Financial services, foundational to all industry and economic activity, is going through the greatest upheaval since the invention of double-entry bookkeeping in the Middle Ages. Every aspect of the industry is about to change, from how we move and store value to how we access credit, invest, trade, transact and insure against risk. But this upheaval is about more than changes to existing industries like banking or insurance. It’s about enabling new business models and organizational capabilities that will transform existing industries, redefine the architecture of the firm and other institutions, change profoundly how we interact online with companies and with each other, alter the fabric of daily life, reimagine the nature of work and more.

At the root of this upheaval are blockchains, which allow us to create new asset classes, business models and governance systems for the digital age. The industrial-age solution of companies and vast government bureaucracies coordinating human activity and the movement of value in the economy and in society is coming to an end. Blockchain enables new decentralized governance systems that are more inclusive, participatory, transparent and trustworthy.

Blockchains are tamper-resistant ledgers of transactions distributed across a network maintained by many parties. These shared ledgers serve as common sources of the truth. In effect, they supplant the records of banks, governments, corporations and the large technology companies that intermediate much of the digital economy. Blockchains are the first digital medium for value, just as the internet was the first digital medium for information.

In this brave new world, we can move, store, manage, organize, govern, create, fragment and direct anything and everything of value to whatever end we desire, peer to peer. Financial services are no longer centralized within an industry; they are decentralized across blockchain networks such as Bitcoin, Ethereum, Solana, Terra Luna, Avalanche and Cosmos. Decentralized finance (DeFi) is shaking the windows and rattling the walls of Wall Street banks, government agencies and global institutions. Call it the DeFi Revolution. Like many revolutions, it holds great promise and great peril. Critics malign its chaotic and seemingly uncoordinated growth and its potential to displace jobs and accuse it of undermining the monetary sovereignty of governments, exacerbating inequality and warming the planet.

The revolution began in 2008 with the launch of the Bitcoin blockchain. Its creator Satoshi Nakamoto once quipped, “I’m better with code than with words.” But his brilliant white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” introduced a radical new concept: cash for the internet and a means of minting, moving and storing value without intermediaries like banks and governments. What’s more, Bitcoin worked. It set the wheels in motion for changes underway now.

DeFi extends Satoshi’s concept of peer-to-peer electronic cash to lending, trading, investing, managing risk and more, built on top of distributed networks, not corporations. These innovations are possible, thanks to a breakthrough called a smart contract, an immutable self-executing decentralized application (dApp) settled on a blockchain such as Ethereum. Contracts are the foundation of every asset class, every corporation and all economic activity. Yet, most of today’s contracts are quite dumb. The changes wrought by decentralized applications (dApps) in general and smart contracts will be cataclysmic. Every industry will feel DeFi’s impact, because finance is the cardiovascular system of the global economy, the lifeline of all other industries.

To be clear, DeFi is not fintech. Fintech applications, while important, still require banks and other intermediaries to establish trust between parties, verify account balances and perform the business logic — clearing, settling, contracting and so forth — that makes the system work. And in the end, most fintech innovation is digital wallpaper — a sleek user interface that conceals the old system beneath. Instead of slapping on a fresh coat of paint, DeFi reimagines finance from a networked point of view with digitally native assets, or tokens.

Our token taxonomy has grown to nine assets, a virtual ennead:

- Cryptocurrencies (aka digital money): Bitcoin is the mother of all cryptocurrencies with a market capitalization of over US$1 trillion and tens of millions of users. It functions like cash for the internet and a final settlement layer for the crypto-economy. It’s digital gold for investors and a life-line for many of the world’s unbanked. Bitcoin is unrivalled in this role.

- Protocol tokens: These are the native tokens of the foundational platforms that power DeFi and much else. Examples include Ether, the native token of Ethereum; AVAX, the native token of Avalanche, SOL, the native token of Solana and ATOM, the native token of Cosmos and IBC. They are also what venture capitalist Joel Monegro calls “fat protocols” — meaning they accrue much of the value that is created at the application layer, which is built on top: They account for nearly US$1 trillion of cryptoasset market value.

- Governance tokens: Governance tokens such as Uniswap’s UNI, Aave’s AAVE, Compound’s COMP and Yearn Finance’s YFI give holders say in the governance, specifically the allocation of resources from a common wallet of decentralized autonomous organizations (DAOs) and decentralized applications, or dApps. As dApps take in more assets and users, their governance tokens often appreciate as the economic value they control increases, and their fees increase. For example, the value of UNI, native token to the Uniswap decentralized exchange, is over US$11 billion.

- Non–fungible tokens (NFTs): NFTs are unique, provably scarce digital assets; they provide a means to verify the scarcity, provenance and ownership of these assets. They can also represent physical assets, such as sports memorabilia and luxury goods. Today they are primarily used for art, collectibles and digital assets inside games. Ultimately, they can be used as identities, to represent intellectual property and express ownership of many other kinds of virtual goods. NFTs have exploded in popularity. OpenSea, one single NFT site, recorded over US$3.4 billion in transaction volume in a single month in August 2021.

- Exchange tokens: Crypto-exchange tokens such as BNB and FTT (valued at US$80 billion and US$7 billion respectively) are native to centralized exchanges like Binance and FTX. Typically, these tokens are essential to the exchange’s functionality and incentivize adoption but are more centrally managed and confer no governance rights. BNB serves a dual purpose as an exchange token and the native token of the layer-1 Binance Smart Chain.

- Securities tokens: There are three kinds of securities tokens: digitally native securities such as DeFi investment funds, synthetic securities such as Mirror’s mGOOGL or mTSLA and securities tokens originated by traditional financial entities, such as investment banks or asset managers. They are transforming markets for stocks, bonds and derivatives.

- Stablecoins: Stablecoins are cryptoassets — such as USDT, USDC, DAI and UST — with stable value pegged typically to the U.S. dollar. Now with a total market value that exceeds US$130 billion, stablecoins use different methods to stabilize their value. Centralized stablecoins are backed by deposits of cash and equivalents inside financial institutions like banks. Decentralized stablecoins are typically collateralized by cryptoassets held in smart contracts.

- Natural asset tokens: These are digital assets backed by real world commodities such as oil or gas, land, or carbon. For example, the blockchain-based ecology network Regen is connecting land stewards who protect and conserve ecosystems with buyers of offsets through the Regen registry, bringing transparency, liquidity and verifiability to the carbon credit market.

- Central bank digital currencies (CBDCs): CBDCs are crypto versions of fiat currency, such as China’s e-cNY digital renminbi and South Korea’s digital won. Advocates tout their potential to reduce friction, improve stability, and broaden financial access; opponents point to their potential use for mass surveillance and political oppression.

This taxonomy is not intended to be exhaustive or predictive of every possible use case for blockchain and digital assets. History teaches us to be humble with predictions in the face of technological change. Unlike taxonomies in nature, it is also not completely mutually exclusive, as it’s possible that one asset may fall in more than one category. However, any asset falls primarily into one of these categories. The taxonomy represents an attempt to organize this ecosystem of disparate assets into a coherent structure so that we can better understand what’s happening and grasp its greater significance.

If Bitcoin was the spark for the financial services revolution, then DeFi and digital assets are the accelerants. The fire will engulf firms that fail to innovate, adapt and embrace this hot new industry. The conflagration will suck oxygen from centralized entities and spread them into a new decentralized internet and financial system. The financial and economic phoenix that rises will be virtually unrecognizable from the system we have today.

This article is for information purposes only and should not be relied upon as investment advice.

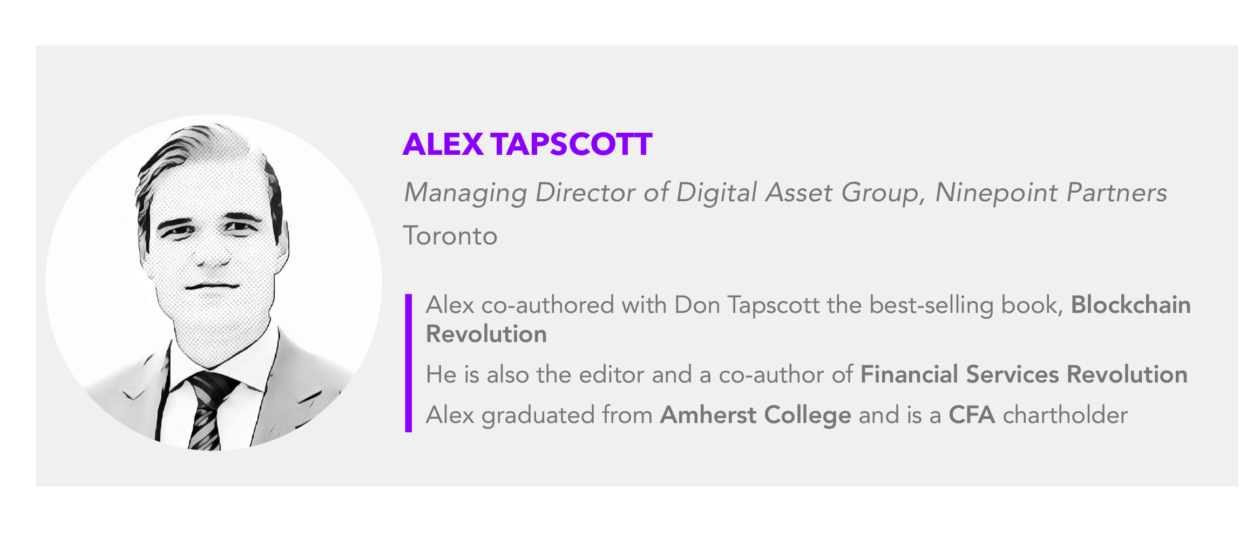

Tapscott will be a speaker and moderator at the Bitcoin & Beyond Summit this week sponsored by Forkast.News and AAX. To attend this virtual event starting this Wednesday, Nov. 10 at 9 a.m. HKT (Tuesday, Nov. 9 at 8 p.m. EST) register here.