Hong Kong’s Securities and Futures Commission (SFC) has approved the jursdiction’s first ever digital asset manager to launch a crypto fund, allowing institutional investors to add bitcoin to their portfolios.

Blockchain-oriented Arrano Capital, part of Hong Kong-based Venture Smart Asia Limited, is now able to legally manage a bitcoin-tracking fund, which has the aim of raising $100 million in total assets in its first year of operation.

“As a designated approved virtual asset manager, we’re able to have portfolios that invest up to 100 percent in virtual assets,” said Avaneesh Acquilla, CIO of Arrano Capital, in an interview with Forkast.News Editor-in-Chief Angie Lau.

Highlights

- “As a designated approved virtual asset manager, we’re able to have portfolios that invest up to 100 percent in virtual assets.”

- “It’s an exciting time whereby we’re going to see investment products for professional investors to access the space. And that’s going to range from passive—like the bitcoin fund that we’re going to launch—all the way to active, more like hedge fund type products.”

- “Our target was to have a comparable fund to that in Asia that creates daily liquidity and gives Asian investors access under a Hong Kong regulatory umbrella.”

- “There would be some tax gains for investors in Hong Kong investing in this asset class. But the question we’re trying to answer here is, how can we provide the easiest access?”

- “I think we’re seeing the market very quickly shift from being a retail sort of early adopter market to being one that’s driven by large flows from institutions.”

- “We could do a product that covers a basket of different cryptocurrencies. We could even look into things like security tokens and security lending where we can get a yield of stablecoins or other tokens. So, it’s really limitless.”

Listen to the Podcast

The fund is not available to everyone, and it was granted approval to cater only to institutional investors. But the news potentially paves the way for more asset managers to file for SFC approval under Hong Kong’s stringent rules to be designated as “authorized funds” to market to the public.

Hong Kong’s approval comes on the heels of Singapore-based digital securities investment marketplace Stack launching Asia’s first bitcoin index fund in January, showing a growing appetite for digital assets like bitcoin among institutional investors in Asia. Stack also has high ambitions, aiming to accrue over $2 billion in assets under their management by next year.

“Demand [for bitcoin] is definitely there. Is it a green light for some of these investment companies that have been sitting on the sidelines? We think that time is certainly approaching,” Stack COO Matthew Dibb told Forkast.News in an earlier interview.

See related article: Why invest in Bitcoin when global markets are still a hot Covid mess?

SFC’s green light to Arrano comes as the global economy remains in turmoil from stay-at-home orders that have shut down countries around the world. The S&P 500 Index has reflected investors’ overall unease with Covid-19’s economic effects, suffering its worst-ever first quarter performance of falling by 20%.

The fund’s launch is scheduled for mid-May, but the market volatility amidst the ongoing pandemic has not dampened Arrano’s ambitions.

“There are uncertainties about the economic impact of the coronavirus on the fundraising,” Acquilla said. “But I think taking everything together and looking at the size of the market, looking at bitcoin as an increasingly accepted instrument, asset and network — all of the above — I think [aiming for $100 million is] reasonable.”

A second fund approved for Venture Smart Asia will be an actively managed fund dealing with a basket of digital assets, which is scheduled for launch later this year, according to Arrano.

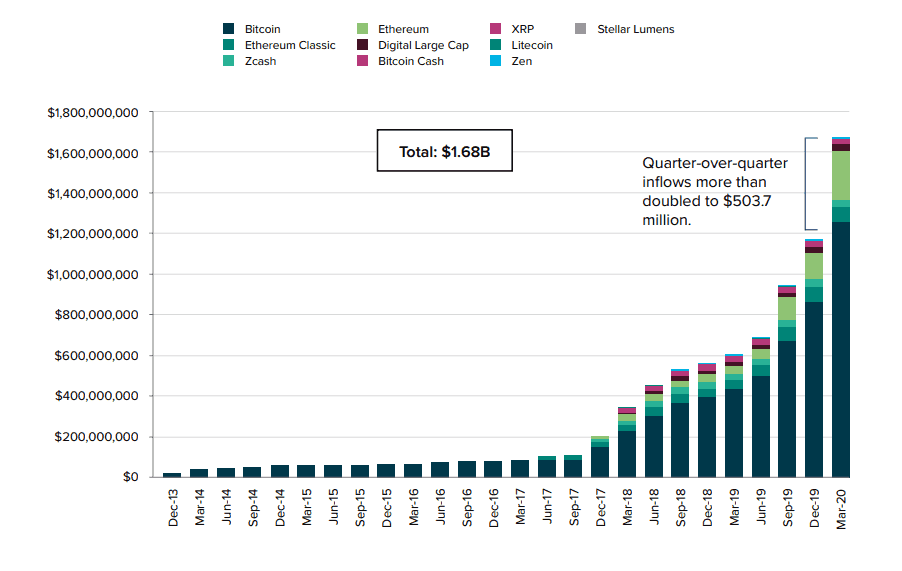

The adoption of bitcoin as an institutional investment asset may be another sign that cryptocurrencies are becoming mainstream. New York-based digital currency asset manager Grayscale Investments, for example, recently reported over $1 billion dollars invested into their crypto funds in the past year.

“88% of inflows this quarter came from institutional investors, the overwhelming majority of which were hedge funds,” according to the report, highlighting increasing interest in the digital asset class.

In 2018, multinational investment bank Morgan Stanley reported that bitcoin, cryptocurrencies, and altcoins have become a “new institutional investment class,” signalling a shift from traditional assets like gold.

See related article: Opinion | Why the Security Token Industry Hasn’t Taken Off

The coronavirus crisis has boosted demand for stored value assets such as gold. But while bitcoin is sometimes described as digital gold, experts say cryptocurrencies holds several advantages over precious metals, including being more divisible and portable.

“The one asset that has done well, on the back of the current economic environment has been gold,” Acquilla said. “So I do believe that is a positive indicator for bitcoin… last quarter was a record quarter for institutional inflows into bitcoin.”

“We decided to launch this fund to address market demand from professional investors who are increasingly focused on bitcoin as an alternative store of value,” Acquilla added, in a statement. “Going forward, we see enormous potential for further passive and active products.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the emerging technology that shapes our world. It’s what we cover right here on Forkast.News. I’m Editor-in-Chief Angie Lau. On this episode, a regulatory first for professional investors who just want to buy some bitcoin.

This week we saw the SFC — that’s Securities and Futures Commission of Hong Kong — approving a digital asset manager who’s launching its first crypto fund in Hong Kong for professional investors. It’s the first and it’s a pretty big deal as institutional and professional investors can now add bitcoin to portfolios.

More importantly, providing the bridge to liquidity that bitcoin and cryptocurrency markets had always dreamed of. CIO of Arrano capital, the blockchain arm of Venture Smart, Avaneesh Acquilla spearheaded the two-year journey to SFC regulatory approval, and he joins us right now to tell us all about it. Welcome, Avaneesh.

Avaneesh Acquilla: Thanks, Angie. Thanks for having me along.

Lau: All right. Well, two years in the making, and what do you have to tell us?

Acquilla: Yeah, it’s been a long journey, and we’re glad to finally get to the achievement of being the first approved virtual asset manager in Hong Kong. I’m really excited to launch the first fund.

Lau: Ok, so what does that mean exactly? To have had SFC approval to become a digital asset manager? There’s some designations there that already exist, but this one is a little bit more specific.

Acquilla: Exactly, there’s a licensing condition. So an asset manager that we would all be familiar with is a type 9 manager. Those type 9 managers would be able to invest up to 10% of their assets in virtual assets. As a designated approved virtual asset manager, we’re able to have portfolios that invest up to 100% in those virtual assets. And what it means is we have a type 9 license like everybody else, but we also meet the SFC’s licensing condition, which is set out in a document called the Proforma Terms and Conditions for Virtual Asset Managers.

So that’s an additional licensing condition that we have to meet. And those conditions are quite stringent. So we’re happy to get over that hurdle and prove to the SFC that we’re capable of running managed portfolios in this business.

Lau: I remember Ashley Alder, who chairs the SFC, making the announcement in Hong Kong about two years ago and really trying to figure out how to deal with cryptocurrencies and specifically exchanges. And certainly this industry, trying to create a sandbox in and trying to move forward with the regulatory compliance, which was at times very, very strict.

For the past couple of years, since he made that announcement, we’ve been waiting to see what kind of approvals that are actually going to be meted out by the SFC. This is really the first to be as comprehensive and really strict compliance that polices essentially your role. But now that you have that regulatory compliance for your role, what can Hong Kong expect? What can professional investors in the region expect and be able to tap into?

Acquilla: Yeah, so we have the regulation in place. And like you say, there were a couple of circulars. There was one in November of 2018 and there was a more detailed version, which is the document that I referred to, from October 2019. So we have all of the regulatory pieces in place.

We have the framework in place that allows managers to manage portfolios in the sector. And so I think it’s an exciting time whereby we’re going to see investment products for professional investors to access the space. And that’s going to range from passive—like the bitcoin fund that we’re going to launch—all the way to active, more like hedge fund type products.

Lau: So how does your fund, this first fund, differ from the other listed BTC funds that we’re seeing in the market right now?

Acquilla: There’s a few different types of funds. The biggest one is a fund in the U.S., which is two billion dollars at last check. And that works in quite a similar way to the way that our fund would work, obviously there’s slightly different nuances in terms of custodians, subscription and redemption type arrangements. But that’s probably the most comparable one to us.

Our target was to have a comparable fund to that in Asia that creates daily liquidity and gives Asian investors access under a Hong Kong regulatory umbrella. They follow the U.S. regulatory environment. There’s also a couple of exchange traded type products. There was one in Canada that was recently announced, but the problem with some of those types of products is that they’re listed on major markets like with Hong Kong, for example. And there’s certain issues with whether they trade at a premium, whether you can actually trade bitcoin at the correct price. Sometimes it will trade at a premium and sometimes the liquidity is a little bit limited.

Lau: And so as a bitcoin tracker, the idea then is to also take advantage of the very welcoming and friendly tax conditions for capital gains that are very specific to Hong Kong?

Acquilla: Yeah, there would be some tax gains for investors in Hong Kong investing in this asset class. I think Hong Kong investors get tax advantages in most asset classes. But the question we’re trying to answer here is how can we provide the easiest access? So that’s something that’s easy to access, that’s also familiar. So investors are very familiar with the traditional Cayman fund structure. And so we follow that type of structure with a fund administrator that they’d be familiar with.

The second point would be security. And so we want to follow the most stringent regulations, hence being in Hong Kong and also have the service providers like custodian and legal services that provide the most secure processes for investors to feel at ease with.

And then finally, liquidity. We wanted to offer daily subscription redemptions. And so we don’t want to have any lockups like some of the other funds that have lockups. We want to provide a fund which doesn’t have those types of restrictions on investors. So if they want to invest and the price moves and they want to redeem that, they’re able to do that.

Lau: Another interesting aspect is from an industry perspective, this really kind of opens the door to a lot of funds for investors that are bound by their own fiduciary responsibilities or their own protocols that really restrict them or prevent them from investing in anything but highly compliant, regulated funds. And so being able to tap that for liquidity, do you think that that potentially could shift the market?

Acquilla: Yeah, I think it will shift the market. And I think we’re seeing that institutional demand is going up. And like you rightly point out, institutions want to deal with other institutions. That’s the safety net that people feel more comfortable with. I think what’s interesting is the bitcoin fund I discussed in the U.S., they are taking in, according to their numbers, they’re taking in around 80% to 90% from institutions in terms of inflows. So I think we’re seeing the market very quickly shift from being a retail sort of early adopter market to being one that’s driven by large flows from institutions.

Lau: Well, two years ago when this all started, certainly we were talking about a crypto winter, we were talking about a lot of volatility in the market. And now that you got what you wanted and now that you are the first SFC approved digital asset manager, it happens in the most inopportune moment. Global shutdowns, pandemic, market volatility, market destruction in some cases, there’s massive turbulence. How are you assessing the fact that you’re launching a fund right now?

Acquilla: Yes, you’re right. It’s not really the best opportunity or the best moment to be fundraising on a new fund at the moment. There’s been a huge loss of value from the correction in equities and bonds and commodities. But I do think there’s a huge opportunity here because of the current economic climate. I think the biggest thing is when we’re looking at the interest rate environment globally, seeing huge reduction in interest rates across the board, and we’re seeing more and more government debt, which is negative yielding.

And so there has been a boost in the demand for stored value assets. We’re seeing a lot of demand for gold, bitcoin is being described as digital gold. So the one asset that has done well, on the back of the current economic environment has been gold. And so I do believe that is a positive indicator for bitcoin, referencing the inflows in the space, like those institutional inflows in the U.S., last quarter was a record quarter for institutional inflows into bitcoin.

So we’re seeing actually a lot of demand as a result of the economic backdrop. And I would say in terms of opportune timing, I think we’re launching at a very important time for bitcoin because next month we’ve got mining rewards halving. That’s an important event. Historically, that event has generally been followed by an increase in the price. You’re effectively increasing the scarcity of bitcoin beyond next month, starting next month.

Lau: There’s no doubt that — it’s almost an Asian cliche — that within chaos comes opportunity. And so I’m curious about the fact that there’s a lot of private wealth in Asia and Hong Kong and across the region compared to the West. What’s the appetite amongst professional investors when it comes to cryptocurrencies in Asia?

Acquilla: I think there’s two things we can talk about there. One is digital assets, broadly speaking, and bitcoin specifically are uncorrelated to traditional finance assets, and I think there’s some argument to say that those traditional finance assets have become more correlated as the liquidity environment moves at the macro level with central banks printing money and engaging in quantitative easing, that tends to shift asset classes in the same direction.

So bonds will go up at the same time as equities, and commodities will follow a central bank’s easing monetary policy. We have an asset class here which is uncorrelated. And so I think that is another benefit to not just Asian investors, but any investors would want to include uncorrelated assets into their portfolios. But the second thing is the risk, which you rightly point out, this is not an asset class for the fainthearted. There is this high volatility, bitcoin is on average about five times more volatile than the S&P, for example.

I do think Asian investors are suited in that sense because we can observe that Asian investors tend to be a little bit more comfortable with higher volatility and we can see that in certain investment products that have been popular. Certainly the stock markets in Asia are more volatile than in Europe and the U.S. So I think there’s certainly an appetite for those two reasons.

Lau: So, bitcoin today. What’s next? What’s tomorrow?

Acquilla: It’s such an exciting field to be working in. It’s constantly evolving. We have the ability to do passive and active products. And so the funds that we were approved to launch, first of all, the bitcoin tracking fund, which is a simple product, I think is very timely and also an actively managed portfolio, which we’re working on. So that’s going to be more like a hedge fund product. So that’s a passive and active [product].

And even in the passive space, we could do a product that covers a basket of different cryptocurrencies. We could even look into things like security tokens and security lending where we can get a yield of stablecoins or other tokens. So it’s really limitless. And I think we have a very pragmatic approach where we’d like to really gauge whether the investor demand is at the moment.

We’ve just got our sights set on the first two funds. And then I think we’ll take it from there. But ultimately, the way we want to proceed is with caution. We want to proceed gradually one step at a time. So our focus at the moment is on the bitcoin fund and then we’ll take the next step after that.

Lau: Well, the target date to go live is mid-May. And I understand you’re already accepting subscriptions and it’s quite ambitious. You hope to attract up to 100 million dollars of client assets over the next 12 months. That’s fairly ambitious considering the market conditions and the fact that millions of us are still in isolation and quarantine. Is that a little too optimistic?

Acquilla: I think the numbers are realistic on the basis of in-flows that we can see in other regions. There’s not a lot of regulated products. Not a lot of licensed managers are able to have offerings in this space. If we look at those inflows in the U.S., around 400 million dollars of inflows just last quarter from institutions in just one bitcoin fund.

I do think there is an appetite for this in Asia. So based on those numbers, 100 million wouldn’t be a crazy number, that’s for sure. But there are uncertainties about the economic impact of the coronavirus that’s going to impact the fundraising. But I think taking everything together and looking at the size of the market, looking at bitcoin as an increasingly accepted instrument, asset and network — all of the above — I think it’s a reasonable number.

Lau: Well, and if it represents what’s truly happening right now, which is the fuel behind a technology that is advancing digitization, that’s something that people can certainly wrap their heads around. This is very interesting. We’re going to be paying close attention here to what access to professional investors in this new liquidity pool will certainly mean to the overall market. Thank you so much for joining us.

Acquilla: Thanks, Angie.

Lau: All right, and thank you, everyone for joining us as well on this latest episode of Word on the Block. I’m Forkast.News Editor-in-Chief Angie Lau. Until the next time.