Introduction

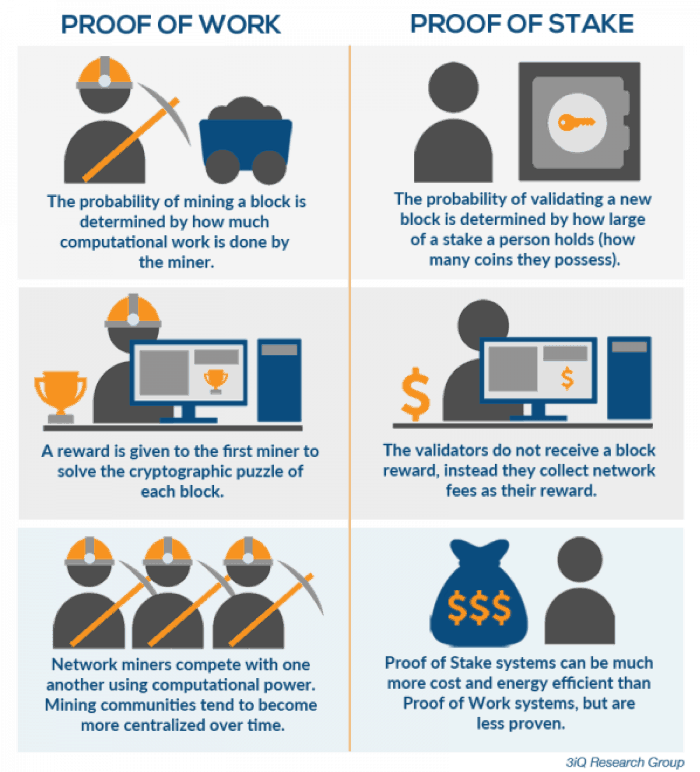

The blockchain revolution is happening so fast, that it too is being revolutionized. Until now, the de facto mechanism to reach consensus on distributed ledgers has been Proof of Work (PoW), in which computers compete to solve fictitious mathematical problems. However, this system wastes a lot of energy and computer power. But now a faster, simpler, and more energy-efficient method to run the blockchain has emerged called Proof of Stake (PoS).

The Problem

Both Bitcoin and Ethereum-based blockchain networks run on Proof-of-Work systems whereby miners solve ‘cryptographic puzzles’ and earn cryptocurrency rewards. However, the technology is not a viable long-term option because PoW is slow, costly, and vulnerable to attack, according to a report by the Bank for International Settlements.

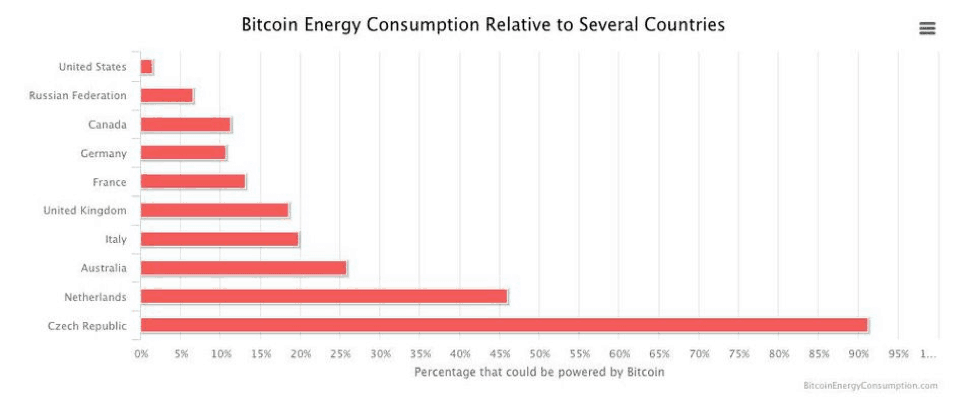

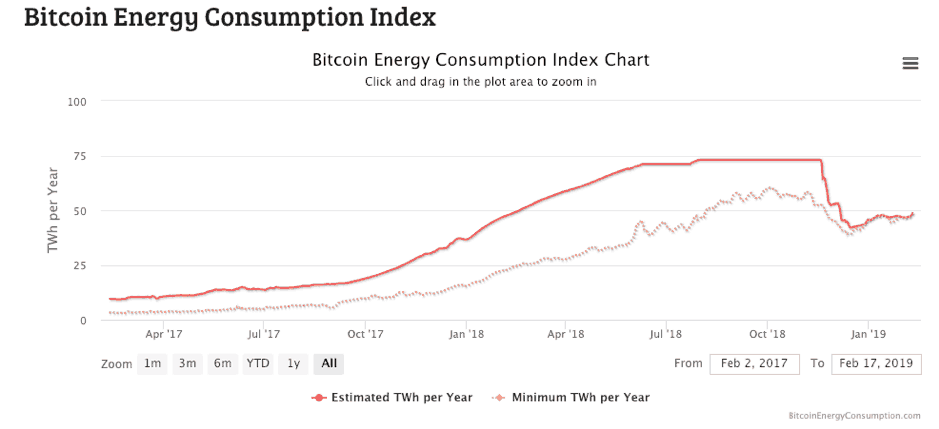

PoW demands a significant amount of computer power to satisfy a specific difficulty level. According to the Digiconomist, the annual estimated electricity consumption of the Bitcoin network is currently around 49.06 TWh.

In addition to high energy consumption, here are some other problems with Proof of Work:

- High cost of expensive mining rig hardware, ASIC processors, cooling equipment, etcetera, leading to a significant barrier of entry

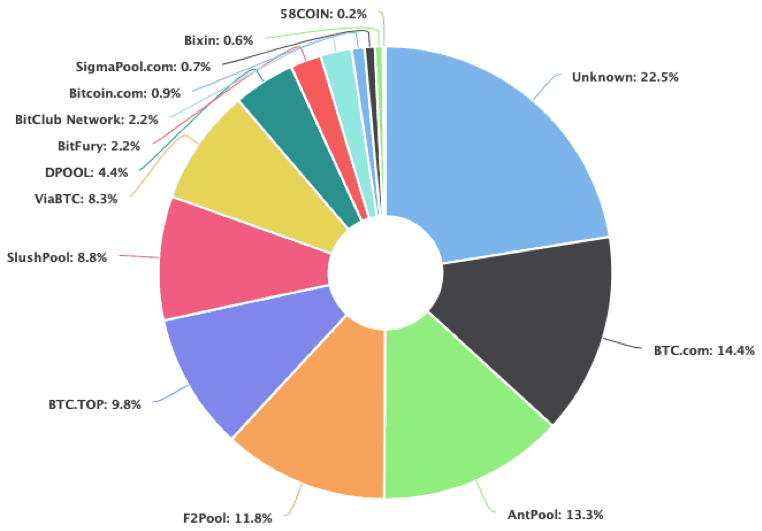

- Concentration of power: currently 5 large mining pools control almost 60 percent of the mining hashrate of the Bitcoin network. Below graph depicts the current Bitcoin Hashrate distribution:

Blockchain.com: Hashrate Distribution 2019.

Of these five mining pools, the top four are all located in China. In fact, China is home to more than 70 percent of the computing power that runs and secures the Bitcoin network. The country also controls more than 70 percent of the Bitcoin network’s collective hashrate problem-solving race. Such consolidation conflicts with Bitcoin founder Satoshi Nakamoto’s vision of a decentralized, trustless network.

As a result, Etherum co-founder Vitalik Buterin is working to move the cryptocurrency away from Proof of Work towards a Proof of Stake consensus mechanism. On December 10th, 2018, he tweeted:

What is Proof of Stake

In 2012, an anonymous developer under the pseudonym “Sunny King” co-wrote a paper that described PoS. Unlike PoW, which allows “miners” to “mine” blocks, PoS enables “validators” to “forge” new blocks of transactions only after they stake a certain number of tokens. Validators ultimately earn network fees instead of crypto rewards.

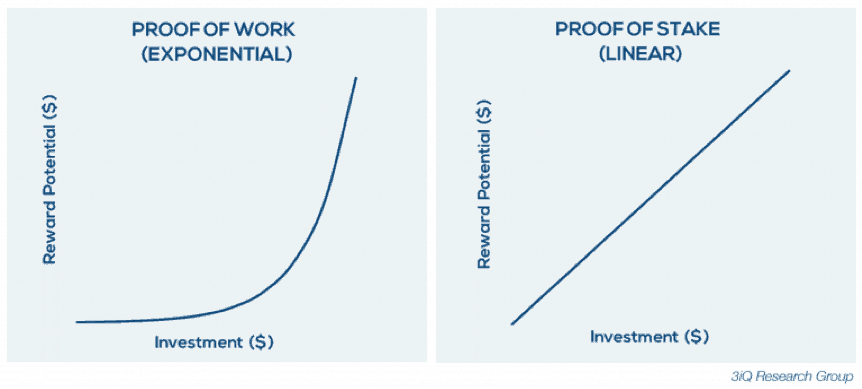

Such a system can provide a fairer reward structure by linking the validator’s share of the network to the size of his/her investment. In other words, you invest ten times as many tokens over a competitor, you are ten times more likely to be the validator for the next block. By contrast, in PoW systems, if you invest ten times more in your mining rig, you can gain actually gain more than 10 times the computational power because of economies of scale.

Every node can predict with reasonable accuracy the next validator.

Proof of Stake drawbacks/concerns:

Risk of oligarchy/centralization— The wealthy can obviously afford to stake a larger amount of tokens and thus gain more control of the network and earn more fees. However, thanks to the selection methods mentioned above, PoS system is less susceptible to centralization compared to a PoW blockchain where a few entities control the most of the mining power.

Risk of losing stake– In a PoW network, the theft of BTC miner’s coins will not affect the mining infrastructure. The miner continues to keep his “vote” in the network and tries to mine the next block.

However, in a PoS network, such a theft could cost a validator his stake in the network and he can no longer be eligible to mint the next block.

Moreover, a validator requires a “hot wallet” as they need to sign a message from a system connected to the Internet. Thus, this increases the risk of exposing funds to hackers. And finally, if ‘’slashing conditions” exist, a malicious actor that has compromised the validator (but is unable to withdraw funds) could still cause the validator to lose his staked funds.

1. Nothing at stake– The “Nothing at Stake” issue is described as an important flaw of the PoS mechanism on Ethereum’s Wiki page:

In the event of a fork, whether the fork is accidental or a malicious attempt to rewrite history and reverse a transaction, the optimal strategy for any miner is to mine on every chain, so that the miner gets their reward no matter which fork wins. Thus, assuming a large number of economically interested miners, an attacker may be able to send a transaction in exchange for some digital good (usually another cryptocurrency), receive the good, then start a fork of the blockchain from one block behind the transaction and send the money to themselves instead, and even with 1% of the total stake the attacker’s fork would win because everyone else is mining on both.

Simply put validators have nothing to lose. They could use the same stake to validate two or more competing chains, thereby increasing their rewards without adding more risk. When a chain forks into another chain, a validators’ stake also exists on the forked chain. A person can therefore can collect fees on both chains without incurring additional costs. With PoW, miners need to direct their efforts on a specific chain.

However, PoS developers have created some safeguards. For example, Ethereum’s planned Casper upgrade introduces a penalty mechanism called Slasher, which requires validators to commit a certain amount of Ether through a Casper smart contract. Should the validator try to double dip into different chains with the same stake, the contract would destroy the Ether the validator committed.

2. Long range attack– Under this scenario, a malicious actor can create a fork of the blockchain starting from the Genesis block and overtake the main chain. This is also called a ‘’history revision attack” or “alternative history attack.”

The attacker will need the private keys to one or more large stake wallets in the past, either through hacks or collaborating with several of the largest stake holders in the last chain.

In contrast to PoW, PoS does not require a large amount of computational power or significant energy to mint the next block. Therefore, an actor can create new blocks on the forked chain and catch up with the main chain with relative ease. As a result, validators will face a tough time determining the real chain because they are both equally long.

To mitigate this, most PoS blockchain solutions propose introducing a checkpoint, which dictates that people can dispute only a certain number of blocks prior to the last block. NXT blockchain, for example, will automatically reject any changes older than 720 blocks. Another way is to simply broadcast the hash of the correct legitimate blockchain on a daily basis.

Conclusion

Ethereum’s planned implementation of Casper will hopefully solve problems with PoW blockchains: huge energy consumption, mining centralization and high barriers to entry. However, PoS is young and unproven. Given the complexity and potential risk of unforeseen issues, Vitalik plans to implement PoS in stages: the first stage is Casper release 1, which will offer a hybrid of PoW and PoS in which the system will use PoS to verify every 100th block. After establishing stability, Vitalik intends to move towards a 100 percent PoS-based Ethereum network.