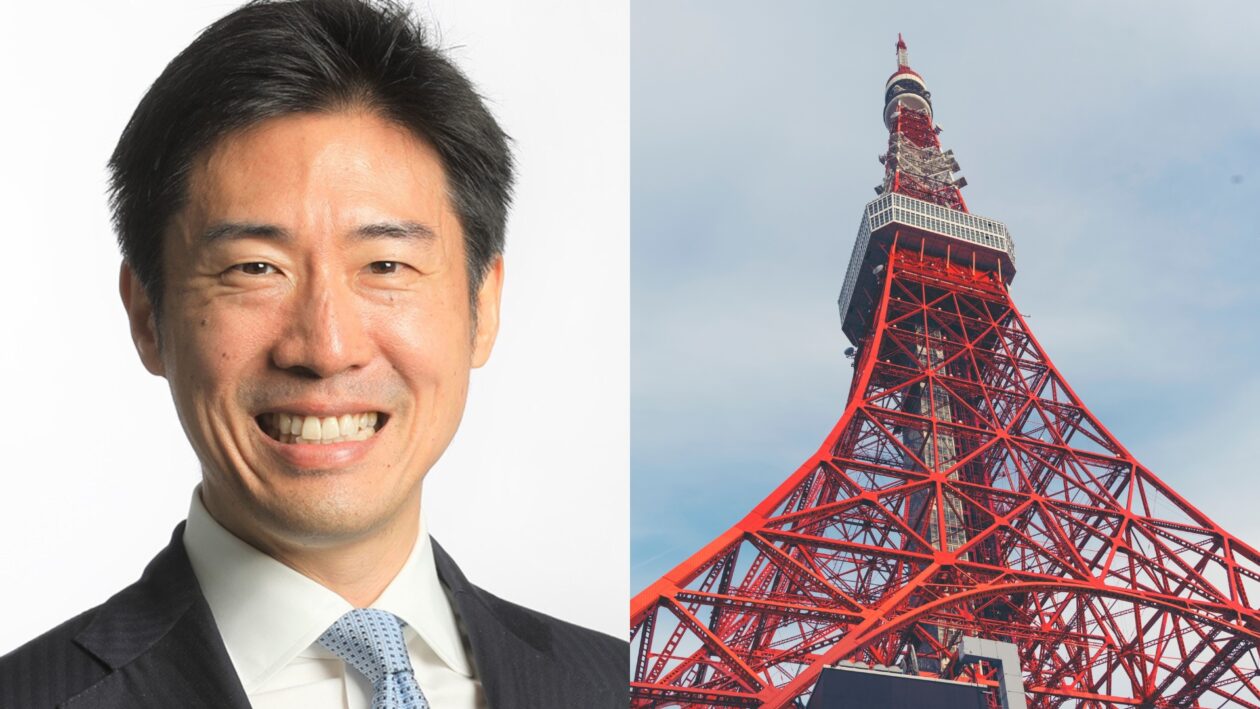

Akihisa Shiozaki, a lawmaker who helped formulate the country’s cryptocurrency policy, called for more transparent regulations for the industry following the meltdown of FTX.com, where investors were not warned of the potential risks associated with the bankrupt exchange’s native cryptocurrency, FTX Token (FTT).

See related article: Japan’s Web 3.0 lawmaker urges further easing of country’s crypto regulation

Fast facts

- The Japan Virtual and Crypto assets Exchange Association (JVCEA), the self-regulatory body that oversees local crypto exchanges, did not notify investors of the risks in FTT, the ruling Liberal Democratic Party lawmaker said in an interview with Bloomberg published on Wednesday.

- FTX Japan listed and started offering FTT trading pairs on its platform in February 2022 after the token was approved by the association.

- However, JVCEA’s green light included a condition that further required FTX Japan to monitor the FTT holding balance of its parent company’s trading arm, Alameda Research, according to Bloomberg.

- The poor disclosure and management of Alameda’s large FTT holdings came to light in early November, which led to the rapid downfall of FTX.

- “It will become more and more important to ensure transparency for consumers when there are any matters that require attention on tokens,” Shiozaki told Bloomberg.

- Shiozaki, however, insisted that Japan should relax its strict screening process on token listings despite the FTX collapse.

- JVCEA is reportedly planning to ease its lengthy screening process to allow tokens to get listed on exchanges if it has previously been traded in the local market.

See related article: Japan eases token vetting process to expand crypto offerings: report