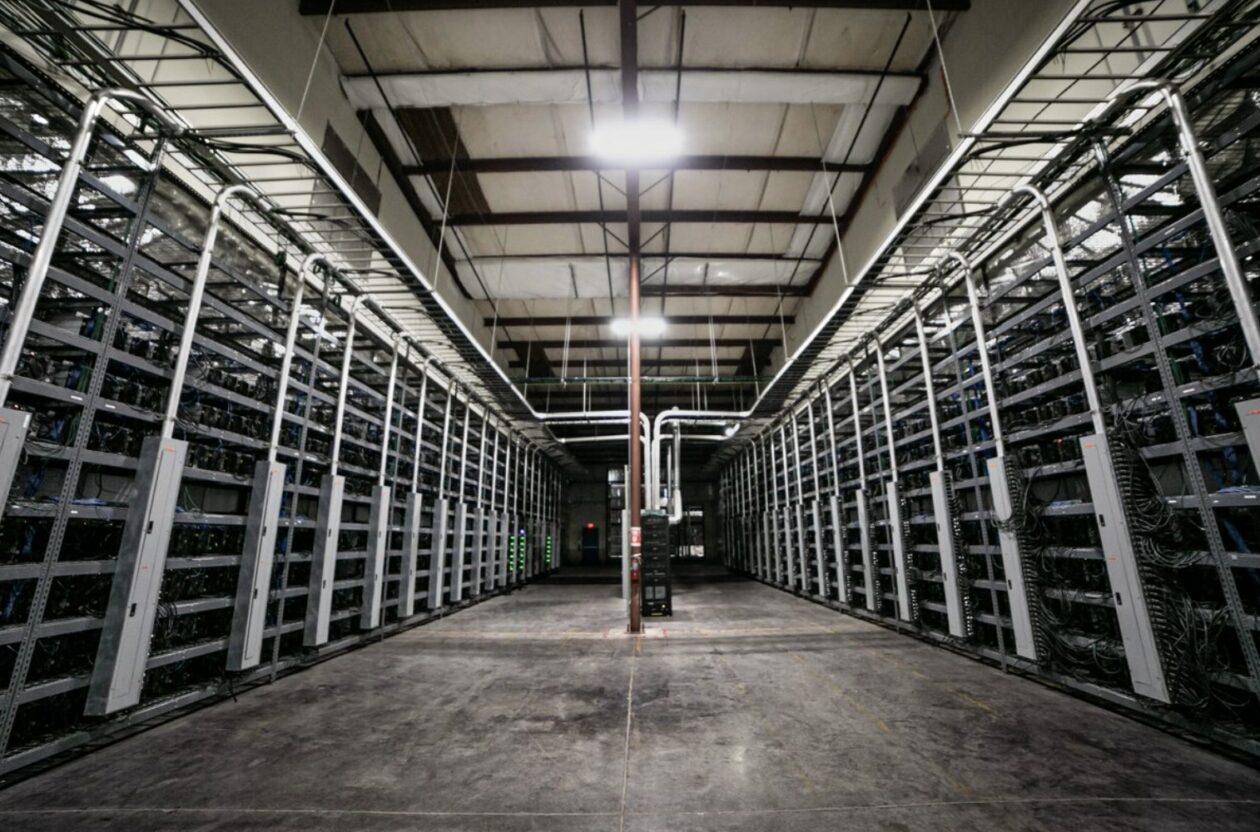

Core Scientific, one of the world’s largest publicly-listed Bitcoin miners, said it may sell some of its mining facilities under development that could be worth up to a gigawatt of power after it filed for Chapter 11 bankruptcy protection on Wednesday, The Block reported, citing the firm’s chief mining officer.

See related article: U.S. crypto miner Core Scientific files for Chapter 11 bankruptcy, continues to mine Bitcoin

Fast facts

- The U.S.-based miner said that it will only consider selling facilities under development that were planned to go online in 2023. It doesn’t plan to sell existing mining sites that are worth up to 850 megawatts, according to The Block’s report.

- A Core Scientific spokesperson has confirmed the report with Forkast.

- The Nasdaq-listed mining company’s shares closed down 75.53% to US$0.051 on Wednesday, a significant drop from US$11.34 a year ago.

- Core Scientific’s liquidity crisis comes as low Bitcoin prices and high electricity costs continue to damage Bitcoin miners’ profits.

- The company said in a statement on Wednesday that it will “continue to operate its existing self-mining and hosting operations, which remain significantly cash flow positive on a debt-free basis.”

- In October, Core Scientific warned that it expected to run out of cash resources by the end of this year.

- Earlier this week, another troubled U.S.-based miner Greenidge Generation Holdings Inc. entered a debt restructuring agreement with NYDIG, a cryptocurrency service provider to which Greenidge owes US$74 million.

- Last month, mining firm Foundry Digital LLC said that it plans to acquire two turnkey mining facilities from embattled miner Compute North.

See related article: Bitcoin mining difficulty rises 3.27% in latest adjustment