The issuer of USD Coin (USDC), the world’s second-largest stablecoin after Tether, has raised questions about crypto exchange giant Binance’s decision to stop supporting USDC and other stablecoins on its platform.

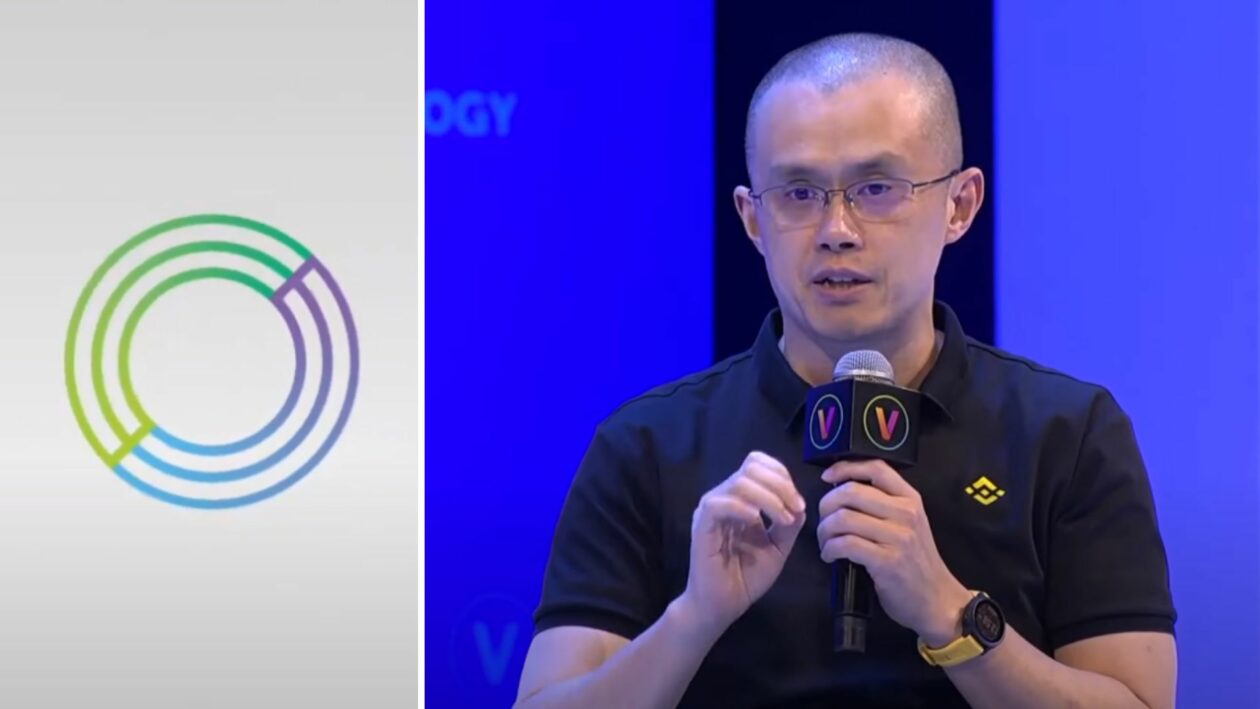

Binance, the issuer of the world’s third-largest stablecoin BUSD, announced on Monday it would convert customers’ holdings in three rival stablecoins — USDC, Pax Dollar (USDP) and True USD (TUSD) — into BUSD on Sept. 29. It would remove spot, future and margin trading with USDC, USDP and TUSD pairs as a result.

USDC, issued by Circle Internet Finance, has a market capitalization of just under US$52 billion, followed by BUSD at US$19.5 billion, according to CoinMarketCap. Both trail market leader Tether (USDT), which has a market capitalization of US$67 billion, and will still be tradeable on Binance.

The world’s largest cryptocurrency exchange said the move was designed to “enhance liquidity and capital-efficiency for users.”

A spokesperson from Circle, the issuer of USDC, told Forkast via email: “Based on market activity, it would seem much of this transition has already passed and while optimizing dollar liquidity on the world’s largest exchange may carry benefits, the paradigm does raise potential market conduct questions.”

Circle did not provide further detail.

On-chain analysis shows that from Aug. 13 to Aug. 26, Binance’s USDC holdings dropped from US$2.2 billion to US$960 million, while its holdings of BUSD increased from US$16.6 billion to US$18 billion during the same period, according to data from blockchain data aggregator Glassnode.

When asked whether Binance had swapped USDC for BUSD in customers’ accounts ahead of the announcement, Jiyun Lily Lee, a spokesperson for Binance, told Forkast via email: “We can confirm that user funds were not swapped ahead of the announcement.”

Lee also told Forkast that the firm had “a long communication process with stakeholders, including Circle, and that Monday’s announcement was merely to communicate the timeline to customers.”

As an exchange that controls more than three times the daily transaction value of its nearest competitor, concerns have been raised about the possible anti-trust implications of Binance’s move to apparently sideline other stablecoins in order to promote its own.

“Many countries have strong anti-competition or anti-trust laws, and these have not seen much, if any, application to cryptocurrencies to date,” said Michael Bacina, a digital law specialist and partner at Australian commercial law firm Piper Alderman, in a written commentary to Forkast.

In jurisdictions such as Australia, Bacina said, consumer competition laws prohibit those with “a substantial degree of power in a market” from using that power to eliminate or damage a competitor, preventing market entry or deterring someone from engaging in competitive conduct in a market.

“A case around whether the removal of support of a token amounts to a misuse of market power would be a novel and speculative claim, with very uncertain outcomes given that there are many other exchanges where USDC is available,” he said.