The Bank for International Settlements (BIS) has launched a new project with the central banks of Singapore, France and Switzerland to study the possibility of integrating some decentralized finance (DeFi) features with central bank digital currencies (CBDCs).

See related article: mBridge participants to end domestic payments of foreign CBDCs

Fast facts

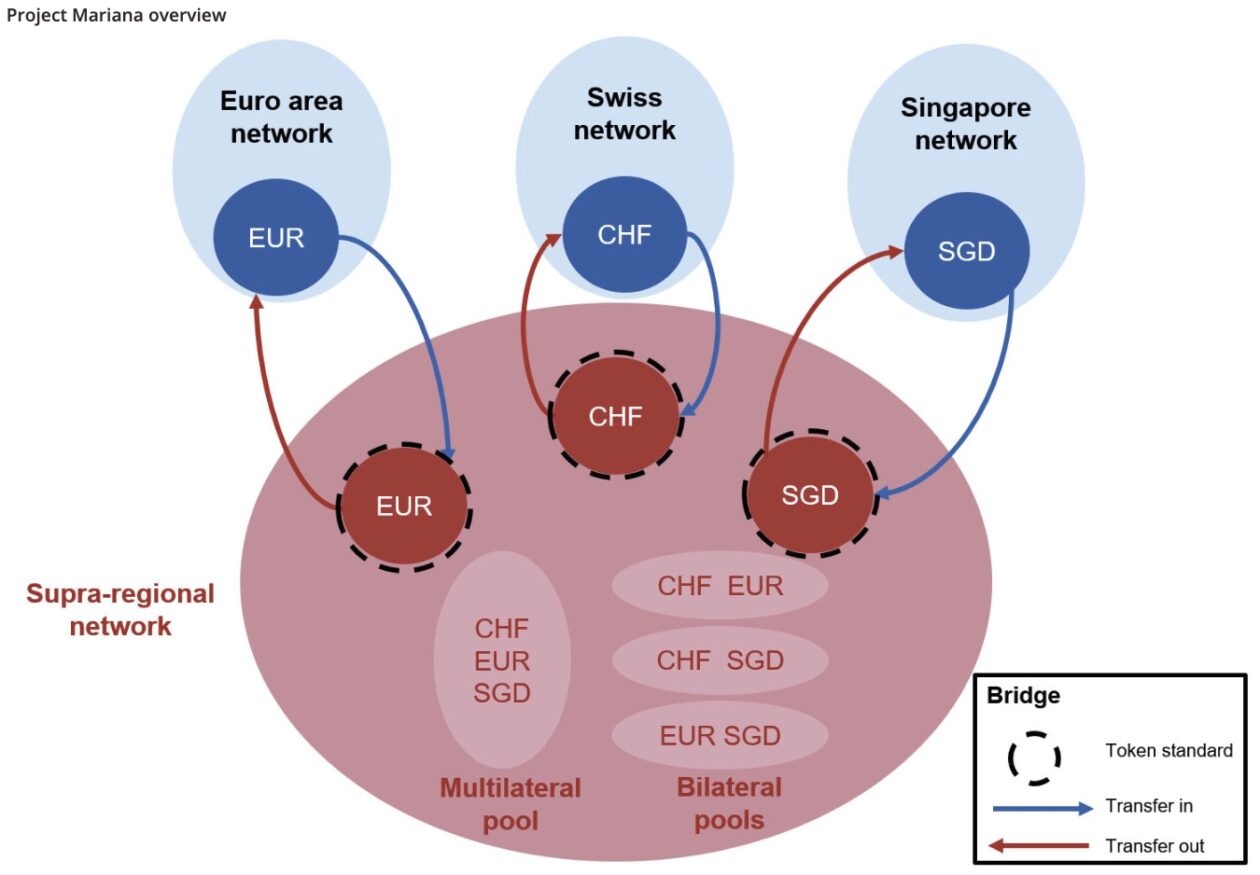

- The BIS announced on Wednesday a new “Project Mariana” that will study the use of automated market makers (AMMs) to automate foreign exchange markets and settlement, and potentially improve cross-border payments.

- An AMM is a type of smart contract that adopts liquidity pools to transfer digital assets automatically, as opposed to the traditional process of matching buyers and sellers, according to the BIS.

- “As DeFi and its applications have the potential to become systemically important parts of the financial ecosystem, central banks need to understand their impact for cross-border payments,” the BIS said.

- The BIS explained that the concept of such AMM protocols could form the basis for a new generation of financial infrastructures that facilitate cross-border exchanges of CBDCs.

- The BIS last week published a report on its mBridge pilot project examining CBDC cross-border payments in collaboration with the central banks of Thailand, China, the United Arab Emirates and Hong Kong.

See related article: BIS’ mBridge shows CBDCs enhance cross-border payment efficiency: HKMA