Under increasing regulatory heat around the world, Binance — the world’s largest cryptocurrency exchange — announced that it would tighten its know-your-customer (KYC) requirements and help users with tax compliance. Its CEO and founder yesterday also repeated his revelation last week that he was seeking to replace himself with a different chief executive with a stronger regulatory background.

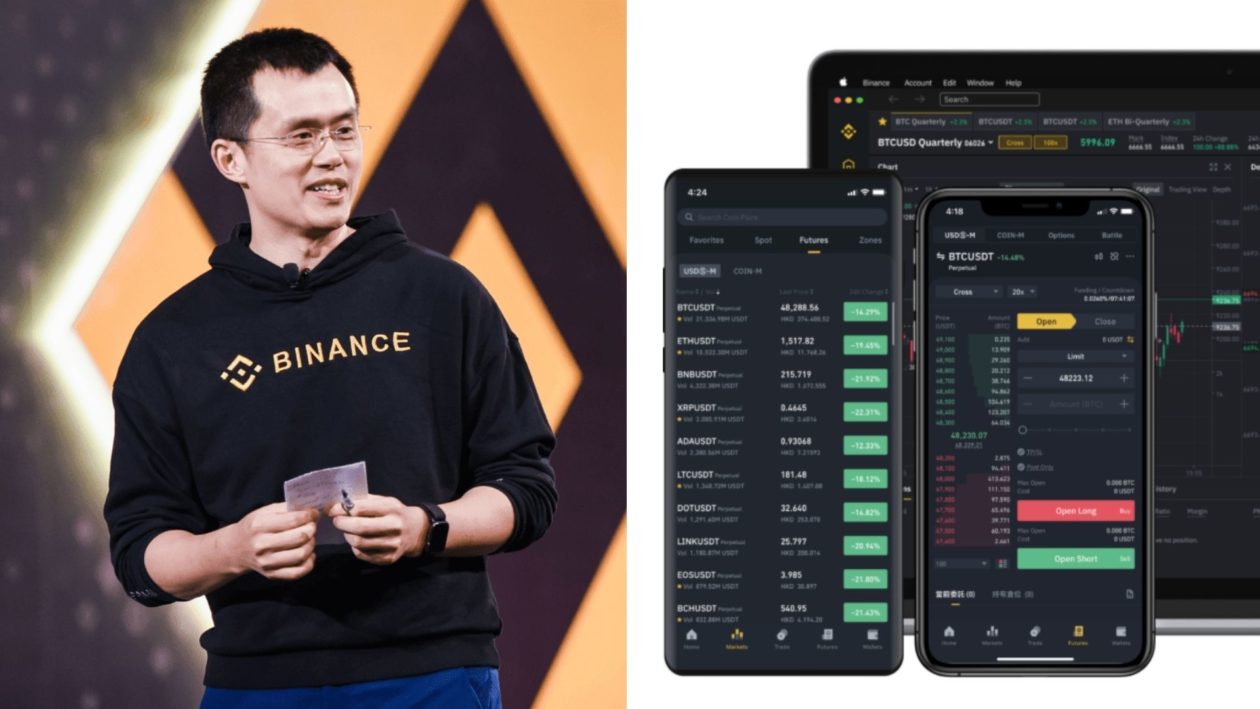

“We’re enhancing our KYC efforts to further our leadership in this area,” said Binance CEO Changpeng (CZ) Zhao in a tweet thread today, following a press conference held by the company to “share the active steps we’re taking to build upon our efforts to be more compliant with local regulations everywhere.”

According to a Binance blog post on July 27, daily withdrawal limits on Binance will be adjusted, from 2 Bitcoin to 0.06 Bitcoin (BTC) — approximately US$2,000 — for accounts that have completed only basic account verification, which involves customers providing their name, nationality, date of birth and address details to Binance.

The daily withdrawal limit can be increased to a maximum of 100 Bitcoin upon the completion of identity verification that includes providing Binance with ID documents, facial verification and proof of address.

The change is effective immediately for new account registrations on Binance and will be required for existing customers in phases from Aug. 4 to Aug. 23.

Binance — which has its founding roots in China and until recently operated in over 180 countries — has been under increasing scrutiny from regulators around the world over its stock tokens, derivatives trading services and KYC practices. Earlier this month, Hong Kong and Lithuania joined a growing list of jurisdictions — including the Cayman Islands, Germany, Italy, Japan, Poland, Thailand, the United Kingdom and the United States — that have issued warnings to Binance or launched investigations.

See related article: Binance chief ‘CZ’ seeks regulatory expert to lead as exchange looks to boost image

New tax reporting API tool

Perhaps to address concerns that some users may be dodging taxes, Binance yesterday also launched a new tax reporting application programming interface (API) tool.

The software allows two applications to talk to each other, to enable Binance customers to track their crypto transactions and to transfer their transaction history, including capital gains and loss records, more easily with third-party service providers for tax reporting. The tool also provides customers with a real-time overview of their local tax liabilities.

Leverage limits reduced on Binance Futures

Zhao and Binance’s statements Tuesday and today followed the company’s recent move to greatly reduce the high leverage — or the amount of potential debt — that crypto traders can take on its platform. On Monday, following an announcement by Sam Bankman-Fried, CEO of Hong Kong-based crypto derivatives exchange FTX, that FTX was removing high leverage and capping margin trading to 20x, Zhao tweeted: “@binance futures started limiting new users to max 20x leverage last Monday, Jul 19th, 7 days ago. (We didn’t want to make this a thingy).”

Leverage limits for new accounts opened within the past 30 days on the Binance Futures platform — where customers can go long or short with leverage — have been reduced to 20x from July 19, down from 125x. The limit will be extended to accounts opened within the past 60 days from July 27, Zhao said.

See related article: Binance and FTX slash leverage limit from 100x to 20x amid crypto regulations heat

Help wanted: a new CEO with background in compliance

Binance’s press conference and Zhao’s latest tweets reiterate Zhao’s previous remarks on July 23 at the SCB 10X DeFi virtual summit, when Forkast.News first reported Zhao saying that Binance was actively seeking someone with a strong compliance and regulatory experience to possibly replace him as CEO.

“Right now I’m actually looking for a senior person with a strong compliance background, with a strong regulatory background to lead the entire organization, maybe become the new Binance CEO,” Forkast.News reported Zhao as saying at the time.

“The message is very loud and clear that regulators want to regulate the space heavily now. So I think from our perspective for Binance, we really have to make a big pivot from a technology startup into a financial services company,” said Zhao in the fireside chat session with Mukaya Panich, chief venture and investment officer at SCB 10X, the venture arm of Siam Commercial Bank, Thailand’s oldest lender.

See related article: Binance CEO says ‘never easy’ running a crypto exchange as ‘new chapter awaits’

In a tweet today, Zhao said that while there are no plans to replace him immediately as CEO, “I/we would very much like to hire a strong compliance background CEO to show our commitment to compliance as this is the top priority of the organization.”

“CEO contingency planning starts in day 0, same as any other role… We are always hiring for CEOs,” Zhao added, in his tweet. “I don’t need to be CEO, and I am not leaving. I will always find ways to contribute to the community behind the logo tattooed to my forearm.”

“Binance is ready to assist regulators from around the world and together find the optimal way to set a fair playing field – consumer protection is important to all of us, Zhao tweeted. “We want to create a sustainable ecosystem around blockchain technology.”

See related article: Crypto exchange Binance in regulators’ crosshairs as scrutiny mounts