In this issue

- Crypto market swells with bitcoin fever

- IBM’s blockchain network for Covid medical supplies

- BitMEX cuts off Japanese users

- In China: central bank taps SenseTime for AI help

- Startup funding in India, Japan and Singapore

From the Editor’s Desk

Dear Reader,

As the global economy continues to stumble, stimulus efforts from top-tier economies appear to be the only strategy. For investors, the math doesn’t add up as demand erodes, jobless numbers climb, and production lines freeze up. But investor money has to go somewhere, and at the moment, it’s going into bitcoin. The Current Forkast this week is marking a divergence: with recovery rates strengthening in Asia and the beginnings of going back to the business of life outside the home (chance of sun) with established mask-wearing and rigorous Covid-19 testing policies in place, versus confusion and increasing politicization of all matters regarding the coronavirus in America and Europe (remains cloudy).

There is also divergence in technology dynamics this week. While Western economies focus on prices, markets and supply chains, China is readying itself for its own version of a central bank-backed digital currency in the form of DCEP (Digital Currency Electronic Payment) by partnering up with SenseTime, the world’s most valued artificial intelligence (AI) unicorn. This would be the U.S. equivalent of the Federal Reserve signing an agreement with Google to cooperate in research and development for Wall Street. Impossible in America for all the obvious legislative and corporate reasons, but in China, it’s in keeping with the tightly-controlled private market sensibility by the Chinese government. Market success is often a privilege and can be revoked at any time with new legislative orders by the National People’s Congress. China-based corporates are mindful to stay on the right side of government policy. Therein lies the tensions and obstacles for multinational firms doing business in China. Blockchain, paired with AI innovations, will evolve China’s fintech sector and standardize a new system very quickly. Is this an opportunity to lead global integration or does it speed up decoupling between East and West? We’ll be watching for the signs.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

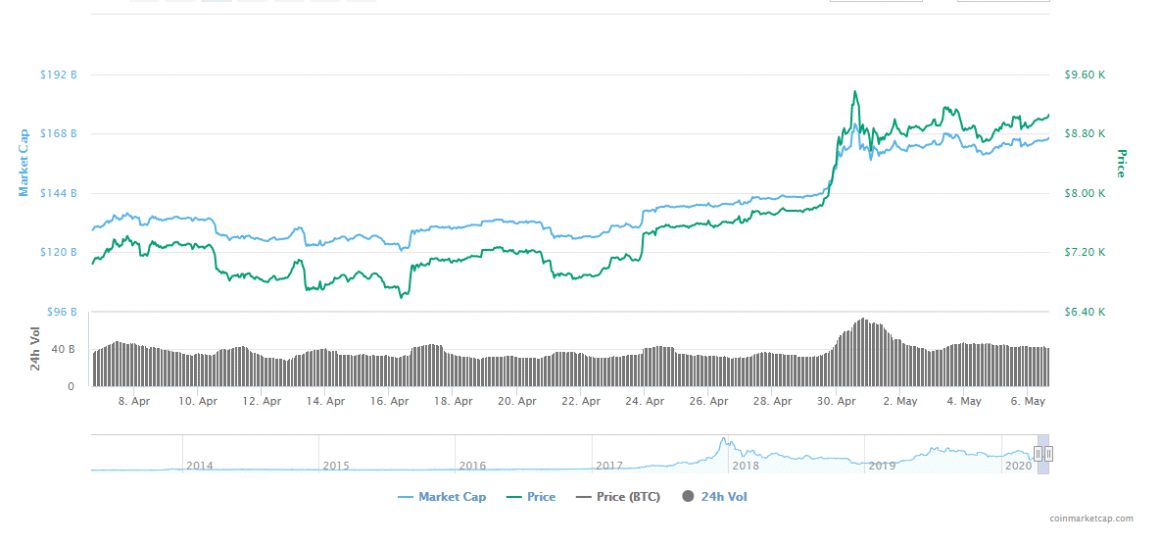

1. Cryptocurrency market value, bit by bitcoin fever, jumps $35 billion in 24 hours

By the numbers: Cryptocurrency market value jumps $35 billion in 24 hours led by — over 5,000% increase in Google search volume.

No, you’re not looking at a typo. As the lengthy search term suggests, the cryptocurrency market value climbed by $35 billion in 24 hours led by a surge in bitcoin price with less than a week estimated to be remaining for bitcoin’s next halving event. The original cryptocurrency leaves the damages of March’s Black Thursday far in the dust, trading closely around the vicinity of $9,000.

- Just a few moments before bitcoin’s surge, a popular Twitter bot Whale Alerts, which provides live tracking coverage of large cryptocurrency transactions, picked up a transfer of 50,015,000 USDT (Tether) from an unknown wallet to Binance.

- Bitcoin commentator Keith Wareing: “My best guess is in that scenario would be that tether holders will get f***** and #bitcoin would skyrocket. In all honesty I don’t have that down as something I consider likely in the short term.”

- Whale Alerts has also picked up multiple instances of the Tether Treasury’s printing rampage.

- Bitcoin commentator Keith Wareing: “My best guess is in that scenario would be that tether holders will get f***** and #bitcoin would skyrocket. In all honesty I don’t have that down as something I consider likely in the short term.”

- Also, following the first $1,200 U.S. stimulus package distribution, Coinbase’s Brian Armstrong points out a spike in $1,200 dollar deposits.

Forkast.Insights | What does it mean?

The S&P had its strongest month in decades, as did other major indices such as the Nasdaq and London’s FTSE. Yet bitcoin also had a stellar 30 days, climbing almost 35% since March 31.

So what’s happening? Isn’t the prevailing logic supposed to be that BTC and the broader crypto market are safe-haven assets? A place to go when the seas of equities and traditional commodities markets are rough?

Yes, and that’s still true. Many investors are laughing at the absurdity of the equities market and moving their capital out of town before a mega crash happens. Right now, equities are being propelled to the stratosphere by stimulus money; there’s no reason why they should be as high considering the U.S. quarterly GDP numbers have turned negative for the first time in years, and Europe’s numbers are also dismal. People in the world’s major economies aren’t consuming like they were, and the stock market isn’t yet reflecting that. Eventually, something’s got to give.

The other issue on the horizon is bitcoin’s halving. As discussed before on Forkast, this scheduled event means that it’s going to take a lot more work to produce a single bitcoin. This is a measure to reduce the possibility of inflation by creating scarcity. After the halving is complete, there will be 6.25 fewer BTC rewards per block. Given the world’s current mining capacity, that means 900 fewer new coins per day — a drop in the bucket compared to the 270,000 that change hands every day.

All that being said, this rally might be in the process of correcting itself. As of Monday morning in Asia, the June futures board on Hong Kong’s FTX crypto exchange was deeply in the red, meaning that traders expect price compression to happen by June 1 and this trend continued throughout the week, albeit with some points easing off anything in the red. This means that traders aren’t expecting a big jump in price.

2. IBM: Covid supply chain management, and blockchain drones

By the numbers: IBM — over 5,000% increase in Google search volume.

New York State’s largest health group, Northwell Health, is joining IBM’s Rapid Supplier Connect. IBM’s blockchain network will allow Northwell Health to purchase Covid-related supplies and equipment from new suppliers.

- In an interview with Forbes, Vice President of Northwell Health Phyllis McCready explains the time-consuming process of vetting new suppliers due to the increase in demand during the coronavirus outbreak.

- IBM’s Rapid Supplier Connect will leverage the company’s Trust Your Supplier network and introduce buyers to suppliers that have revised their manufacturing strategies to produce Covid-19 relief equipment.

- IBM is also gaining attention from a study published by the U.S. Department of Transport last month titled “Blockchain for Unmanned Aircraft Systems.” IBM owns the patent that uses blockchain for drone fleet security.

Forkast.Insights | What does it mean?

As Covid-19 continues to ravage the world, a challenge that has emerged in the frantic race to keep the medical sector supplied is verifying the quality of the materials and equipment being procured. As the Wall Street Journal recently described, China’s medical goods market has become a “wild west” as bad actors — taking advantage of people who lack the experience in the field — are producing gear so shoddy that they present a danger to the end-user and need to be sent back.

This is where blockchain can play a role. IBM’s Rapid Supplier Connect is a marketplace of pre-vetted suppliers that are already trusted and can meet international standards. Secured by the blockchain, purchasers can verify that the equipment they receive comes from a reputable supplier and is not counterfeit. This saves the purchaser a substantial amount of time and hassles vetting suppliers. In turn, suppliers can build up verified feedback and a business profile allowing them to reduce the cost of acquiring new customers. In addition, as this business profile is registered on the blockchain, it could be ported to other platforms and allow the business to build up more channels.

Supply-chain management is a well-established use case for blockchain, and not just in healthcare. But in the healthcare industry, there are other use cases too, as Dr. David Hanekom, chief medical officer and North America president of Solve.Care, explained in a recent interview on Forkast. From trusted data platforms that allow for the portability and examination of data by multiple parties, to helping shift the U.S. healthcare system from a fee-for-service structure to a value-based care model where rewards are based on the patient outcome, the potential for the technology in this field is enormous. Covid-19 may be the “Manhattan Project” needed to rapidly mature the technology and get it deployed in more real-world scenarios.

3. BitMEX shuts out Japan

By the numbers: BitMEX — 5,000% increase in Google search volume.

Cryptocurrency derivatives trading platform BitMEX announces that it is restricting Japanese residents’ access to its services, as the Financial Service Agency’s new cabinet order is enforced from May 1. Existing users will not be able to open new positions or increase existing positions.

- Authorities in Japan originally planned to tighten the grips in April, but pushed the enforcement to May due to a delayed official notice.

- Although cryptocurrencies gained popularity in Japan, early in its history, prominent hacks such as the $500 million Coincheck debacle in 2018 pushed regulators to strengthen regulations.

Forkast.Insights | What does it mean?

Cryptocurrency derivatives platforms are under the watchful eye of regulators, even more so than their plain-vanilla crypto exchange counterparts.

Unlike the traditional commodities market, the crypto market doesn’t have the same predictable cycles; while the relationship between macroeconomic events and traditional commodities is expected and well-understood, the same can’t be said for crypto. For example, in these Covid times, it was expected that the value of crypto assets would have an inverse relationship with the equity market. Not the case.

Another problem that many regulators have taken interest in is the lack of independent custody services, known in the traditional equities world as a central counterparty clearing house or derivatives clearing house. These firms collect enough money from each buyer and seller to cover potential losses if either party fails to follow through on an agreed trade, or if the exchange itself has technical problems or liquidity issues. This is also something that has been brought up in the mega class-action lawsuit brought against crypto exchanges by Roche Cyrulnik Freedman and Selendy & Gay. These law firms allege that many cryptocurrency derivatives platforms took unfair advantage of the investors’ vulnerability and lack of knowledge of cryptocurrencies by using terms commonly found in the traditional markets, and these terms when used in traditional markets carry specific legal weight.

Lastly, there’s also a question about the validity of publicly available data that’s used by traders to drive investment decisions. Research shows that a substantial amount of data on cryptocurrency exchanges is fake, and this data can be manipulated to move the prices displayed on any trading platform. Clever, malicious actors could use this to manipulate the pricing of futures contracts for their gain.

But this all isn’t to say that regulators don’t want crypto derivatives exchanges to exist. The Commodity Futures Trading Commission has approved a number of crypto derivatives products to operate in the U.S., and the CFTC chair has said that regulated derivatives will “help to legitimize [digital assets], in my view, and add liquidity to these markets.”

But will these regulated derivatives markets that offer over 100x leverage — a popular feature on many exchanges — be like their unregulated peers that currently dominate the market? Unlikely.

4. In China: central bank taps SenseTime for AI help, blockchain sector now has over 1,000 firms

The world’s most valued artificial intelligence (AI) unicorn, SenseTime, has signed an agreement with the Digital Currency Research Institute, a unit of People’s Bank of China.

- The two will cooperate in researching and cultivating AI innovations in fintech sectors. New AI applications and applying scenarios will be jointly developed across China’s financial sector.

- Close to 300 stories related to SenseTime and PBoC were published in Chinese media over the past three days.

- Chinese citizens seem upbeat about the news, with more than 50% of related social media posts expressing positivity.

- One internet user commented: “add oil, hope SenseTime should not only be the prominent one domestically but need to be a global company ” on SenseTime’s Weibo post about the agreement.

- Chinese citizens seem upbeat about the news, with more than 50% of related social media posts expressing positivity.

Forkast.Insights | What does it mean?

As DCEP is in the final stages of preparation before the platform’s official launch. No doubt one of them will be the mitigation of fraud. This is where SenseTime — perhaps best known for its facial recognition software — will play a role. For the traditional financial ecosystem, AI can be used to identify fraud even before it starts: compromised accounts, fake identities, fishy transfers. DCEP is a new platform, and fraudsters will likely be hard at work looking for bugs and ways to exploit the system. AI will be the line of defense against this.

SenseTime has the requisite experience, and the PBoC seems to have picked this company on merit. One of Hong Kong’s few technology unicorns, the AI company has closed $3.3 billion in funding over nine rounds to date, according to Crunchbase Pro. Industry pillars Softbank, Alibaba and Qualcomm are all investors, and SenseTime technology is already being used by both Weibo and Huawei.

An official timetable for launching China’s digital currency has not yet been announced, but many speculate that it could be toward the end of this month.

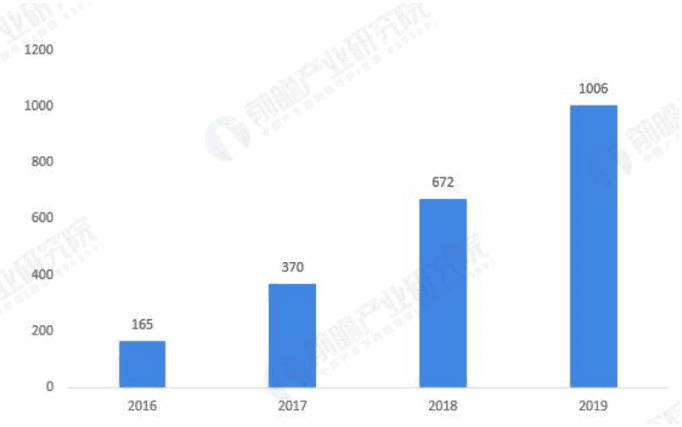

The newest analysis on the development and status of China’s blockchain industry in 2020 has been published by Forward Industrial Research Institute, a consulting agency based in Beijing.

- It states that the market scale of China’s blockchain industry has grown rapidly, from 100 million yuan in 2016 to 1.2 billion yuan, or $170 million USD, in 2019, and the total number of blockchain-related enterprises now totals 1,006. By 2022, China’s blockchain and related industries are expected to reach 10 billion yuan, or about $1.4 billion USD in market scale.

- The number of regional blockchain research institutions has reached 97, and 24 universities have gotten involved in either teaching or researching blockchain technology. The report also predicts that China’s blockchain standards and regulations will be improved by 2020.

Forkast.Insights | What does it mean?

Although China has had considerable success in the blockchain industry by leveraging the private sector, having the state set goals aligned with national policy, and providing a market environment conducive to growth, there are still serious questions about just how many of these “blockchain” companies in China are legitimate.

As Forkast has reported, after the third round of service filing number has been issued by officials this month, only 730 companies have the qualification to conduct blockchain information services, or to put it another way, less than 2% of all companies registered in China with blockchain in their name are actually meeting official standards for what blockchain information service means. Per Crunchbase Pro, which admittedly has some major blindspots on China data, only seven blockchain companies within China have revenue over $1 million compared to nearly 200 in the United States, thanks to exchanges and crypto lending.

China’s blockchain sector is leading the world in technology that is deployed and fighting real-world pain points. However, it’s important to apply a critical lens to market metrics and other data coming out of China as they often aren’t as clear or robust as they seem to be.

5. Funding roundup: investments in India, Japan and Singapore

NIRA — venture, $2.1 million USD India

Indian fintech NIRA raised $2.1 million in funding earlier this week, bringing its cumulative total funding to $3.1 million. It previously raised money through the Techstars Bangalore Accelerator, a division of the Techstars capital funding initiative. This is the corporation’s third round of funding. NIRA Finance uses a mobile app interface for a consumer-focused line of credit following a three-minute application process. Credit interest rates for the service have recently been lowered to a monthly 3% following the pandemic’s effect on Indian commerce.

Moneytree — Series C, undisclosed, Japan

Japanese fintech platform Moneytree raised an undisclosed amount of funding from investment bank Fidelity International, furthering its $15.1 million USD in publicly known capital. The firm has previously attained venture and Series B funding from the Global Brain Corporation, Sony Financial Ventures and Hiroshima Venture Capital. The company’s main product is a “personal wealth management service” available through a mobile application. This compares to existing competitors in the Americas, such as You Need a Budget and Intuit’s Mint. Founder and CEO Paul Chapman has previous executive experience at cvMail, which was acquired by Thomson Reuters in late 2007.

PhonePe — corporate round, $28 million USD, India

Indian payment service PhonePe announced a funding round of $28 million from Asian e-commerce firm Flipkart, a subsidiary of Walmart. PhonePe was acquired by Flipkart in 2016. This raises their total funding to $673.5 million through 10 funding rounds. The payment service’s application has a consistent growth in monthly app downloads of 26.25%, with instantaneous money transfers available through mobile integration, similar to Venmo and Zelle.

Helicap — Series A, $10 million USD, Singapore

Singaporean investment platform Helicap received $10 million in funding from Saison Capital late last week, pushing its total funding to $16.5 million. The organization has also been funded from VC firms East Ventures, Access Ventures, and Soilbuild Group Holdings. Helicap specializes in fintech and alternative lending with a history of venture capital firm acquisitions in the Asia-Pacific region.

Forkast.Insights | What does it mean?

Banking as a Service (BaaS) companies and challenger banks continue to close funding rounds even as VCs slow their spending to preserve what “dry powder” they have left as uncertainty looms about raising the next round. At the same time, Revolut, the champion of this space with a sky-high valuation, posts continued losses as it struggles to make a profit — all the while continuing to be on the hunt for acquisitions. In contrast, Revolut’s smaller competitor, TransferWise, which lacks the rich featureset of Revolut, continues to post a profit.

Looking down the road, we’ll continue to see investment dollars flow towards BaaS and challenger banks, but likely at much more moderate valuations. Consolidation is also a given; Revolut will be picking off competitors and complementary companies. Then there will be firms that don’t want the same kind of scope creep expansion at the expense of quick growth. But for investors, the market will remain an attractive one with a practical, revenue-generating product. Sectors that don’t yet have the business model and revenue streams down — like blockchain — could be left in the dust as the competition for VC dollars intensifies.