In this issue

- Can Elon Musk reform Bitcoin mining’s environmental impact?

- Ray Dalio admits to owning crypto

- How PancakeBunny fell victim to $200 million hack

- Australia signals progressive approach to crypto

- Hong Kong moves close to banning retail crypto trading

From the Editor’s Desk

Dear Reader,

If fracking can lead to earthquakes, it seems that crypto mining can, too.

Cryptocurrency mining has been at ground zero this past week, the target of a regulatory offensive in China and under pressure pretty much everywhere, thanks to renewed attention to the industry’s size-26 carbon bootprint.

China’s moves made headlines at the end of last week, coming as Beijing’s second broadside against the crypto industry in a matter of days. Its latest crackdown on Bitcoin mining — and, by extension, all crypto mining — prompted miners to down tools and run for the escape shaft, with many hastily drawing up plans to decamp to the U.S. and elsewhere.

Whether or not Chinese miners will be welcome in other countries, though, is a moot point, as environmental concerns around their chosen trade have come to the fore. Yet again steps forward Elon Musk, whose every tweet has crypto investors twitching as they weigh the fluctuating value of their holdings.

The Tesla founder’s meeting this week with American miners, in which he followed up on his newfound environmental evangelism of his company’s recent Bitcoin payment ban by exhorting the miners to use green power, sent the price of BTC back up 10% — proof positive that crypto investors aren’t entirely immune to the considerations of climate change and planet-killing carbon emissions.

And in another example of a seismic shift, Hong Kong, which had taken a relatively laissez-faire approach to cryptocurrency regulation, has proposed that it would put all crypto trading off limits for most people — or those with less than US$1 million in pocket change.

Hong Kong’s government appears to have succeeded once again in triggering, as a miner might say, an accidental detonation. The city hosts some of the world’s biggest crypto exchanges, and some now predict that a number of them are likely to quit the financial hub.

Between expectations of a wave of exchange closures in Hong Kong and an exodus of miners from mainland China, there’s an unmistakable sense of continental shifts in the air.

That may not be a bad thing for the crypto sector — and the wider public. After all, does anyone really want a multi-trillion-dollar global industry to balance on the precipice that its enormous dependence on China has grown to represent? Or, for that matter, to perch on the fault lines of Twitter?

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Bitcoin mining’s seismic shifts

By the numbers: Bitcoin mining — over 5,000% increase in Google search volume.

The tectonic plates of crypto mining — which has come under increasing criticism for its carbon footprint — are shifting this week in ways that could reshape the future topography of the sector.

- Tesla founder Elon Musk, who recently triggered a crypto market crash after expressing concerns about Bitcoin mining’s reliance on fossil fuels, and MicroStrategy CEO Michael Saylor, whose company has made Bitcoin investing part of its business strategy, announced that they have formed the Bitcoin Mining Council, a renewable energy initiative for crypto mining. The council grew out of a meeting the pair held with some of North America’s largest mining operators, including Galaxy Digital, Hive Blockchain, Blockcap and Argo Blockchain.

- Bitcoin mining’s image boost in North America comes as China — still by far the world’s largest Bitcoin producer — signaled that it would further tighten the screws on crypto mining. Vice Premier Liu He and the State Council said last week that “cracking down on Bitcoin mining and trading behavior” was necessary, fueling expectations of an imminent exodus of crypto miners from China.

- “In past 48 hours, Chinese miners already started to accelerate migrating process to other countries. There will also be large quantities of Bitcoin mining machines available for sales,” tweeted Mustafa Yilham, vice president of global business development for Bixin, a Bitcoin mining firm.

Forkast.Insights | What does it mean?

Bitcoin’s carbon footprint has long been an issue the industry needs to address. Although some argue that most Bitcoin mining activities promote energy efficiency by using renewable energy or unused energy off the grid, there’s no denying that its power guzzling does little to contribute to a sustainable future.

This isn’t just a Bitcoin problem. Governments have been urged in myriad ways and by numerous parties to shift from fossil fuels such as coal to renewable alternatives. But Bitcoin’s energy issues are also viewed as something of a red herring by those willing to look beyond the fear, uncertainty and doubt.

Bitcoin mining uses only half the energy consumed by the traditional banking system, and gold mining uses up to twice what Bitcoin mining does, according to a report published by Galaxy Digital, a cryptocurrency investment firm.

Nevertheless, China — which hosts nearly 65% of the world’s Bitcoin mining — sees the BTC network’s energy consumption as an obstacle to its professed mission to achieve carbon neutrality by 2060, and its State Council is cracking down on mining operations in the country. This has led Huobi Mall, the crypto mining arm of heavyweight crypto exchange Huobi, to suspend its Bitcoin mining services and sales of mining equipment. BTC.top, one of the biggest mining pools in China, has announced that it would no longer provide joint mining services to mainland Chinese users. The result is expected to be an exodus of Chinese miners in search of sustainable destinations with friendly regulations.

West Texas is currently looking like a prime site for relocation, as the lone star state produces the most wind energy in America, with more than 13,000 wind turbines generating about 25,000 megawatts a year — enough to power 23 million homes. This week, Nasdaq-listed Marathon Digital Holdings, one of the largest enterprise Bitcoin self-mining companies in North America, announced a deal to host around 73,000 Bitcoin miners at a new 300-megawatt data center in Texas.

Another long-standing criticism of the Bitcoin network has been the centralization of the network’s hashrate in China. Despite the news sending shockwaves through the crypto markets and contributing to a major crypto price correction over the past couple of weeks, the relocation of mining hubs could be a net positive for Bitcoin’s stability.

“Bitcoin’s network hashrate will be far more evenly distributed,” Jiang Zhuoer, chief executive of BTC.top, told Forkast.News. “This ensures that the fate of a multitrillion-dollar economy will no longer be dependent upon the whims of a single government.”

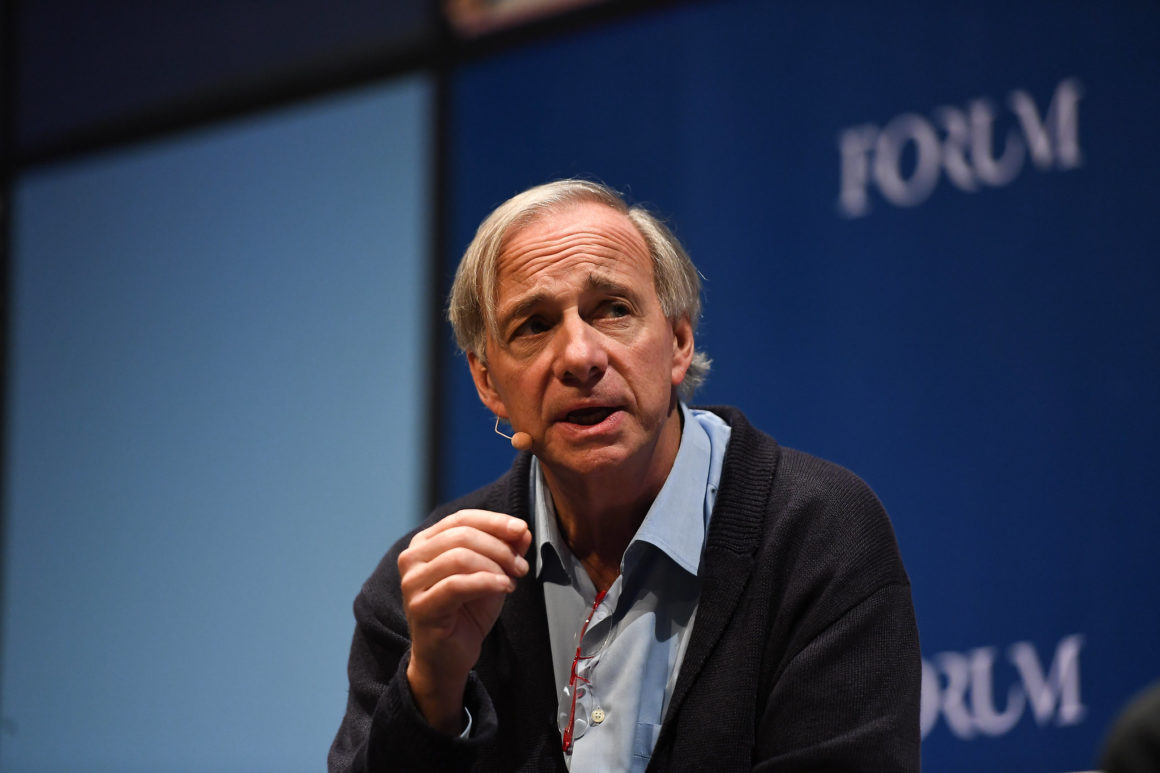

2. Ray Dalio confirms his bitcoin holdings

By the numbers: Bitcoin — over 5,000% increase in Google search volume.

Billionaire hedge fund manager and founder of Bridgewater Associates Ray Dalio this week revealed in an interview broadcast during Coindesk’s Consensus event that he owns some Bitcoin. At the same event, Wyoming Governor Mark Gordon also admitted that he holds some cryptocurrencies.

- Bitcoin had a volatile week, hitting a low of US$30,681 — its lowest price since January — according to CoinMarketCap data. Bitcoin’s weekly high was US$42,462.

- Bitcoin’s recent volatility did not stop Goldman Sachs managing director and senior strategist in Global Macro Research Allison Nathan from recognizing Bitcoin and crypto as an official asset class.

- Over the weekend, the Bitcoin community celebrated the 11th annual Bitcoin Pizza Day to commemorate the world’s first commercial crypto transaction, when a man in Florida paid for two pizzas with 10,000 BTC.

Forkast.Insights | What does it mean?

The cryptocurrency story has seen some curious plot twists this year, thanks to a new wave of meme-coin investors, led by Tesla founder Elon Musk, whose on-again, off-again opinions on Bitcoin over the past few months have sent its price soaring and slumping with each new tweet. It’s becoming clear that as Bitcoin matures, we may need a more mature influencer in this space — one who studies the market rather than appears to be trying to manipulate it. Could that man be billionaire hedge fund manager and Bridgewater Associates founder Ray Dalio?

Unlike Musk, who has jumped on and off the Bitcoin bandwagon over the years, evidence suggests that Dalio’s recently announced support for the world’s first cryptocurrency is calculated, researched and grounded. Dalio is highly influential, but it’s unlikely that he’ll take a stream-of-consciousness approach to Bitcoin commentary.

Indeed, Dalio’s opinion of Bitcoin has evolved over the years. Back in November 2020, he suggested there was a high probability that governments would “outlaw” Bitcoin and put an end to its promise as an asset. A month later, he said during an ask-me-anything session on Reddit that he was not a huge Bitcoin fan, but that it could be a “diversifier to gold.” Another month passed, and Dalio then updated his description of Bitcoin to being “one hell of an invention,” and said the cryptocurrency should not be ignored by Bridgewater as a potential asset.

Alongside his revelation this week that he personally holds Bitcoin, Dalio explained his reasoning through the lens of macroeconomics, saying that the U.S. dollar may devalue and that China continued to threaten the greenback as the world’s top currency.

As Bitcoin remains in recovery mode following the price crash, the industry needs cooler heads more than ever, and someone as reasoned and calculated as Dalio admitting that he owns Bitcoin, with the ability to articulate an argument for or against the coin, may be just the right remedy.

3. PancakeBunny in the headlights

By the numbers: PancakeBunny — over 5,000% increase in Google search volume.

PancakeBunny, the Binance Smart Chain-based decentralized finance (DeFi) yield aggregator, last week fell victim to a flash loan exploit in which the hacker made off with more than US$200 million worth of assets from the protocol. A flash loan allows borrowers access to assets as long as they are returned within one block transaction. If they are not returned, a smart contract reverses the transaction.

- According to PancakeBunny, a hacker used PancakeSwap to borrow BNB coins, then used the loan to participate in low-liquidity and high-yield pools of USDT/BNB and BUNNY/BNB to obtain large amounts of BUNNY.

- The hacker then dumped the BUNNY, causing BUNNY tokens to tank from US$150 to US$1. BUNNY had reached a new all-time high of US$513 late last month. It was trading at US$32 as of press time.

- PancakeBunny says it will compensate its users for their losses to the tune of the difference in BUNNY’s price before and after the hack by creating a compensation pool.

Forkast.Insights | What does it mean?

In last week’s Current Forkast, we discussed the upside of DeFi when compared to centralized finance (CeFi), with human error resulting in the creation of surprise millionaires via BlockFi’s reward system. But this week, CeFi appears to have evened the score.

DeFi is still in its infancy, with loopholes remaining open to hackers and bad actors. And BunnySwap users weren’t the only ones to lose their shirts in DeFi in recent days. Uranium Finance — a Uniswap clone on the Binance Smart Chain — recently lost US$50 million. Rari Capital fell victim to a caper worth around US$10.6 million in ETH. And Bogged Finance suffered a flash loan exploit that resulted in a loss of US$3 million.

Although DeFi can serve as an alternative source of revenue for investors looking to generate interest from their assets, “free money” doesn’t come without risk. DeFi’s position as an emerging paradigm is also one of its biggest weaknesses, which explains why CeFi is still the preferred ecosystem for serious traders.

All of that brings us back to the scalability “trilemma” posited by Ethereum co-founder Vitalik Buterin, who suggests that it’s not possible to prioritize decentralization, scalability and security all at once.

But most of these cases don’t point to a hole in code (in Uranium’s case, miscoding was the culprit) but a flaw in the system that allows those that exploit it to earn huge profits through the likes of flash loan schemes.

DeFi is weakened by loopholes on most of its blockchains. But as demonstrated by PancakeBunny’s response to its flash loan loss, DeFi is now evolving to a point at which protocols are to blame for losses of funds. It’s not perfect, but it is a step in the right direction when it comes to winning the trust of institutional investors.

As it has for Bitcoin, attracting interest from banks and other businesses in the traditional finance sector can validate DeFi as a legitimate ecosystem. And it’s safe to say that those seasoned players have already taken notice.

4. Can Australian crypto investors relax now?

By the numbers: Jane Hume — 2,350% increase in Google search volume.

Some industry watchers might be forgiven for thinking otherwise, but not all governments are down on cryptocurrencies. Australia’s minister for financial services and the digital economy, Senator Jane Hume, has said Canberra has “no issue” with consumers investing in cryptos. Speaking during the Stockbrokers and Financial Advisers Association Conference in Sydney last week, she nevertheless warned investors that cryptocurrencies are highly volatile and risky investments.

- Hume added that cryptocurrencies are an asset class that will grow in importance.

- “If you want to invest in Dogecoin, I won’t stand in your way,” Hume said. “Personal opportunity and personal responsibility are two sides of the same coin.”

Forkast.Insights | What does it mean?

Following comments by ruling Liberal Party Financial Services Minister Jane Hume, who took a decidedly libertarian view of retail investors getting into cryptocurrencies, the Labor opposition struck back, saying that the government is at risk of creating a “massive loophole for money laundering” and “major investor losses.”

However, speaking at the Stockbrokers and Financial Advisers Association Conference in Sydney on May 20, Hume noted that crypto assets are unregulated and warned Australians that they are “volatile, high-risk assets” and that investors would not get a free pass on “market conduct, know-your-client and tax laws.”

A day later, a fellow Liberal party member Senator Andrew Bragg appeared on Sky News and asserted that Australia needs to introduce a better regulatory framework for cryptocurrencies to ensure it can continue to foster innovation and “stay ahead of the game.”

Bragg, who is chairing a senate inquiry into Bitcoin and digital assets — stressed his party’s line that cryptocurrencies have already penetrated the Australian market, and emphasized fostering a positive business climate and boosting consumer protections for the crypto asset class.

“The reality is these products are out there now, people are using them,” he said. “We need to make sure that we have the right policy and regulatory environment to be able to maintain our competitive advantage, but also to protect consumers.”

As China continues its crackdown on cryptocurrencies and U.S. Securities and Exchange Commission Chair Gary Gensler warns that regulators will enforce crypto rules “aggressively and consistently” in the United States, the Australian government’s progressive attitude toward crypto is viewed by many as refreshing.

5. Beijing reminds China’s crypto community who’s boss

More bad news for crypto investors in mainland China and Hong Kong: Beijing has reiterated its prohibition of crypto trading, and Hong Kong is moving closer to exclude retail investors from the cryptocurrencies trade.

- Hong Kong’s is set to allow cryptocurrency trading only by “professional investors,” and the city’s crypto exchanges will be required to obtain licenses to operate in the near future.

- Hong Kong’s Financial Services and Treasury Bureau recently disclosed the results of a public consultation on the matter, and it is aiming to introduce a draft bill to the territory’s Legislative Council during its 2021-22 session.

- Meanwhile, Chinese Vice Premier Liu He and the State Council said in a statement on Friday that it was necessary to “crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to society.” The statement marked the first time that Beijing has targeted crypto mining specifically. In response, crypto industry players such as exchange Huobi shuttered some services and Bitcoin mining pool BTC.TOP suspended part of its mining business.

Forkast.Insights | What does it mean?

Things are not looking up for cryptocurrencies in China. Beijing is doubling down on its efforts to rein in China’s crypto industry, targeting crypto mining for the first time, prompting many exchanges and miners to suspend mining-related services and plan an exit from the country.

In Hong Kong, proposed legislation threatens to deny 93% of the local population access to cryptocurrency trading.

However, some observers say the clampdown is simply a way to take the froth out of an over-hyped crypto market, and that regulations will be gradually eased, as has been the case in previous years. Nevertheless, the fresh regulatory offensive seems set to usher in fundamental changes for China’s crypto miners, at least.

Jiang Zhuoer, chief executive of BTC.top, told Forkast.News that the circumstances of the crypto mining industry in China were not as bad as many believed. He said that amid the expansion of China’s mining industry, businesses that underpinned the functioning of the country’s financial system had become closely linked to mining, which had led the government to worry about risk spreading to society.

In Hong Kong, some industry insiders believe that regulations are required for the overheated crypto market.

“With the hype around meme coins, and sharks ready to take profits, the crypto downturn is already imminent,” said Toya Zhang, chief operating officer at crypto exchange platform AAX, in an interview with Forkast.News. “It is unhealthy for the crypto space, once again proving that the market needs proper guidance and regulation to protect investors from chasing the bubble and to protect the healthy crypto from being demonized.”

The cryptocurrency community may take comfort in knowing that most industry observers view the new restrictions on crypto mining in mainland China and Hong Kong’s proposed legislation as unlikely to be permanent.

“The [Securities and Futures Commission] did express the possibility of opening up the crypto market to non-private investors after a certain period of observation,” Zhang said. “We hope that the SFC will permit exchanges to serve retail users.”