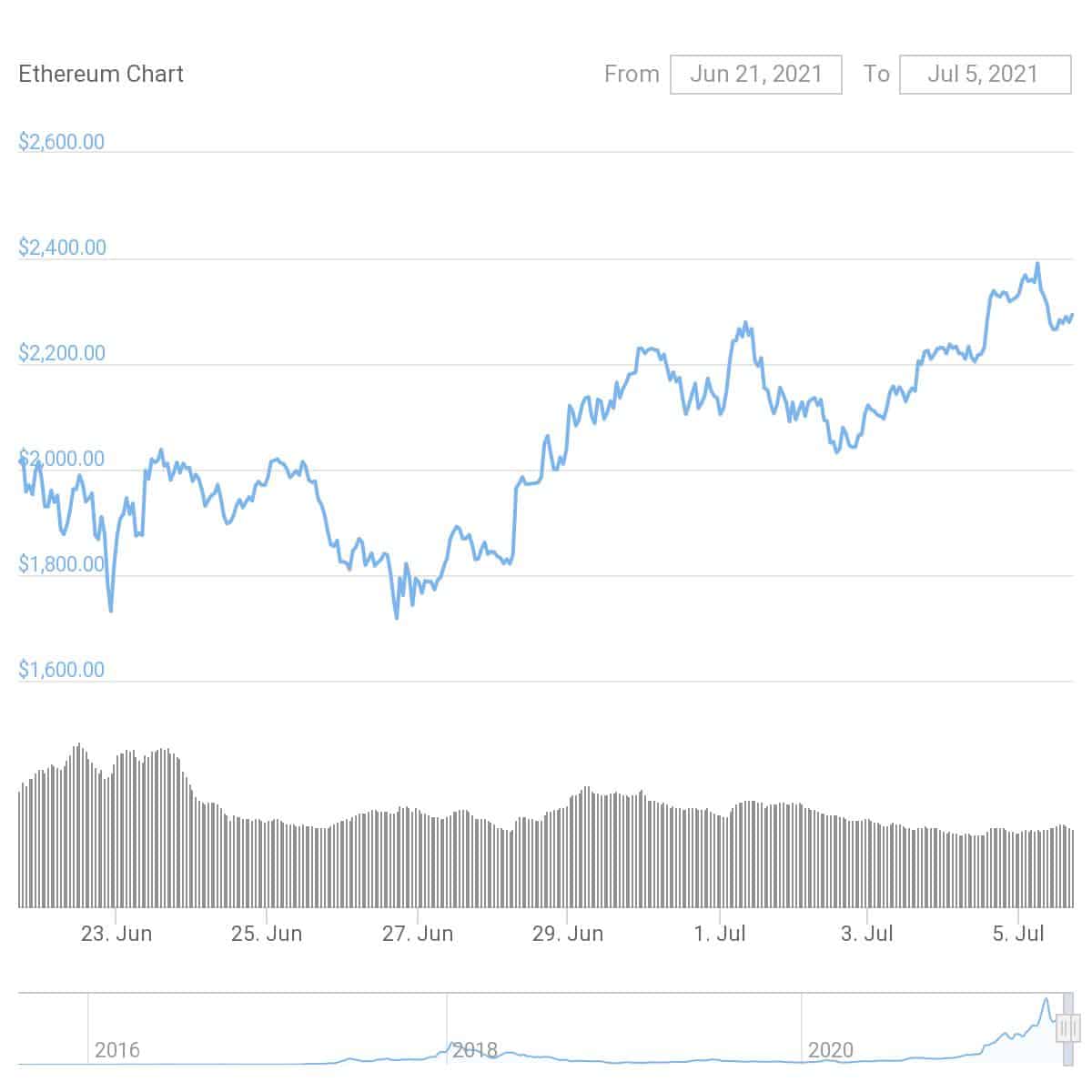

Ether — the native cryptocurrency of the Ethereum blockchain — saw its price jump to a two-week high of around US$2,390 this morning, according to CoinGecko data.

Ether’s rally comes as Ethereum edges closer to its London update this month. The London upgrade will incorporate the Ethereum Improvement Proposal 1559 (EIP-1559) and change Ethereum’s fee mechanism to usher in a more predictable base fee for transactions. The London upgrade is expected to be deployed to mainnet after its successful release to its three testnets — Ropsten, Goerli and Rinkeby. The Rinkeby testnet release is scheduled for July 7.

Work on Ethereum’s 2.0 upgrades has also been under way as it transitions from a proof-of-work to a proof-of-stake consensus mechanism. The Beacon Chain upgrade, implemented in December, was the first Ethereum 2.0 upgrade, and brought staking to the Ethereum ecosystem. “The Merge” — Ethereum mainnet’s merge with the Beacon Chain’s proof-of-stake system — will mark the end of proof-of-work Ethereum and is scheduled to take place later this year or next year.

According to a recent blog post by Ethereum software company ConsenSys, more than 170,000 validators have staked over 5.4 million ETH on the Beacon Chain, with an annual percentage return of 6.6%. Investment bank J.P. Morgan predicted in a recent report that Ethereum’s shift to proof-of-stake could drive crypto adoption and help the staking industry grow from US$9 billion currently to US$40 billion by 2025.

See related article: Vitalik Buterin: Why Eth2 will propel Ethereum’s use in enterprise

Justin d’Anethan, head of exchange sales at Nasdaq-listed cryptocurrency exchange Eqonex told Forkast.News that although investors are looking at the positive developments on the Ethereum blockchain, “most of the capital is simply cycling from different assets within the crypto space.”

“While BTC is rising and feeling stronger, traders are more interested in alts, which tend to be more volatile but so generate higher returns when things feel well supported and headed higher,” d’Anethan said. “So what we’re seeing is crypto investors gaining confidence and re-entering altcoins, including — but not limited to — ETH.”

Ether, which had a market cap of about US$265 billion at press time, is the second-largest cryptocurrency by market value after Bitcoin, and the vast majority of decentralized finance protocols and stablecoins operate on the Ethereum network. The total value locked in DeFi protocols on the Ethereum DeFi ecosystem has remained the largest, with a TVL of US$55 billion, according to DeFi Pulse.

“Price volatility is an ever-present fixture of crypto markets whilst in this early stage,” Sidney Powell, CEO and co-founder of Maple Finance, an institutional capital marketplace built on Ethereum, told Forkast.News in an email. “What’s changing is that it is no longer price alone which draws institutional interest.”

“What we are seeing is … institutions being drawn to the space by the potential of products such as on-chain lending, [exchange-traded funds] and options and swaps,” Powell said. Maple Finance will launch its second lending pool at US$20 million on July 7, led by Maven 11, a global digital asset investment firm that will act as the pool’s delegate.

Despite recent institutional outflows from Ether investment products, market analysts believe there may be some upside momentum for Ether.

“Technically, following its impulsive rally from the March 2020 low near US$88.20 to the May 12 US$4,380 high, Ethereum commenced a pullback,” wrote Tony Sycamore, City Index’s senior market analyst for APAC, in a recent market analysis. “The pullback neatly tagged uptrend support near US$1,700 in late June coming from the 2020 low and notably, the pullback unfolded in three waves, usually a good sign of a correction rather than an impulsive move lower.”

Sycamore predicts that “a positive bias is in place looking for the rally in Ethereum to extend towards US$2,900 in coming weeks, provided Ethereum holds above the US$1,730/00 support region.”