From Coinbase making a jaw-dropping $771 million profit last quarter to FTX bringing in the largest crypto fundraising round in history, raising $900 million, we now know that digital assets are far too big to ignore.

But cryptocurrencies are inherently complex. They require users to protect cryptographically coded digital assets via a range of methods, often which involve the questionable user experience of physically writing down a range of keywords to ensure their money stays safe.

They also come with great risk — centralized exchanges are often prone to hacking and the industry is often renowned for scams and attacks. Crypto is also volatile because it is so nascent, meaning newcomers often lack the confidence that they have the tools to manage risk.

The large majority of those who are taking advantage of digital assets at the moment are traders who have dedicated extensive time to understanding the underlying technology of blockchain that underpins these assets. By equipping themselves with the tools for building effective strategies, these traders are accessing a variety of new opportunities, from trading spot and futures to the more complex staking and yield-farming of assets.

It is unrealistic to expect newcomers to easily understand a new world of digital asset trade. Furthermore, the strategic tools that bring in the greatest profits are often limited to those who can afford these tools at an extra fee, or high net-worth individuals who can afford to hire brokers to organize these complexities for them. It is these players who are currently accessing the greatest financial yields.

We are also witnessing a high-entry barrier of access to new asset classes. Some territories and countries have begun banning cryptocurrencies and enforcing regulations on the asset class because of the high risk exposure to newcomers, seen across Hong Kong and for future derivatives in the U.K.

Sophisticated and high-tier investors have off-shore entities who can still access and participate in crypto whereas such access is not available to retail traders where crypto is banned. This goes against the core mission of the community, to decentralize access to finance so that anyone with internet access can seek greater opportunities for wealth generation outside of inflating traditional fiat currencies.

This next iteration of the cryptocurrency movement will mirror the introduction of other technologies, like color TVs, airplanes, automobiles and the internet. Even the internet had times where it was adopted, and then dropped off, before witnessing mass adoption.

Cryptocurrencies are simply following the same adoption curve of other technologies. If crypto was the internet right now, we would be in the 1998 phase of adoption. In 2021, we’re only halfway, and there is so much more room to grow.

This next iteration will resemble the introduction of a smoother user experience for onboarding newcomers, just like the interface development that Apple brought to the world of computing and mobile phones, which enabled the company to become one of the most widely used and profitable in the world.

There is still a huge gaping gap in the market for crypto companies that prioritize user experience. A lot of platforms may seem intuitive, but they are built by people deep within the tech and/or finance space.

Apple’s graphic interface made computing accessible to the mass market. Prior to the graphic interface, it was only institutions, tech enthusiasts and early adopters who used computers. It was seen as something that “hackers” and “nerds” used, but no one else.

Today, millions of people use computers, and the next evolution will see smooth UX that makes crypto accessible and easy, which will see this space experience mass adoption.

Welcome to the next wave of cryptocurrency adoption

Cryptocurrencies have become increasingly popular over the last few months, and interest will only continue increasing. In the U.K., regulators found that 2.3 million adults now hold crypto assets.

In Australia, two-fifths of Aussie millennials think that crypto investments beat real estate — a response to the difficulties of the next generation being able to afford traditional investments, and with crypto being the next viable option for storing and growing wealth.

But we still have a long way to go with crypto user experience. Digital assets offer great wealth potential for everyone from traditional financial institutions to the Gen Z retail traders. It’s time for UX to keep up.

During crypto’s next innovation wave, we will see a greater focus on UX for both beginners and experienced traders. Currently, some of the industry’s most advanced platforms still lack the functionality and seamless interface to access some of the most widely used trading tools, like futures or options for example.

But today, anyone can learn strategic trading tools and risk management techniques with the right educational tools and guidance, which is available through various platforms, from CoinMarketCap to Binance and even YouTube. But the learning curve is steep, and the next phase will see platforms providing more options to customize and automate trading through gamification techniques or more advanced features and smooth UX. Robinhood, for example, found great success when simplifying a trading strategy like options for both novices and newcomers on their app.

It’s time to stop accepting complex user experience

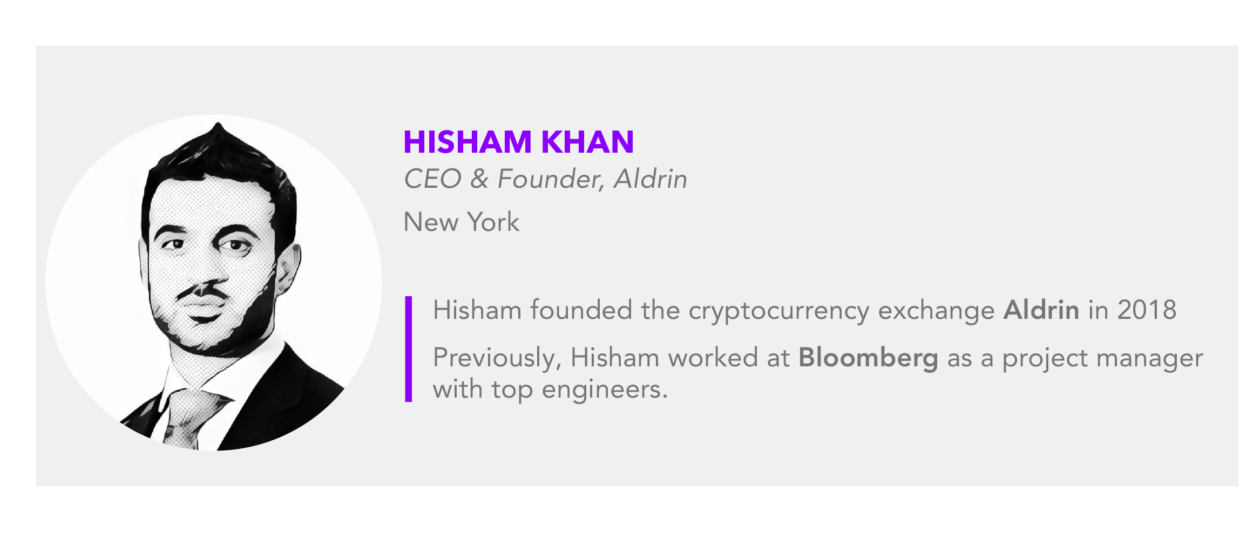

Let’s take the example of Bloomberg. As a former Bloomberg project manager, I saw some of the most talented financial engineers build a platform that enables its users to be proud of using the platform. One of the world’s largest sources of financial insights and data wants their institutional traders to be equipped with the tools to make the best decisions.

This is what we seek to do everyday in the world of crypto, not just for institutional investors but also for everyday investors. We want to empower users with the tools that can be accessible by any user, and for traders to feel proud that they can utilize these tools to become better traders and manage their investment with proper risk management.

At the moment, the industry too often accepts frustratingly poor user experience and exchange fragmentation, as both crypto natives and newcomers are forced to use a variety of different platforms to optimize their trading strategies.

Traders are bombarded with too many decisions: should they use a decentralized exchange (DEX) or a centralized exchange (CEX)? DEXs enable peer-to-peer transactions with minimum information on investors and full control of their data and funds. But they require self-custody, which can be intimidating and time consuming for newcomers in the space.

CEXs on the other hand, offer greater liquidity, enable easy on-ramps to purchase digital assets, prevent the need for self-custody, but are also prone to hacks or attacks, and personal data is held in one central location.

There needs to be easier tools for traders to understand how to execute advanced strategies that allow them to appropriately manage risk, limit or increase their exposure to risk. Traders need simpler features that also enable them to overcome complexities, including moving liquidity from a CEX to a DEX to explore a range of incredibly high-yield earning pools.

Today, there are a number of innovative developers in this space working to debunk the theory that access to high-yield benefits of crypto must be difficult for newcomers who enter the space. They are building products and platforms where newcomers can access advanced tools much more easily. We will see more developments like this in space in the very near future.

We need to support those innovators and developers who seek to empower traders with the tools to access smart trading, including advanced stop and loss/take profits, and other innovations that help the end user access financial empowerment.

Crypto mass adoption will come when vulnerabilities are better resolved

The industry still needs to find better ways to protect consumers from hacks. Testing vulnerabilities on platforms and regular auditing initiatives will be critical. But even after some platforms have completed auditing rounds, they have been susceptible to hacks. Flash loan attacks have introduced a new wave of sophisticated attacks in the recent months.

Crypto, and digital security in general, will continue becoming stronger as it evolves. But we can do much better at protecting users in the space by encouraging insurance initiatives and ensuring auditing rounds are regular and ongoing components of business strategies.

People don’t need to understand how email gets from A to B. We know we will have reached mass adoption when there’s no need to explain the inner workings of the complex technologies that underpin digital assets.

We are seeing more reputable companies and VC firms like Alameda Research who are now investing in projects that see decentralized finance being built into the backend of platforms, without users needing to even know they exist. MAPS.ME, an application used by 140 million people, will soon enable users to stake and yield-farm, but may not have any idea what yield farming is.

We will know we have reached an ultimate achievement in crypto adoption when users don’t need to understand what’s under the hood of cryptocurrencies, and people from all demographics can easily access these innovative financial assets. Just like the internet in the early 90s, HTML and email were exciting, world-changing innovations. We’re just moving, at a very fast pace, through this next iteration that will see cryptocurrencies become a society-changing evolution.