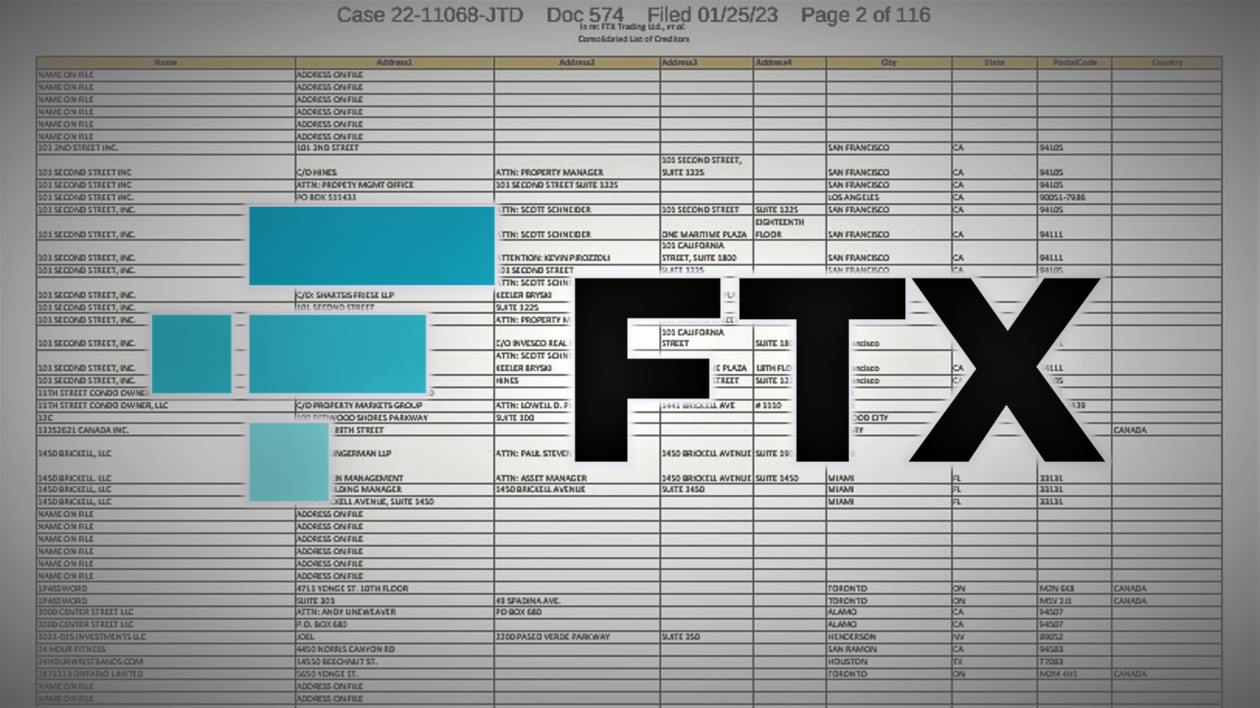

Lawyers for the bankrupt cryptocurrency exchange, FTX.com, filed a 116-page court document containing a list of institutional creditors on Wednesday, which included major technology firms, media organizations and government bodies.

See related article: Bankrupt BlockFi’s financials show US$1.2 bln exposure to FTX, Alameda: report

Fast facts

- The creditors range from tech giants like Apple and Netflix to media firms such as Fox Broadcasting Company and the New York Times.

- The Hong Kong Securities and Futures Commission and Hong Kong Monetary Authority were named as FTX creditors alongside various government agencies from around the world. The exchange was headquartered in Hong Kong before moving to the Bahamas in September 2021.

- Apple, Netflix, Fox, New York Times and the Hong Kong government agencies did not immediately respond to Forkast’s requests for comments.

- The list does not disclose how much each entity is owed, nor does it specify the relationship between the creditors and FTX.

- A company’s inclusion on the list doesn’t necessarily mean that the entity had a trading account with FTX.

- FTX and its founder Sam Bankman-Fried, were once influential figures in the cryptocurrency industry, demanding the attention of media members and policymakers. The exchange filed for bankruptcy after a bank run on the exchange in November led to revelations of secret customer asset loans to Bankman-Fried’s trading firm, Alameda Research.

- Bankman-Fried has since been arrested and charged with eight criminal charges in connection with the collapse of the exchange. FTX was once valued at US$32 billion before its collapse, and lawyers from its restructuring team have testified that at least US$8 billion of customer assets were missing.

- Earlier in January, U.S. Bankruptcy Judge John Dorsey sided with FTX’s legal team’s motion earlier to keep the names of 9 million customers closed to the public for three more months.

See related article: Bankrupt FTX exchange has recovered US$5 bln worth of ‘liquid’ assets, lawyers say