The crypto market took a plunge following its bullish run towards the end of 2021, and neither Bitcoin or Ethereum were spared from the downturn.

Bitcoin’s price is down about 21% year-to-date, and 44.5% lower than the all-time high it achieved in November 2021. Ether has also tapered off since the start of the year, falling about 30% year-to-date, and possibilities of further price declines are still looming.

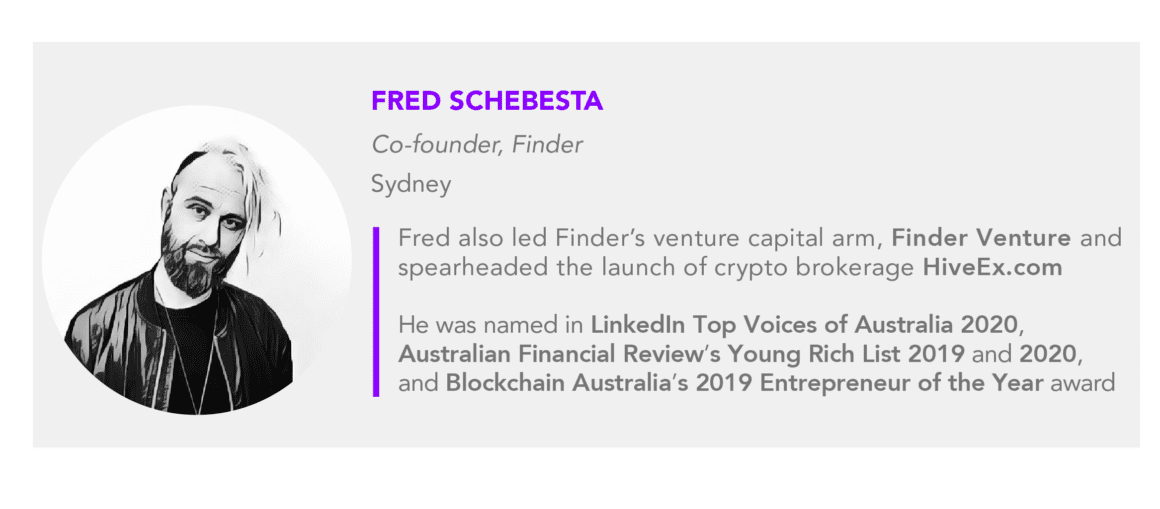

So how will Bitcoin and Ethereum fare for the remainder of 2022? Finder surveyed fintech, cryptocurrency and NFT specialists, including myself, to answer this very question.

Bitcoin vs Ethereum: 2022 returns

A panel of 33 experts that Finder surveyed last month predicts that Bitcoin, by Dec. 31, 2022, will be worth US$76,360. That’s about 10% higher than Bitcoin’s previous ATH and 99% increase from the coin’s price at the time of writing.

Panelist Ganesh Kompella, co-founder of Tykhe Block Ventures, predicts BTC will be worth US$80,000 by year-end.

“Bitcoin is in a multi-year process of higher highs and lower lows, with 2021 being a relatively quieter year in a backdrop of sideways accumulation. Lots of talk on whether Bitcoin is a ‘risk asset,’” Kompella told Finder. “It’s programmable money, and the substitution effect we may see over the next few years is not just gold to BTC, but also long-term bonds to BTC.”

While the predicted price increase for BTC by the end of 2022 sounds impressive, the figure dwarves in comparison to that of Ethereum’s.

A separate panel of 50 experts predicts that Ethereum will be worth US$6,500 by the end of the year. Not only is this 33% higher than ETH’s previously recorded ATH, but it is also a sizable 149% increase from its price at the time of writing. This suggests that ETH could garner larger returns than BTC by the end of the year.

Several panellists, including University of Brighton senior lecturer Paul Levy, attribute their bullish ETH price predictions to the Ethereum blockchain’s shift to a proof-of-stake model this year.

“Ethereum, if it stays on top of technical and innovation challenges, will continue potentially erratic growth with the potential to thrive in the medium to longer term,” Levy said. “It is an early innovation success story and that innovation potential needs to be matched by further innovation capability.”

In fact, 79% of the Ethereum panel think the shift will lead to an inevitable increase in ETH’s price. On the other hand, 11% think it’ll lead to a decrease, and the remaining 11% are either unsure or think there will be no impact.

However, it’s important to note that if Ethereum’s upgrades are successful, it’s reasonable to expect a lag between the success and a positive movement in price, as the market will want to test and explore in the short term before confidence can be re-captured.

Does this mean it’s time to buy?

Given these optimistic predictions, it’s not surprising that 61% of the experts say now is the time to buy Bitcoin, while 29% say it’s time to hold and the remaining 10% think that it’s time to sell.

CoinSmart CEO and co-founder Justin Hartzman is part of the 61% who say it’s time to buy, considering the U.S. Federal Reserve is likely to hike the interest rate – which he says will inevitably have a negative impact on the broader market, including crypto. However, he firmly believes that crypto prices will bounce right back up.

On the other hand, fewer panelists say it’s the time to buy ETH, despite forecasting a higher average increase than BTC. A little over half (52%) of the panel say it’s time to consider buying ETH, 29.5% say to hold onto what you have, and 18.5% think it’s time to sell ETH.

This may, in part, be because while ETH’s network certainly has an advantage in global market awareness and developer base, Ethereum is also against increasingly strong competition from other blockchain platforms that Bitcoin does not face by contrast.

Bitcoin is safeguarded due to its focus on delivering a highly trusted and secure network that captures people looking for a store of value asset, whereas Ethereum is seeking to offer the world a way to execute the computational processes and tasks to power smart contracts and open up decentralized business and collaboration.

Thomson Reuters technologist and futurist Joseph Raczynski builds on this point and believes it’s time to buy ETH, saying that “scalability and throughput are king, but doing this in a decentralized manner with security is critical — PoS on ETH in 2022 should get them there.”

If you’d like more details from Finder’s Cryptocurrency Predictions Reports, here are the summaries for Bitcoin and Ethereum.