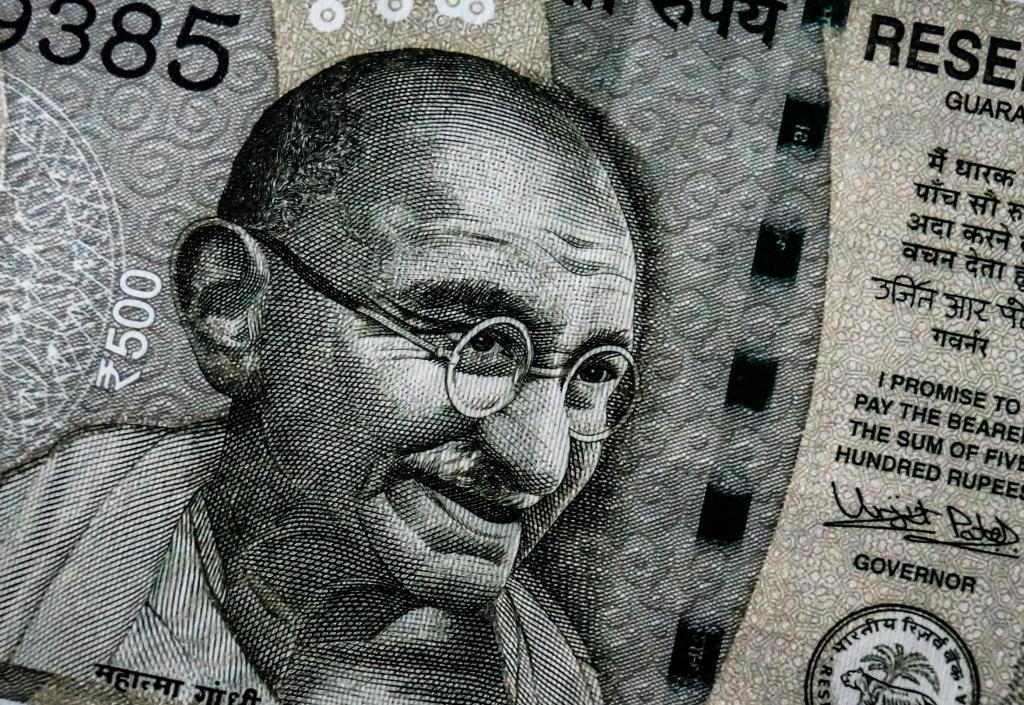

Blockchain in India has had an interesting, albeit slightly paradoxical journey. On the one hand, the technology has seen great support from the startup ecosystem as well as the Indian government. On the other hand, cryptocurrencies have faced huge regulatory hurdles in India. Though not banning cryptocurrency outright, the Reserve Bank of India (RBI) has issued a directive that essentially forbids regulated entities like banks from getting involved in crypto transactions. The RBI justified the restrictions, which forced some crypto exchanges out of business, as being necessary for protecting banks from the risk of trading virtual assets.

So what does the future hold for blockchain in India? Here are the top predictions and trends to watch for in 2020:

From experimentation to use cases

The last two to three years have been all about proofs of concept and pilots when it comes to blockchain projects in India. But in some sectors at least, things are moving toward large-scale implementation. According to the 2019 Nasscom Blockchain Report, startups are involved in at least 50% of blockchain projects in India, and many of these startups are now signing on big enterprise clients for large-scale implementation. Param Network, for instance, is an Indian startup that uses technology to bring down the cost of an invoice from $11 to $15 USD per invoice to around $6. As of now, the startup has signed on at least four top multinational corporations who are implementing their technology in real-use environments.

Upskilling to meet the blockchain skills gap

According to Indian Staffing Federation President Rituparna Chakraborty, blockchain technology is set to create 30,000 jobs in India this year. Given that there are currently only 6,500 qualified blockchain developers, a major skill gap exists. However, given that India produces more bachelor degree graduates in science and engineering than any other country in the world, this gap may decrease in the next few years. Helping fill the skills gap are homegrown startups such as Upgrad, an online learning platform offering blockchain classes and certification that produced over 4,000 blockchain learners in the last year.

Collaboration across multiple stakeholders

Across the world, big consortiums have come together to create a favorable ecosystem for blockchain technology. In India, too, there is a need for regulators, financial institutions, technology firms, and the government to work together to build a more collaborative ecosystem. It looks like 2020 will see a lot more on this front — in fact, 11 major banks in India have recently come together to create a blockchain-linked fund for small and medium enterprises in the country.

The government has also been playing an important role. According to Nasscom’s India Blockchain Report, there are as many as 40 blockchain initiatives in the public sector in India. While only 8% are in the production phase, some are likely to scale up this year.

Key movements in the cryptocurrency ecosystem

In April 2018, RBI, which functions as the country’s central bank, issued a directive prohibiting banks from receiving or transferring any money related to cryptocurrencies. In July 2019, a government-appointed committee proposed a blanket ban on cryptocurrencies — and their recommendations are in the form of a draft law which, if passed, could mean the end of cryptocurrencies in India. At the same time, there is a strong movement from cryptocurrency activists in the country petitioning the government for more positive crypto regulation. 2020 will be an important year on this front, and the cryptocurrency scene in India will be clarified one way or another.

See related article: India vs. the people: The battle over cryptocurrency ownership continues

“It’s an interesting time for cryptocurrencies in India. If Libra does see the light of day, we will witness the biggest bull market in Bitcoin history,” said Robin Singh, founder of crypto tax startup Koinly. “In fact, India is one of the key markets that Libra is targeting. But if regulation continues to head in this direction, India could well be on the sidelines, just watching the seismic shift take place.”

Blockchain funding comes into its own

When it comes to funding in blockchain startups, India remains far behind the global curve. While this has a lot to do with the ambiguity surrounding the crypto environment, India has only been able to attract 0.2% of global blockchain funding. But this, too, should see a shift in the coming year. The Delhi-based Draconis Capital Future Fund, for instance, will invest $100 million in the next year in blockchain and other emerging tech startups — which in itself will enable a massive shift in the funding ecosystem.

As one of the world’s biggest and youngest economies, India has a number of complex challenges across sectors — whether that’s agriculture, healthcare, financial services or real estate. Based on these trends, India’s blockchain sector might see some big shifts this year and beyond.