Hong Kong’s central bank digital currency (CBDC) project with three other central banks and the Bank of International Settlements (BIS) will enter its pilot stage this year to test international trade settlements, a Hong Kong government official said.

Fast facts

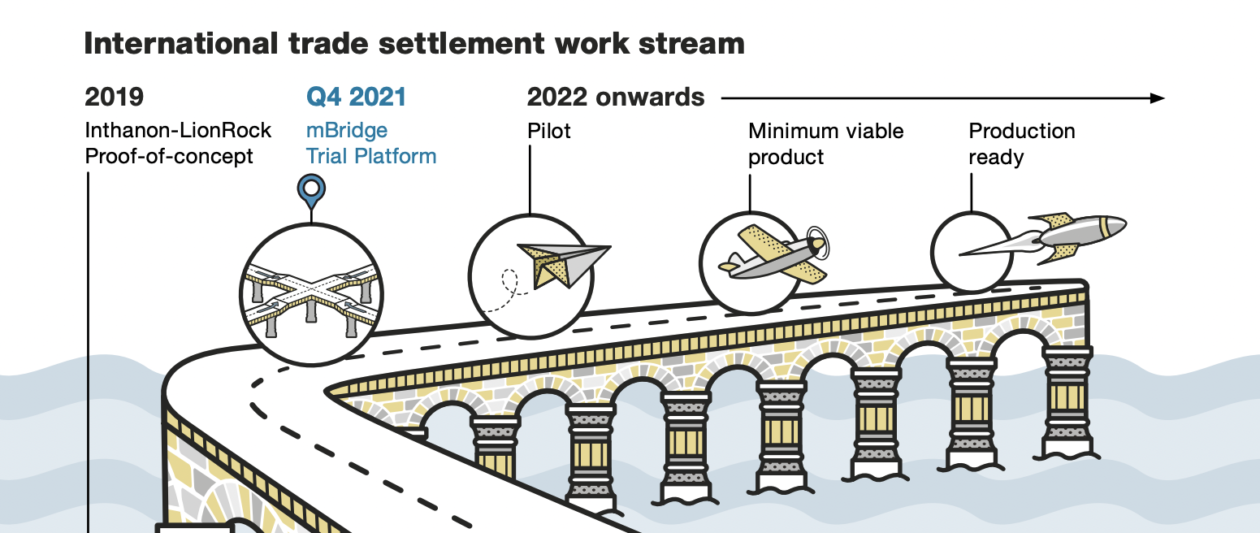

- Christopher Hui, Hong Kong’s Secretary for Financial Services and the Treasury, said on Wednesday the Multiple CBDC Bridge (mBridge) project has been proven to enhance the efficiency of cross-border payment through previous trials.

- The mBridge, or mCBDC, is a collaborative wholesale CBDC project between the Hong Kong Monetary Authority (HKMA) and the central banks of Thailand, China, United Arab Emirates and the BIS to enhance multi-currency cross-border payments.

- The HKMA, the city’s de facto central bank, will come up with an initial view from academia and industry on an October whitepaper of its retail CBDC, the e-HKD, in the middle of this year, according to Hui.

- “I believe 2022 is the year of the cross-border test on CBDC,” Josh Lipsky, director of the Atlantic Council’s GeoEconomics Center, told Forkast in a video interview.