Changpeng “CZ” Zhao, the CEO of Binance — the world’s largest cryptocurrency exchange by trading volume — said today that businesses in the crypto industry needed to pivot from being technology startups to financial services companies, given heightened regulatory interest in, and scrutiny of, the crypto industry in recent months.

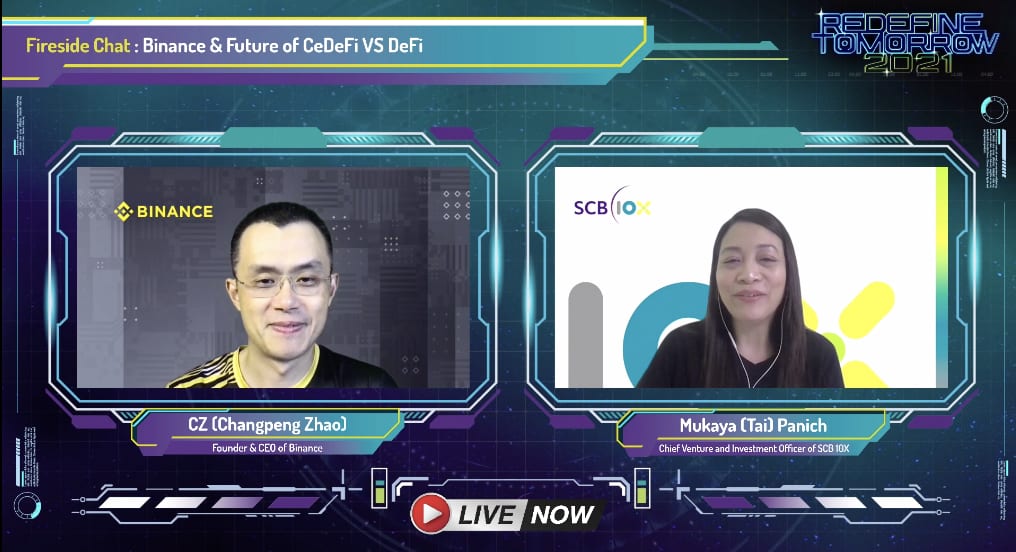

“The message is very loud and clear that regulators want to regulate the space heavily now. So I think from our perspective for Binance, we really have to make a big pivot from a technology startup into a financial services company,” said Zhao in a fireside chat session with Mukaya Panich, chief venture and investment officer at SCB 10X, the venture arm of Siam Commercial Bank, Thailand’s biggest and oldest lender, at the REDeFiNE TOMORROW 2021: Global DeFi Virtual Summit.

“For the entire industry, we need to make a pivot,” Zhao said. “Right now, crypto is very much understood as a financial asset type, and we’ve just got to treat it as such, and we’ve got to run the company as such.”

Zhao added that he was looking for a senior person with a strong regulatory background to lead Binance.

“Right now I’m actually looking for a senior person with a strong compliance background, with a strong regulatory background to lead the entire organization, maybe become the new Binance CEO,” he said.

“I’m a tech entrepreneur, I’ve led the company for four years and it’s good, and we’ve got to go through this pivot,” Zhao said. “I don’t think I’m the best person to lead that effort. I think having somebody with a very strong regulatory background is actually better.”

Binance has been under increasing scrutiny from regulators around the world over its stock tokens, derivatives trading services and know-your-customer practices. Earlier this month, Hong Kong and Lithuania joined a growing list of jurisdictions that have issued warnings or launched investigations of Binance, including the Cayman Islands, Germany, Italy, Japan, Poland, Thailand, the United Kingdom and the United States.

See related article: Binance CEO says ‘never easy’ running a crypto exchange as ‘new chapter awaits’

Pointing out that Binance had “not done a great job communicating with the regulators,” Zhao said the exchange was significantly increasing the size of its compliance team and hiring many people with compliance backgrounds, including former regulators, to improve communications with authorities.

“This way they join our organization, they know what’s going on here, and they can use the same language to speak to their ex-colleagues,” Zhao said. “Then the communication will get better.”

In recent months, Binance has announced high profile appointments, including former FATF Executive Secretary Rick McDonell, former Head of the Canadian delegation to the FATF, Josée Nadeau, and Max Baucus, a former U.S. senator for Montana and a former ambassador to China, to provide guidance on the company’s global compliance and regulatory strategies.

Zhao also spoke on the need to localize Binance’s operations. He said every country had slightly different rules, so a one-size-fits-all approach would not suffice, and that the company needed to segregate its product service offerings on the basis of location much more specifically.

On the crypto landscape around the world, Zhao said: “China was really hot in terms of both trading and mining and over the last four, five years, [but] they’ve pushed out all of them”, and that the United States was very strong when it came to technological innovation, with many DeFi projects emerging.

Zhao said he saw huge potential for crypto growth in Southeast Asia, which had been fairly friendly towards crypto in general. Africa, he said, was interesting because there was little existing financial infrastructure.

“Every region is a little bit different, and as a global business we need to be very cognizant of the fact that every region is different,” Zhao said. “We’ve got to have different strategies for different places.”

See related article: Binance suspends SEPA euro deposits as CZ calls compliance a ‘journey’

Responding to Panich’s question on whether a Binance IPO was on the cards, Zhao said there were no immediate plans for one. “We are self-sufficient, we are growing very healthily, so IPO… maybe later.”

He said that right now, it was looking at how to structure itself so it would be easy to be compliant with regulation, adding that most regulators were used to companies conforming to certain corporate structures, such as having a headquarters and being a legal entity.

One of the difficulties Binance faced was the perception that it was “dodgy” because it did not have a headquarters, Zhao said. “We are a global business, we’re virtual, we are online all the time. For the exchange, we are setting up those structures so that it is easy for the regulators to understand.

“Once those structures are in place, it may make it easier for an IPO to happen. So that’s not out of the question,” Zhao said. “But I think right now it’s still early stages.”

See related article: Why Thailand’s oldest bank is investing US$110 million in DeFi