The Bitcoin blockchain’s network congestion has been easing since Ordinals, an iteration of non-fungible tokens (NFT) on the world’s first decentralized blockchain, surpassed its millionth inscription earlier this month.

Bitcoin’s network congestion can be measured by its memory pool size, or mempool, the queue of pending valid transactions waiting to be added to blocks. It is often measured in virtual bytes (vbytes), and a single Bitcoin block can theoretically hold up to a million vbytes.

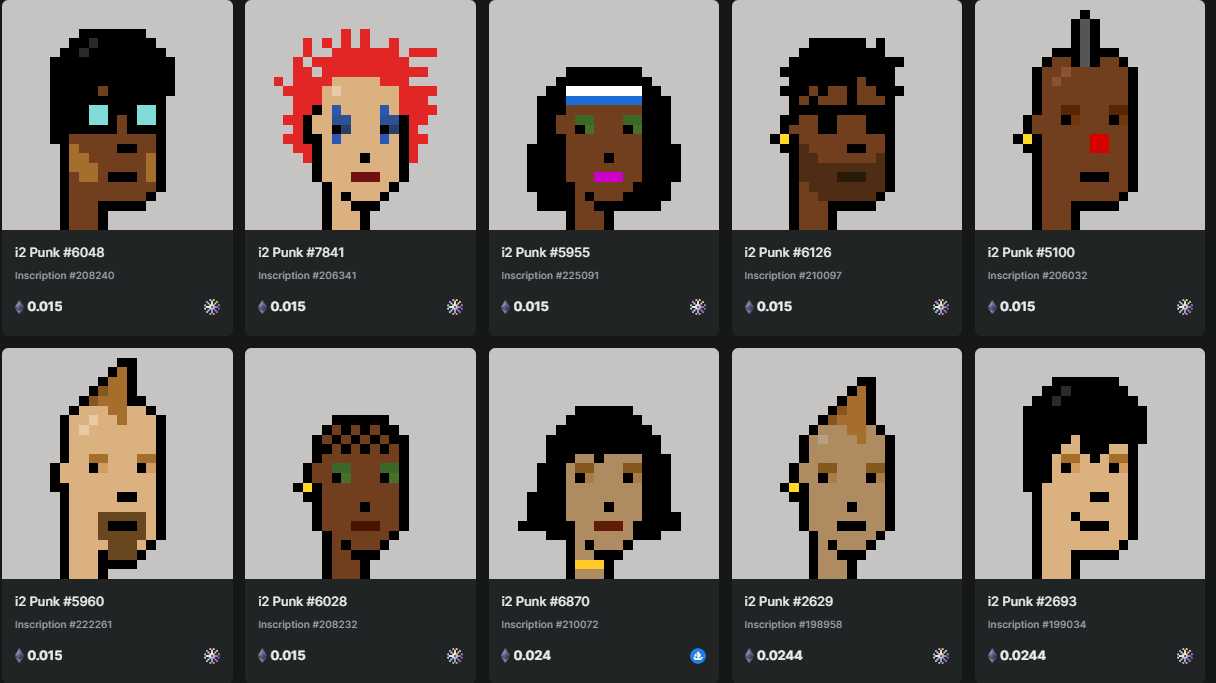

Ordinals, a protocol that allows data such as text and images to be inscribed on the Bitcoin blockchain, launched on Jan. 21 when the mempool size was 7.1 million vbytes. Bitcoin’s transaction queue expanded in the following months, peaking at around 247.9 million vbytes on March 24, the highest in nearly two years, blockchain data from mempool.space shows.

A larger mempool signifies a congested network, which creates longer transaction times and higher fees. As a result, “miners earn more per block,” Kadan Stadelmann, chief technical officer of blockchain infrastructure development firm Komodo, told Forkast in a statement.

There were around 400,000 Bitcoin Ordinals inscriptions during the two weeks period ending on April 8, when the millionth inscription took place, according to Dune Analytics data. The previous 400,000 inscriptions took almost a month to fill.

On the date of the millionth inscription, Bitcoin’s mempool size was at 132 million vbytes. This has decreased significantly to around 20 million vbytes on April 20.

“The Bitcoin Ordinals phenomenon, as well as the work being done by the Lightning Network, suggests we are still at the very beginning of Bitcoin’s evolution,” Brian Santos, founder of Bitcoin-powered social platform UpTweet, said in a statement shared with Forkast. “In the short-term, Bitcoin’s mempool could become congested due to on-chain experimentation, but long-term could result in newly discovered use cases for Bitcoin.”

Although mempool congestion raises transaction costs for Bitcoin users, it can benefit miners’ bottom lines.

Last year, transaction fees accounted for 1.6% of Bitcoin’s security budget, or funds paid to miners as block rewards and transaction fees, according to Dune Analytics data. The other 98.4% came from block rewards, which are fresh, newly minted Bitcoins awarded to miners for validating blockchain transactions.

Roughly every four years, block rewards are cut in half, which means miners will earn fewer Bitcoins. For some miners, new Bitcoin use cases, such as Ordinals, could be a lifeline.

“This [security budget] issue can potentially be resolved by projects like Ordinals or layer-2 solutions, which could provide additional revenue sources for the network,” Slava Demchuk, the co-founder of AMLBot, a developer of crypto anti-money laundering software, said in a statement shared with Forkast.

Miners currently earn 6.25 Bitcoins for successfully validating a block. This will be chopped to 3.125 during the next halving, which is estimated to occur in April or May of 2023.

See related article: EU green lights MICA but Cryptos tumble on economy worries