Ethereum — the second-largest cryptocurrency by market cap — crossed the US$4,850 mark today and hit a new all-time price high, according to CoinGecko data. Ethereum was trading at US$4,812 as of publishing time.

The majority of decentralized finance (DeFi) protocols, stablecoins and non-fungible tokens (NFTs) operate on Ethereum and there is currently over US$180 billion in total value locked in DeFi protocols on Ethereum, according to DeFi Llama.

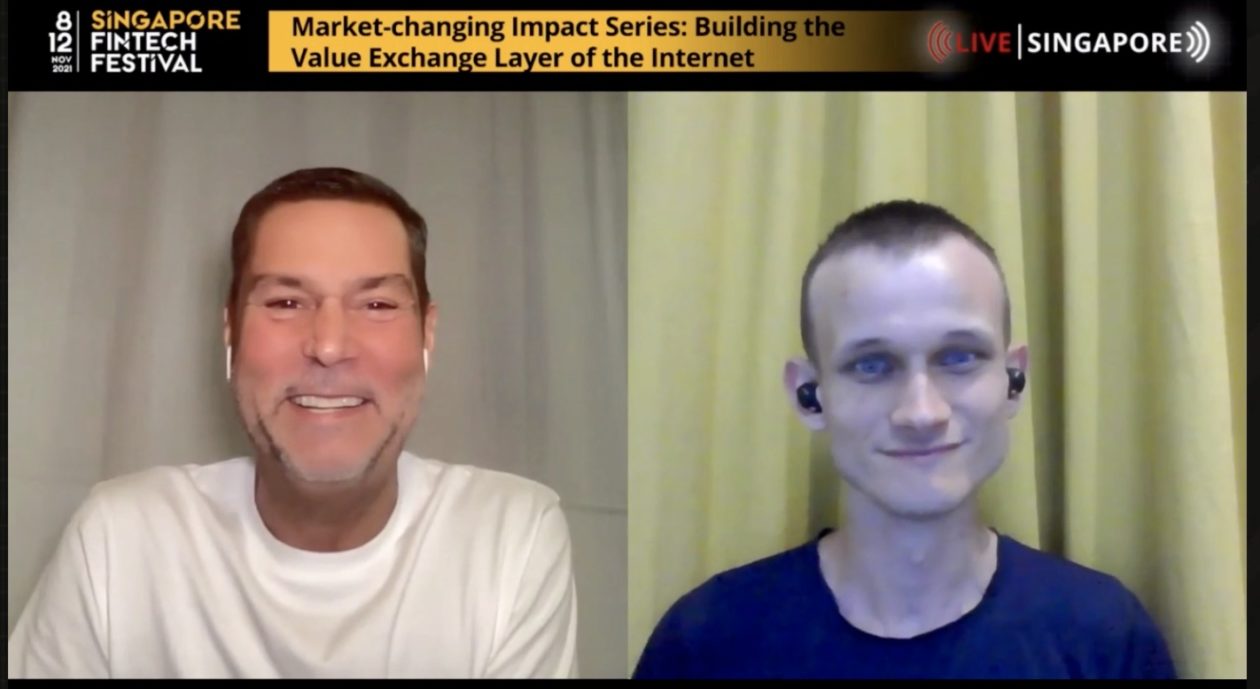

The DeFi ecosystem is maturing with core projects like Maker and Uniswap that have existed for a few years, said Ethereum’s creator Vitalik Buterin in a fireside chat with Raoul Pal, Real Vision co-founder and CEO, on “Building the value exchange layer of the Internet” at the Singapore FinTech Festival 2021. “Trust in those platforms is continuing to increase and that by itself is going to make people more and more comfortable over time.”

Growing the massive value layer

Buterin sees the future of the crypto ecosystem as neither financial nor non-financial, but “mixed financial.” “It’s projects that are not just about money in nature, but that still benefit a lot from being directly plugged into this kind of massive value layer that we’ve created with the Ethereum and the greater crypto ecosystem.”

For example, buying and selling an NFT could involve an auction involving smart contracts and a coin like Dai, which was created by a DeFi platform. “There’s DeFi components that are being plugged in all over the place,” Buterin said. “Ethereum does not have a killer app. It has a killer ecosystem — the value comes from all of these different pieces that are able to talk to each other.”

As adoption of NFTs, blockchain gaming in the metaverse, and decentralized autonomous organizations (DAOs) increase, and as new applications of the technology bring in new users and build on different financial layers, Buterin expects the basic building blocks to keep growing and stabilizing to bring value.

There are going to be many different kinds of NFTs, Buterin said. Some would represent assets that are purely crypto native, while others could represent real-world assets with legal or intellectual property rights. Fractional ownership being applied to NFTs could be applied to NFTs representing real estate. NFTs could also be linked to DAOs.

“There’s a lot of different ways to connect every one of these components and most of the interesting applications end up connecting different pieces together,” Buterin added. DAOs and smart contracts are like Lego for governance, making it easy for people to create new and different constructions, he said. “I don’t see one kind of dominating use case. I just see it opening up the floodgates for a thousand different experiments.”

Technologies such as blockchain and zero-knowledge proofs are doing an important job of making it possible to do things that were not possible before, solving trust problems, and allowing more collaboration without centralized trust points to happen, Buterin said.

Echoing Buterin’s view, Pal said DeFi was not just a part of the financial system that’s disintermediating the banks, but an entirely new parallel financial system and an economic system that’s being built. “It’s a whole ecosystem, it’s not just about finance.”

See related article: How you can own a (tiny) part of a Thai beachfront villa for US$150

How countries can think about the transition to Web 3.0

On how countries can navigate the transition to Web 3.0, Buterin said one way to think about it was to be supportive of good projects that are being developed locally. “Singapore is in a potentially good position to do a lot of that. It’s already a financial hub, it’s already a legal registration hub,” said Buterin, adding that the country could be a great choice for people who want to work on projects that involve NFTs backed by some kind of legal property rights.

Another approach is to think about the specific applications that could be valuable, such as whether there could be use cases for NFTs or DAOs for fractionalized real estate in Singapore. Other potential use cases could include artists using NFTs as a means of earning revenue or funding art or cultural works through DAOs.

Solving Ethereum’s usability issues

With high Ethereum transaction fees posing a challenge to usability, Buterin said Ethereum layer two protocols like Optimism, Arbitrum and Polygon would solve the scaling issue. The crypto industry was also working on solutions to address the risk of people losing their digital assets such as through multisig wallets, social recovery wallets or hybrid institutional forms of custody where an institution could help serve as a backup without actually having complete control over the asset. “All of these problems are going to just slowly start to get solved over the next couple of years,” Buterin said.

See related article: Vitalik Buterin: Layer 2 is the future of Ethereum scaling