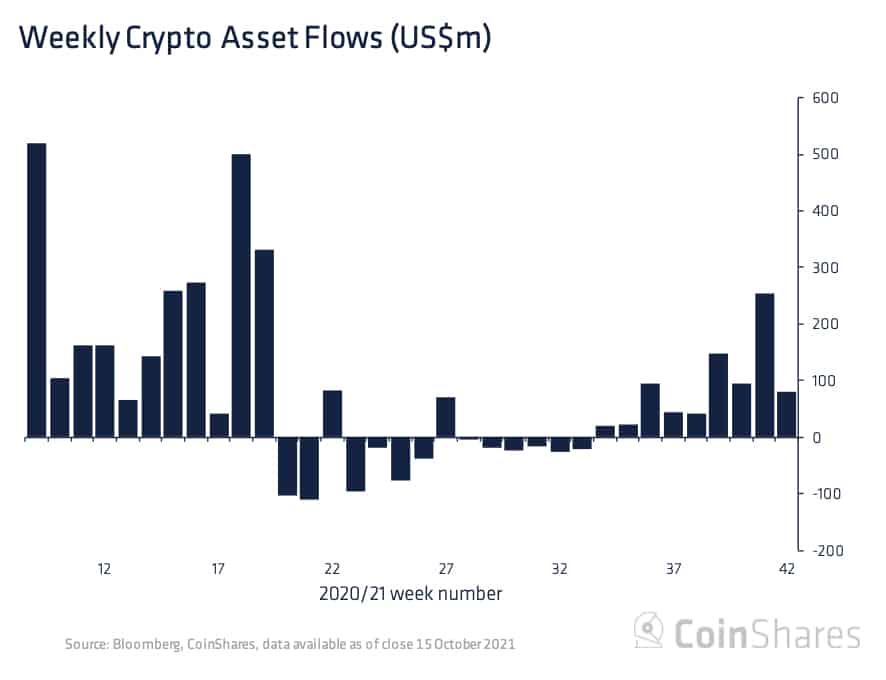

As excitement grew over the imminent approval of Bitcoin futures exchange traded funds (ETFs) in the United States, Bitcoin investment products saw inflows of US$70 million last week — the fifth consecutive week of inflows — while Ethereum saw outflows of US$1 million, according to digital assets manager CoinShares.

Fast facts

- According to CoinShares, the total assets under management (AUM) of digital asset investment products was US$72.3 billion last week, the highest on record, surpassing May’s high of US$71.6 billion.

- In terms of alt coins, Polkadot and Cardano saw continued inflows of US$3.6 million and US$2.7 million respectively. Polkadot is poised to conduct its first parachain slot auctions on Nov. 11, with the proposal currently pending a public referendum.

- Bitcoin’s weekly inflows were “much lower than inflows seen in the first quarter of 2021, where there was much greater participation by US investors,” wrote CoinShares investment strategist James Butterfill. “The recent decision by the SEC to allow a futures-based ETF in the United States could prompt further significant inflows in the coming weeks as US investors begin to add positions.”

- Grayscale — the largest digital assets manager by assets under management — on Oct. 18 announced that it was planning to convert its Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund. “Today, I’m happy to confirm that @Grayscale WILL file for $GBTC to be converted into an #ETF as soon as there’s a clear, formal indication from the SEC,” said Jennifer Rosenthal, director Of communications at Grayscale Investments, in a tweet thread. “Once there’s official and verifiable evidence of the SEC’s comfort with the underlying #Bitcoin market — likely in the form of a Bitcoin Futures ETF being deemed effective — the #NYSE Arca will file a document called the 19b-4 to convert $GBTC into an ETF.”

- The price of Bitcoin has soared in recent days and is approaching its all-time high of $64,804.72 per CoinGecko data. In a SEC filing on Oct. 18, ProShares announced that its ProShares Bitcoin Strategy ETF — the first Bitcoin Futures ETF to be launched in the U.S. — would begin trading on the NYSE Arca today.