In this issue

- Coinbase set to go public on Nasdaq

- Mary hard fork takes Cardano closer to Goguen

- Goldman Sachs, other big banks line up behind bitcoin

- NFT king Beeple’s $6.6 million crown

- Are these ‘crypto miners’ in China for real?

From the Editor’s Desk

Dear Reader,

A rising tide lifts all boats. In the world of cryptocurrency, we are seeing the bitcoin price surges do exactly that.

From Coinbase’s eye-watering pre-public valuation to musicians and artists dropping their works in the digital sphere for millions of dollars, it is the unstoppable advance of the digital asset age. And as more investors look for opportunities for exposure to this new alternative asset class, there are countless options beyond bitcoin. Demand is frothing over to blockchain-focused goods and services that sit adjacent. That also explains the latest drama in the China cryptocurrency mining industry as one company, which shed its P2P lending business for a more profitable one in cryptocurrency mining, appears to maintain demand despite getting called out by short sellers.

Still, there’s deeper value here than meets the investor’s eye at the moment. The intrinsic, fundamental value remains in the technology and how it can shift legacy systems. Speculative interest will come and go. But the rise of the cryptocurrency economy will benefit all who participate in it.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Coinbase set to go public on Nasdaq

By the numbers: Coinbase — over 5,000% increase in Google search volume.

Coinbase, the largest cryptocurrency exchange in the United States, has filed its S-1 registration with the U.S. Securities and Exchange Commission for the direct listing of its Class A common stock on the Nasdaq under the ticker symbol COIN. Prior to its disclosure, it was widely believed that Coinbase would go public through an initial public offering. Instead, its registration confirms that the company will not be creating new shares and will not go through an underwriter, but registered stockholders may elect to participate in resales of their Class A stock.

- Coinbase’s largest Class A shareholder is venture capitalist Marc Andreessen, who owns 24.6% of the shares. CEO Brian Armstrong holds 10.9% of Class A shares.

- The filing also reveals that Coinbase’s total assets have more than doubled since Dec. 31, 2019, when it reported just under US$2.4 billion of total assets. By Dec. 31, 2020, its assets grew by more than 140%, reporting over US$5.8 billion in total assets, which includes US$316 million in cryptocurrency, a significant increase from US$33.9 million in 2019.

- Coinbase recorded a net loss of US$30 million in 2019, but by the end of 2020, the company reported a net income of US$322 million.

Forkast.Insights | What does it mean?

An IPO is a rite of passage. A moment when a company’s vision, hard work, and millions of investors’ dollars in those funding rounds all pay off.

In 2020, companies skipped the IPO rite of passage and chose to go public via special-purpose acquisition companies (SPACs) instead. In 2021, filing a direct listing (which is what Coinbase did) is the new path to going public. You could say, direct listing is the new SPAC.

As Coinbase goes public on Nasdaq via a direct listing, it’s also skipping the part of subjecting itself to an IPO discount that usually ranges up to 20% from its median peer. The discount is usually applied to stoke public interest and hopefully the share price on the first day. But Coinbase is likely riding on different factors in the market, namely bitcoin and FOMO.

Coinbase’s latest valuation per FTX in a pre-IPO contract is estimated to be US$100 billion on US$3.4 billion in revenue. It’s a heady figure, considering Coinbase was valued at US$8 billion at its 2018 funding round. Compare that, too, to Nasdaq, Inc. — owner of Nasdaq and the Philadelphia and Boston stock exchanges — which has a market cap of US$23 billion on a reported US$2.9 billion in 2020 revenue.

A direct listing has risks for the company and its investors alike. No long-term or large cornerstone shareholders ahead of an IPO means fewer defenses against price volatility. But is that different in the world of crypto? It is not. The risk appetite is great amid a perceived upside.

2. Mary takes Cardano closer to Goguen

By the numbers: Cardano — over 5,000% increase in Google search volume.

Cardano blockchain successfully launched its Mary hard fork upgrade to its mainnet this week. The upgrade, which introduces user-defined native tokens to Cardano, allows Cardano to perform the functions of a multi-asset (MA) blockchain. The hard fork, named after Frankenstein author Mary Shelley, continues Cardano’s rollout of its Goguen smart contract era, named after American computer scientist Joseph Goguen.

- The Goguen era will enable the Cardano blockchain to support smart contract applications such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Dubai-based crypto investment fund FD7 ventures is ditching US$750 million in bitcoin over the next 30 days in favor of Cardano (ADA) and Polkadot (DOT). “Aside from the fact that Bitcoin was first to market and society has given it meaning as a store of value, I think Bitcoin is actually pretty useless,” Prakash Chand, managing director of FD7 Ventures, said in a statement.

- In the market, Cardano’s native cryptocurrency ADA has been surging. Over the weekend, ADA vaulted over Binance Coin (BNB), Polkadot (DOT) and Tether (USDT) to become the third-largest cryptocurrency by market capitalization, after bitcoin and Ethereum’s ether, and is now trading at US$1.25 at the time of publishing.

Forkast.Insights | What does it mean?

“Forget bitcoin, what about all those other coins?” (said every institutional investor in the market right now).

Cardano’s ADA is one of those coins grabbing the alt-attention in the cryptocurrency investment space. Since the start of 2021, Cardano’s token ADA has jumped more than 570% and is now one of the top three cryptocurrencies by market capitalization.

The Mary hard fork means that ADA can support DeFi, smart contracts and NFTs. That’s exciting because now users can create their own tokens that interact on Cardano — which means anyone can send coins to another without the need to register users, the first step to full, smart contract functionality.

It also means that the Cardano blockchain is now well on its way to realizing its vision for enterprise usage, especially in Africa. As we reported in Forkast.News, developing economies such as Africa’s have been part of Cardano’s strategy since its launch. Prior to the Covid-19 pandemic, the International Monetary Fund (IMF) estimated that the top five of the world’s fastest growing economies would be in Africa. Ethiopia, one of the countries with the highest potential for economic growth as well as crypto adoption, has a population that is more than 70% under the age of 30. The underlying blockchain of ADA has African use cases in mind.

FD7, the Dubai investment firm that is shifting US$750 million of its bitcoin allocation to Cardano and Polkadot, sees beyond the notion that cryptocurrency’s only use case is a store of value. The new value lies with those tokens that fuel the transactions of the present and future Web 3.0.

3. Wall Street lines up behind bitcoin

By the numbers: Bitcoin — over 5,000% increase in Google search volume.

Although bitcoin’s recent prices suggest that demand may be hitting a plateau, cryptocurrency has never been more popular on Wall Street.

- JPMorgan & Chase strategists are recommending that investors consider diversifying 1% of their portfolios with cryptocurrencies.

- Goldman Sachs is now rebooting its cryptocurrency trading desk — after shelving an earlier effort in 2018 — to offer bitcoin futures and other financial products by mid-March, according to Bloomberg.

- Citibank published a research note, “Bitcoin: At the Tipping Point.” The note states that bitcoin is at the cusp of mainstream acceptance and predicts bitcoin will eventually become the “currency of choice for international trade.” (A dissenting view in the Financial Times bashes Citi’s bitcoin analysis as being “embarrassingly bad.”)

- In Europe, private Swiss bank Bordier & Cie SCmA has announced that it is partnering with digital asset bank Sygnum to offer cryptocurrency products and services to its clients. The bank, which was founded in 1844, states that the expansion of its offerings to include digital assets was driven by increasing client demand.

- Back in the United States, the Massachusetts Institute of Technology’s Digital Currency Initiative has launched the Bitcoin Software and Security Effort — a four-year research and development program that will include bitcoin’s reference software, Bitcoin Core. The project has received US$4 million in funding from bitcoin investors Jack Dorsey of Twitter, Michael Saylor of MicroStrategy and the Winklevoss twins of Gemini.

Forkast.Insights | What does it mean?

Talking your book. It’s something one always has to keep in mind when monitoring the headlines of opinions in cryptocurrency. But when you’re trying to gain a position, a foothold in cryptocurrency where once you didn’t have it, it might be convenient to express doubt and suspicion as one tries to cement holdings.

There has certainly been a lot of cold water poured onto the notion that bitcoin or other cryptocurrencies should store anything let alone value. Questions about whether it would be anything more than a digital haven for speculators, or if holding cryptocurrency would simply encourage your neighborhood criminal to go on a spree. These comments come from some of the biggest names in the land. All this amid concerns that bitcoin rose too far, too fast and is now tumbling back down to more modest levels.

So as bitcoin prices fell from its high of US$58,640 on Feb. 21, MicroStrategy (and likely others) swept up more bitcoin for its institutional client base. According to its latest 8-K filing with the SEC, MicroStrategy said it acquired an additional US$15 million in bitcoin at an average price of $45,710. That’s a nice 22% discount from bitcoin’s all-time high last month.

4. NFT king Beeple’s $6.6 million crown

By the numbers: Beeple — over 5,000% increase in Google search volume.

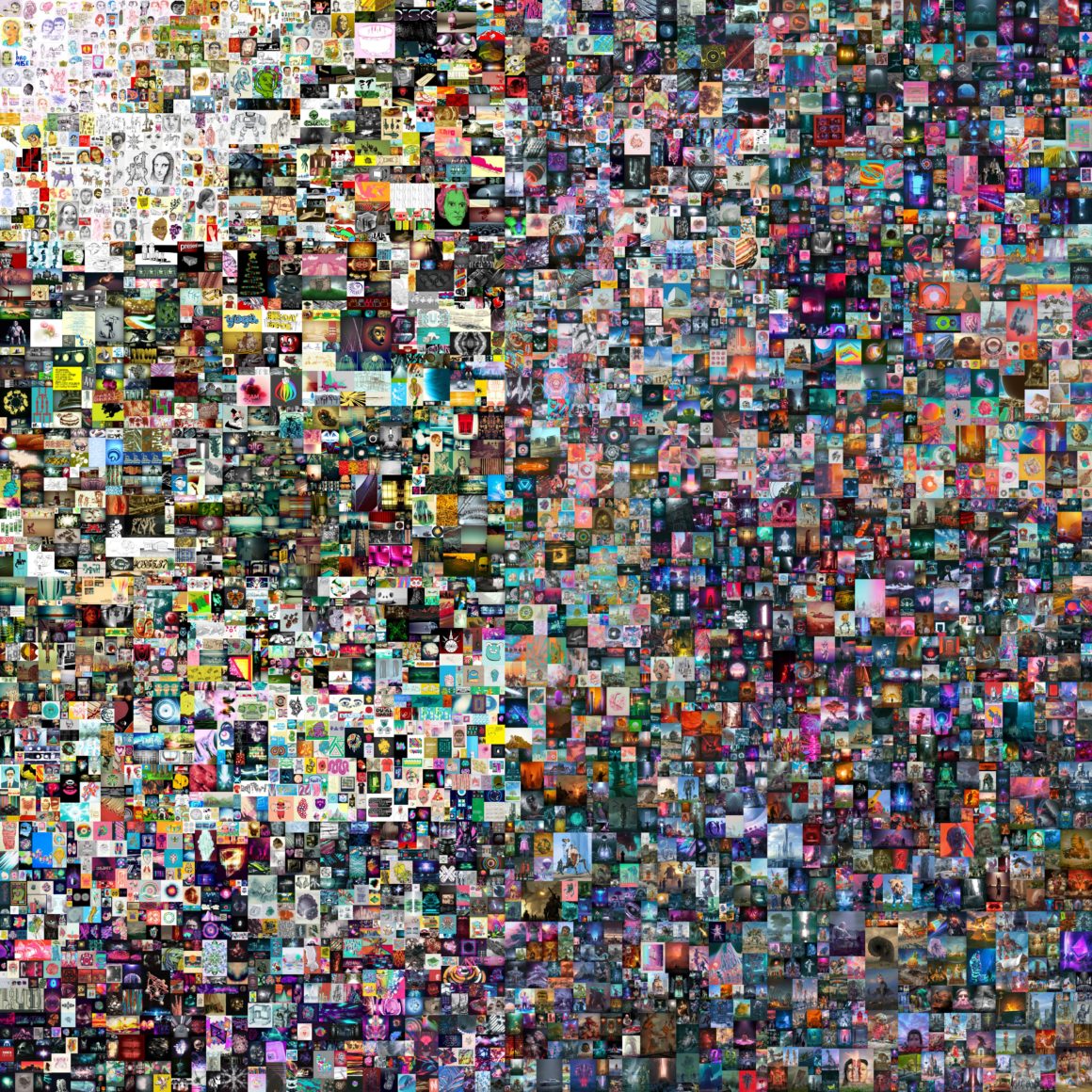

Speaking of the Winklevoss twins, an artwork by non-fungible token (NFT) pioneer and digital visual artist Beeple, “Crossroads,” was sold for a record-breaking US$6.6 million of ether in Nifty Gateway, an NFT marketplace owned by the Winklevosses. “Crossroads” — which depicts former president Donald Trump lying tummy-down on grass — is Beeple’s first 1/1, meaning it’s his first unique piece.

- Beeple also has an on-going auction at Christie’s for his digital artwork, “Everydays: The First 5000 Days.” The auction at Christies opened at US$100, and quickly rose to US$1 million in just the span of an hour.

- The auction, which currently has 125 bids reaching US$3.25 million as of press time, closes on Mar. 11.

- In the world of NFT music, 33 unique NFTs of American DJ 3Lau’s “Ultraviolet” album sold for a total of US$11.68 million, with one single ringing up US$3.67 million, while singer Grimes’s 10-piece series sold for US$6 million.

Forkast.Insights | What does it mean?

The starving artist is no more.

Beeple — aka graphic designer Mike Winkelmann of Neenah, Wisconsin — is not only making a name in New York’s fine art world. He is transforming it globally via NFTs — a blockchain-powered technology that marries the scarcity value of art with the dynamism of tokenomics. Digital content producers couldn’t be happier. But it also means that fans of artists, athletes, celebrities and musicians can support the very works they admire — in the lifestyle that they have grown accustomed to.

It’s a new marketplace. And in a world steeped in assets, NFTs are yet another digital form of it, an alternative asset subclass of tokens and cryptocurrencies that is finding a digital home.

According to the NFT Report 2020 published by L’Atelier, BNP Paribas, and Nonfungible.com, the value of the NFT market has more than tripled in 2020 and is on track to reach a US$1 billion market valuation this year, according to one estimate.

A recent collector paid 800 ETH for Punk 6965 that’s US$1.5 million at the time of purchase. The current asking price is now US$2 million, or 1,500 ETH. So the next time someone asks whether cryptocurrency will ever become the currency of choice, the answer might already be answered in the art world. Cryptocurrency is paying for other digital assets, and the demand appears to be growing.

5. Are ‘crypto miners’ in China taking investors for a ride?

Short sellers took aim at a couple Chinese companies, questioning the authenticity of the non-crypto companies suddenly jumping into the crypto mining business — allegations that one of those firms has vigorously denied.

- Two short-sellers, Hindenburg Research and Culper Research, published two separate reports last week, saying they were shorting shares of Chinese firm SOS Ltd., according to Reuters. Formerly known as China Rapid Finance, a company listed on the New York Stock Exchange, SOS is a P2P lending firm that sold its legacy P2P business in August 2020 due to government regulations. Earlier this year, SOS shifted to the cryptocurrency mining business by buying 5,000 mining rigs for crypto farming in China’s Sichuan province. “We find the Company’s claims regarding its supposed cryptocurrency mining purchases and acquisitions to be extremely problematic, if not fabricated entirely,” wrote Culper Research in its report.

- SOS has emphatically denied the short sellers’ allegations. “These attacks were purposefully designed to manipulate the price of the company’s shares, with the aim of causing a stock price decline in order to economically benefit the short sellers,” SOS said in a statement.

- SOS’s mining venture is not the only pivot to crypto being questioned by short sellers. Nasdaq-listed Bit Digital — another former P2P lender from China — had a surge in share prices to all-time highs of US$29 on Jan. 4 after announcing its jump into crypto mining. Less than a week before that, at the end of 2020, Bit Digital was on the brink of delisting and had its shares trading for only US$5. On Jan. 11, U.S.-based short seller J Capital Research published a report questioning the authenticity of Bit Digital’s crypto mining business. Bit Digital’s shares have since stumbled, and the company now faces a class-action lawsuit by investors in New York that alleges securities fraud.

- More chill in the wind for companies wanting to enter crypto mining in China: Inner Mongolia, the autonomous region in northern China that is home to some of the world’s biggest cryptocurrency mining farms, is planning to ban mining. Citing its enormous consumption of coal-fueled electricity in the region, Inner Mongolia declared it would shut down all cryptcurrency farms by April.

Forkast.Insights | What does it mean?

Short sellers do the necessary business of vetting companies. One can’t depend on China’s media as a way of evaluating companies, or holding the powerful to account. So two separate short sellers, Culper Research and Hindenburg Research, did the due diligence and found SOS needing some help of its own.

From listing a hotel room as headquarters; to debunking photos of mining rigs that were not the A10 Pros SOS claimed they were, but instead Avalon’s A1066 miners; to the droll observation about the company’s listed gmail account that “presumably, a mining supplier with the capability to fill a $20 million order at a far faster rate than its peers would have its own company email address,” Culper listed all of its findings that supported its call to short sell SOS.

SOS replied with a statement, saying simply that the short seller’s allegations were “distorted, misleading and unsubstantiated.”

Bitcoin’s bull run has been a boon for cryptocurrency miners, who have a high operating leverage (buy equipment in bulk, operate at scale to save on electricity costs). Any increase in bitcoin prices have sparked an increase in crypto mining company share prices. Case in point: Riot Blockchain and Marathon Digital Holdings — two Nasdaq-listed bitcoin mining companies in the U.S. — are up more than 200% since the beginning of this year. Simply put, higher bitcoin prices mean higher mining profit margins. If you’re going to switch businesses, as China Rapid Finance did when it became SOS, cryptocurrency mining would be a lucrative one.

The business case is robust, but whether SOS has the equipment or capability to ride the bitcoin price climb may be another matter. For investors who want indirect exposure there are many more better-known firms, such as PayPal and Square, raising their hand looking to profit off of bitcoin adoption.