The Financial Stability Board (FSB) — an international body that monitors and makes recommendations about the global financial system — this month said that countries’ implementation of its recommendations for “global stablecoin” regulations was “still at an early stage” and international coordination was critical to overcoming regulatory arbitrage.

“While the current generation so-called stablecoins are not being used for mainstream payments on a significant scale, vulnerabilities in this space have continued to grow over the course of 2020-21,” the FSB wrote in its progress report published on Oct. 7, which provided a status update on the implementation of the FSB’s high-level recommendations first issued in Oct. 2020.

In its report, the FSB warned the emergence of global stablecoins would pose greater risks to financial stability than existing stablecoins. “Ensuring appropriate regulation, supervision and oversight across sectors and jurisdictions will therefore be necessary to prevent any potential gaps and avoid regulatory arbitrage,” the FSB wrote.

Stablecoins’ rapid rise

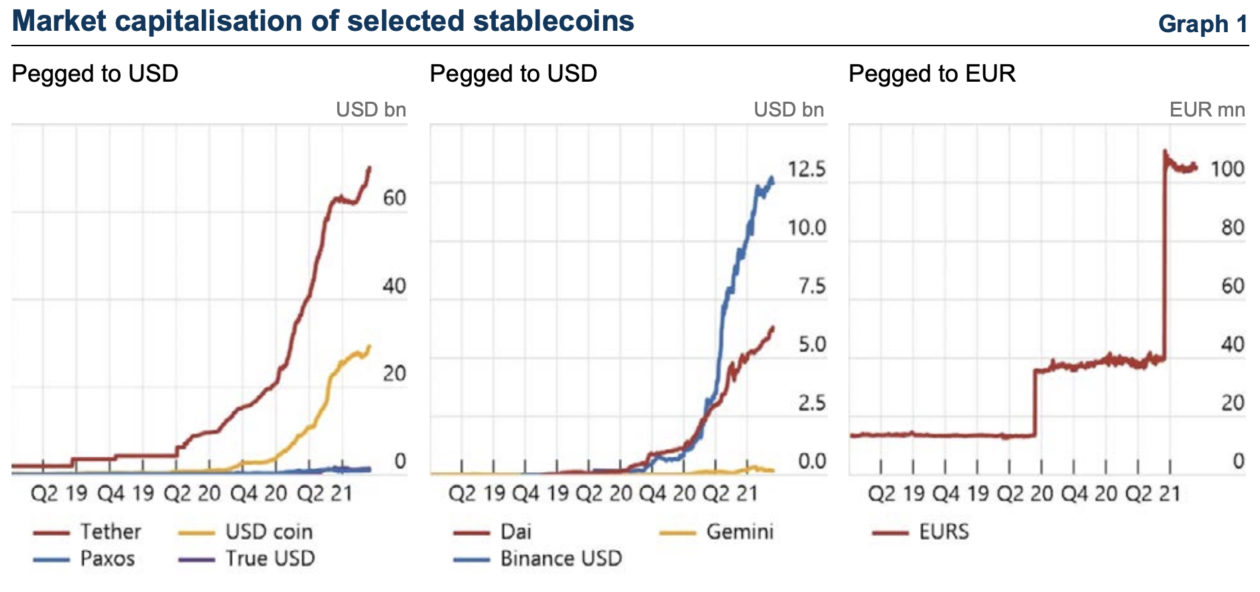

Alongside the growing adoption of cryptocurrencies and decentralized finance (DeFi), stablecoins have experienced exponential growth in the past year. Stablecoins — typically pegged 1:1 to fiat currency and designed to minimize price volatility — come in various forms including fiat-backed, crypto-collateralized, interest-bearing, synthetic and algorithmic. They play an important role in the crypto industry by facilitating trading and payments, and are mainly used as a bridge between traditional fiat currencies and other cryptocurrencies, in DeFi projects, or as collateral in cryptocurrency derivative transactions.

The total market value of stablecoins currently stands at over US$130 billion, with Tether (USDT) taking the lead at US$69 billion, followed by USD Coin (USDC) at US$32 billion, according to CoinGecko data.

See related article: What are stablecoins, and why are some governments so afraid of them?

Growing regulatory scrutiny over stablecoins

The FSB’s report comes amid greater regulatory scrutiny over stablecoins. “The lack of transparency around stablecoins and how they are collateralized is a key issue for regulators right now,” Andre Da Roza, counsel at law firm Allen & Overy in Hong Kong, told Forkast.News.

Tether — the largest stablecoin by market value — last week hit back against a damning Bloomberg report that said Tether was not fully backed as the company claimed and was using its reserves to make crypto-backed loans. Tether is currently banned in New York following a settlement with the New York Attorney General’s office for falsifying statements regarding Tether’s reserves.

Circle, the issuer of the USD Coin, has disclosed in a recent regulatory filing that it had, in July, received an investigative subpoena from the U.S. Securities and Exchange Commission (SEC) Enforcement Division “requesting documents and information regarding certain of our holdings, customer programs, and operations.”

More regulation on the way

“The SEC sending subpoenas to Circle clearly indicates the SEC is conducting an investigation into Circle related to securities,” Robert Whitaker, chief operating officer of Huobi Nevada, the parent company of Nevada-chartered retail trust company Huobi Trust, told Forkast.News. “We can expect the SEC to continue investigations around the stablecoin and DeFi markets in the foreseeable future.

“When regulation for DeFi platforms comes into place, it will certainly bring with it centralization. The only way to keep this from happening is to have embedded supervision built into stablecoins. The central bank digital currency (CBDC) is an example,” Whitaker said.

Crypto industry experts told Forkast.News that it was no surprise that stablecoins have attracted increasing attention given their market size and potential market impact should a major stablecoin collapse, and a clearer regulatory regime will help catalyst adoption.

“This has led to global regulators looking to treat stablecoins and the companies behind them as true financial instruments, or even like banks in some cases. This should lead to stablecoins ideally having little or no credit or liquidity risk in case of default,” Michael Conn, CEO and chairman of Zilliqa Capital, told Forkast.News.

“All of this attention means that stablecoins should, post-regulation, be theoretically more ‘trustable’ since they would be covered by governmental regulations and vis-à-vis that, would theoretically receive de facto backstopping by the regulators, especially if bank-like treatment is adopted, as is being proposed in the United States,” Conn added. “A clearer framework around stablecoins could ultimately lead to greater adoption globally, and especially by institutional clients.”

Cynthia Wu, founding partner and head of sales & business development at Matrixport, told Forkast.News that it was a very positive sign that regulators are now considering including stablecoins in the banking regulations.

“Being regulated will help eliminate fraud and instill the highest degree of trust in a financial market, ultimately paving the way for faster and larger institutional and retail adoption. Also, it will be the only way stablecoin could get FDIC deposit insurance, which again is a strong propeller of wider adoption and use cases,” Wu said. “How stablecoins get regulated is going to have further repercussions on the other related activities and parties in the crypto industry, and everyone in the space must pay close attention and contribute to striking the balance between trust and innovation — creating a win-win situation for all.”

Julian Hosp, co-founder and CEO of Cake DeFi, told Forkast.News: “The presence of regulation in the stablecoin ecosystem is but a sign of the sector’s maturity. No longer content in allowing firms to operate in a legal gray zone, a framework that can encourage consumer protections while recognizing the innovation and significant benefits that stablecoins can bring in the long term is ultimately a positive development for the space.”

See related article: Stablecoins promise much, but can they deliver?

Global regulatory outlook for stablecoins

Implementation of regulation on stablecoins across jurisdictions, for now, remains uneven.

“Europe is probably the furthest ahead in terms of looking at regulations around stablecoins, followed by the United States,” Allen & Overy’s Da Roza said. “The approach in Asia is more ‘wait and see and try to take a pragmatic approach’ so as not to stifle innovation.”

The European Commission has issued a proposal for regulation on markets in cryptoassets (MiCA). The proposed regulation, still under discussion, requires stablecoin issuers to seek authorization in the EU and submit a crypto-asset white paper.

In the United States, U.S. Treasury Secretary Janet Yellen said in July that the country needs “to act quickly to ensure there is an appropriate U.S. regulatory framework in place” for stablecoins. The President’s Working Group on Financial Markets is expected to issue recommendations on stablecoin regulation in the near future.

In Asia, regulations over stablecoins run the gamut. While China prohibits the trading of any cryptocurrency, including stablecoins, the Bank of Thailand earlier this year outlined a framework for regulating stablecoins. In Singapore, the Monetary Authority of Singapore has granted a Major Payment Institution license for e-money issuance to Xfers, a local fintech company that issues XSGD — a stablecoin backed 1:1 by the Singapore dollar.

Da Roza adds that regulation for global stablecoins won’t work well unless everybody has the same or similar standards. “There should be a global approach to the regulation of stablecoins in order to prevent systemic risk,” Da Roza said. The directives will need to come through global bodies such as FATF, BIS and FSB.”

Global standard-setting bodies such as the Basel Committee on Banking Supervision (BCBS), Financial Action Task Force (FATF), Committee on Payments and Market Infrastructures (CPMI) and International Organization of Securities Commissions (IOSCO) have been taking steps to assess whether and how existing international standards may be applied to stablecoins.

The BCBS, in June, launched a public consultation on preliminary proposals for the treatment of banks’ cryptoasset exposures. Under its proposed framework, stablecoins would be categorized as Group 1b, and depending on their stabilization mechanism, require at least equivalent capital requirements based on the risk weights of underlying exposures as set out in the existing Basel capital framework. Bitcoin, in contrast, could attract a high-risk weight of 1,250%.

See related article: Will Basel Committee’s proposed rules for crypto banking fly?

Earlier this month, the CPMI and IOSCO launched a joint report proposing that international standards for payment, clearing and settlement systems be applied to “systemically important” stablecoin arrangements.

FATF — the global anti-money laundering and counter-terrorist financing standards-setter — is expected to finalize and publish its revised guidance on virtual assets service providers and virtual assets including stablecoins by November.

See related article: Key takeaways from FATF’s latest report on virtual assets

With the rapidly evolving crypto and stablecoins landscape, more work at an international level still needs to be done, including considerations for determining a stablecoin as a “global stablecoin,” investor protection and redemption rights, the FSB noted.

“To address the risk of regulatory arbitrage and harmful market fragmentation and the greater financial stability risks that could arise were stablecoins to enter the mainstream of the financial system, effective international regulatory cooperation and coordination are critical,” the FSB wrote.