The agenda for the Indian parliament’s winter session, including a bill that “seeks to prohibit all private currencies” as a key objective, may be misleading, former finance secretary Subhash Garg told News18 in an interview on Tuesday. The proposed bill has not been published or made available to lawmakers yet so how “private cryptocurrencies” is defined remains unknown. Therefore the description of the bill as a ban on crypto was “perhaps a mistake,” Garg said.

Garg drafted the 2019 crypto bill that forms the basis of the new one. The 2019 bill called for a blanket ban on all cryptocurrencies and stipulated penalties and jail time for infractions. Garg’s view on cryptocurrency appears to have changed since then as he called crypto assets “a useful tool for humanity” in the News18 interview.

According to Garg, the 2019 bill sought to curb the use of cryptocurrencies as a medium of exchange. However, the “blockchain world of cryptocurrency is way bigger” today and the new bill needs to encompass aspects of digital assets apart from their function as a currency, Garg said.

Garg also said that classifying cryptocurrencies as assets is a “big mistake” — it is “too much of oversimplification” to treat crypto as assets, he said.

While the planned 2021 bill aims to lay a framework for India’s central bank digital currency, Garg said that bringing in a CBDC requires solving several complex questions. For instance, CBDCs can be stored in wallets on smartphones and used to make payments. However, not all Indians have a smartphone. Therefore, bringing in a CBDC that does not exclude anyone is a difficult task, Garg said.

Moreover, Garg also expressed skepticism about the bill getting introduced in the parliament during the ongoing session. “I am not so sure whether [the] crypto bill is expected any day. The bill has still not been formulated. It has not been considered by the cabinet and therefore, I have even doubts whether this bill will get introduced,” Garg said.

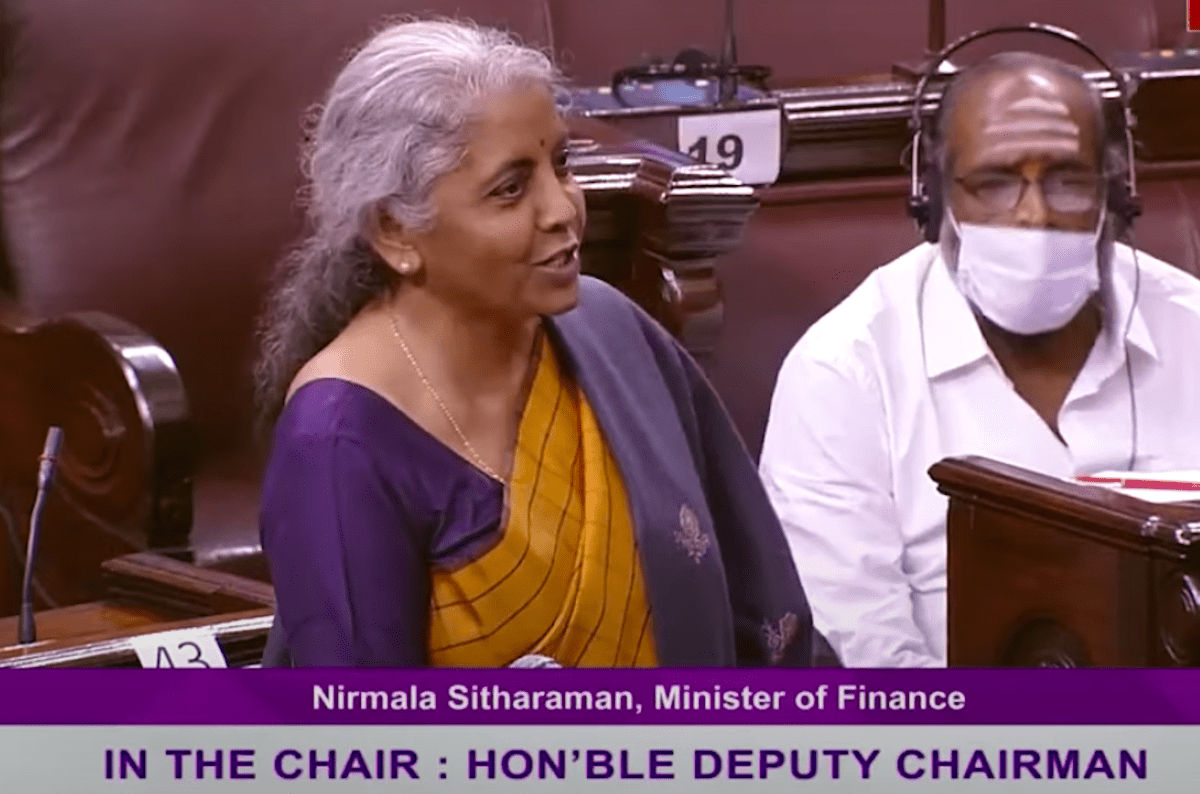

It is to be noted that the bill was earlier listed on the parliamentary agenda for the budget session but never tabled. Finance Minister Nirmala Sitharaman, during a parliamentary session on Tuesday, said that the bill will be introduced after the union cabinet approves it.

She added that the regulation of non-fungible tokens is also being explored and that no decision has been taken on banning crypto ads. “No decision was taken on banning its advertisements. However, steps are taken to create awareness through RBI and SEBI,” she said, referring to the Reserve Bank of India and the Securities and Exchange Board of India.

Last month, at the meeting chaired by the prime minister and the first parliamentary meeting on crypto, the impact of crypto ads, which many deemed to be misleading, was extensively discussed. As a result, crypto exchanges Bitbns and WazirX stopped advertisements. But it is important to note that the first parliamentary meeting on crypto had ended in a consensus on regulation and not a ban.

Sitharaman has also reassured the crypto community on multiple occasions that India will not shut out crypto. This did not stop investors from selling their assets in panic as soon as the bill was listed on the parliamentary agenda. By the early hours of Monday, Bitcoin and Ethereum prices dipped by nearly 24% in less than 24 hours and traded at a discount compared to the global market. Many investors began considering ways to protect their assets, such as by transferring them to a hard wallet or moving them out of Indian exchanges.

But crypto exchanges have largely been optimistic. Both CoinDCX and ZebPay have said that they expect positive regulation from the government. Singapore-based Coinstore even began operations in India this week despite the regulatory uncertainty.

Whatever the planned bill may entail, India’s retail crypto investors are jittery — even those who saw the crash this week as a buying opportunity. Answers may not come soon, however. Passing legislation is a lengthy process and, even if a ban is imposed, there will likely be an amnesty period for investors to safely liquidate assets.