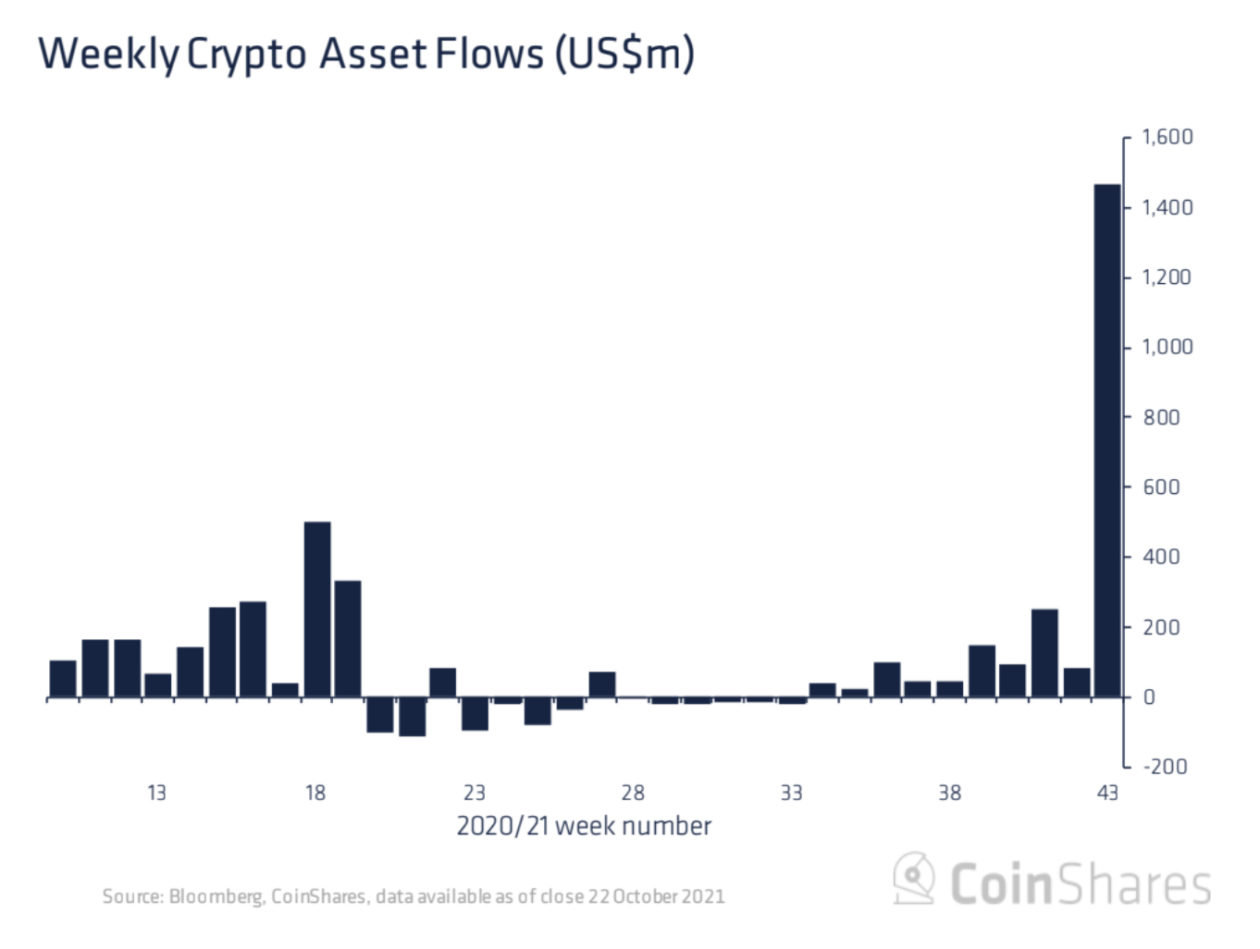

Crypto investment products saw record inflows last week of US$1.47 billion, with Bitcoin accounting for 99% of the inflows, according to digital assets fund manager CoinShares. Total crypto assets under management also reached a new peak of US$79.2 billion.

Fast facts

- Bitcoin investment products saw record inflows of US$1.45 billion last week. “The record inflows were a direct result of the US Securities & Exchange Commission allowing a Bitcoin ETF investing in futures and the consequent listing of two Bitcoin investment products with inflows totalling US$1.24bn,” CoinShares investment strategist James Butterfill wrote. Bitcoin reached a new all-time high of $67,276.79 on Oct 20, according to CoinGecko data.

- Ethereum investment products, however, saw minor outflows of US$1.4 million on profit taking, according to Butterfill. Ethereum — the second-largest cryptocurrency by market value — reached a new all-time high of US$4,361.18 on Oct. 21 — a day after Bitcoin’s peak — according to CoinGecko data.

- Solana, Cardano and Binance also saw inflows of US$8.1 million, US$5.3 million and US$1.8 million respectively. Solana prices, which have soared over 11,000% this past year, reached a new all-time high of US$219.05 on Oct. 25, according to CoinGecko data.

- “BTC has been the overall macro trendsetter for the crypto space. Even now many coins exhibit an extremely high correlation with the price movements of BTC leaving it the de facto market leader. Where BTC points, many others follow,” wrote Singapore-based QCP Capital in its market analysis published Oct. 24. “As of this year however, we are beginning to see correlations as a whole fall sharply as the market begins to trade to themes… Many coins have begun to perform well even as BTC is dropping or going sideways which shows how the market is beginning to mature and decouple itself from following the BTC trend blindly.”

See related article: Ethereum price touches new all-time high in altcoins rally