces will invest 25 trillion yuan in key programs in 2020.

Forkast.Insights | What does it mean?

China’s Blockchain Service Network launched last week, creating a national blockchain infrastructure for developers. The scale of this network is immense. It has the participation of all of the country’s telecoms and hundreds of cities that will host nodes. It’s of a size that only China can pull off. This is an endeavor that China takes seriously. It understands the potential for blockchain and is treating it as infrastructure, just like how a nation would prioritize its telecom network, bridges, highways and tunnels. The seriousness of this effort will all but ensure that China leapfrogs over the U.S. in blockchain, despite the U.S. having many industries and pain points where the technology would prove useful.

This won’t be a closed network. Although it is a permissioned chain, it will be intercompatible with most major existing chains from the West and China. Hyperledger, Ethereum, EOS, WeBank’s FISCO BCOS, and Baidu’s Xuperchain are all said to be compatible.

Now that the technical infrastructure is close to being finalized, it’s time to bring to the forefront the next step: standardization. Just like the world’s major corporations signed up for the ISO standards in the late 1940s and the 1950s in order to do business abroad, China hopes that this will be the equivalent for the 2020s.

The BSN is a global effort, and the portal’s global commercial launch is expected this June. But in a time of rising tension with China, this also gives China the ability to weaponize access to this network. Firms that run afoul of Beijing might find themselves excluded from accessing the world’s most important blockchain network. The thought of this might be enough to dissuade Western firms from participating.

5. Funding roundup:

Igloo – $8.2 million USD, Series A, Singapore

Igloo, a Singaporean digital insurance firm, raised $8.2 million in Series A funding from Thailand’s InVent, a private equity firm that primarily invests in Southeast Asia. It provides small claims insurance, such as transit insurance and travel insurance, through its API integration system. With an AI focus, it uses a real-time risk engine to access consumer risk and price accordingly. It also outsources its proprietary microinsurance technology to interested firms, with further personal and lifestyle insurance developments to come. Igloo, formerly known as Axinan, was founded by Wei Zhu, former CTO of Grab, one of the largest ridesharing and food-delivery applications in Southeast Asia.

Applied Blockchain – $2.48 million USD, venture, United Kingdom

Applied Blockchain, a UK-based startup, announced the closing of a new round worth $2.48 million led by QBM Capital, a Guangdong venture capital firm. Applied Blockchain is notable for its proprietary zero knowledge proofing system. It provides a framework for financial transactions and cryptographic verification and was originally presented in a published white paper. This round brings their cumulative funding to approximately $4.3 million.

Set Labs – undisclosed, seed, United States

Set Labs, a crypto-financial platform based in San Francisco, closed a funding round from Meyer Capital earlier this week. The terms of this deal were not disclosed. This adds to their previous funding round of $2 million USD. Registration for a Set account permits the buying and selling of crypto baskets. Set Labs is creating something similar to an ETF vehicle for cryptocurrency, as it allows users to package together with a basket of digital assets with stablecoins as well as BTC and ETH to counterbalance risk and provide stability.

tZero – $5 million, venture, United States

tZero, the venture capital subsidiary of Overstock.com, closed $5 million in equity funding this week from Beijing-based GoldenSand Capital, bringing its total funding raised to $472 million. GoldenSand Capital has now invested in two venture rounds as well as tZero’s initial coin offering. Overstock.com recently announced their sale of 4.1 million shares of “Digital Voting” preferred stock through an “alternate trading platform” on tZero. The platform also made headlines earlier this year when it was announced that tZero would lead the creation of the Boston Security Token Exchange, a regulated exchange for cryptocurrency. It would be the first of its kind and is currently awaiting SEC approval.

Forkast.Insights | What does it mean?

From Set Labs’ transformative cryptocurrency baskets to tZero’s initial coin offering, the financial sector is responding positively to institutionalized investment in blockchain technology. The banking sector is not rejecting the prospect of change, but rather embracing it to keep ahead of the competition in the region, as well as find new efficiencies. As Forkast recently reported, even during Covid-19 — when the venture capital market is challenging for entrepreneurs — companies in the Banking as a Service (BaaS) sector are still raising funds at a healthy pace. VCs understand the disruptive power blockchain can bring to the traditional finance space and many are happy to continue investing in it. In a post-coronavirus world, we expect this integration to continue further, especially as businesses try to compete in the consumer finance industry in the Asia-Pacific region.