Imagine you order an Uber to get to your big meeting.

Except after you request a ride, there is no instant confirmation and no ETA on your estimated arrival time. Anxiety kicks in. You fidget with your phone, check the time, do some quick mental math to see if you’ll make the meeting. You pace the room, peeking out the window when you hear a car pass by. You are at the mercy of blindly trusting that your Uber arrives on time. The experience would be an anxious void of critical contextual information.

Today, transacting on Ethereum is like this.

But, instead of waiting anxiety, it is Transaction Anxiety: a hold-your-breath, hope for the best, fingers-crossed-behind-your-back crypto-native phenomenon. And, when it comes to Transaction Anxiety, there is perhaps no crisper example than an in-demand NFT drop.

NFTs: A source for good — and a source of gas

NFTs, or non-fungible tokens, exist at the intersection of culture and technology, unlocking unprecedented new possibilities of creator empowerment. If you look at the recent frenzy surrounding NFTs – which, admittedly, can seem harder to do every day — it is possible to spot signs of a more profound structural shift.

Art, and the value one ascribes to it, is in the eye of the beholder. The price of a piece of art is dictated by what someone is willing to pay for it. But, as it turns out when it comes to a high-demand NFT drop like COVIDPunks, every user in the Ethereum ecosystem ends up indirectly paying as well as a consequence of increased network congestion, higher gas fees, and heightened transaction anxiety.

All 10,000 COVIDPunks NFTs were sold out in less than an hour. Because the launch coincided with Ethereum’s London hard fork and the associated EIP-1559 upgrade, COVIDPunks became one of the largest “ETH burners” of all time, destroying 525 ETH — or more than US$2.2 million. This demand drove up network congestion and transaction fees, resulting in an onslaught of failed transactions and subsequently wasted capital — not to mention user frustration — as Ethereum gas fees are not reimbursable.

Think of it like Uber surge pricing on New Year’s Eve: you will pay more for a ride regardless of whether you are going to the most popular party in town or to the airport. Except that you will get charged a fee even if your driver never arrives.

Gas prices impact every transaction and are driven by competition in the mempool — the ephemeral pre-blockchain layer — in what is essentially a live auction system. To watch what is happening in the mempool is to watch value in motion, and is sort of like watching the map of your Uber driver before they arrive at your place.

Understanding how the mempool works yields empowering insights for builders and traders alike. And NFT drops provide the perfect specimen to examine under the microscope.

Filling up the tank: a primer on gas fees

Before the London hard fork, Ethereum had a first-price auction system with a single variable: gas price. You just had to set your gas price, and that was it. The good news was that it was easy to understand. The bad news was that it was difficult to estimate the correct gas price, resulting in things like overspending missed transactions. It was like a 1:1 negotiation that went something like this:

Person A) “I would very much like to buy this thing; I will pay you $5.00 to buy it for me. Deal?”

Person B) “No.”

Person A) “How much would you like for me to pay to buy this thing?”

Person B) SILENCE

Person A) “Uh… here is $6.00?”

Person B) “No.”

Person A) “Ok… how about $7.00?”

Person B) “Yes.”

You get the picture. Rigid, inefficient, and like throwing spaghetti at the wall and seeing what sticks.

The London hard fork included EIP-1559, which made gas prices easier to estimate with variable block sizes and deflationary qualities. However, EIP-1559 also made things considerably more complicated. Rather than one variable like before, Ethereum transaction fees are now set via interdependent variables: the Base Fee, the Max Priority Fee, and Max Fee Per Gas. Another hard part? This system has only been in production since Aug. 5, so we all have limited real-world data about how transactions perform and how the fees change over time.

A tale of two fees: where psychology meets algorithms

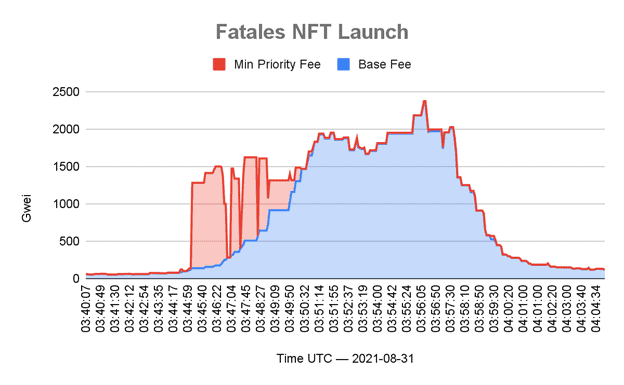

Network congestion and high gas fees during NFT drops stem from the combined effect of algorithms and human psychology. During a high-demand NFT drop like the Fatales NFT, the Base Fee (that is, the algorithm) is driven by market dynamics, which ratchets up based upon how full each block is. In contrast, the Priority Fee, also known as the Miner Tip, is driven by human psychology. Once human psychology takes over, gas fees, like people, become a lot more challenging to understand.

Recent history shows that the Max Priority Fee takes over during NFT bidding wars. Demand feeds into more demand, and human psychology takes over as users tip more and more for the chance to buy the NFT. In other words, the barrier to entry skyrockets. One could infer that the increase in gas fees is a catalyst for more people to get involved, because hey, if people are willing to pay this much in gas fees, the NFT may be worth a heck of a lot more down the road. It’s like the phenomenon of queuing theory, where a long line outside of a restaurant attracts more patrons willing to wait in that line on the presumption that if a large group of people is willing to wait for the food, it must be good! A person’s willingness to spend hours waiting for a pastry could be evidence of any number of cultural, economic, and psycho-social phenomena. These businesses signal quality with their long lines, and at the same time, they create buzz, as could be the case with higher gas fees during an NFT drop. Nothing attracts a crowd like a crowd, as the saying goes.

Let’s take a real-world example and show visually what is happening with gas fees behind the scenes of the Fatales NFT launch.

Look at the red lines — at the beginning of the Fatales NFT launch, the Max Priority Fee (Miner Tip) dominates over the Base Fee for inclusion. People are tipping like mad. Effectively what happens is, very suddenly, the network shifts from this smooth network to what amounts to a priority gas auction, where people are just bidding on the priority fee for inclusion to participate in the drop. The red line, in the beginning, is around one hundred Gwei, which is what people typically think an appropriate minor tip is, but as soon as the Fatales NFT drop launches, this table-tops into the new “cost of admission.” Right away, people who are jumping into this NFT are tipping more than 1,000 Gwei. To get included, you must tip massively.

In this graph, these two fees are overlaid to illustrate the difference:

However, in practice, what happens is your base fee and your priority fee get added together into what is known as the transaction fee. The purple graph shows what is actually happening on the entire network when you sum the two fees up.

The tipping point

This is a recurring pattern during in-demand NFT drops: psychology kicks in, and it’s all about tipping. Under periods of rapid increases in network demand, the priority fee takes over. The network’s behavior flips from being algorithmically determined by the base fee to being psychologically determined by people trying to get on-chain.

One moment your transaction seems appropriately priced and a good candidate for inclusion. And the next moment, it’s not. This is where Transaction Anxiety lives, lurking in the shadows.

Alleviating transaction anxiety

Typical blockchain transactions are like handing your luggage over at the airport. There’s a hidden maze of complexity happening beyond the walls of the terminal. Most of the time, your bag comes out, but sometimes, it doesn’t.

Transaction anxiety is a genuine and problematic aspect of the Ethereum ecosystem — a deterrent to institutional and retail investors alike. For all of us crypto enthusiasts who want to witness crypto ecosystem participation continue to climb, transaction anxiety is a serious matter that needs to be addressed.

Right now, transaction anxiety is holding the industry back. However, as with real-world anxiety where meditation, mindfulness and walks outside can help reduce anxiety, there are tools available for the crypto space too: namely, mempool. Although it’s currently underutilized, as more decentralized exchanges (DEXs), decentralized apps (dApps) and protocols begin to leverage the extraordinary predictive capabilities enabled by mempool data to detect pre-chain anomalies, massive opportunities will present themselves, solutions will be solved at scale, and transaction anxiety will wither away.