Bitcoin’s bid as an inflation hedge is facing a major challenge as Russia’s invasion of Ukraine tanked the crypto markets while rival gold solidified its safe haven position.

Even before this week, Bitcoin’s volatility left many asking whether it can be considered a reliable store of value. It hit an all-time high of nearly US$69,000 in November 2021, in an upswing that began a year earlier, before seeing its value halve by January 2022. It now trades at US$38,693, as of press time.

Julian Liniger, CEO of Switzerland-based Bitcoin investing app Relai, said Bitcoin remained in the camp of speculative assets.

“Bitcoin is undeniably viewed and treated as a high-risk alternative asset by many traders and investors, which is why the volatility is still high and the short-term hedge against inflation does not hold yet,” he said.

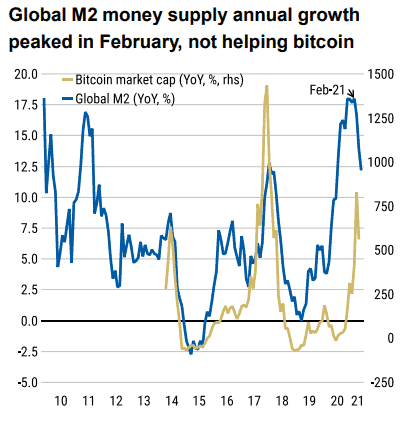

Some believe Bitcoin’s price rise in 2020 may have been buoyed by unusual market conditions at the onset of the Covid-19 pandemic. One explanation points to the unprecedented liquidity created by central banks following the onset of the pandemic, including a move by the US Federal Reserve to lower its benchmark interest rate to zero in March 2020.

This helped push up the share prices of technology companies and other risk assets, but it also ignited a sharp rise in the consumer price index (CPI).

Initially viewed as “transitory” by Fed officials, the CPI ran hotter than expected, hitting 7% in the second half of 2021, the highest since 1982. Because of that, market watchers began to anticipate that the Fed and other central banks would begin to hike interest rates to curb liquidity.

“Bitcoin did not correct because of the high inflation numbers but rather due to the fear of the Fed’s [Federal Reserve] announced tightening,” said Adrian Fritz, a research associate at crypto investment firm 21Shares.

Bitcoin’s price decline since November has been in line with other risky assets, suggesting it may not have been the safe haven that some believed it was, according to Fritz.

Bitcoin can be seen as trading just like some of the big techs listed on the US index for high growth companies. According to figures by Bloomberg, a 40-day coefficient for Bitcoin and the Nasdaq benchmark technology index showed a correlation of 0.66, a historical high. In recent days this correlation has started to decline, according to Fritz.

But data seen since the beginning of the year shows that Bitcoin continues to trade alongside risk assets that come under pressure during times of market distress. Further volatility can be expected if risk assets remain under pressure, according to analysts.

Morgan Stanley has urged investors to be cautious, noting in a report in June last year that Bitcoin and other cryptocurrencies trade as “speculative assets and not as currencies”.

Things could improve if Bitcoin gains wider adoption. Some believe Bitcoin will gradually trade more like a store of value owing to its limited supply. Bitcoin can be viewed as even scarcer than gold as its upper supply limit is fixed at 21 million, whereas gold is continually being physically mined, with the result that its total above ground supply gradually increases each year.

“Bitcoin’s fundamental value proposition is to be the ultimate risk-off asset one day, a safer haven for value storage than even gold,” said crypto commentator Robert Breedlove, founder and CEO of Parallax Digital.

Among other positives, Bitcoin is at almost no risk of being dislodged by rival cryptocurrencies, such as Dogecoin, that share the same hashing algorithm, according to Fidelity Digital Asset Management.

Whereas first-movers in technology are usually supplanted by superior concepts that follow, Fidelity argues that Bitcoin is “unique” because it functions as a form of money and not just a payment technology.

“Bitcoin… should be considered an entry point for traditional allocators looking to gain exposure to digital assets,” Fidelity said in its January report “Bitcoin First”.

So where does all this leave investors?

So far, Bitcoin hasn’t proven itself to be a good hedge against inflation, although it may eventually emerge as a reliable store of value over time.

For now, investors are better off looking at Bitcoin as a way to protect against fiat money devaluation, or global money supply growth.

In other words, to discern the future price direction, watch what central banks are doing and whether their policy positions are oriented toward tightening or loosening.