The declining number of non-fungible token traders on the Cardano blockchain has given it the “ghost chain” nickname, but data from Forkast Labs show that the network’s NFT market performance in June outperformed some of the top blockchains in the industry.

Cardano picked up the ghost chain moniker as its monthly unique NFT buyers plunged from its October 2021 peak of 254,383, according to CryptoSlam, the data arm of Forkast Labs. The number of unique NFT buyers fell to 13,559 in June, 10.12% lower than May.

The Forkast CAR NFT Composite, a CryptoSlam index to measure the Cardano NFT market performance, dropped 3.84% to 982.01 last month, giving an estimate of losses for NFT traders in some of the top collections on Cardano.

While that looks like all bearish news for the so-called ghost chain, Forkast Labs data suggests that NFT traders on Cardano suffered fewer losses than those on some of the world’s top NFT networks, such as Ethereum, Solana and Polygon.

New picture

Throughout June, the Forkast ETH NFT Composite suggests that traders that bet on the top NFT collections on Ethereum, the most popular blockchain for NFTs, would have copped an estimated loss of 14.41%.

Over the same period, Forkast SOL NFT Composite (Solana) fell 14.71%, and the Forkast POL NFT Composite (Polygon) slumped 13.49%. The Forkast 500 NFT Index, the gauge for the overall NFT market, dropped 16.14%.

Cardano’s native cryptocurrency, ADA, is the world’s eighth-largest cryptocurrency by market capitalization, with around US$10.4 billion in circulation. And despite it being the sixth largest blockchain for NFTs by all-time trading volume with US$597 million in sales, the network’s NFT ecosystem has on numerous occasions been declared dead by social media users.

But Moosa Zaidi, the founder and chief executive officer of NFT advertising firm NFT Hive Club, said he wouldn’t dismiss Cardano from the top NFT blockchains.

“There are still some die-hard Cardano supporters and projects out there that back the chain, and as past crypto portfolios show, a single market bull run can be a game changer,” Zaidi told Forkast.

“New founders and upcoming investors have Ethereum or Solana as their primary preference… Those wanting to venture out in Cardano tend to invest in the projects down the top 10 ranks to make the most out of it.”

Enthusiasts

The falling number of buyers has not stopped creators from releasing their NFT collections on Cardano.

Australia-based digital artist Joel Moore, better known as Mulga, released the MulgaKongz NFT collection on Cardano on June 23, a collection of 5,555 gorilla NFTs that sold out within 48 hours of its launch.

Moore said choosing Cardano to house his digital art was an “easy decision.”

“Cardano is a blockchain with a good future, community and ecosystem,” wrote Mulga, in a Twitter response to Forkast. “There’s been some great support from the community and the future is looking bright.”

See related article: Can Azuki’s new Elementals spark the entire NFT market?

While most top Cardano NFT projects remain engaged with their community, a few notable ones have been inactive on social media.

CardanoBitz, a 10,000-piece NFT collection on Cardano with over US$1.12 million in total sales, has not shared any original Twitter posts since June 10.

Zombie Chains, a collection with over US$1.73 million in total sales, has been silent since May 18. Unsigned Algorithms, a collection with US$423,799 in total sales volume, last posted on Feb. 2, while Clumsy Ghosts, an NFT gaming project with over US$1.78 million in sales, last tweeted on April 11.

“More and more top 50 projects on Cardano are going silent,” a Twitter user posted on June 24. “Do we need to do more as a community to support real builders? Or continue to hype dead weight?”

Input Output Global, the Colorado-based tech firm behind the Cardano blockchain, hadn’t responded to Forkast‘s request for comment by the time of publication.

Buyers

Solana had 65,459 unique NFT buyers in June, almost five times that of Cardano. But average NFT sales on Solana were US$78.79 in June or less than the US$95.22 on Cardano, suggesting that traders on the network were willing to pay a higher average price for their NFTs.

According to Anndy Lian, author of the book “NFT: From Zero to Hero,” Cardano’s forte is offering a user-friendly experience for NFT creators and traders.

“The platform offers low-cost transaction fees, making it an attractive option for enthusiasts seeking cost-effective and scalable solutions,” Lian told Forkast.

Lian added that low crypto market liquidity is affecting the NFT market performance across all blockchains, including Cardano.

“When liquidity is limited, it becomes more challenging for NFT holders to find buyers willing to purchase their tokens at desired prices. This can lead to longer waiting times and difficulties in selling NFTs. Additionally, a decrease in overall market activity may result in a decline in demand for NFTs, which can further affect their liquidity,” said Lian.

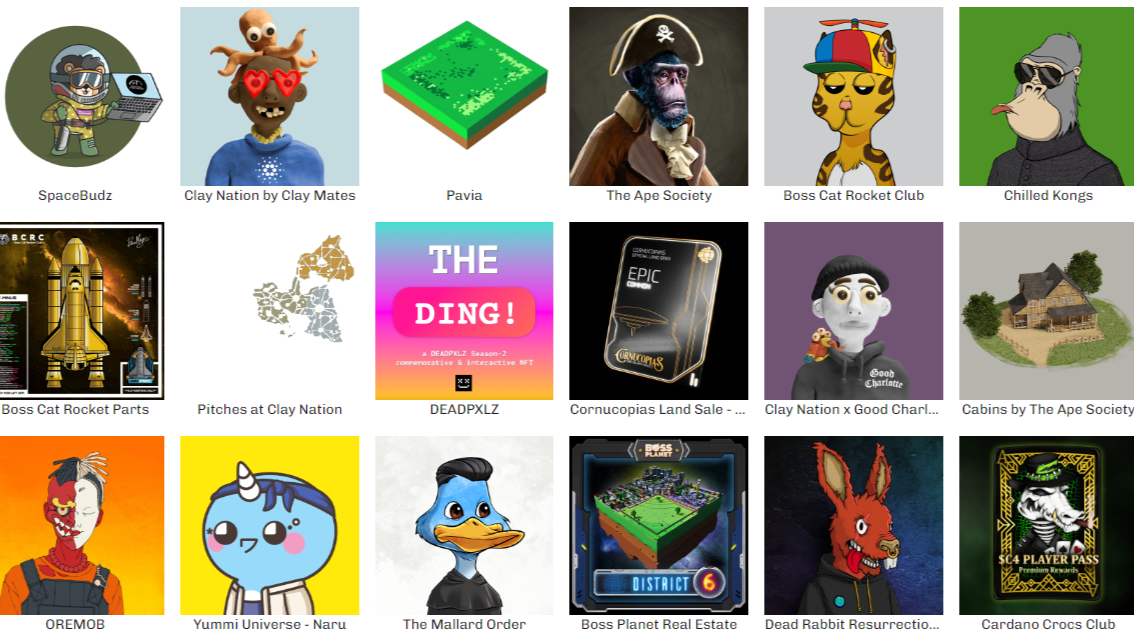

Count Stackula, a pseudonymous Space Budz NFT holder, a collection of 10,000 NFTs with over US$46 million in total sales, said that Cardano developers keep building, despite the market conditions.

“There was some more hype around the Cardano NFT scene when smart contracts were still to be announced, but it’s an overall healthy NFT ecosystem,” Count Stackula told Forkast.

“Admittedly, there have been a lot of the typical clone projects that don’t display much originality, but Cardano devs also know it’s important to focus on building the perfect roads and freeways before perfecting the automobile.”