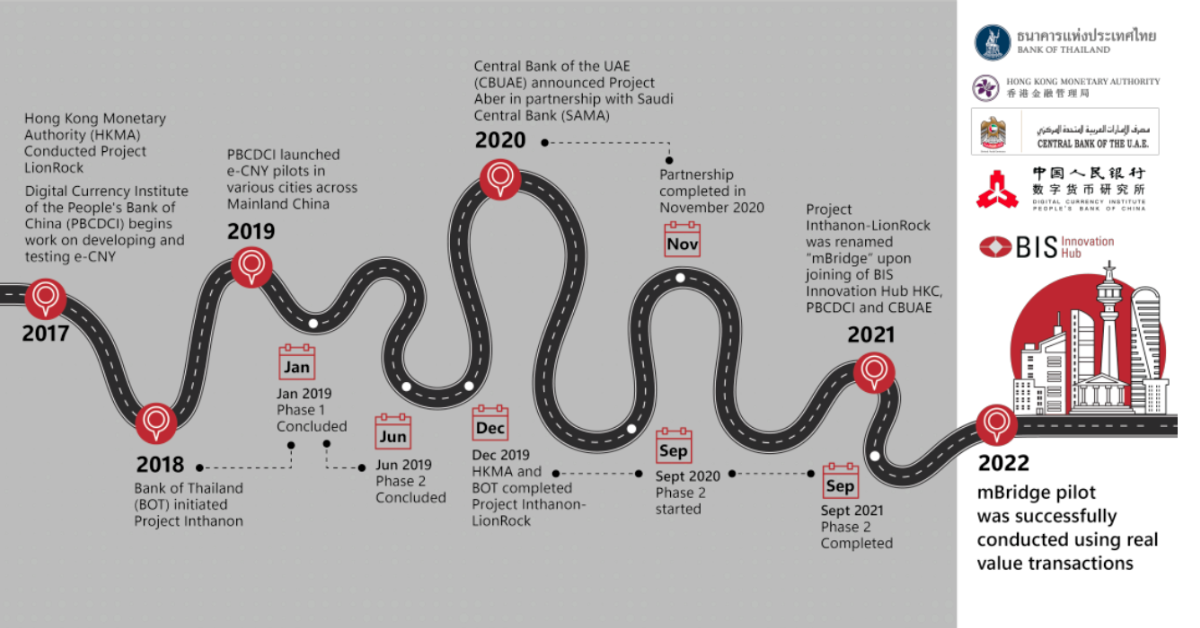

The Hong Kong Monetary Authority (HKMA), the city’s de facto central bank, has published a report of the mBridge central bank digital currency (CBDC) pilot project with three other central banks and the Bank for International Settlements (BIS), which examined cross-border payment transactions via CBDCs.

See related article: Future of CBDCs & Stablecoins

Fast facts

- The pilot successfully executed real-value cross-border transactions involving four currencies and 20 commercial bank participants across four jurisdictions, the HKMA said in a statement shared with Forkast on Wednesday.

- The mBridge, or mCBDC, is a collaborative CBDC project between the HKMA and the central banks of Thailand, China, the United Arab Emirates and the BIS to enhance multi-currency cross-border payments.

- Over the course of six weeks in August and September, the participating commercial banks conducted payment and foreign exchange transactions worth over US$22 million on behalf of their corporate clients using the CBDCs issued on the mBridge platform, according to the report.

- Tayo Tunyathon Koonprasert, a senior specialist of Bank of Thailand, wrote in a Wednesday social media post that the project’s findings demonstrated that it can bring down cross-border transfer times from three to five days to just several seconds.

- The HKMA and the Bank of Thailand said the team will keep working to improve existing functionalities and add new features to the platform.

- In September, the HKMA said it would likely take at least two or three years to build the system for the city’s wholesale CBDC.

See related article: Hong Kong, BIS explore CBDC-backed stablecoins in retail prototype