Justin Chow: Why Asian institutional investment in Bitcoin will only grow

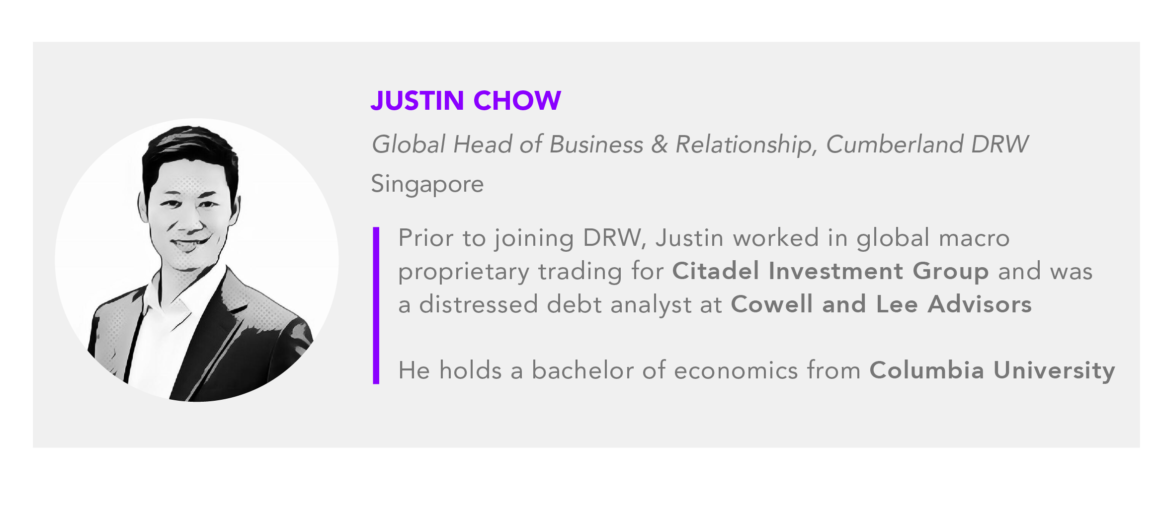

Justin Chow of Cumberland DRW explains why Asia has lagged behind the US in institutional interest in crypto — and why that will likely change soon.

China-based mobile app firm Meitu, which now holds US$100 million in Bitcoin and Ether, is part of a wave of growing institutional interest in investing directly in the cryptocurrency market.

But Meitu’s dive into crypto has been the exception rather than the rule in Asia so far. Despite a recent spate of large Western companies from MicroStrategy to Tesla raiding their corporate treasuries to scoop up crypto, many companies and financial institutions in Asia have hesitated.

But that tide could be turning soon. Banking behemoths such as Singapore’s DBS have publicly embraced the industry, recently launching its own crypto exchange and making it easier than ever for institutional investors to jump in.

“The number of institutional investors that have gone public with their investments in crypto is actually only a fraction of the conversations we’re still having,” said Justin Chow, global head of business development and relationship management at Cumberland DRW, in a video interview with Forkast.News.

According to Chow, after the first wave in 2017 — following the launch of Bitcoin futures by CME exchange in Chicago — the industry was in a very early stage without the necessary infrastructure to allow major investors to access the space.

“Most institutional investors are now somewhat versed in understanding the basics of Bitcoin and blockchain,” Chow said. “You take on top of that the fact that there are more qualified custodians, and the liquidity in the industry has increased dramatically. And that just makes it a lot more palatable and easier for institutional investors to entertain the idea of getting access to crypto.”

The increasing number of regulations has been another barrier to entry for crypto investors in Asia — especially for retail investors. The retail crypto ban in Hong Kong where the government is mulling a legislative proposal to ban retail investors from trading cryptocurrencies, as well as increasing warnings from the likes of the Monetary Authority of Singapore have been contributing to uncertainty in the retail sector.

Chow argues that regulation can still be a positive development as the progressiveness of the Singaporean government is what attracted a migration of talents and businesses into the country. He is also supportive of a government that wants to protect its citizens by introducing new regulations.

“It’ll allow and encourage not only more institutional investors, but even in some cases, more retail investors to be willing to get exposure to crypto or at least try to understand it better,” Chow said. “So it creates an environment that people know has a level playing field and removes some of the tail risks of the nascence of the asset class.”

Watch Chow’s full conversation with Forkast.News Editor-in-Chief Angie Lau on Asia’s growing institutional investor interest in cryptocurrency, Hong Kong retail crypto trading ban, and why crypto trading is looking a lot like of what FX trading was 10 years ago.

Highlights

- Timing behind institutional investment wave: “All the different infrastructure rails including the regulated futures products makes it a lot easier for them to say, ‘Okay, if we wanted to get exposure, it’s not that difficult.’ This is just the positive development and the infrastructure landscape that encourages the institutional investors that it’s not as difficult to get exposure as it used to be.”

- Asia lags behind the U.S. in institutional adoption: “Asia will take a little bit more time to ramp up. Typically, what we’ve seen — at least in our business — is that U.S. investors and asset managers are much more progressive with the larger capital market…. At least on the institutional side, we’re starting to see much more activity out of the U.S. And the conversations in Asia are maybe lagging slightly, but they’re very progressive at the same time, more different than it would have been, say, three years ago.”

- More banks may follow DBS’s footsteps: “There have been announcements in the public space about other banks getting involved in the industry. We definitely see that trend happening right now. I believe the next six months to 12 months, we will see more of the larger global investment in commercial banks pivoting in, in different various ways. That could again, just be the beginning of another on-ramp or another conduit for more institutional investors to get access to crypto.”

- Crypto reflects FX market during the Asian financial crisis: “There are many geographies out here that had non-freely convertible currencies and they created the derivative market to allow traders to hedge their exposures. And of course, corporates, if you’re a big importer or exporter in this region, you’ve got local currency exposure. You want to be able to hedge it. I see the crypto market following in very much the same footsteps. The market we operate in, is an over-the-counter trading business. So we trade physical cryptos over-the-counter with our counterparties exactly the same way banks trade FX over the counter with their clients. ”

Transcript:

Angie Lau: Are Asian institutions ready for crypto? Will Hong Kong’s proposed retail crypto ban accelerate institutional adoption? And are more banks coming into the crypto space?

Welcome to Word on the Block, the series that takes a deeper dive into blockchain and the emerging technologies that shape our world at the intersection of business, politics and economy. It’s what we cover right here on Forkast.News. I’m Forkast Editor-in-Chief Angie Lau.

Well, Hong Kong listed Chinese beauty app Meitu has purchased crypto recently. And we’re wondering, is this going to foreshadow a wave of institutions to follow suit? Hong Kong is also mulling a retail crypto ban and a licensing mandate for exchanges to pave the way for institutional adoption. Where does this all lead us?

Well, let’s bring on our next guest right now. He is global head of business development of crypto trading desk, Cumberland, Justin Chow. Welcome to the show.

Justin Chow: Thanks Angie. Thanks for having me.

Lau: Well, let’s talk about Cumberland very quickly first, because you were essentially set up by institutionals. It’s a specialized crypto asset trading company within DRW — well-known trading firm with more than 25 years of experience. So it was very prescient then. Where are we now when it comes to that kind of nascent institutional thinking at DRW and where we are today?

Chow: Sure. Well, the history of Cumberland really dates back to the inception of the business within DRW about seven years ago. As you mentioned, the DRW has well over 1,100 employees around the world. And Cumberland is our crypto asset trading division that’s wholly owned by the parent company.

The exciting part, obviously, is not just the development of the space over the last seven years, but specific to our conversation over the last six to nine months or so, we’ve definitely seen a dramatic increase in the amount of institutional interest in cryptos, the conversations and folks that are reaching out to us are very excited. They range from, as you’ve mentioned, banks to hedge funds and even large asset managers. So that’s really the story of right now.

I believe that the number of institutional investors that have gone public with their investments in crypto is actually only a fraction of the conversations we’re still having. That’s what’s really exciting, is that it feels right now that most of these large institutional players are taking the industry very seriously and that they’re trying to understand what is happening in crypto and whether or not getting exposure to some of the crypto assets will actually fit into their investment thesis in the future. And so we look forward to seeing what happens in the next three to 24 months. But certainly, there are a lot of folks circling around the space.

Lau: Why do you suppose now? Cumberland started seven years ago anticipating this interest to come in. It took seven years. Why now? Is it the price? Is it the momentum? Is it, first-player advantage? What is it?

Chow: That’s a very good question. I think it comes down to two things. First, the crypto asset industry really got a lot of attention in 2017 on the first run-up after the CME exchange in Chicago, one of the largest and oldest regulated exchanges in the world, launched a Bitcoin future. At the time, we saw a tremendous amount of media attention and folks starting to pay attention to crypto and doing their basic research to understand the industry. But of course, it was still very early and a lot of the infrastructure solutions were not there to allow major players to access crypto as easily as they can today. So that first 2017 wave really sparked the interest and allowed people to do their research.

In this subsequent rally and move in the market, most institutional investors are now somewhat versed in understanding the basics of Bitcoin and blockchain. It’s not like they’re visiting it for the first time or hearing about it for the first time. Now, you take on top of that the fact that there are more qualified custodians and the liquidity in the industry has increased dramatically. That just makes it a lot more palatable and easier for institutional investors to entertain the idea of getting access to crypto, because previously for them to have purchased bitcoin or any crypto, they would have essentially had to buy a cold wallet, physical USB device, and store the coins in self custody.

Now, they don’t have to. I think all the different infrastructure rails including the regulated futures products makes it a lot easier for them to say, “Okay, if we wanted to get exposure, it’s not that difficult.” This is just the positive development and the infrastructure landscape that encourages the institutional investors that it’s not as difficult to get exposure as it used to be.

Lau: We’ve certainly seen that over the past couple of years. The regulators have stepped in and a lot of people in the industry recognize that could also pave the way for the comfort level of a lot of these dollars coming into the space.

We’re also seeing a lot of corporate treasury dollars coming in. We heard about it from Tesla — and MicroStrategy is really shouting it from the mountaintop, as to all of this corporate treasury interest as well. We talked to CZ over at Binance and recognizing, 1% to 2% — that’s a lot of new liquidity in the market.

In Asia, now, we’re hearing from Meitu, this publicly listed social media app company that is listed in Hong Kong. It announced it just purchased Bitcoin and Ethereum. Is this also going to be the start that we’re going to see of Asia-based firms putting corporate treasuries into cryptocurrency?

Chow: Well, that’s a very good question. In general, the landscape for corporates to allocate part of their treasury to crypto or Bitcoin in particular has only just begun. It kind of makes sense to me because there are so many corporations in the world and businesses that at least are involved in the technology sector and Bitcoin essentially is one of the frontier technologies that people are looking at in today’s world.

More importantly, it’s really the story around the overarching macro environment and the world that we are in today that we haven’t really seen for decades. So if you think whether it’s a fund manager acting on behalf of their investors as a fiduciary or a corporate or even you and I, a lot of us are posed with the same questions and asking ourselves: “What is the world going to look like in the next five or 10 years with the expansion of the balance sheets of governments, et cetera?” Especially with social media and information traveling as fast as it does in this day and age, more people are starting to really look at different ways of either investing or diversifying their asset base. Certainly, the story around gold and now Bitcoin as a digital asset store of value is really coming to the fore. And so it makes perfect sense to me that the corporate treasuries would entertain that.

Asia will take a little bit more time to ramp up. Typically, what we’ve seen — at least in our business — is that U.S. investors and asset managers are much more progressive with the larger capital market. They’re more well versed in allocating money to stocks and bonds and different asset classes. Asia has been typically more brick and mortar businesses and real estate, for example. At least on the institutional side, we’re starting to see much more activity out of the U.S. And the conversations in Asia are maybe lagging slightly, but they’re very progressive at the same time, more different than it would have been, say, three years ago. And with the corporate side, a similar kind of mentality as well. I think over here the corporates are very focused on building their businesses, whereas the US is definitely focused on “where can we make sure that we are building for the future and setting up our business for the future” as opposed to just in the micro of actually the product.

Lau: Yeah, that dynamic absolutely exists in Asia. You have some really forward-thinking, very creative, innovative companies who dare to embrace. You have nations that are really supporting blockchain adoption and thinking about CBDC developments from Hong Kong to Thailand to China. And then, on the other hand, Justin, you and I both know being here in Asia, there’s also a very conservative element to it. It’s one thing to be creative and innovative and make all of that money, but once you have that money, you want to be super conservative about it.

I note that Meitu’s CEO, when making that announcement, quoted a Chinese proverb about a general who had the courage to become the first person ever to eat a fearsome-looking crab. I’m sure it makes much more sense in Chinese. But, it’s almost as well that, a nod that others in Asia might want to make the move but are scared and conservative.

Chow: Yeah. That mentality is going to slowly get broken down. Even within the family office sphere, there are a tremendous amount of family offices in Asia and they’ve often hired seasoned investment professionals to manage the overall office. These are ex-hedge fund managers, et cetera. And that’s where the progressiveness actually comes from, not necessarily the patriarchs of the families themselves. And I think the same thing with corporates. You’re starting to see that some of these Asian corporates are becoming so large because the domestic economy within Asia is gigantic. Whether it’s a large tech company or a manufacturing company, the truth is some of the largest businesses in the world are now in Asia. Because of that, the management of these businesses are being diversified away from the original founders.

That’s, again, where you’re going to see the progressiveness come in. It’s not always going to be the founder of the business as we need to do this. It may be one of his board of directors or a close confidant or in many cases, it could be a manager that he’s hired externally to help him expand his business in that mentality will shine through and they’ll say, “Hey, the world is really changing and evolving and we should pay attention to what is happening, at least in the crypto space, diversify our asset base, diversify our treasury and look at solutions like crypto and Bitcoin again, particularly because the infrastructure is now there to allow us to get access and exposure to the asset class more easily.” So it’s just an evolving story. And it’s really quite fascinating and exciting for the space.

Lau: How do you think of crypto adoption from Asian institutions and those traditional investors, these family offices, high net worth clients? If they come into the space, all of that liquidity into the global crypto market, what would that mean? How will that impact?

Chow: That’s a phenomenal question. What I can say is certainly the amount of money managed by the institutional investors that we’re having conversations with, that have yet to allocate to crypto is astronomical. Again, even if they were to allocate 20, 30, 50 basis points of their asset base to crypto, that would be a significant amount of money. The liquidity in the market has improved significantly over the years, which makes it easier for institutional players or even corporates to get exposure in large sums to crypto today.

However, there needs to be a changing of hands of coins. As you know, there’s a limited supply of Bitcoin out there, many different estimates of how many coins potentially may be lost. Obviously, there’s the one million coins in the original Satoshi wallet that have yet to move. And people assume that that’s just out of circulation. So there is limited supply. But at least what we see in our business is we see a lot of two-way flow. As the market continues to rise, we do see early adopters liquidating their positions and essentially cashing out. Taking their Bitcoin chips off the table and allocating into something else.

But as the price continues to rise, you’re going to see more and more people decide that they’ve enjoyed being involved in the space for thus long, and they want to take their Bitcoin and liquidate it. So that changing of hands is going to spur the increase in liquidity to allow these new market participants to actually get exposure. It’s like a passing of the baton, let’s say.

Then the other way I think about it is, as the price goes up, the dollar value may not necessarily change. So if you’re a big institutional investor and you’re looking at investing one hundred million dollars into Bitcoin for the first time, the number of coins that you need to purchase, if it’s at 30,000 versus 50 or 100,000 is obviously very different. And so even if you have large sums of capital coming into the space as the market cap or the price of coins goes up, there will be, again, early adopters that have those coins and may be willing to liquidate. And that, again, is creating it will create pockets of liquidity for the ecosystem.

In fact, even if we look at the last two or three months when Bitcoin consolidated, when it went to 42 and then back down to sub 30K, and then more recently 58K down to mid-40s or low 40K, during those periods of consolidation, that’s when a lot of the changing the hands of coins goes on. And that’s a healthy thing.

Lau: What do you think that drives the prices then?

Chow: Certainly with all the capital on the sidelines that’s looking at the space right now, it’s hard not to have a positive outlook on the industry. So I think we are still very, very constructive. We continue to build our business for the future and make sure that we are ready for when the institutions come in. And so I believe that the next couple of years could be very exciting for the industry. And in some ways, as risky as it is to say, it feels like we’ve only seen the tip of the iceberg.

Lau: I do not disagree with you there. I absolutely think it is just the tip of the iceberg and the regulators are coming in the space because the institutional dollars are here and likely the market demands it. It evens out the playing field. But I do want to note that Hong Kong’s proposed retail crypto ban has seen some controversy. On one hand, much of the industry says it’s going to drive business out of Hong Kong and retail investors elsewhere. And others say it actually creates more incentive for institutions to come into the space. And that’s actually good for the business. How do you see it?

Chow: The overall regulatory landscape has evolved dramatically over the last three or four years, we’ve seen pockets and geographies that have been very supportive of the industry and others that have been a bit more cautious. The way I look at it is almost like a board game, where when one geography or one country decides to be a little bit more cautious, the industry moves so quickly that it causes a migration of talent to different regions. And Singapore being certainly, as you know, one of the regions that has benefited from that. A lot of businesses have moved down here as the government has been more progressive and welcoming of crypto businesses. I think also in general, any time that any government wants to protect its citizens and introduce regulation, that’s something that we certainly support. You’ve seen that over time in the history of capital markets that regulation has come in to protect, in many cases, investors from themselves. And so that’s just a positive development. And it’ll allow and encourage not only more institutional investors, but even in some cases, more retail investors to be willing to get exposure to crypto or at least try to understand it better. So it creates an environment that people know has a level playing field and removes some of the tail risks of the nascence of the asset class. So for us it’s a positive development.

Lau: In Singapore, obviously DBS coming in and setting up an exchange. It really also continues to legitimize and also provide that on-ramp for a lot of more conservative and institutional clients as well. Are more coming?

Chow: Great question. Certainly so. DBS has been a forerunner on the banking side in terms of trying to understand that. And then, of course, launching products around the crypto space. It’s incredibly exciting for not only the bank with Singapore as a whole, the fact that DBS is here and the largest bank in Singapore and so progressive.

There have been announcements in the public space about other banks getting involved in the industry. We definitely see that trend happening right now. I believe the next six months to 12 months, we will see more of the larger global investment in commercial banks pivoting in, in different various ways. That could again, just be the beginning of another on-ramp or another conduit for more institutional investors to get access to crypto.

Not all institutional investors are going to be willing to use some of the infrastructure available over the last three years that has come online, despite how good their solutions may be. Sometimes just having the stamp of approval or the familiarity of dealing with an institution like a bank that you’ve been dealing with for a hundred years is what they look for. When we see these banks starting to explore the space and develop solutions, whether it’s custody or even in some cases trading, first and foremost, it’s a phenomenal opportunity for Cumberland to work with them. We’re very excited about that.

But again, it just shows that people are taking the industry more seriously. And the probability that crypto is here to stay and become mainstream is only increasing. So it’s very, very exciting.

Lau: And so that just is more runway for Cumberland, how would you be working with these banks? How do you already work with institutional clients in Asia?

Chow: So Cumberland, as you know, is an institutional trading desk and we make markets and provide liquidity to institutions around the world. For us, we have a very steady counterparty base of early crypto adopters, whether they’re miners or even some businesses or ultra-high net worth that we trade with. More recently, we’ve seen family offices get involved. Then the next wave, as we kind of discussed earlier, is the next evolution of large institutional investors, whether they’re long-only or banks. We believe Cumberland plays a very important role in the ecosystem as one of the largest principal equity providers to be there, to be able to help the banks and other institutional investors get the liquidity they need for either their business or their clients. So it’s very exciting because banks have a tremendous distribution network. DBS, they have clients all over the world of different types, whether it’s retail or ultra-high net worth from the private banking side. Some of them have their own asset managers and then, of course, they deal with fund managers as well.

As banks start to learn about the space, we’re there for them to explain to them what’s happening, what the infrastructure and market structure of the industry looks like, and then, of course, to be able to provide liquidity and make markets to them as they dabble in the industry for the first time. So we see ourselves as partners to banks and helping enable them to launch their crypto businesses. That’s been the message thus far and it’s been very well received.

Lau: Explaining crypto to investors, a common comparison that’s used is forex because of its relation, obviously. But how do you compare the two markets? How do you compare crypto’s growth to the growth of FX in Asia where these new institutional dollars that we’re talking about in this region are more than familiar during the 90s? When you speak to these institutions, how are they thinking about that opportunity? How do you explain it? And then how do you talk about custody as well, especially when so much money is at play?

Chow: A lot of these banks are starting exactly there at ground zero, understanding custody and potentially even building their own custodial solutions in-house or working with some of the third-party providers to develop a white label solution. They are understanding that for their clients, they need to have that solution in place for them.

On the growth of the industry, I think you hit the nail on the head. For me, as my background is as an FX trader and in crypto, in many ways reminds me of the early developments in the FX, NDF market around the time of the Asian financial crisis at the time. There are many geographies out here that had non-freely convertible currencies and they created the derivative market to allow traders to hedge their exposures. And of course, corporates, if you’re a big importer or exporter in this region, you’ve got local currency exposure. You want to be able to hedge it. I see the crypto market following in very much the same footsteps. The market we operate in, is an over-the-counter trading business. So we trade physical cryptos over-the-counter with our counterparties exactly the same way banks trade FX over the counter with their clients. Two of the largest markets in the world are actually the FX and the treasury market, and they’re both over-the-counter and crypto also has that marketplace as well. I see it that as banks get involved, it’s not that easy for them to access liquidity on some of the offshore exchanges. But they’re comfortable trading with a large trading firm like Cumberland, DRW. So, we’re able to bridge that gap for them. We’re able to essentially provide liquidity to them over the counter that they’re comfortable with. And of course, they will bring that to their clientele.

What I naturally expect to happen is that as the client interest from the bank starts to increase, the volumes that they generate over the counter will increase. The over-the-counter trading market in crypto will start to grow exponentially. It’ll just follow in the footsteps of crypto. I wouldn’t even be surprised if one day you have a Bitcoin trader sitting next to the dollar-yen or the Aussie dollar trader at a bank. That could happen.

Lau: That day is coming. I have zero doubt about that. As you’ve noted — if even a small percentage of the wealth here in Asia gets into crypto in a serious way, it will be a seismic shift for the entire industry and the entire market. Absolutely right. Justin Chow, always a pleasure, and thank you so much for joining us on this latest episode of Word on the Block. Can’t wait to touch base with you again and see where this market is going here for me.

Chow: Thank you very much, Angie. Thanks for the invite on the show.

Lau: And thank you, everyone, for joining us on this latest episode. I’m Angie Lau. Forkast.News Editor-in-Chief. Until the next time.