Warning that the American dollar’s leadership could be challenged if it remains an analog instrument in an increasingly digital era, the Digital Dollar Project — a partnership between the Digital Dollar Foundation and Accenture — released a white paper today that outlines the pathway for introducing a Central Bank Digital Currency (CBDC) in the United States.

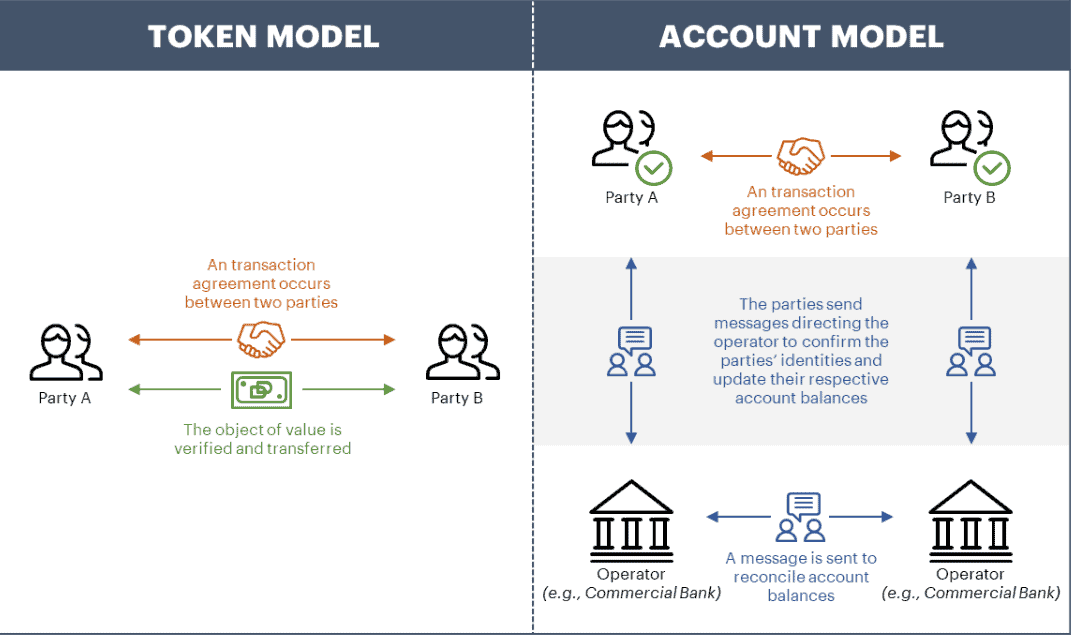

On the surface, a U.S. CBDC, as proposed by the foundation, would not look all that different to consumers compared to existing electronic or mobile phone-based payment systems. The back end, however, is where efficiency is found. The foundation’s proposed digital dollar would be fully fungible with Federal Reserve notes (cash issued to consumers) and reserves. As the white paper explains, it would be a “digital bearer instrument” and a “token-based digital representation of money” that is effectively the same as a digital version of a Federal Reserve note. All of this would be managed by a digital ledger that records transactions and authenticates the tokens to ensure that they are genuine and not double spent.

The Digital Dollar Project is led by a group composed of former government officials, including the previous chair of the Commodities Future Trading Commission J. Christopher Giancarlo, and the technology consulting firm Accenture. The project’s goals, according to its website, include “educating policy makers, organizing key industry stakeholders, and proposing a U.S. CBDC strategy.”

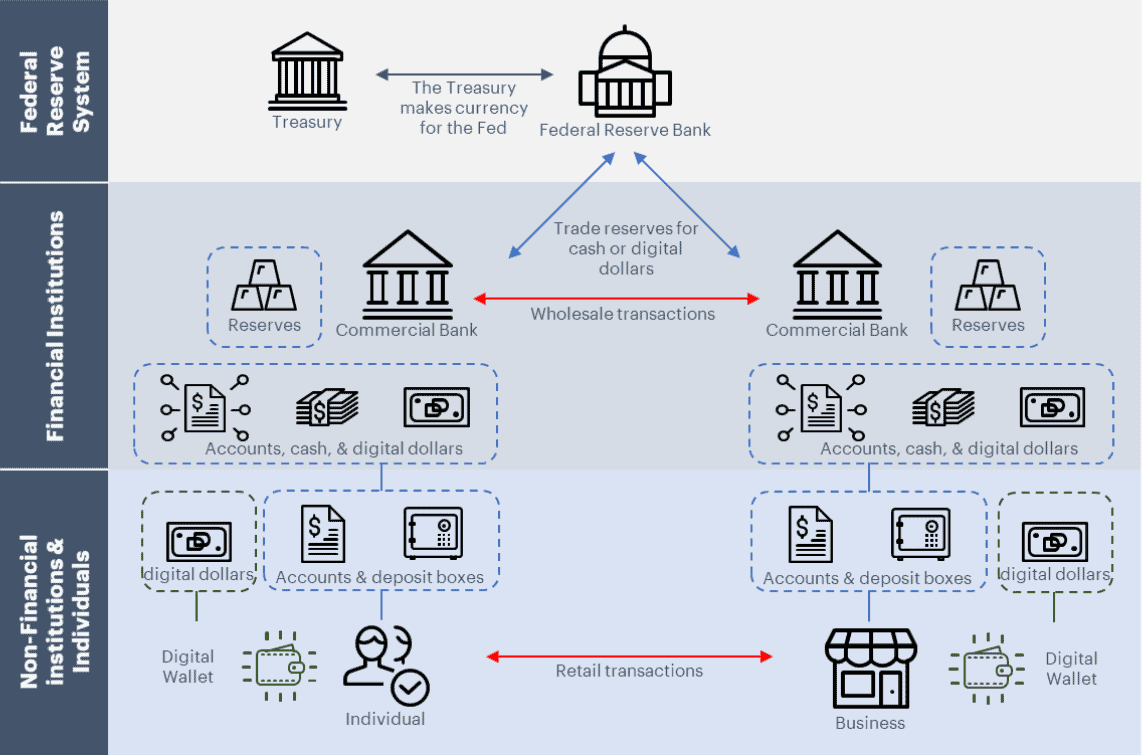

In order to create buy-in for the CBDC, commercial banks and money transmitters would exchange a portion of their reserves for digital dollars, and they would be subsequently distributed to consumers via apps or cards. Consumers could elect to use a specific digital dollar app that’s offered by their existing financial institution, or when they interact with an incumbent payment processor the purchase might be facilitated by CBDC-based transactional infrastructure. This frictionless flexibility adds to its value as a payment rail, as the consumer might choose to use CBDCs, or might use it but not know at all.

But aren’t most dollars already digital? What makes a CBDC different?

This project interchanges the terms digital dollar and CBDC, but for taxonomy purists these aren’t the same things.

Most people these days are paid salaries via some sort of electronic remittance. When they shop at a retailer they use a debit or credit card, perhaps completing the transaction with a tap of their phone. To make a purchase online, a payment service such as PayPal could be used. Existing payment rails such as Automated Clearing House (ACH), which processes scheduled payments like payroll or bill payments, transmit in ones and zeros that by default would make funds received through that method “digital dollars,” right?

Not quite, and this is where the taxonomy gets tricky.

The physical bank notes in your wallet represent a direct liability from the central bank. When you transfer those notes to another person, that liability transfers. This currency has value because of the ability for the central bank to honor the liability expressed on the banknote. However, money in your account is different. Banks hold reserves. When you pay for something with a service like PayPal or a credit card, or receive your salary via an ACH transfer, reserves (which are still fully convertible like banknotes) move between banks to settle the transaction.

The difference between these types of money is studied by central bankers and economists at a very granular level, as the supply of all these types of money impacts the ability of central bankers to prosecute their respective monetary policies. M0, bank notes and cash, is something bankers have the most control over, while M2, which is where electronic money exists, is not as closely controlled.

As a side note, this additional control over the broader economic cycle is why China is investing in DCEP.

What the Digital Dollar Project is proposing is a token that represents the liabilities of the Fed, M0. “Digital Dollars,” or previous attempts to digitize dollars, as described before are M2, a liability of the issuing commercial bank. And these are also different from stablecoins, which are tokens tied to a company’s holdings of dollars at a 1:1 ratio.

See related article: Is Covid pushing universal basic income and digital currencies closer to reality?

Why do we need a CBDC?

Retail payments would be seamless, as discussed earlier it would be an app on one’s phone or smartwatch; APIs would ensure that it integrates into existing apps so the user would likely not know the difference. But the real value is perhaps not this, but rather giving firms that need to do large transactions the ability to deal directly with each other without going through intermediaries.

Right now transactions are settled through a variety of different networks and mediums. At the core of all of these layers of payment processors are real-time gross settlement systems (RTGS) that cover high-value transactions, like Fedwire. Central bank money is swapped from account to account to cover the transactions of the institution’s respective money. Of course, not everyone can have central bank money; only firms big enough to have an account with the Fed can transact at this level.

So, for smaller firms, navigating through all of these different systems takes time, and is a costly endeavour. The Digital Dollar Foundation’s proposed CBDC would “facilitate broader, more diverse access for institutions to make large value payments,” according to its white paper. Large realtors, for instance, could act as an intermediary brokering payment between a party and counterparty.

There’s also the question of international payments. Although some complain that SWIFT, the interbank messaging service that handles 50% of the world’s high-value cross-border payments, is feeling long in the tooth regional incumbents have only made dents in its market share and not eroded it entirely. But SWIFT takes too long, sometimes days, and for certain payment corridors, it requires the use of intermediary banks. At its core, SWIFT is a messaging service, the transactions are reconciled between partner banks based on the instructions in the message.

A CBDC would bypass all of this. There would be no need to use an intermediary like SWIFT. Transactions would be recorded on a central ledger and funds released instantly. There would be no need for a messaging service like SWIFT.

China has taken note of this and its one of the reasons why it drives the sense of urgency in developing DCEP. As Forkast.News has reported, if China can get buy-in from countries in its sphere of influence, such as those in the Belt and Road Initiative, it could position DCEP as an alternative to the USD — and SWIFT — for transaction settlement.

But would America accept a CBDC?

Given the immense regulatory (and not technical) hurdles to realizing a CBDC, the white paper gives no firm timeline in its implementation. But it conveys an overwhelming sense of urgency that it should happen sooner rather than later. Given the strength of the Digital Dollar Project team — which has an advisory group that includes business leaders, economists, attorneys, academics and human rights experts — and its experience navigating Washington’s halls of power, it might not be that long of a wait. However, political plays can also backfire. Given Accenture’s large role in the project, it could also be disparaged by critics as a make-work endeavor for the technology consultancy.

Although there’s always a market for digital disruption by reducing friction points and allowing consumers to save on fees, the reality is, for many consumers and companies that don’t know any different, the current global financial system works well enough.

So how will central bankers sell CBDCs and encourage adoption?

University of Chicago Booth economist Zhiguo He thinks that can come via negative interest rates, which would be akin to paying people to accept it.

“Once you have the CBDC that everybody is stuck with, then the central bank’s tool box gets enlarged to such a great extent,” said He, in an interview with Forkast.News. “I do think on the one hand that a greater tool box enjoyed by a central bank is a great blessing. On the other hand, if the central bank makes some mistake, that’s also something worth looking at.”

Investor Tim Draper, however, thinks CBDCs are pointless, and adding an encrypted software layer to a national currency doesn’t change the fundamentals of its value. A digital version of a government-issued currency is still the same currency, subjected to political whims and guided by, as Draper says, “the politician on the top.”

“I wouldn’t want to take Chinese digital currency anymore than I’d want to take renminbi,” Draper said, in a Forkast.News interview. “Trying to digitize the dollar makes no sense. You’ve got the dollar. You now have a better currency — you have bitcoin, you have Tezos, you have other currencies that are just better. They are faster, more friction-less.”

So while there might be a lot of economic merit to the U.S. having a CBDC as an infrastructure upgrade for transaction settlements, it could be a political challenge to get the vocal swath of government-averse Americans to support the platform, especially when their existing system — while not fantastic — is good enough.

The Digital Dollar Project’s white paper is available HERE.