In this issue

- Bitfinex, Tether banned from New York

- Bill Gates weighs in on bitcoin

- Ripple and SEC continue legal face-off

- Nvidia shields gamers from crypto miners

- China, UAE, Hong Kong and Thailand explore joint-CBDC bridge

- Non-blockchain Chinese companies pivot to crypto mining

From the Editor’s Desk

Dear Reader,

I recently sat down with 50+ executives from across industries in an intimate virtual conversation about blockchain and bitcoin. It was a rapt audience. As bitcoin prices soared, so too has interest. Now that prices are off their highs and the market has lost up to US$200 billion in just a matter of 24 hours, will we finally see a leveling off? Quite the opposite.

Smart money is more likely considering making a move on the perceived lows. Curiosity, stoked a few months ago, is likely maturing into the research and exploratory phase. We’ve seen public admissions by folks like Ray Dalio on exactly that. Corporates have increased their holdings to date, with more than 1.3 million coins in their treasuries. That’s 6% of the total pool of available bitcoin. More are coming.

So while we’re getting inundated by what Bill Gates said about crypto, here at Forkast.News, we’re more interested in understanding the growing sentiment surrounding cryptocurrencies as a relevant alternative asset class.

There is an entire industry whose blockchain functionality, the underlying technology that drives new blockchain layer-1 protocols, represent the real fundamentals that support the price movements of the token that fuels it. The market consists of people who are making a bet that this will be the token that will drive smart transactions in enterprise, DeFi, fintech, you name it. The market also consists of people who are using it for transactions.

Where will this market go? Some say to zero, while others predict US$400,000. The answer lies in your interest.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Bitfinex, Tether banished from New York

By the numbers: Tether — over 5,000% increase in Google search volume.

Bitfinex and Tether have stopped operating in the state of New York after agreeing to pay US$18.5 million in fines for hiding US$850 million in losses, according to a settlement reached with New York Attorney General Letitia James, stamping an end to her office’s 22-month investigation into the world’s most popular stablecoin.

- The investigation found that Bitfinex and Tether parent company iFinex falsified statements on the backing of their stablecoin, USDT. The state attorney general also noted Tether’s unbanked status in mid-2017 and inability to hold a 1:1 dollar-to-Tether reserve.

- “Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines,” James said, in a statement. “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

- As part of the deal reached with prosecutors, Tether admitted to no wrongdoing. “Contrary to online speculation, after two and half years there was no finding that Tether ever issued tethers without backing, or to manipulate crypto prices,” Tether said in a statement.

Forkast.Insights | What does it mean?

Finally, some clarity.

In Asia we call this “saving face.” The language describing Bitfinex and Tether’s “reckless” and “unlawful” behaviour allows the New York State Attorney General’s Office to mark this as a win (along with US$18.5 million into its general coffers to fight criminals for another day).

And life goes on for Bitfinex and Tether — outside of New York state, where the company is now banned from doing business. There have been doubts about its earlier claims of 1:1 dollar backing in Tether reserves. Yet, that uncertainty has not stopped the legions of users that have catapulted Tether ($USDT) to its status as the most widely used stablecoin in the world. Estimates of Tether’s stablecoin trading volume dominance range from 70% to 94%, though last month, Coinmetrics noted Tether ($USDT) had dropped to below 75% for the first time ever. Tether is still dominant, but other stablecoins are starting to erode its market share.

Having U.S.-dollar reserves to back the $USDT was critical to Tether’s beginnings. Akin to the gold standard, where the U.S. dollar (and other nations that ratified the Bretton Woods system) was once backed by actual gold reserves, there came a time in America’s market dominance in the global economy when it became clear that gold was a moot point. It is now the faith and trust in the U.S. government and strength of the American economy that backs the value of the U.S. dollar. So in 1971, the U.S. ended the convertibility of the U.S. dollar to gold, ending Bretton Woods and triggering the free-float of other currencies.

Tether may have already reached this point with its market dominance. Users care more about volume than the actual 1:1 backing with U.S. dollar reserves. With one caveat. As more institutional investors come into the system, they’ll demand much more clarity. And the stablecoin that provides that auditable trust and proof of reserves, might just win over the market. Tides can turn quickly in crypto land, but for now Tether just won a reprieve (and a slap on the wrist). The broader stablecoin market and its participants can regard this as a speed bump that jolted but did not destabilize the overall market. Indeed, this may have been a critical part of the consideration behind this settlement.

Full steam ahead as the latest bump in cryptocurrency prices will attest.

2. Bill Gates takes his turn at the bitcoin mic

By the numbers: Bill Gates— over 5,000% increase in Google search volume.

Elon Musk’s dive into bitcoin has sparked a new trend of prominent business leaders pitching their two cents on cryptocurrencies. This past week, Microsoft founder Bill Gates decided it was his turn.

- “Elon has tons of money and he’s very sophisticated, so I don’t worry that his bitcoin will sort of randomly go up or down,” Gates told Bloomberg. The billionaire also weighed in on bitcoin’s high energy consumption in mining.

- Treasury Secretary Janet Yellen shared Gates’ concerns about bitcoin’s carbon footprint. “It’s an extremely inefficient way to conduct transactions and the amount of energy consumed in those transactions is staggering,” she told the New York Times.

- Over the week, bitcoin has recorded a 7-day high of US$58,330 and a low of US$45,290. It is currently trading at US$50,444, at the time of publication.

- But Gates’s stance toward bitcoin is noticeably softer now, compared to a few years ago.

- In a 2018 interview with CNBC, Gates dissed bitcoin’s market prospects. “I would short it if there was an easy way to do it,” he said at the time.

- Last week, Gates told CNBC: “I don’t own bitcoin. I’m not short bitcoin, so I’ve taken a neutral view. I do think moving money into a more digital form and getting transaction costs down, that’s something the Gates Foundation does in developing countries.”

- When asked by The Wall Street Journal: “What’s the one tech innovation that the world would be better off without?” Gates responded: “The way cryptocurrency works today allows for certain criminal activities. It’d be good to get rid of that.”

- But Gates then quickly corrected himself, saying he should have said “bioweapons.”

- Last March, Microsoft filed a patent for a new cryptocurrency mining mechanism using “body activity data.” The patent seeks to use body heat or brain waves emitted when a user when performing certain activities such as viewing internet ads to be used in the process of mining.

Forkast.Insights | What does it mean?

Bill Gates’ comments are ironic coming from a man who understands the power of code, that he’d be so dismissive of cryptocurrency. In fact, it undermines what Microsoft has actively been chasing for the last decade.

When it comes to blockchain, cryptocurrency’s underlying technology, Microsoft’s business stance is very different. From Microsoft’s patent filing last year that proposed the mining of cryptocurrencies with humans-as-batteries concept to hosting various blockchains (like Ethereum, NEO, Corda and many others) on Azure, Microsoft’s cloud computing service, Microsoft’s blockchain ambitions to date are greater than the man who founded the company.

Africa, too, central in the Bill & Melinda Gates Foundation’s extraordinary efforts to eradicate polio, happens to be one of the fastest growing continents adopting cryptocurrency. Why? Reducing cost of cross-border remittances to family back home, but also the ability to participate in a global market and work. Access to cryptocurrencies are driving entrepreneurship as the job market remains stagnant for young people in Africa. It is providing opportunity for wealth generation for future generations to come, beyond just the exchange-for-labor trap. Possibly a better inoculation to basic diseases that are still prevalent because of poverty.

3. SEC vs. XRP: the ripples

By the numbers: Ripple — over 5,000% increase in Google search volume.

More legal pyrotechnics on the Ripple-U.S. Securities and Exchange Commission front, with no signs of a settlement on the horizon.

- Last week, the SEC filed an amended complaint to its lawsuit against Ripple Labs, sharpening the government’s case against CEO Bradley Garlinghouse and executive chairman Christian Larsen for playing “significant roles” over the sale of XRP to institutional investors. The SEC contends Ripple and its two executives allegedly conducted an unregistered securities offering worth US$1.38 billion through the sales of 14.6 billion tokens of Ripple’s cryptocurrency, XRP.

- “On June 12, 2017, Larsen and others employees met with an investment fund (“Institutional Investor A”), which Ripple Agent-2 described in a June 12, 2017 email to Ripple Agent-3 as “a $12B [$12 billion] alternative asset hedge fund based out of New York,” the SEC alleged.

- “In 2017, Ripple sold approximately 14.8 million XRP for $2.1 million to Institutional Investor A, without restricting Institutional Investor A’s ability to resell this XRP into public markets in any way, at price discounts of up to 30% below XRP market prices.”

- From at least 2016 through 2019, Ripple sold approximately 115 million XRP to an entity (“Institutional Investor B”) that describes itself as a “full-service digital currency prime broker” that “provide[s] investors with a secure marketplace to trade, borrow, lend & custody digital currencies.”

- Ripple’s all-star legal team fired back.

- The SEC is “dead wrong legally and factually,” said former SEC chair Mary Jo White, who is now one of Ripple’s defense attorneys.

- In a pretrial hearing this week, another Ripple defense attorney, Andrew Ceresney — who previously served as SEC’s director of enforcement under White — contended there was an “absence of fair notice” in the SEC’s lawsuit against the payment protocol and unfair treatment of XRP compared to other cryptocurrency.

- Away from the courtroom, MoneyGram, the world’s second largest money transfer service, said it would suspend its partnership with Ripple.

- XRP prices soared to a 24-hour high of US$0.6399 from a 24h low of US$0.5201 since White’s comments, but after the pretrial hearing and the MoneyGram news, is now trading at US$0.4870 at the time of publishing.

Forkast.Insights | What does it mean?

The SEC must continue to build its case. Once formally announced, the integrity of its authority and jurisdiction means lawsuits must be seen through to the end, either in court or through a settlement.

But we are also getting a glimpse of how a very hands-off previous administration preferred enforcement over policy guidance when it came to establishing what the rules should be for the crypto community. Regulatory clarity through enforcement, as SEC Commissioner Hester Peirce told Forkast.News, is never the ideal.

Ripple has battened its hatches and hired SEC’s own star alumni, including Mary Jo White, the former SEC chair, to defend the case. White has suggested that politics (a lawsuit filed in the departing days of key SEC personnel) rather than legal arguments (how is XRP different from Ethereum’s ether, which SEC recently declared is not a security?) is driving what she calls an arbitrary lawsuit against Ripple.

But in the meanwhile, for all those holding XRP, there are few markets left. Crypto exchanges have dropped the legally challenged token, closing it off to the U.S. market. In Japan, however, regulators have stated it does not consider XRP a security, and it remains accessible to XRP’s Japanese fans.

A reprieve may come after March 2. That’s the date the U.S. Senate has set for the confirmation hearing of Gary Gensler, nominated as the next chair of the SEC. He’ll face the Senate Committee on Banking, Housing and Urban Affairs. There is a high degree of likelihood he’ll be questioned about his stance on cryptocurrency and blockchain. He may be able to educate a senator or two, as he is well-versed in crypto matters and has even taught blockchain at MIT.

More important will be the mood of this new administration. How will they regard the rise of cryptocurrencies? This may very well be the political bellwether that predicts the future for not only Ripple, but for the industry.

4. China, UAE, Hong Kong and Thailand explore joint-CBDC bridge

By the numbers: HKMA — over 5,000% increase in Google search volume.

Four central banks — China, United Arab Emirates, Hong Kong and Thailand’s are joining together to explore a real-time, 24-hour digital currency “bridge” with each other in foreign exchange and cross-border payments.

- The “Multiple Central Bank Digital Currency (m-CBDC) Bridge” project — a collaboration between the Digital Currency Institute of the People’s Bank of China, the Central Bank of the United Arab Emirates, the Hong Kong Monetary Authority and the Bank of Thailand — is also “strongly supported” by the Bank for International Settlements Innovation Hub Centre in Hong Kong, according to a joint statement.

- Previous to this, Hong Kong and Thailand collaborated on a cross-border CBDC research effort, Project Inthanon-LionRock. “Building on the experience learnt from Project Inthanon-LionRock, the m-CBDC Bridge project will further explore the capabilities of distributed ledger technology (DLT) through developing a proof-of-concept (PoC) prototype, to facilitate real-time cross-border foreign exchange payment-versus-payment transactions in a multi-jurisdictional context and on a 24/7 basis.”

- The joint statement also states that the CBDC bridge would look to create an environment for more central banks in Asia and beyond to study the potential of distributed ledger technology for “enhancing the financial infrastructure for cross-border payments.”

- Over in the United States, Federal Reserve Chair Jerome Powell testified to Congress today that development of a digital dollar is a “high priority project” but that the Fed is still “looking carefully” at whether it should or shouldn’t issue a digital dollar.

Forkast.Insights | What does it mean?

We are quickly coming to a point when the global economic system will be divided into the digital currency Haves and the Have Nots.

One of the most glaring absences on the global digital currency scene thus far is the U.S., where despite efforts from the Digital Dollar Foundation and “grave concerns” from industry lobby group Chamber of Digital Commerce that America is falling behind, there have been little traction over the past few years that have moved digital currency conversations in the U.S. beyond the research phase. “America has got to wake up,” said Don Tapscott in an interview with Forkast.News editor-in-chief Angie Lau, reflecting his Blockchain Research Institute’s blockchain strategy report for the Biden administration.

Fed Chair Jerome Powell’s Congressional testimony today does not allay concerns. While calling a U.S. digital dollar a “high priority” issue, Powell also notes that a key question still to be answered is “whether we should do this.”

Contrast Powell’s stance with that of other central bankers in the world, such as those now working together to actively explore a CBDC bridge for Asia and the Middle East.

The m-CBDC Bridge is a major development that finally graduates the monetary system (at least parts of it) to one that is more seamless, thanks to technology. With this, the four participants — China, Hong Kong, United Arab Emirates, and Thailand — have created an ease-of-trade zone using each trading partner’s digital currency. This partnership could also evolve into other economic partnerships, possibly even a free trade zone. While the UAE’s list of free trade agreement partners does not currently include China, with m-CBDC, it is a big signal of economic partnership.

Who will be left out? The countries that haven’t even yet left the CBDC starting gate.

5. Nvidia redirects miners to CMPs

Image: Pixabay

By the numbers: NVIDIA CMP — over 5,000% increase in Google search volume.

High-end graphic cards have become difficult to come by for gamers as crypto miners buy up the wares to build crypto mining rigs. Major graphic card producer, Nvidia, is now trying to keep crypto miners from disturbing its serious gamer customer base by offering the two groups different products.

- To ensure that its new GeForce RTX 3060 GPU would be reserved for gaming and not end up in the hands of crypto miners, Nvidia has purposely made them suboptimal for mining cryptocurrencies. For instance, the RTX 3060’s driver will detect any attempt at Ethereum mining and will limit the hash rate — or reduce the efficiency and profitability of crypto mining — by 50%.

- “We are gamers, through and through. We obsess about new gaming features, new architectures, new games and tech. We designed GeForce GPUs for gamers,” NVIDIA said, on its company blog. “With the launch of GeForce RTX 3060 on Feb. 25, we’re taking an important step to help ensure GeForce GPUs end up in the hands of gamers.”

- Nvidia also announced the launch of a different product, Nvidia CMP (Cryptocurrency Mining Processor), a GPU (graphics processing unit) designed for Ethereum mining, and “optimized for best mining performance” by removing display outputs to improve airflow to allow dense packing.

- Ethereum, which has already launched phase 1 of its Beacon Chain upgrade to Ethereum 2.0’s proof-of-stake network — which would to shift the blockchain away from a mining-based proof-of-work consensus mechanism — has surpassed 3 million ether deposited in its deposit contract and recorded a new all time high of US$2,036. Ether is currently trading at US$1,640 at the time of publishing.

Forkast.Insights | What does it mean?

It’s tough to be a crypto miner these days.

Notwithstanding the rising profitability from soaring crypto prices, computational difficulty is increasing. A global chip shortage is also choking the production of mining equipment. The list of burdens goes on…

So miners started repurposing GPUs designed to optimize the virtual gaming experience (like Nvidia’s GPU), to put to work in mining bitcoin and ether. With the rise of bitcoin and ether prices, this has become a very profitable affair. Until the gamers revolted. Nvidia is protecting its traditional customer base of gamers, to ensure customers buy its product as it is intended for gaming use. The company created a separate product for crypto miners to cash in on the current great demand.

More interesting is that as demand grows by the day for bitcoin and ether, mining difficulties are following suit — which has implications for the broader crypto market. If more institutional dollars are starting to engage, demand will only grow. While a lot of froth remains in bitcoin land as we’re currently seeing, with the price swings down from the latest record high of $58,332 set this past weekend, more liquidity may be chasing bitcoins that are increasingly harder to mine.

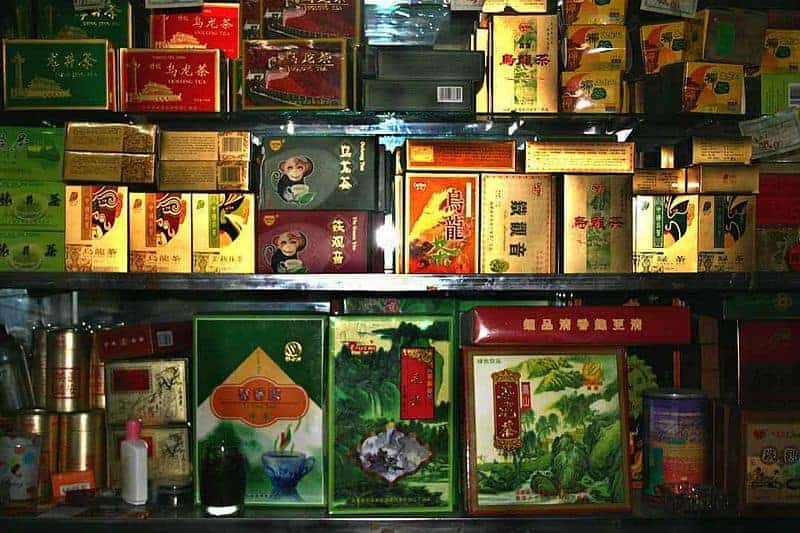

6. In China: Non-crypto firms read tea leaves, pivot to bitcoin mining

The rise in bitcoin and other cryptocurrency prices has riveted China, causing some companies that had nothing to do with crypto, to suddenly decide to take up crypto mining.

- U.S.-listed Chinese sports lottery service 500.com has acquired one of China’s major bitcoin mining pools, Bitdeer — which includes BTC.com — by signing a share exchange agreement with Blockchain Alliance Technologies, a subsidiary of Bitdeer Technologies.

- In addition, Urban Tea Inc., a tea and baked goods chain retailer based in Hunan province, China, announced its entry into the crypto mining business. It appointed a new chief operating officer and independent director experienced in crypto mining and digital asset management to lead the company’s foray into blockchain and cryptocurrency mining.

- Sino-Global Shipping America, Ltd., a global shipping and freight logistical giant, announced recently that it has signed a letter of intent to acquire 51% of Nine-Chain Intelligent, located in Erenhot city in Inner Mongolia, to help the company expand into bitcoin and ether mining.

Forkast.Insights | What does it mean?

China may not have invented the corporate pivot, but it is infamous for them. The company that started as a market research firm got into pharmaceuticals, then went full Club Med and Cirque du Soleil (Fosun). And now, the latest iteration of the corporate metamorphoses: A tea and bakery chain is now mining for crypto. More are joining them.

Crypto mining in China is experiencing a renaissance moment. With or without official favorable business environment status. More struggling Chinese companies with little to no experience are joining the virtual armies of crypto miners. They’re prepared to spend dollars and hiring experienced talent to build their own internal teams.

While China in 2018 made a concerted effort to shut down cryptocurrency miners, limiting energy use and instructing local governments to make an orderly exit from the industry, there seems to be an unabashed rush to mining in 2021.

With all things China, we will find out about the top down directive soon enough. Either miners will continue to go about their merry way, or we’ll experience an arbitrary ruling that may suck the oxygen out of the room entirely. We’ve seen it before, and we’ll see it again. The question one should consider today is how this current market’s drive to extrapolate digital wealth to support domestic economic growth will supersede the fears of uncontrolled capital flight.