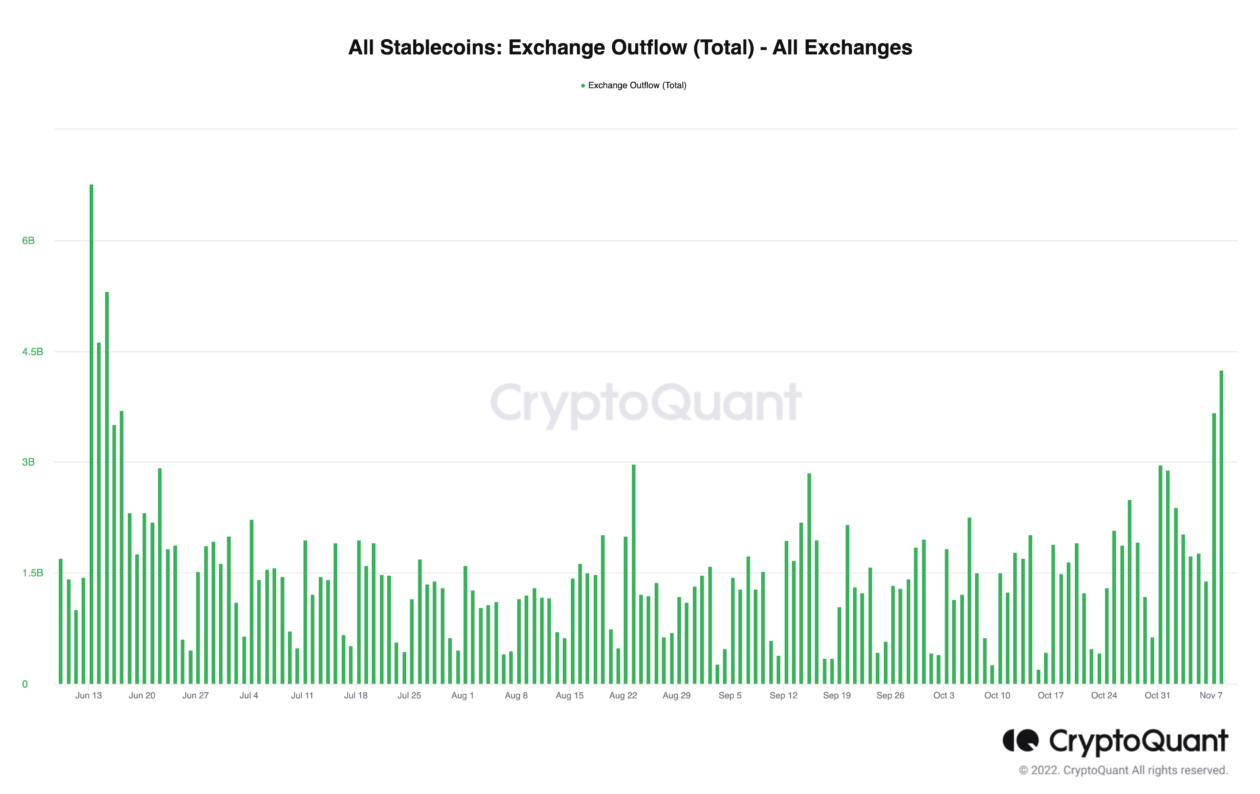

Cryptocurrency exchanges are experiencing the largest volume of stablecoin withdrawals in about six months, following FTX’s liquidity crunch that has sent shockwaves throughout the industry and led to Binance’s pledge to acquire the troubled exchange.

The number of stablecoin withdrawal transactions through exchanges grew to 49,070 on Tuesday, the highest since May 12, according to data from on-chain data analytics firm CryptoQuant.

Over 4.2 billion stablecoins moved out of all exchanges on Tuesday, the most since June 15, CrytoQuant data showed.

The outflows occurred as FTX encountered a liquidity crunch on Tuesday, with users unable to withdraw assets. Binance, the world’s largest crypto exchange that said on Sunday it would sell all its holdings of FTX’s native crypto token FTT, announced on Tuesday that it will bail out FTX by acquiring it.

The series of risk events have triggered withdrawals at a number of major exchanges over the past few days.

In the past seven days, KuCoin saw the largest stablecoin outflows among exchanges, recording US$298.1 million in stablecoins transferred out from the exchange, according to data from blockchain analytics platform Nansen.

FTX saw about US$255.8 million in seven-day stablecoin outflows as of 3 p.m. on Wednesday in Hong Kong, followed by US$219.5 million at OKX, US$166.1 million at Kraken and US$119.6 million at Huobi, Nansen data showed.

Binance also booked large volumes of withdrawals. On Tuesday, it processed transactions of 1.75 billion stablecoins transferred out of the exchange, marking the largest outflow since Aug. 23, according to CryptoQuant data.

Transparency pledge

To enhance transparency, Changpeng Zhao (commonly known as “CZ”), chief executive officer of Binance, tweeted on early Wednesday in Asia that Binance will start to carry out merkle-tree proof-of-reserves. A merkle tree is a kind of data structure that can be used by blockchains to ensure data integrity, and such merkle-tree proof-of-reserves can prove that the exchange is properly accounting for clients’ crypto assets.

A number of crypto exchanges have pledged to follow suit in conducting and disclosing such documentation.

OKX tweeted on Wednesday that it will publish its merkle-tree proof-of-reserves or proof of funds within 30 days, as it is “an important step to establish a baseline trust in the industry.”

Tron founder Justin Sun, who recently became Huobi’s global advisory board member, said that Huobi had just wrapped up such a procedure about a month ago, but “but we would love to do a third one with CZ’s proposal.”

I want to echo CZ’s advice. @Poloniex and @HuobiGlobal both have done it before. Huobi actually just finished it about one month ago. But we would love to do a third one with CZ’s proposal. Merkle-tree proof-of-reserves 100% is very important to our industry and transparency. https://t.co/v4e09RWxGx

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) November 9, 2022

Johnny Lyu, CEO of KuCoin, also tweeted that it will release merkle-tree proof-of-reserves or proof of funds in about one month and work with auditors to build confidence and transparency in the industry.

Justin D’Anethan, institutional sales director of crypto finance firm Amber Group, told Forkast in a Wednesday interview that it would be hard for a crypto trading entity to operate efficiently and disclose its positions and holdings in a transparent manner.

“You do need a certain level of secrecy in order to just [trade] and execute orders in the right way for yourself and for your clients,” D’Anethan said. “So it’s not as easy as saying I want to be transparent and therefore I will be. There’s a trade-off here.”

Antonio Juliano, founder of crypto derivatives exchange dYdX, also questioned that a proof-of-reserves might not disclose all the relevant information of a centralized exchange’s assets.

“How do you know if the entity has outstanding loans? How do you know what contracts they’ve entered into?” Juliano wrote in a Wednesday tweet.

Clara Medalie, research director of crypto data firm Kaiko, told Forkast that Coinbase could be one of the few exchanges that stand to gain from this new behemoth, as it could “leverage its regulated status and transparency of reserves to attract a more institutional client base.”

See related article: Binance’s pending acquisition of FTX may attract attention of antitrust regulators