London-based Bitcoin miner Argo Blockchain PLC’s stock price spiked by more than 100% during U.K. trading hours on Wednesday and closed up 73.33% on the London Stock Exchange after the company announced it would sell its Texas-based Helios facility to Galaxy Digital Holdings Ltd, a financial services and investment management firm led by billionaire investor Mike Novogratz.

See related article: Bitcoin hashrate drops nearly 40% as deadly U.S. storm unplugs miners

Fast facts

- The deal, worth US$65 million, does not include Argo’s cryptocurrency machines which the company will continue to operate at Helios, it said.

- About 24,000 of the mining machines will act as collateral on a US$35 million loan from Galaxy to Argo as part of the deal.

- The funds secured by the sale and loan will help Argo avoid bankruptcy and to pay down around US$85 million in debt and fees on its balance, the company said.

- The Bitcoin miner believes that the deal will reduce the company’s net debt by around US$41 million. While the sale boosted Argo’s stock on Wednesday, it is down by more than 90% in the past year.

- On Tuesday, Argo requested a suspension of trading on its Nasdaq-listed shares.

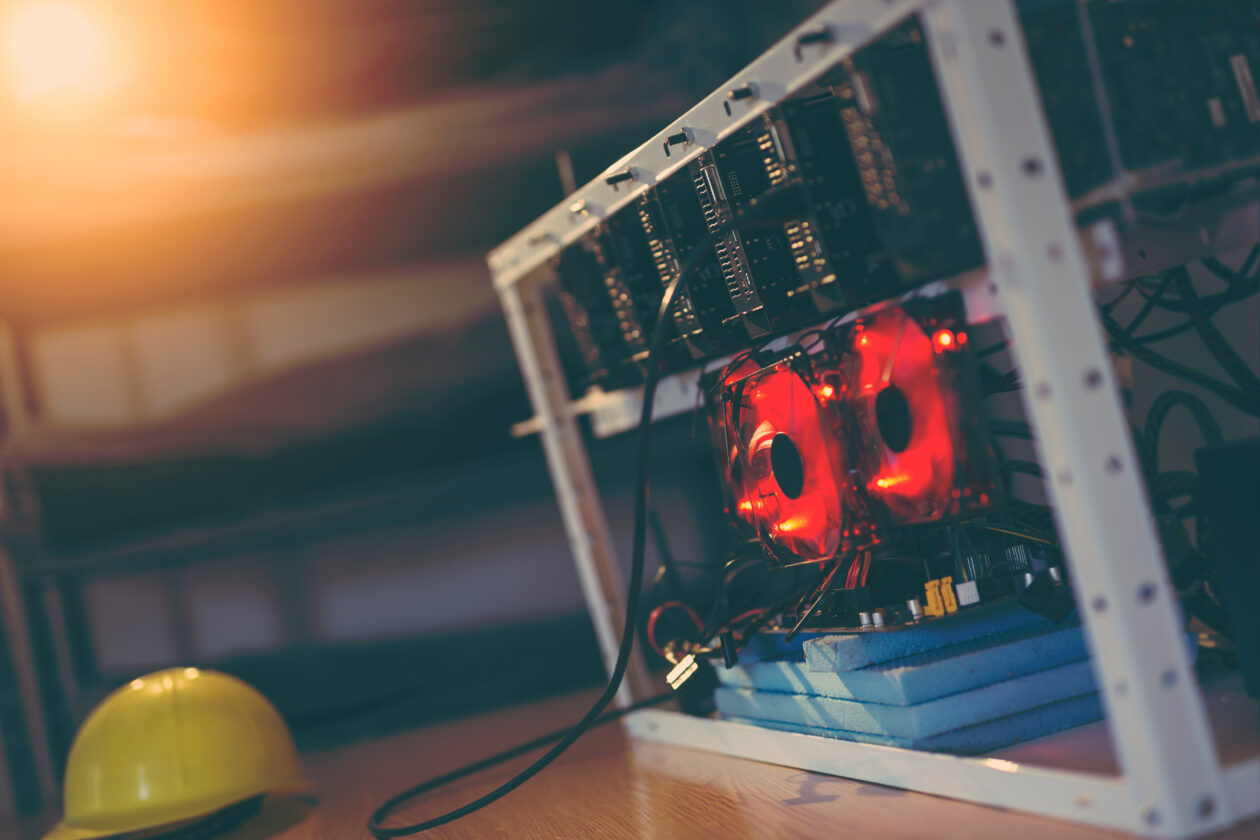

- The crypto mining industry has been hit hard this year amid rising energy costs and falling Bitcoin prices.

- Bitcoin mining hashrate, the level of computing power used for mining and processing transactions, dropped nearly 40% earlier this week due to deadly blizzard conditions in the U.S. that have forced miners to shut down their facilities.

- Last week British Columbia, Canada, suspended new electricity connections for crypto miners, and one of the largest publicly traded crypto mining firms, Core Scientific, filed for bankruptcy.

See related article: Bankrupt miner Core Scientific may sell facilities under development: report