In this issue

- Ethereum: Upgrade anxieties

- Apple: Bitcoin hideout

- Hong Kong: Wooing Web3

From the editor’s desk

Dear Reader,

When it comes to showing the extent to which digital assets have become integrated into our lives, the metaphors don’t come much more vivid than the news that the Bitcoin white paper has been hidden in Apple’s MacOS operating system for the past six or so years.

And the fact that the white paper has been slipped into an Apple technology rather than into another form of tech doubles down on that message: Like cryptocurrencies currently are to traditional finance, Apple was once an underdog in its industry. Its evolution into one of the world’s most valuable companies demonstrates the transformative power of innovation, and a similar sense of pioneering innovation hints at the possibilities for crypto and other digital assets.

Yet regulators are still playing catch-up. Perhaps nowhere is this more evident than in the United States, where the Securities and Exchange Commission, alongside other authorities, has this year launched a series of occasionally controversial enforcement actions against crypto companies, despite a slew of unanswered questions and official disagreements on how to regulate digital assets.

Bitcoin is an excellent example of the regulatory muddle. The original crypto was defined as a virtual currency and a means of payment by the U.S. Treasury a decade ago, classified as a commodity by the Commodity Futures Trading Commission a year later — when the Internal Revenue Service designated it as property — and treated as physical cash in the Biden Administration’s infrastructure bill, which became law in 2021.

If Apple’s technology had been subject to such confusing, conflicting regulatory reasoning, alongside enforcement action that some in the crypto industry — and even some in the regulatory community — consider little more than arbitrary, would it ever have grown into one of the most successful companies of all time?

For digital assets to develop to the extent that their untapped potential is fully realized, the regulatory roadblocks must be cleared and rules must be made rational and predictable — as is required for the development of any young industry. A good place to start would be settling the ongoing impasse between the SEC and the CFTC over whether cryptocurrencies are securities or commodities.

We are the custodians of a brave new era in the evolution of finance that’s already embedded in our financial ecosystem. We must not let its promise be diminished because regulating it is challenging. Digital assets present authorities in the U.S. and elsewhere with a challenge, but, more importantly, an opportunity. They need to step forward and take it.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. Fork up

Ethereum’s long-awaited Shapella upgrade, also known as the Shanghai hard fork, is scheduled for mainnet activation on Thursday, April 13, at 6:27 a.m. Hong Kong time, at epoch 194048, according to an announcement by the Ethereum Foundation.

- Ethereum holders have been looking forward to the Shapella upgrade, which promises to enable stakers to withdraw their ETH from the Beacon Chain for the first time while claiming staking rewards.

- The upgrade is the most significant since The Merge transitioned Ethereum from a proof-of-work consensus mechanism to its current proof-of-stake setup last September.

- Daily ETH staking deposits shrunk from 55,456 ETH on March 31, to as low as 11,728 ETH on April 11, according to BeaconScan data.

- Investors worry that the upgrade could significantly increase selling pressure on ETH, since more than 18.2 million ETH worth US$34.16 billion is staked on the Beacon Chain, or 15.15% of the token’s total supply, according to Dune.

- “The voluntary [validator] exit count surges higher as Shanghai approaches,” tweeted James Straten, a data analyst at CryptoSlate, adding that there may be “a lot of potential sell pressure,” due to the large sum of staked ETH.

- However, crypto exchange Gate.io said the impact of sales “might be small,” as only 1% of the circulating ETH supply consists of staking rewards, with a high probability of withdrawal.

- Lido Finance, the largest liquid staking protocol, will enable staking withdrawals only from early May, Lido developer Kadmil.eth said in a Twitter space on April 6. That could further reduce selling pressure because more than 31% of total staked ETH was staked through the protocol.

- Ether fell 2.4% in the past 24 hours to US$1,874 and is overall flat for the past week, according to CoinGecko. ETH remains 37.4% lower than its prices a year ago and is down 61.6% from its all-time high in November 2021.

Forkast.Insights | What does it mean?

Most Ethereum upgrades are strictly crypto affairs, but the upcoming Shanghai upgrade has exacerbated a split between regulators in the United States.

That’s because ETH’s move to a proof-of-stake consensus mechanism, allowing users to stake and earn interest on their holdings, is now considered — by the Securities and Exchange Commission, at least — to make it a security.

Historically, the SEC was satisfied with ETH’s designation as a commodity. But the arrival of staking rewards has changed that.

SEC Chairman Gary Gensler has publicly stated that interest-bearing contracts fundamentally change what ETH is, because those contracts are essentially financial services, making them securities instruments.

But the Commodity Futures Trading Commission begs to differ. It has held the view since 2014 that ETH is a commodity and has been saying as much in Senate hearings. CFTC Chair Rostin Behnam has stressed that the derivatives watchdog would not have allowed ETH futures products to be listed on exchanges it regulates “if we did not feel strongly that it was a commodity asset.”

The outcome of this regulatory rift is likely to shape the future of crypto more broadly. If ETH is designated a security, all the companies offering staking services — such as Coinbase, Binance, Ledger and eToro — are likely to have broken the law. Some have already faced legal challenges for offering these services.

If ETH is classified with certainty as a commodity, it’s likely to become a magnet for hedge funds and other large finance sector players awaiting regulatory clarity. For now, however, ETH’s future remains subject to some uncertainty.

2. Buried treasure

The Bitcoin white paper, the theoretical outline of the network underpinning the world’s first cryptocurrency, has been hidden inside every version of the operating system used by Apple’s Mac computers shipped since at least 2018.

- The white paper was hidden within MacBook’s Virtual Scanner II, a function disabled by default.

- Although it’s unclear who hid the paper in the system, it was first discovered by MacOS community forum user bernd178 and shared in April 2021. However, the document’s concealment only came to widespread attention with its re-discovery by blogger Andy Baio, who wrote a blog post about it last week.

- Baio said he didn’t know why the paper was hidden in the operating system, but suggested that an engineer had put it there.

- “A little bird tells me that someone internally filed it as an issue nearly a year ago, assigned to the same engineer who put the PDF there in the first place, and that person hasn’t taken action or commented on the issue since. They’ve indicated it will likely be removed in future versions,” Baio wrote.

- The world’s first cryptocurrency has risen 6.6% since a week ago, to US$30,029, and has climbed 36% over the past 30 days, according to CoinGecko. But it’s still 24.1% lower compared to a year ago, and more than 56% lower than its all-time high of US$69,045 in November 2021.

Forkast.Insights | What does it mean?

Bitcoin has always had admirers, and it seems an engineer at Apple is one of them. While some are interpreting this as further evidence of the wild theory that Steve Jobs was Bitcoin inventor Satoshi Nakamoto, the answer is probably a little less exciting.

Software engineers have long hidden things inside operating systems for other engineers or curious users to discover. Jokes by program designers were inserted into the code of MS-DOS as long ago as the 1980s,

It seems the white paper, located inside a folder with assets used for internal testing by Apple engineers, was a prank in the same vein.

The same folder also contains other random images and PDF files that are used to simulate the process of scanning and exporting documents and images with the app, without actually needing a scanner.

Although Apple was aware of the issue, it seems the engineer in charge of removing the white paper hasn’t gotten around to the task of removing it yet. Is it a sign of Nakamoto’s return? Don’t bet your BTC on it.

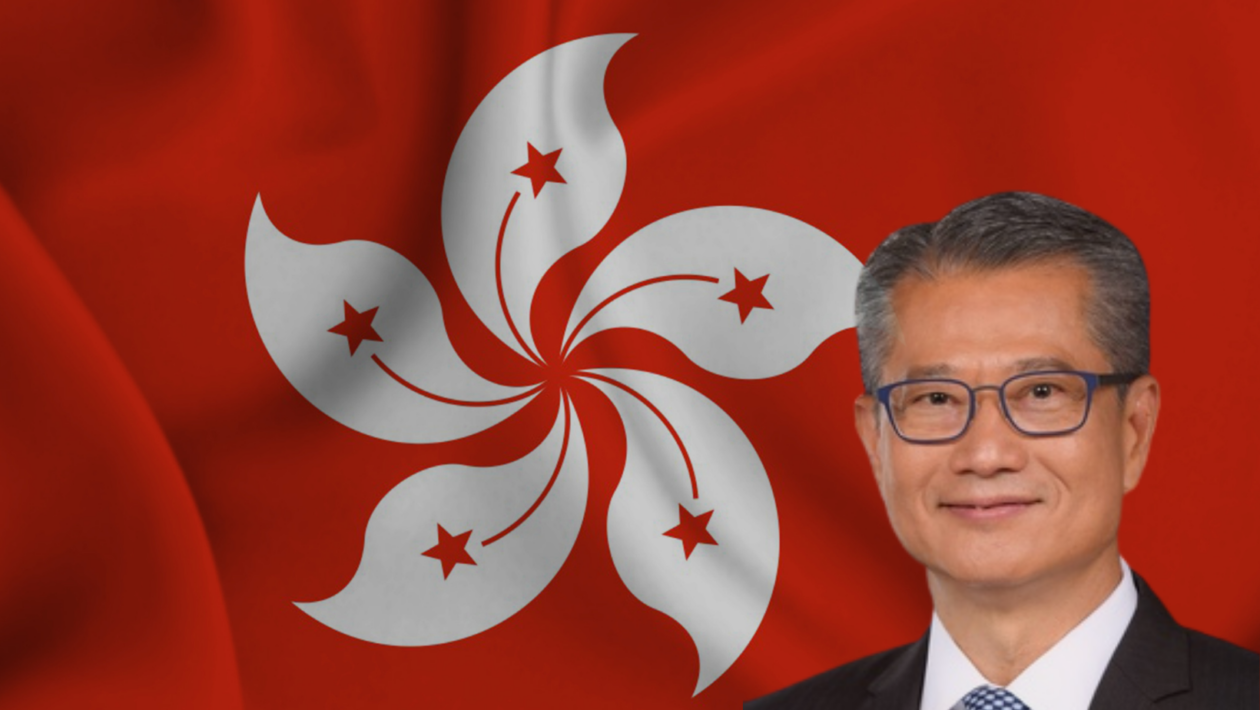

3. Chan-neling positivity

Paul Chan, Hong Kong’s financial secretary, has proposed further Web3 development as one of three key themes in the city’s fiscal budget and that now is the “best time” to do so, according to a blog post published on the website of his office.

- “The digital economy and the application of Web3 have great potential for development and have triggered a positive response from society,” Chan wrote.

- Chan added that he is optimistic about Web3 development despite “virtual assets having fluctuated significantly” and the recent closures of virtual asset exchanges.

- Chan’s comments come two months after Hong Kong detailed a new licensing regime for crypto service providers that is set to take effect in June. The framework may eventually extend to retail crypto trading, which has been restricted in the territory.

- The finance secretary added that the Web3 push will prioritize developing industry regulations while focusing on real-world use cases such as the tokenization of green bonds and using blockchain to “simplify the supply chain process and reduce costs.”

- Chan made his remarks ahead of a busy week for the city’s Web3 industry, with the Hong Kong Web3 Festival under way on Wednesday, and the government hosting a two-day Digital Economy Summit starting Thursday.

Forkast.Insights | What does it mean?

Hong Kong is sparing no effort to show that it is pouring resources into developing Web3, an area of innovation that appears to have gained backing from Chinese authorities.

In addition to developing a regulatory framework for crypto trading platforms that will come into effect in two months, the government is making sure the city’s Web3 industry gets support, setting aside HK$50 million (US$6.4 million) in a new part of its budget for Cyberport, a government-backed technology incubator project, to “boost the development of Web3 ecosystems.”

Meanwhile, Norman Chan, a former chief executive of the Hong Kong Monetary Authority, the city’s de facto central bank, will head newly-formed industry group the Institute of Web 3.0 Hong Kong, established to facilitate Web3 development in the city, according to a report by the Hong Kong China News Agency.

The list of members joining the new Web3 industry group underscores the extent to which Beijing is backing Hong Kong’s Web3 development plans. It includes several Chinese tech heavyweights, including Li Feng, chairman of state-owned telecommunications giant China Mobile Hong Kong, who will serve as one of the institute’s honorary chairpersons.

It’s important to note that although China has banned crypto trading on the mainland, it’s become clear that it intends to develop the former British colony into an international Web3 hub. Hong Kong Financial Secretary Paul Chan wrote in a blog post on Sunday that the city’s government will work to find a balance between sound regulation and innovative development.

When Hong Kong’s government starts issuing crypto-trading licenses later this year, it will be telling how ambitious its plans are in their size and scope.