South Korea’s leading blockchain game developer Wemade’s shares tumbled on Friday after the country’s four largest digital asset exchanges – Upbit, Bithumb, Coinone and Korbit – announced Thursday that its symbolic crypto token WEMIX will be delisted from the exchanges.

Wemade shares fell 29.89% on Friday, and its other KOSDAQ-listed subsidiaries also took a hit. Game software maker Wemade Max fell 29.92% and mobile game developer Wemade Play declined 29.93%.

The declines had a ripple effect on other gaming giants in the country, with Com2uS Holdings’ stock dropping 6.27%, DragonFly falling 8.56% and Netmarble losing 3.39%, according to Naver Stock.

WEMIX will be delisted in December, but the price of WEMIX has dropped over 70% in Upbit and Bithumb exchanges since the Thursday announcement. Wemade will file an injunction against the four exchanges to rescind the delisting announcement.

Last month, the four licenced crypto exchanges that are part of DAXA, South Korea’s joint crypto market monitoring organization, added Wemade’s WEMIX token to an “investment warning” list for inaccurately reporting circulation numbers.

The WEMIX issuer provided an estimate to Upbit in January that some 245 million tokens were in circulation. But actual WEMIX tokens circulated until Oct. 25 exceeded the estimate by about 72 million. Upbit is the largest cryptocurrency exchange in South Korea.

Wemade explained at the time that it made a mistake by excluding issuance of WEMIX tokens used to provide liquidity for its blockchain mainnet, for deposits in making loans and expanding and managing the ecosystem, adding that they did not think that uncirculated tokens should be included in the estimate.

After a grace period of about a month for Wemade to clarify its position, DAXA member exchanges – Upbit, Bithumb, Coinone and Korbit – decided to delist WEMIX, citing the significant disparity between disclosed and actual circulation. Errors were also found in the data that Wemade submitted during the grace period to explain the disparity, resulting in the ultimate loss of trust.

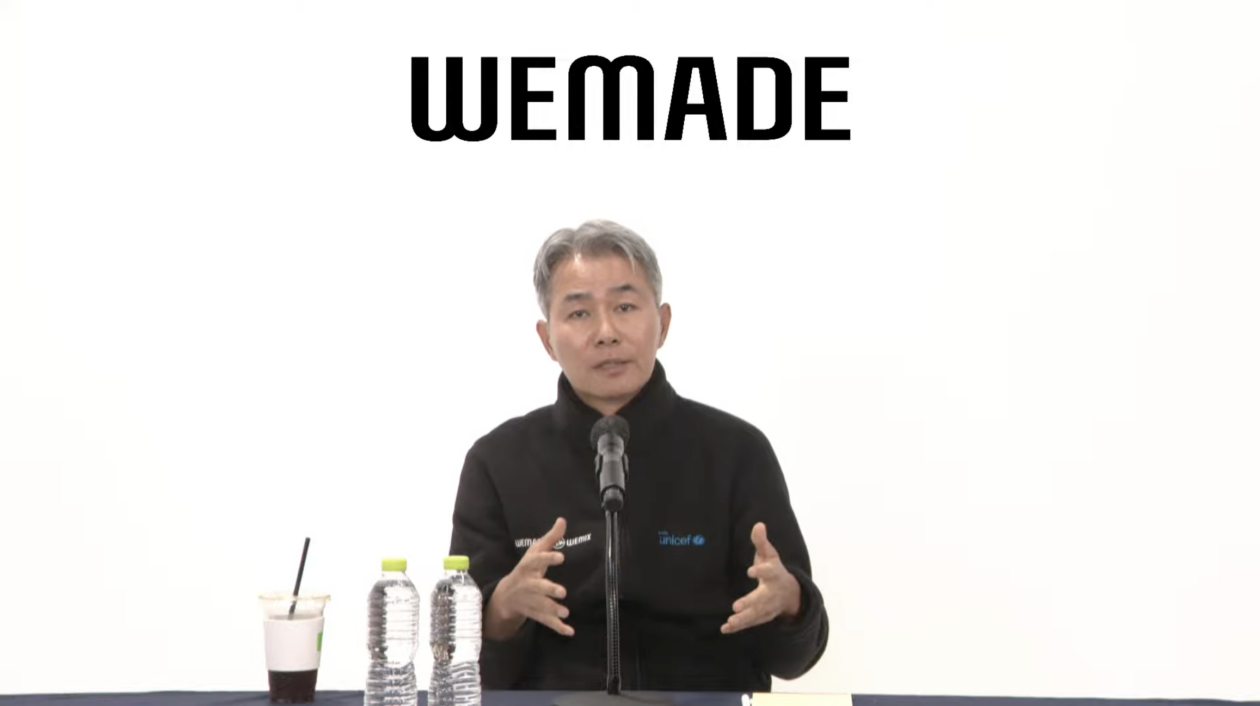

In an online press conference on Friday, Wemade CEO Henry Chang called out Upbit for abusing its power in delisting WEMIX, saying the crypto exchange was behind the “unfair treatment” Wemade was receiving.

“This problem originated from the difference between planned and actual amount of circulation, and the only place Wemade submitted the plan to is Upbit,” Chang remarked.

“When [WEMIX] received the investment warning, we asked Upbit for their standard or guideline for circulation, but to this day have not received anything,” he said, adding that suspending the token without any standard was very unreasonable.

Chang also claims that he only knew of WEMIX’s suspension when he saw Upbit’s notice on the website, and that Upbit has never officially explained how to resolve the issue.

The Wemade CEO also alleged that Upbit supported tokens that have not even notified the exchange of their planned supply, saying WEMIX has been treated unfairly.

Global exchange Bybit, which is not influenced by DAXA nor Upbit, is notifiying users that WEMIX failed to meet the requirements of the exchange and may be delisted.

To convince Wemade users and investors that WEMIX will eventually recover, CEO Chang has said that he purchased more WEMIX tokens the morning of the conference.

Wemade, founded in 2000, is one of the early adopters of blockchain technology among South Korean video game companies, with over 1.4 million players of the play-to-earn MMORPG game MIR4 Global last year.

The company has been expanding its blockchain ecosystem. On Oct. 20, Wemade launched its latest blockchain mainnet WEMIX 3.0. In the following week, the company launched its stablecoin WEMIX$ and WEMIX.Fi, its decentralized finance (DeFi) service that allows users to store, swap and stake Wemade’s tokens.

While WEMIX is at risk of losing its users in four local exchanges, it is also listed on several global crypto exchanges such as OKX, KuCoin and Crypto.com. “We’re also in talks with Coinbase and Binance,” Chang said during the online conference.

In a message to employees last month celebrating the release of WEMIX 3.0, Chang reportedly said the mainnet aims to become a mega-ecosystem that can nurture virtually anything in the realm of digital economy.

Nevertheless, as the WEMIX cryptocurrency remains the integral force driving Wemade’s blockchain ecosystem, the delisting is expected to hamper Wemade’s grand initiative if Wemade’s injunction goes unapproved.