For evidence of the growing popularity of asset-backed loans using non-fungible tokens (NFTs) as collateral, look no further than lending marketplace NFTfi.

The peer-to-peer site said it has handled about US$88 million in NFT-backed loans in the first three months of this year, or more than double the US$40.7 million in all of 2021. Arcade, another NFT lending platform, said it has helped disburse US$24 million in loans since it started up in January this year.

“We’ve seen a surge of activity in the last year as more NFT holders discover how to unlock additional liquidity from their digital assets without selling them,” NFTfi founder and chief executive officer Stephen Young told Forkast.

Arcade estimates the total NFT-backed lending market is currently worth as much as US$400 million, while NFTfi has a more conservative view of around US$200 million.

All well and good for this emerging industry, but NFTs are highly volatile assets, reflecting the volatility in their underlying cryptocurrencies, such as Ethereum or Solana. So what are the pitfalls for the borrower and lender?

In one example last year, a borrower used an “Elevated Deconstructions” NFT worth around US$39,600 at the time as collateral for a US$12,000 loan. Within the loan period of 30 days, the value of the NFT surged to around US$300,000 after Snoop Dogg and other prominent NFT owners praised the work.

But that didn’t help the unnamed borrower, who ended up losing the NFT after defaulting on the loan, handing the lender a valuable asset and a hefty profit.

Risk of default is why several lenders follow the so-called lend-to-own policy, which means the lender gets to own a likely lucrative NFT if the borrower fails to pay back the loan. This offers some enticing scenarios.

The largest NFT-backed loan was issued in April when an anonymous NFT collector put up his collection of 104 CryptoPunks NFTs as collateral to secure an US$8.32 million loan. The same collection had been valued by Sotheby’s auction house in February at between US$20 million to US$30 million.

In March, another NFT collector borrowed US$8.08 million by collateralizing a bundle of 101 CryptoPunks NFTs. This week, crypto lender Nexo said it had arranged a US$3.3 million loan through the Arcade platform, backed by two CryptoPunks Zombies NFTs.

While these examples are outliers and the average loan amounts are lower — US$18,114 on NFTfi and US$300,000 on Arcade — they do help illustrate the surge in growth of NFT-backed lending.

However, although companies offering loans may have opportunities to gain ownership of valuable NFTs at a distressed price, they also face a downside risk.

Even so-called “blue chip” NFTs can experience severe price volatility. The floor price of CryptoPunks has dropped around 50% since October 2021, while the floor price of Cool Cats NFTs fell more than 35% in the past 30 days, according to data from NFT Floor Price.

For an extreme volatility example, the NFT of the first Jack Dorsey tweet sold for US$2.9 million in March 2021, but in an April auction the highest bid for the same NFT was less than US$280.

A sharp drop in an NFT price can also incentivize borrowers to default. But according to Young at NFTfi: “Defaults aren’t as big a problem for NFTfi since all our loans are over-collateralized and many lenders actually use NFTfi as a way to acquire NFTs for a discount in defaults.” Arcade said in an email response to questions that it has had no loan defaults to date.

Most platforms enable borrowers to secure loans equivalent to 20-30% of their collateral. At another NFT-backed loan site Drops DAO, loans are capped at 30% of collateral value. On Arcade, the loan-to-value ratios range from 20% to 60%.

Still, risk increases when lenders cannot value an NFT properly since values can be influenced by intangible factors, such as scarcity and sudden shifts in popularity.

Young at NFTfi says lenders on the site can range from people looking to gain some extra yield, to professionals that use artificial intelligence to value NFTs.

“We inform lenders to be mindful of picking a loan-to-value ratio they are comfortable with, not making large loan offers on assets they can’t appropriately value, and only offering longer-term loans (30-90 days) to NFTs they think will hold its value through the entire loan period,” he said.

Arcade, however, said it provides valuation and appraisals for NFTs to help lenders and borrowers reach an agreement. It has an “in-house data engineering and science team that works on automating valuations,” Gabe Frank, Arcade CEO and co-founder, told Forkast in an email.

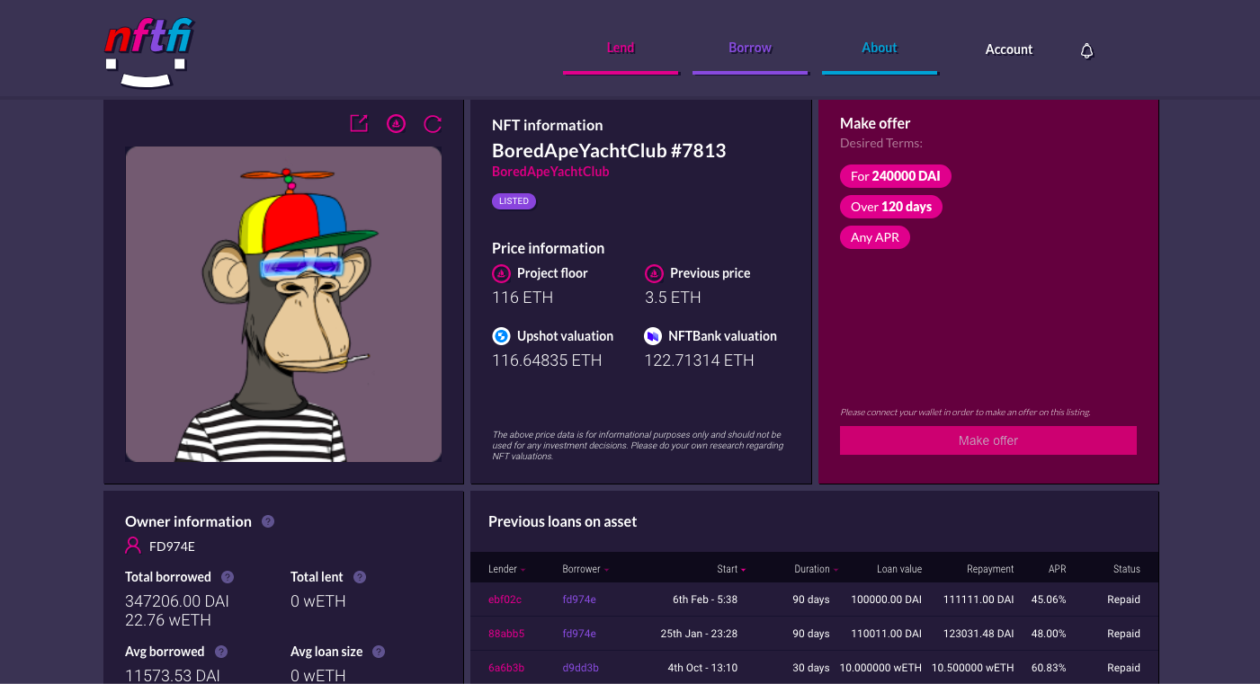

As for the nuts and bolts of how peer-to-peer lending works on NFTfi, once a loan offer is accepted, a contract is created and the NFT is sent to an NFTfi escrow account, while the loan is transferred to the borrower, who receives an NFTfi promissory note NFT. All this takes place simultaneously in a single transaction, eliminating the risk of either party not receiving promised assets.

On NFTfi, the average annual percentage rate (APR) — or the annual interest rate for a borrower — for loans of 14 days and 30 days stands at 94% and 63.7% respectively. Arcade said it has an average APR of just 20% across loan terms, while it can go as high as 60%.

With APRs reaching as high as 302% for seven days and loan terms going up to 90 days, it is borrowers that assume much more risk in such deals.

Moreover, just as in traditional finance, a loan default is recorded and affects credit score. As the default rates of borrowers on NFTfi are displayed to lenders, a high default rate may make it more difficult for borrowers to secure loans. This is also to ensure borrowers don’t default on purpose when the value of their collateralized NFT drops.

According to Frank at Arcade, there are projects working on on-chain credit scoring and identity, but it is yet to be widely adopted.

Foreclosing early on NFT loans on NFTfi can also be expensive. This is to ensure that borrowers don’t pay back early to accept better offers from other lenders, Young said.

“We do cap the repayment amount at 50% more than the loan amount to avoid predatory offers,” he said. “On a seven-day loan that is still a very expensive APR to pay.”