China-based Bitmain, one of the world’s biggest producers of cryptocurrency mining rigs, confirmed in a social media post a 20% price hike in the chips it buys from Taiwan Semiconductor Manufacturing Company (TSMC).

Fast facts

- Bitmain said on Thursday in a WeChat post that TSMC had informed all clients, including the mining rig maker, that it was going to increase the prices of its products made through semiconductor processing by 20%.

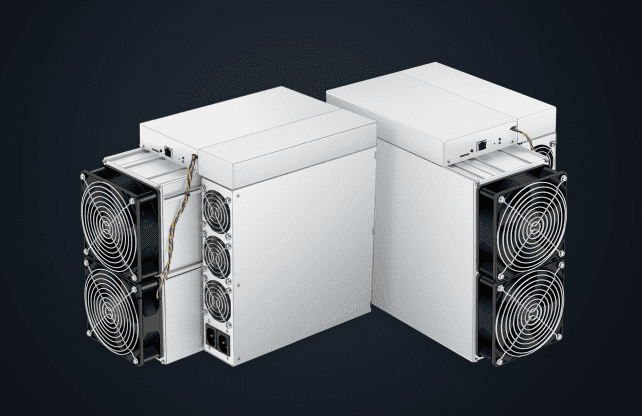

- Bitmain mainly sources wafers from TSMC for its flagship Antminer S19 series, delivered to major crypto mining companies including Poolin.

- Despite the increased cost, Bitmain said it would “steadily increase the production capacity of Antminer machines while its supply chain team works to ensure production quality.”

- It remains unclear if the price hike would hinder TSMC’s business with Bitmain and if such a price increase would be passed on to customers buying the rigs. Justin d’Anethan, head of global exchange sales at Eqonex, told Forkast.News: “Mining is always a balancing act between the cost of operating and the potential return of Bitcoin. With chips shortages being the topic of most conversations in all things tech, it wouldn’t be surprising that, with a maybe delayed effect, we would see an impact for miners and, therefore, in hashrate.”

- “While this sounds negative, it also assumes that miners are looking to grow operations,” d’Anethan added. “Conceptually, crypto miners can continue running their operations as is, provided that it is profitable in Bitcoin terms and that they have enough fiat currency to cover expenses. This somehow gives an advantage to already established miners.”

- Winston Hsiao, co-founder and chief revenue officer of blockchain fintech company XREX, who also founded one of Taiwan’s largest semiconductor parts-exporting companies a decade ago, told Forkast.News that while a chip price jump affects the cost of manufacturing mining machines, the impact to the industry as a whole could be minimal and that the market values of the currencies being mined should be more of a concern.