XRP is a cryptocurrency that powers real-time gross settlements on the XRP Ledger (XRPL) blockchain. Developers David Schwartz, Arthur Britto and Mt. Gox founder Jed McCaleb started developing the distributed ledger in 2011 to improve cross-border payments.

The XRPL launched in June 2012 with XRP, the same year financial technology firm Ripple Labs was founded (initially called NewCoin, then OpenCoin, before rebranding to Ripple Labs) by veteran Silicon Valley entrepreneur Chris Larsen and the three developers.

After the company was founded, XRPL architects gifted 80 billion XRP tokens to Ripple for the company to start building on the network.

This Forkast explainer will explore:

- What is Ripple?

- The XRP Ledger’s native token — XRP

- What makes Ripple and XRP stand out?

- Criticisms of Ripple

- What does the future hold for Ripple and XRP?

What is Ripple?

San Francisco-based Ripple Labs is the operator of RippleNet, a payments and currency exchange network dedicated to removing the hurdles and lags in the existing financial system with blockchain-powered innovations.

RippleNet was designed to provide an alternative to the SWIFT network by offering faster and cheaper cross-border payments through the XRPL and XRP.

The company uses XRPL technology to enhance cross-border payments, liquidity and central bank digital currencies (CBDC).

The XRP Ledger’s native token — XRP

XRP is used as transaction fees in XRPL, cross-border transactions, international settlements and liquidity sourcing.

XRP has a maximum supply of 100 billion tokens, with almost half in circulation as of October 2022. The 100 billion XRP was pre-mined in January 2013, where the founders retained 20%, 77.8% was allocated to Ripple Labs and 0.2% was airdropped on different forums.

Ripple initially placed 55 billion XRP tokens in an escrow account that still had 45.7 billion as of October 2022.

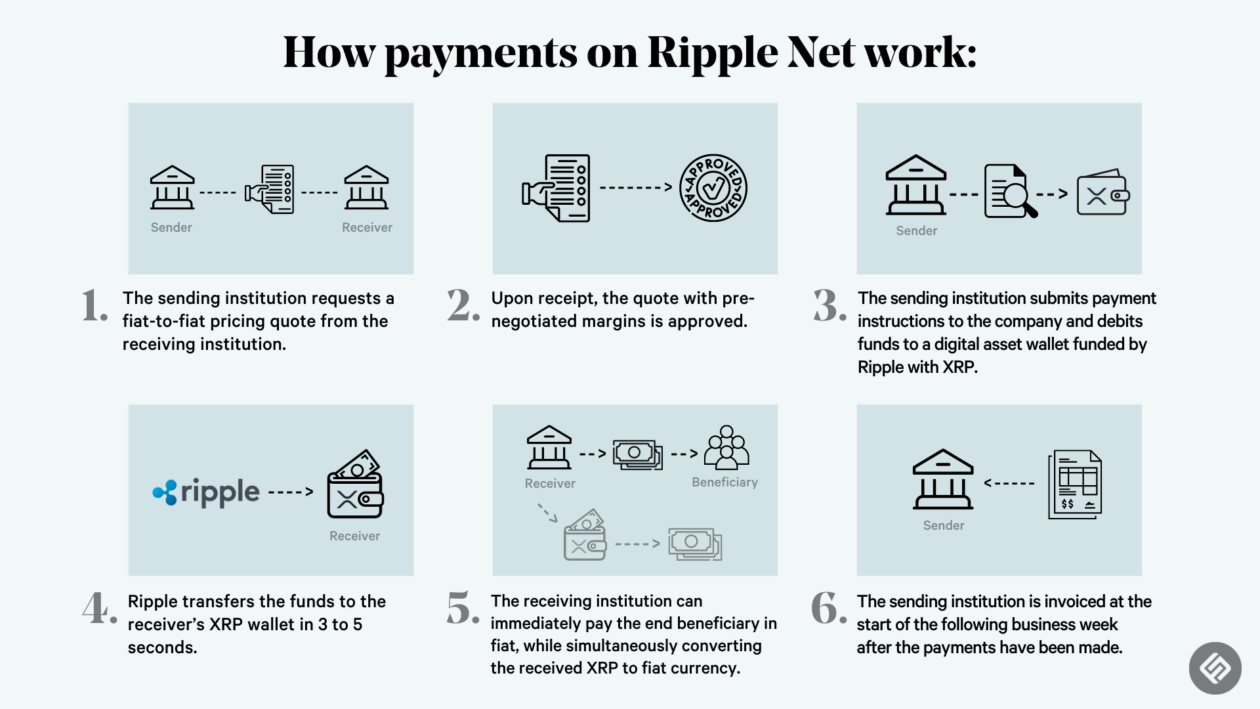

Financial institutions can use XRP to bridge two currencies to facilitate cheaper and faster cross-border transactions. XRPL’s decentralized exchange converts payments using the cheapest currency trade order available.

For these banks and institutions to use XRP’s payments technology, they often join RippleNet financial network that runs on XRPL.

According to the Ripple whitepaper, the network offers 3 to 5-second settlements and can handle around 1,500 transactions per second with an estimated US$0.0002 in transaction fees through its Unique Node Lists (UNL) consensus mechanism.

UNL is a list of validators trusted by a node operator. Each node operator chooses its own UNL, usually based on a default set provided by a trusted publisher. UNL helps nodes choose the most trusted validators.

What makes Ripple and XRP stand out?

Central banks can use Ripple’s CBDC Private Ledger based on XRPL to manage and issue CBDCs, without building an entire network from scratch. The U.S. Digital Dollar Project has recently announced it is working with Ripple to launch a pilot program to study a U.S. dollar-based CBDC.

Sustainability is one of the main focuses of Ripple Labs and XRPL. The blockchain employs a unique consensus mechanism with reduced energy consumption. For 60 million transactions, XRP consumes 474,000 kWh of electricity, while Bitcoin needs 57.09 billion kWh, the ledger’s carbon calculator claims. XRP emits 270 metric tons of CO2 for the same amount of transactions, while the Bitcoin network emits 27.96 million metric tons of CO2.

Criticisms of Ripple

While Ripple Labs argues that XRPL is a decentralized, public ledger, the sub-penny transaction fees and fast settlements come at the cost of validator centralization. RippleNet has 139 active validators, mostly run by financial institutions, a centralized tally when placed beside the likes of Ethereum’s near-half million.

While anyone can run a validator node on XRPL, each node configures its own UNL. New validators can’t verify transactions unless they’re part of another node’s list. Considering that validators on XRPL receive no financial incentives, the ledger is expected to maintain a centralized node structure.

In addition, the U.S. Securities and Exchange Commission (SEC) sued Ripple Labs in December 2020 for allegedly conducting a US$1.3 billion unregistered securities offering. The two are still battling it out in the on-going court case.

The 45% of total XRP in existence is in an escrow account controlled by Ripple Labs. Some critics fear the mass amount of tokens held by a single entity puts the cryptocurrency at risk of price manipulation.

In August, Ripple Labs unlocked a billion tokens from the escrow account, leading to XRP bleeding out 3.4% of its value in the next 24 hours.

What does the future hold for Ripple & XRP?

Ripple Labs’ future largely depends on the outcome of its ongoing legal battle against the SEC. But XRP isn’t the only cryptocurrency at risk of becoming a security in this landmark case. The outcome may have rippling effects on the entire cryptocurrency industry and how tokens are classified.

Despite the ongoing lawsuit, the community has been actively developing new features on XRPL. Some of the most promising developments include smart contracts, non-fungible tokens (NFTs), and sidechains.

In March 2022, Ripple Labs committed 1 billion XRP as an extension of XRPL Grants, aimed toward advancing the development of the XRP Ledger.

XRPL’s low-cost and fast cross-border settlements have been Ripple Labs’ primary selling point in onboarding financial institutions to RippleNet.